(ERM) and a Risk Matrix

Enterprise Risk Management

Building and Using an Enterprise Risk Matrix

NARIMS

12th Annual Professional Day

Royal Glenora Club, Edmonton, AB .

Tom Haber

Senior Manager, Enterprise Risk Management

EPCOR

March 14, 2012

1

2

EPCOR Utilities Inc.

EPCOR Utilities Inc. (EPCOR) builds, owns and operates electrical transmission and distribution networks, water and wastewater treatment facilities and infrastructure in Canada and the United States.

EPCOR is headquartered in Edmonton, Alberta.

Wholly-owned by the City of Edmonton for over 100 years

Minority ownership in Capital Power Corporation

(TSX:CPX), a power generation business

2010 revenue of approximately C$ 1.5 billion

About 2,500 employees

3

Agenda

• What is Risk?

– Risk, is there a common understanding?

– Managing Risk within an Organization

• Enterprise Risk Management (ERM) and a Risk Matrix

– Role of ERM

– ERM Risk Matrix Challenge

• How to Build a Risk Matrix

– Important Considerations

• How to Use a Risk Matrix

– Risk Assessment Process

– Steps of a Risk Assessment

• Benefits and Limitations

4

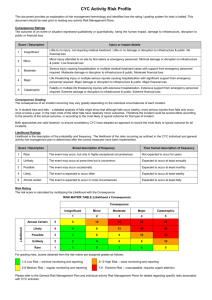

What is Risk?

Risk is not tangible

– Outcomes are tangible (consequences)

– Uncertainty of occurrence (likelihood)

– Risk must be tied to an achievement of an objective

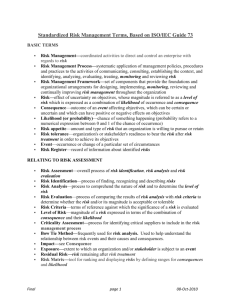

Definition (ISO 31000):

• Risk is the effect of uncertainty on objectives

– Expressed by the consequence and likelihood of an

“event” occurring

– Measured as a product of the consequence of its outcome and the likelihood of occurrence

(Risk = C X L)

– May lead to opportunities or threats

5

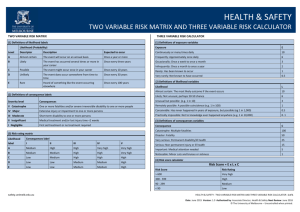

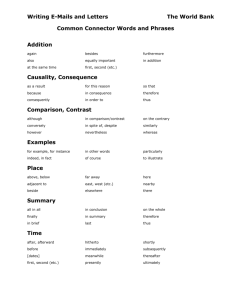

What is a Risk Matrix?

• Graphical tool that combines Consequence and

Likelihood to help analyze the risk of a scenario

• Quick and easy tool to help you understand the level of risk

• Consequence and Likelihood

Levels

• Ranking marked by color bands

• Slope of bands mark equal degrees of risk

6

Organizational Context of Risk

Managing Risk

• Culture

• Processes

• Structures

7

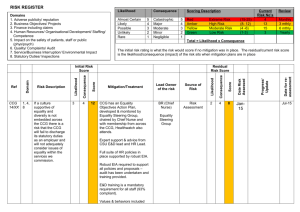

Risk Management

Risk Management: the structured process of identifying, assessing, mitigating and monitoring risks that prevent or impede the achievement of goals and objectives. Includes:

Operational Risk Management:

• Internal event focused

• Risks associated with the people, process and systems, includes services reliability, safety, billing, projects, IT and financial stewardship

Strategic Risk Management:

• External event focused

• Risks associated with managing reputation, competition and the business environment including markets, labor pool, regulatory uncertainty and economic conditions.

8

Current Reality…

Typical Risk Management within a Large Enterprise

– Diverse risk management practices within each business unit or shared services group

– Business Units and Shared Services may identify, assess, monitor and manage risk with different methods, models and language

Why is this a problem?

– Difficult to reliably understand and compare risks within an enterprise risk profile

– Potential misinterpreted threat levels and impact to the company

– Makes decision making on risk tolerances and adherence to risk appetite more difficult

Terminology

9

• Risk

• Hazard

• Hazardous Event

• Risk Factor Statement

• Risk Appetite

• Risk Tolerance

• Risk Treatment

• Risk Response

• Risk Register

• Black Swan Event

• etc…

An extensive risk vocabulary

A common and consistent language is central to a shared understanding of risk

Envision …

Having a common understanding between operations, senior management and the board’s view of risk

Further entrenching operations in consistent and integrated risk-based thinking

Providing increased validity of risk understanding for better informed decision making

Enabling ground level input to all risks company-wide with increased effectiveness of Risk Management and Strategic

Planning activity

10 requires integrated, enterprise-wide Risk Management tools that share a common language and approach

Enterprise Risk Management (ERM)

11

Enterprise Risk Management: the INTEGRATED identification, analysis and monitoring of Risk across the entire business, addressing all levels, including strategic and operational.

