social group profile - The Pittsburgh Downtown Partnership

advertisement

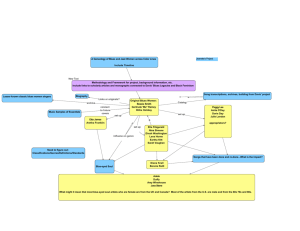

DOWNTOWN WORKER PROFILES 1 66 SEGMENTS FORM 14 SOCIAL GROUPS U1 – 04 07 16 26 29 Urban Uptown Young Digerati Money & Brains Bohemian Mix The Cosmopolitans American Dreams U2 – 31 40 54 Midtown Mix Urban Achievers Close-In Couples Multi-Culti Mosaic U3 – 59 61 65 66 Urban Cores Urban Elders City Roots Big City Blues Low-Rise Living S1 – 01 02 03 06 Elite Suburbs Upper Crust Blue Blood Estates Movers & Shakers Winner’s Circle S2 – 08 14 15 17 18 19 The Affluentials Executive Suites New Empty Nests Pools & Patios Beltway Boomers Kids & Cul-de-Sacs Home Sweet Home S3 – 21 22 30 36 39 Middleburbs Gray Power Young Influentials Suburban Sprawl Blue-Chip Blues Domestic Duos S4 – 44 46 49 52 Inner Suburbs New Beginnings Old Glories American Classics Suburban Pioneers C1 – 10 12 13 Second City Society Second City Elite Brite Lites, Li’l City Upward Bound C2 – 24 27 34 35 41 City Centers Up-and-Comers Middleburg Managers White Picket Fences Boomtown Singles Sunset City Blues C3 – 47 53 60 62 63 Micro-City Blues City Startups Mobility Blues Park Bench Seniors Hometown Retired Family Thrifts T1 – 05 09 11 20 25 Landed Gentry Country Squires Big Fish, Small Pond God’s Country Fast-Track Families Country Casuals T2 – 23 28 32 33 37 Country Comfort Greenbelt Sports Traditional Times New Homesteaders Big Sky Families Mayberry-ville T3 – 38 42 43 45 50 51 Middle America Simple Pleasures Red, White & Blues Heartlanders Blue Highways Kid Country, USA Shotguns & Pickups T4 – 48 55 56 57 58 64 Rustic Living Young & Rustic Golden Ponds Crossroads Villagers Old Milltowns Back Country Folks Bedrock America 2 SOCIAL GROUP PROFILE - UNITED STATES HOUSEHOLDS 11% Landed Gentry City Centers 10% Micro-City Blues 10% Second City Society 9% Country Comfort 8% Midtown Mix 8% The Affluentials 8% Urban Cores 7% Middleburbs 6% Elite Suburbs 5% Rustic Living 5% Urban Uptown 5% Inner Suburbs 4% 4% Middle America 0% % of U.S households 115,306,103 2% 4% 6% 8% 10% 12% 14% 3 SOCIAL GROUP PROFILE - ALLEGHENY COUNTY, PA HOUSEHOLDS 16.0% Middleburbs The Affluentials 12.0% Midtown Mix 12.0% Inner Suburbs 12.0% Urban Cores 10.0% Urban Uptown 7.0% Landed Gentry 6.0% City Centers 6.0% Country Comfort 5.0% Micro-City Blues 4.0% Elite Suburbs 4.0% Middle America Rustic Living Second City Society 0% 3.0% 2.0% 1.0% 5% Middleburbs: The five segments that comprise Middleburbs share a middle-class, suburban perspective, but there the similarity ends. Two groups are filled with very young residents, two are filled with seniors and one is middle-aged. In addition, this group includes a mix of both, homeowners and renters as well as high school graduates and college alums. With good jobs and money in their jeans, the members of Middleburbs tend to have plenty of discretionary income to visit nightclubs and casual-dining restaurants, shop at midscale department stores, buy dance and easy listening CDs by the dozen and travel across the U.S. and Canada. 