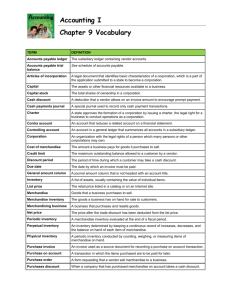

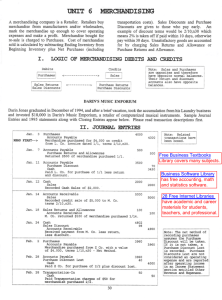

Accounting for Merchandising Activities - McGraw

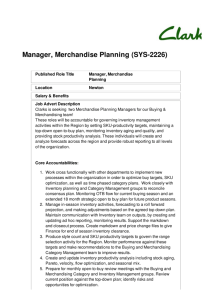

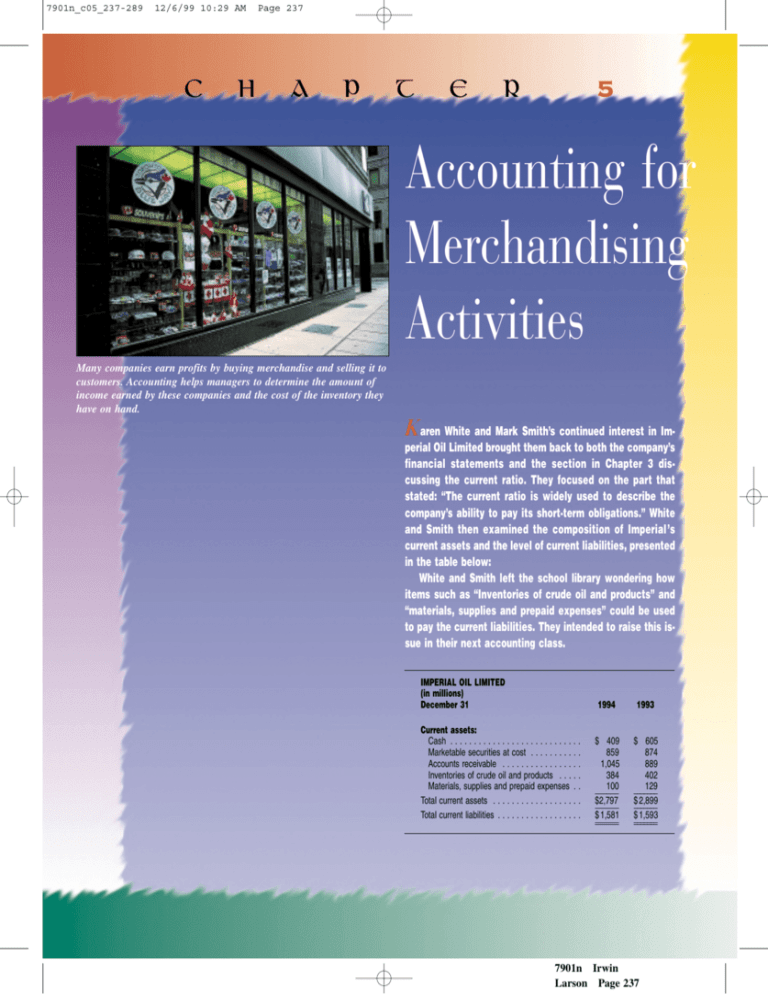

advertisement