An ERM program represents the process to oversee risks within a company’s risk appetite / tolerance and to provide reasonable assurance for the effective execution of strategy

– continuous and systematic

– company wide perspective

– applied in a strategic setting

– not an audit, but should contribute to the development of an audit plan

Key ERM objectives:

– identify, assess, measure, manage, mitigate and report on the company’s top enterprise risks for effective oversight

– promote a common language, framework and process for managing risk across the organization

ERM Role – risk champion, not owner

12

• Overall management and standards setting of the ERM program which includes:

– Development and management of an enterprise-wide risk register

– Design and implement enterprise risk management framework and risk management process standard and guidelines (ISO 31000)

• Facilitate, monitor and report on risk management practices

– Facilitate the implementation of company-wide risk assessments

– Ensure that risk assessments are performed periodically and completely for all business units and shared service areas

– In collaboration with risk owners, determine which risks are most significant and facilitate discussion with management for risk monitoring, management and improvement activities

13

ERM Risk Matrix Challenge

Provide/ensure standardized procedures and tools for assessing, analyzing and evaluating risk that are valid, reliable and meet the needs of decision making at various levels

– Standardize consequence and likelihood criteria that allow for valid and reliable calculations of risk rating

– Standardize a risk model rigorous enough to measure and assess risk that supports decision making at different levels

Risk Matrix Design Considerations

• How to define risk scores, levels and ranks?

• Risk bands and tolerances

• What scale to use?

Semi-quantitative or purely qualitative

• How to handle aggregations of lower risks that may become higher risk?

• Beware the tails – black swans, and false-risks

14

8 x 8 Risk Matrix – a larger view

15

Illustrative example only

8 x 8 Risk Matrix – matrix within a matrix

16

Illustrative example only

8 x 8 Risk Matrix – matrix within a matrix

17

Illustrative example only

Building a Risk Matrix

18

Pick your rating criteria judiciously and carefully

Illustrative example only

Risk Matrix Consequence Criteria

• unique to the organization and its business environment

19

• relative equivalencies of consequence levels

Illustrative example only

Risk Matrix Likelihood Criteria

Unique to the organization and its business environment

Likelihood = probability and/or frequency

Scale should be consistent and logical.

With a balanced matrix , the likelihood scale should mirror the consequence scale

Illustrative 20 example only

Building a Risk Matrix

Medium-High

Medium-Low

High

Low

Assign rankings on grid: semi-quantitative tool, should we

21 use quantitative measures or not?

Illustrative example only

Building a Risk Matrix

22

If you go semi-quantitative , you need to determine what scale to use (linear, logarithmic)

Illustrative example only

Risk Matrix Development Summary

• Determine an appropriate scale and criteria for likelihood and consequences that align across all business areas

– e.g.: Health & Safety, Environmental, Financial

Asset, Community and Reputation

• Determine the best fit grouping of tolerance bands to support risk ranking and escalation

(generally 3, 4 or 5 bands)

– e.g.: low/green, medium-low/yellow, mediumhigh/orange, high/red

23

Ideal End State: build semi-quantifiable matrix that derives risk scores that supports assessments throughout the company. Ensure that the risk score is reliable, valid across the enterprise, and useful for decision making at any level.

Enterprise Risk Velocity Matrix

Risk Velocity is an estimate of how quickly risks events will impact the organization.

• Our evaluation of risk may be affected by how much time there may be to prepare a response or make some other risk treatment decision about an exposure

• It is an additional level of insight to the risk

24

Illustrative example only

Risk Heat Map

(consequence & likelihood) with velocity

Level II

Level III

Level IV

The velocity of a risk event may be displayed as colored (C X L) points on the chart

Very Slow

Slow

Fast

Very Fast

ALARP

Level I

25

Illustrative example only

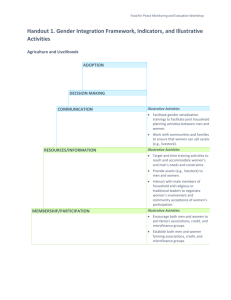

Communicate and Consult

26

Communication and consultation with internal and external stakeholders should take place during all stages of the risk management process.

Involving stakeholders in the risk management process is helpful to:

– Develop a communication plan;

– Help define the context appropriately;

– Ensure that the interests of stakeholders are understood and considered;

– Ensure that different views are appropriately considered in evaluating risks;

– Help ensure that risks are adequately identified; and

– Secure endorsement and support for a treatment plan.

