February 2014 - Marcon International, Inc.

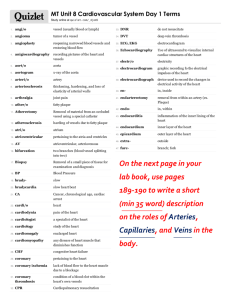

advertisement