10% 15% 20% 4 DOWNTOWN & AGH COUNTY - SOCIAL GROUP PROFILES County (hh = 514,630) 16% Middleburbs 0% The Affluentials 12% 0% 12% Midtown Mix Inner Suburbs 12% 10% 7% Urban Uptown City Centers Country Comfort Micro-City Blues Elite Suburbs Middle America Rustic Living Second City Society 37% 0% Urban Cores Landed Gentry Downtown (hh = 6,764) 50% 13% 100% of Downtown hhs fall into 3 of 14 Social Groups: 6% 0% 6% 0% U1 – 04 07 16 26 29 5% 0% 4% 0% 4% 0% Urban Uptown Young Digerati Money & Brains Bohemian Mix The Cosmopolitans American Dreams 3% 0% 2% 0% 1% 0% 0% 10% 20% 30% U3 – 59 61 65 66 Urban Cores Urban Elders City Roots Big City Blues Low-Rise Living U2 – 31 40 54 Midtown Mix Urban Achievers Close-In Couples Multi-Culti Mosaic 40% 50% 5 DOWNTOWN WORKER PROFILES 6 DOWNTOWN PITTSBURGH – 5 TRACTS 7 PRIZM SOCIAL GROUP PROFILE - ALLEGHENY COUNTY WORKPLACE 14.3% Middleburbs The Affluentials 10.6% Country Comfort 10.1% Landed Gentry 9.4% Inner Suburbs 8.7% Midtown Mix 7.5% City Centers 7.0% Urban Cores 7.0% Middle America 6.8% Urban Uptown 6.3% Micro-City Blues 4.9% Rustic Living 4.5% Elite Suburbs Second City Society 2.4% 0.5% 0% 5% 10% 15% 20% 8 PRIZM SOCIAL GROUP PROFILE - ALLEGHENY & DOWNTOWN WORKPLACE 14.3% 14.4% Middleburbs 10.6% The Affluentials 11.7% Country Comfort 10.1% 7.0% Landed Gentry 8.3% Inner Suburbs 7.9% 9.4% 8.7% 7.5% Midtown Mix City Centers 10.8% 7.0% 5.9% 7.0% Urban Cores 10.2% Middle America 6.8% 4.3% 6.3% Urban Uptown 8.9% Micro-City Blues 3.8% Rustic Living 3.1% Elite Suburbs 2.4% 3.1% 4.9% 4.5% 0.5% 0.4% Second City Society 0% 5% 10% County 15% DT Workplace 9 DOWNTOWN COMPARISONS - DT WORKPLACE VS. DT RESIDENT – SOCIAL GROUP PROFILES DT Workplace DT Resident 14% Middleburbs 12% The Affluentials 11% Midtown Mix 37% 8% Inner Suburbs 10% Urban Cores 9% Urban Uptown 50% 13% 8% Landed Gentry The DT Resident population is comprised of only 3 out of the 14 Social Groups. 6% City Centers 7% Country Comfort However, the DT Workplace population reflects the larger area (Allegheny County), and is represented by all 14 Social Groups. 4% Micro-City Blues 3% Elite Suburbs 4% Middle America 3% Rustic Living 0.4% Second City Society 0% 10% 20% 30% 40% 50% 10 GOLDEN TRIANGLE WORK FORCE PRIZM SOCIAL GROUPS Middleburbs 15% The Affluentials 12% Midtown Mix 11% Urban Cores 10% Urban Uptown 9% Landed Gentry 8% Inner Suburbs 8% Country Comfort 7% City Centers 6% 4% Middle America Micro-City Blues 4% Elite Suburbs 3% Rustic Living 3% 0% Second City Society 0% 5% 10% 15% 20% 11 UPTOWN WORK FORCE PRIZM SOCIAL GROUPS Urban Cores 14% Middleburbs 13% Midtown Mix 12% The Affluentials 11% Urban Uptown 11% Inner Suburbs 8% Landed Gentry 8% City Centers 6% Country Comfort 5% 4% Micro-City Blues Rustic Living 3% Middle America 3% Elite Suburbs 0% 3% 5% 10% 15% 20% 12 STRIP DISTRICT WORK FORCE PRIZM SOCIAL GROUPS 14% Middleburbs Midtown Mix 11% The Affluentials 11% Urban Cores 10% Country Comfort 9% Inner Suburbs 8% Landed Gentry 8% Urban Uptown 7% City Centers 7% Middle America 6% Rustic Living 5% Micro-City Blues Elite Suburbs 0% 3% 2% 5% 10% 15% 20% 13 SOUTH SHORE WORK FORCE PRIZM SOCIAL GROUPS 15% Middleburbs Midtown Mix 14% The Affluentials 12% Urban Cores 10% Landed Gentry 10% Inner Suburbs 8% Urban Uptown 7% Country Comfort 7% City Centers 5% 3% Elite Suburbs Middle America 3% Rustic Living 3% Micro-City Blues 3% 1% Second