27

Establish the Context

• Define objectives and understand purpose of risk assessment

– What decisions will be made, what questions will be answered

– Helps set the scope of the risk management

• Determine Internal and External Conditions

– Define the business environment that exists

• Understand the criteria for evaluation

– Consequence and Likelihood, Velocity

– Follows a single, consistent risk matrix

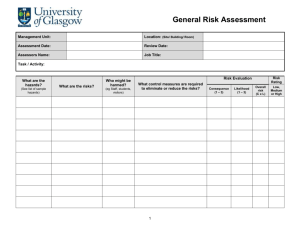

Risk Assessment – Identification

(3 steps: identification, analysis and evaluation)

1. Risk Identification

– Finding, recognizing and describing risks/hazards (risk source, event and outcomes) and associated controls

(prevent or mitigate)

– Brainstorming, interviews, surveys, facilitated discussion

– Process mapping, site visits, historical data

– Scenario descriptions, what-if’s

28

Illustrative example only, does not represent an actual risk

Bow Tie Model of Risk

What event could occur that would impact achieving the business objectives? c a u s e s prevention capabilities

29

underlying factors and conditions contributing to the risk-event event mitigation capabilities u e e q n s c o n c e s risk treatment controls

(layers of protection ) outcomes / impacts on objectives

due to the risk-event occurring

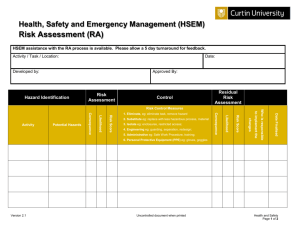

Risk Assessment - Analysis

2. Risk Analysis

– Rate the level of the risk (consequence, likelihood and velocity)

Choose the greatest potential consequence that could reasonably happen, then choose the likelihood that it would occur

– Analyze before controls (inherent risk) then again with existing controls (residual risk)

– May also be done to analyze new controls, costs including the identification of contingencies

30

Who should participate in a risk rating session?

Greatest Potential Consequence and

Likelihood

31

Pick the top consequence that is the greatest potential that could reasonably occur

Illustrative example only

Apply Risk Rank

Determine the likelihood that the event will occur

32

Illustrative example only

Heat Map

(consequence & likelihood) with velocity

Level II

Level III

Level IV

The velocity of a risk event may be displayed as colored (I X P) points on the chart

Very Slow

Slow

Fast

Very Fast

ALARP

Level I

33

Illustrative example only

34

Risk Assessment - Evaluation

3. Risk Evaluation

Assists in the decision about priorities, risk treatment and response:

– Examine the risk analysis

– Discuss variances, confirm understanding of risk and gain agreement on the risk rating

– Evaluate risk level with tolerances

– May need to do a deeper risk assessment

The Value is in the Discussion!

Risk Acceptance and Treatment

Acceptance: taking the risk in order to pursue an opportunity. This means making an informed decision to retain the risk.

Further action may be required if the risk level is not acceptable:

1. Elimination : avoiding the risk by deciding not to start or continue with the activity that gives rise to the risk.

2. Reduction: implement new controls to change the likelihood or the consequence.

3. Transfer/Sharing: sharing the risk with another party or parties (including contracts and risk financing or insurance). In many cases you can share the financial or legal risk, but the reputation risk is not easily transferred.

35

Repeat risk assessment to determine new residual risk level

Apply Treatment and Rate Residual Risk Rank

Determine controls to prevent the risk event from occurring and reduce the consequences ,

36 should the event occur.

Illustrative example only

Monitor and Review

Risk Register: a record of the identified risks.

The evaluation and risk decisions must be retained and reviewed on an ongoing basis.

The frequency to repeat the risk assessment depends upon the circumstances surrounding the business and confidence in achieving the objectives.

Illustrative example only, does not represent an actual risk

37

Benefits of a Risk Matrix

38

• Simple to use

• Common approach

• Compare and Analyze risk across all operations

• Prioritize risk for tolerance or further action

Limitations of a Risk Matrix

39

• Ambiguous risk scenarios may lead to poor assessments

• Human factors and bias may influence results

• Doesn’t make decisions for you!

• May be too simple a tool

• Be aware of the boundaries and tail events (black swans and trivial risks)

Threat and Opportunity Risk Matrix

40

Illustrative example only

Questions?

41

More Information?

42

Tom Haber

Senior Manager, Enterprise Risk Management

EPCOR Risk, Assurance and Advisory Services thaber@epcor.ca

780.412.3524

43

Back-up

44