City Society 0% 5% 10% 15% 20% 14 NORTH SHORE WORK FORCE PRIZM SOCIAL GROUPS 12% Middleburbs Landed Gentry 12% Country Comfort 10% The Affluentials 10% Midtown Mix 9% Urban Cores 8% Urban Uptown 8% City Centers 8% Middle America 7% 5% Inner Suburbs Rustic Living 5% Micro-City Blues 4% Elite Suburbs 3% 1% Second City Society 0% 5% 10% 15% 20% 15 DOWNTOWN WORK FORCE SUMMARY - SOCIAL GROUPS % OF EACH TRACT Urban Uptown 10.5% Golden Triangle 9.2% Midtown Mix 12.1% 10.7% 11.3% 13.5% 8.8% Urban Cores 13.7% 10.2% 10.0% 9.6% 7.8% Elite Suburbs 2.6% 3.4% 1.5% 3.4% 2.5% The Affluentials 10.8% 11.9% 10.9% 12.1% 9.8% Middleburbs 13.4% 14.7% 14.0% 15.0% 12.3% Inner Suburbs 7.6% 8.0% 8.3% 8.1% 5.3% Second City Society .3% .4% .1% .9% 1.0% City Centers 5.8% 5.7% 6.9% 5.3% 7.5% Micro City Blues 3.7% 4.0% 3.1% 2.5% 3.8% Landed Gentry 7.6% 8.2% 7.5% 9.6% 11.8% Country Comfort 5.3% 6.7% 9.1% 6.8% 9.8% Middle America 3.2% 4.1% 5.8% 3.1% 7.0% Rustic Living 3.4% 2.8% 4.6% 2.9% 5.0% Total 100% 100% 100% 100% 100% Uptown Strip District 6.9% South Shore 7.2% North Shore 7.6% 16 DOWNTOWN WORK FORCE SUMMARY - SOCIAL GROUPS % OF ALL TRACTS Urban Uptown .4% Golden Triangle 7.4% Midtown Mix .5% 8.6% .9% .4% .4% 10.8% Urban Cores .5% 8.2% .8% .3% .4% 10.2% Elite Suburbs .1% 2.7% .1% .1% .1% 3.1% The Affluentials .4% 9.6% .9% .4% .4% 11.8% Middleburbs .5% 11.7% 1.1% .5% .6% 14.5% Inner Suburbs .3% 6.5% .7% .3% .2% 7.9% Second City Society 0% .3% 0% 0% 0% .4% City Centers .2% 4.6% .5% .2% .3% 5.9% Micro City Blues .1% 3.2% .2% .1% .2% 3.8% Landed Gentry .3% 6.6% .6% .3% .5% 8.3% Country Comfort .2% 5.4% .7% .2% .4% 7.0% Middle America .1% 3.3% .5% .1% .3% 4.3% Rustic Living .1% 2.3% .4% .1% .2% 3.1% Total 3.9% 80.5% 7.9% 3.1% 4.6% 100% Uptown Strip District .5% South Shore .2% North Shore .3% Total 8.9% 17 DOWNTOWN WORK FORCE SUMMARY - 100% OF EACH SOCIAL GROUPS Urban Uptown 4.6% Golden Triangle 82.9% Midtown Mix 4.4% 79.8% 8.2% 3.9% 3.7% 100% Urban Cores 5.3% 80.4% 7.8% 3.0% 3.5% 100% Elite Suburbs 3.2% 85.9% 3.8% 3.4% 3.7% 100% The Affluentials 3.6% 81.9% 7.5% 3.2% 3.8% 100% Middleburbs 3.6% 81.5% 7.7% 3.3% 3.9% 100% Inner Suburbs 3.8% 81.7% 8.3% 3.2% 3.0% 100% Second City Society 2.7% 78.3% 2.7% 6.2% 10.1% 100% City Centers 3.9% 78.2% 9.3% 2.8% 5.8% 100% Micro City Blues 3.7% 83.3% 6.4% 2.0% 4.6% 100% Landed Gentry 3.6% 79.1% 7.2% 3.6% 6.5% 100% Country Comfort 3.0% 77.3% 10.3% 3.0% 6.4% 100% Middle America 3.0% 76.5% 10.8% 2.2% 7.5% 100% Rustic Living 4.3% 73.6% 11.8% 2.9% 7.4% 100% Uptown Strip District 6.1% South Shore 2.5% North Shore 3.9% 100% Total 18 GOLDEN TRIANGLE WORK FORCE TOP 15 PRIZM SEGMENTS Domestic Duos 8% City Roots 7% Close-In Couples 5% Pools & Patios 5% Gray Power 4% Traditional Times 4% New Empty Nests 4% Old Glories 3% American Classics 3% Cosmopolitans 3% Multi-Culti Mosaic 3% Sunset City Blues 3% Big Fish, Small Pond 3% American Dreams 3% Country Squires 3% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 19 UPTOWN WORK FORCE TOP 15 PRIZM SEGMENTS 8% Domestic Duos City Roots 6% Close-In Couples 6% Pools & Patios 5% Multi-Culti Mosaic 4% American Classics 3% New Empty Nests 3% Cosmopolitans 3% Old Glories 3% Gray Power 3% American Dreams 3% Big City Blues 3% Middleburg Managers 3% Sunset City Blues 3% Low-Rise Living 3% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 20 STRIP DISTRICT WORK FORCE TOP 15 PRIZM SEGMENTS 9% Domestic Duos City Roots 8% Traditional Times 6% Close-In Couples 5% Pools & Patios 5% Old Glories 4% Multi-Culti Mosaic 4% Sunset City Blues 4% American Classics 3% Middleburg Managers 3% New Empty Nests 3% Simple Pleasures 3% Cosmopolitans 3% Gray Power 3% 3% Big Fish, Small Pond 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 21 SOUTH SHORE WORK FORCE TOP 15 PRIZM SEGMENTS 9% Domestic Duos City Roots 7% Close-In Couples 6% Multi-Culti Mosaic 6% Pools & Patios 5% Country Squires 4% 4% Gray Power Old Glories 4% Traditional Times 4% 4% New Empty Nests American Classics 3% Sunset City Blues 3% Big Fish, Small Pond 3% 3% 3% Cosmopolitans American Dreams 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 22 NORTH SHORE WORK FORCE TOP 15 PRIZM SEGMENTS 7% Domestic Duos City Roots 6% Traditional Times 5% Middleburg Managers 4% Country Squires 4% Close-In Couples 4% 4% Big Fish, Small Pond Pools & Patios 4% New Empty Nests 3% 3% Multi-Culti Mosaic Cosmopolitans 3% Gray Power 3% American Dreams 3% 3% Simple Pleasures 3% Sunset City Blues 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 23 DOWNTOWN WORK FORCE SEGMENTS - TOP 10 SEGMENTS Golden Triangle Uptown Strip District South Shore North Shore Domestic Duos Domestic Duos Domestic Duos Domestic Duos Domestic Duos City Roots City Roots City Roots City Roots City Roots Close-In Couples Close-In Couples Traditional Times Close-In Couples Traditional Times Pools & Patios Pools & Patios Close-In Couples Multi-Culti Mosaic Middleburg Managers Gray Power Multi-Culti Mosaic Pools & Patios Pools & Patios Country Squires Traditional Times American Classics Old Glories Country Squires Close-In Couples New Empty Nests New Empty Nests Multi-Culti Mosaic Gray Power Big Fish, Small Pond Old Glories Cosmopolitans Sunset City Blues Old Glories Pools & Patios American Classics Old Glories American Classics Traditional Times New Empty Nests Cosmopolitans Gray Power Middleburg Managers New Empty Nests Multi-Culti Mosaic 24 CLARITAS BUSINESS-FACTS DATA TM Downtown Work Force Profile CLARITAS Business-Facts TM Base file developed from the infoUSA / ABI data system Largest data system in the business-to-business industry Over 12 million records Yellow Pages – White Pages Business White Pages – Edgar Sec Co. Web Sites – Annual Reports State Manufacturer’s Directories City and Industry Directories IPO Reporter – NASDAQ Fact Book County Court House Records Standard & Poor’s - Other 20 million out-bound telephone calls made per quarter to verify Information Data is modeled monthly and enhanced through proprietary Claritas processes 25 2010 DOWNTOWN EMPLOYEE COUNT Number of Employees By Industry Class & Census Tract UPTOWN GOLDEN TRIANGLE STRIP DISTRICT SOUTH SHORE NORTH SHORE TOTAL AGRICULTURE 0 26 142 0 0 168 MINING 0 64 0 0 0 64 CONSTRUCTION 25 698 306 4 408 1441 MANUFACTURING 62 5,714 1,001 30 1,501 8,308 TRANSPORTATION 94 2,484 2,764 44 217 5,603 WHOLESALE 86 459 687 636 93 1,961 RETAIL 260 6,743 2,138 1,703 537 11,381 FINANCE 59 31,158 1,142 413 178 32,950 5,046 38,920 2,038 1,210 2,852 50,066 736 9,242 307 37 4 10,326 6 1,995 2,060 22 19 4,102 6,374 97,503 12,585 4,099 5,809 126,370 SERVICES PUBLIC ADMIN MISC TOTAL Source: Claritas Inc. 26 DETAIL OF DOWNTOWN’S TOP 4 INDUSTRY CLASSES 2010 Number of Employees in Downtown Services Legal Services Eng, Acct, Research & Mgmt Related Srvcs Health Services Business Services Social Services Educational Services Hotels and Other Lodging Places Membership Organizations Amusement and Recreational Service Automobile Repair, Services and Parking Personal Services Motion Pictures Museums, Art Galleries, Zoos, Etc. Miscellaneous Services Miscellaneous Repair Services Total Retail 15,012 9,226 5,523 5,184 3,657 2,922 2,854 1,713 1,631 661 615 432 281 202 151 50,065 Finance Insurance Carriers Security and Commodity Brokers and Service Depository Institutions Insurance Agents, Brokers and Service Real Estate Holding and Other Investment Offices Non‐Depository Credit Institutions Total Eating and Drinking Places Home Furniture, Furnishings and Equipment Food Stores Miscellaneous Retail Apparel and Accessory Stores General Merchandise Stores Building Materials, Garden Sup & Mob Home Automobile Dealers and Gas Service Stations Total 5,682 2,246 1,355 1,196 429 343 93 37 11,381 Public Admin 13,200 9,349 3,924 2,455 2,443 1,258 320 32,950 Exec., Leg. and Gen. Govt. (Except Finance) Justice, Public Order and Safety Administration Of Human Resource Programs Public Finance, Taxation and Monetary Policy Administration Of Economic Programs Admin. Of Environ. Quality & Housing Programs National Security and International Affairs Total 5,233 2,680 1,122 624 317 242 108 10,326 27 2010 DOWNTOWN ESTABLISHMENT COUNT Number of Establishments By Industry Class & Tract UPTOWN GOLDEN TRIANGLE STRIP DISTRICT SOUTH SHORE NORTH SHORE TOTAL AGRICULTURE 0 5 3 0 0 8 MINING 0 6 0 0 0 6 CONSTRUCTION 5 42 18 1 9 75 MANUFACTURING 12 85 54 4 14 169 TRANSPORTATION 6 71 22 2 6 107 WHOLESALE 7 34 47 5 11 104 RETAIL 26 434 136 45 27 668 FINANCE 13 495 27 9 25 569 SERVICES 212 2,003 124 39 87 2,465 PUBLIC ADMIN 9 366 8 2 1 386 MISC 2 173 15 7 6 203 292 3,714 454 114 186 4,760 TOTAL Source: Claritas Inc. 28 2010 DOWNTOWN ESTABLISHMENT MIX % of Establishments By Industry Class & Census Tract UPTOWN GOLDEN TRIANGLE STRIP DISTRICT SOUTH SHORE NORTH SHORE TOTAL Downtown AGRICULTURE 0.0% 0.1% 0.7% 0.0% 0.0% 0.2% MINING 0.0% 0.2% 0.0% 0.0% 0.0% 0.1% CONSTRUCTION 1.7% 1.1% 4.0% 0.9% 4.8% 1.6% MANUFACTURING 4.1% 2.3% 11.9% 3.5% 7.5% 3.6% TRANSPORTATION 2.1% 1.9% 4.8% 1.8% 3.2% 2.2% WHOLESALE 2.4% 0.9% 10.4% 4.4% 5.9% 2.2% RETAIL 8.9% 11.7% 30.0% 39.5% 14.5% 14.0% FINANCE 4.5% 13.3% 5.9% 7.9% 13.4% 12.0% SERVICES 72.6% 53.9% 27.3% 34.2% 46.8% 51.8% PUBLIC ADMIN 3.1% 9.9% 1.8% 1.8% 0.5% 8.1% MISC 0.7% 4.7% 3.3% 6.1% 3.2% 4.3% TOTAL 100% 100% 100% 100% 100% 100% Source: Claritas Inc. 29 DOWNTOWN EMPLOYEE GROWTH Downtown Pittsburgh 1996 to 2010 175,000 150,000 136,928 126,370 125,000 111,557 100,000 75,000 50,000 25,000 0 1996 2006 2010 The cumulative drag of the recent economic contraction, both nationally and regionally, must be considered when comparing counts in 2006 and 2010. The unemployment rate has been almost double (100% higher) in 2010 versus unemployment during the “better times” of 2006. And, although the current “official” unemployment figures for Allegheny County and the City range between 8.6% and 8.9%, “real” unemployment is estimated closer to 11% or higher. Despite the deep recession and accompanying high unemployment, Downtown and the broader surrounding area have weathered the past year better than many other markets Source: Claritas Inc. 30 DOWNTOWN ESTABLISHMENT GROWTH Downtown Pittsburgh 1996 to 2010 5,000 4,945 4,585 4,760 4,000 3,000 2,000 1,000 0 1996 Source: Claritas Inc. 2006 2010 31 WORK FORCE CHANGE BY DOWNTOWN TRACT 32 DOWNTOWN EMPLOYEE CHANGE Number of Employees By Tract By Year 1996 2006 2010 125,000 109,619 97,503 # of Employees 100,000 88,549 75,000 50,000 25,000 7,622 9,591 6,494 6,374 11,371 12,585 2,801 5,311 4,099 2,994 4,133 5,809 0 Uptown Source: Claritas Inc. Golden Triangle Strip South Shore North Shore 33 DOWNTOWN ESTABLISHMENT CHANGE Number of Establishments By Census Tract By Year 1996 2006 2010 5,000 3,897 # of Establishments 4,000 3,630 3,714 3,000 2,000 1,000 341 391 477 454 286 292 102 130 114 121 155 186 South Shore North Shore 0 Uptown Source: Claritas Inc. Golden Triangle Strip 34 DOWNTOWN SUMMARY Establishment & Employee Change By Tract UPTOWN GOLDEN TRIANGLE STRIP DISTRICT SOUTH SHORE NORTH SHORE TOTAL DOWNTOWN # of Establishments 292 3,714 454 114 186 4,760 % Change of Tract + 2.0% -4.5% -5.0% -12.0% +20% # of Employees 6,374 97,503 12,585 4,099 5,809 % Change of Tract -2.0% -11% +10% -22.0% +40% 126,370 Despite the challenging economy, the North Shore has experienced increases in both the employee and establishment counts. Source: Claritas Inc. 35 DOWNTOWN WORK FORCE CHANGE BY INDUSTRY CLASS 36 EMPLOYEE CHANGE BY INDUSTRY Downtown Employees 2006 2010 AGRICULTURE 215 168 -47 -22% MINING 131 64 -67 -51% CONSTRUCTION 2,926 1,441 -1485 -51% MANUFACTUING 10,526 8,308 -2,218 -21% TRANSPORTATION 6,595 5,603 -992 -15% WHOLESALE 2,357 1,961 -396 -17% Growth RETAIL 9,958 11,381 +1,423 +14% Decline FINANCE 42,906 32,950 -9,956 -23% Growth SERVICES 45,514 50,066 +4,552 +10% Decline PUBLIC ADMIN 12,161 10,326 -1,835 -15% Growth MISC 3,639 4,102 +463 +13% 136,928 126,370 -10,558 -7.7% Decline TOTAL Source: Claritas Inc. Net Change 37 FORCE CHANGE BY DOWNTOWN TRACT & INDUSTRY CLASS 38 DOWNTOWN EMPLOYEE CHANGE Top 10 Above Average and Below Average Cells UPTOWN GOLDEN TRIANGLE AGRICULTURE 5 MINING 6 CONSTRUCTION 4 STRIP DISTRICT SOUTH SHORE NORTH SHORE 3 1 MANUFACTURING 3 9 TRANSPORTATION 8 7 9 WHOLESALE 10 7 RETAIL FINANCE 8 2 6 2 5 SERVICES PUBLIC ADMIN 4 10 1 MISC Decline Growth Green cells represent the top 10 areas of growth from 2006 to 2010. Construction in the North Shore (Green #1) is the biggest growth cell. Black cells signify the top 10 shrinking areas. Public Admin in the North Shore (Black #1) is the biggest declining cell. Source: Claritas Inc. Decline Growth 39 APPENDIX 11 PAGE EXAMPLE 40 THE AFFLUENTIALS – POOLS & PATIOS, 1 & 2 41 THE AFFLUENTIALS – POOLS & PATIOS, 3 & 4 42 THE AFFLUENTIALS – POOLS & PATIOS, 5 & 6 43 THE AFFLUENTIALS – POOLS & PATIOS, 7 & 8 44 THE AFFLUENTIALS – POOLS & PATIOS, 9 & 10 45 THE AFFLUENTIALS – POOLS & PATIOS, 11 46