Do Estate and Gift Taxes Affect the Timing of Transfers? B. Douglas

advertisement

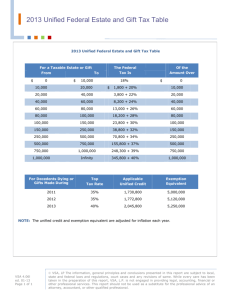

Do Estate and Gift Taxes Affect the Timing of Transfers? B. Douglas Bernheim, Robert J. Lemke, John Karl Scholz ARTICLE OVERVIEW PRESENTATION: PAIGE GANCE Theoretical Background Two types of priorities when choosing between a gift and a bequest Tax minimization – tax rates differ between inter vivos giving (transfer between living people) and bequests (transfer between deceased and living, i.e. through a will) Non-tax priorities: uncertainty over future health, long-term care needs, longevity, investment prospects, altruism, family politics Gift vs. Bequest Gifts receive favorable tax treatment Donors may give $10,000 per person (to an unlimited # of people), every year, which is not taxes and does not count toward the “unified” bequest and gift total Gifts for tuition or medical expenses do not count toward the total and are not taxed If the bequest tax is e, then the gift tax is e/(1+e), a lower rate Except… Appreciated assets (e.g. a house), are “stepped up” to market value once the owner dies This means heirs do not pay capital gains tax on the appreciation that occurred during the owners lifetime More Theory Tax minimization cont. As e falls there is a… Price effect: incentive to make gifts declines because the relative ‘cost’ of bequests declines Wealth effect: more resources will remain after taxes for both gifts and bequests, increasing incentives for transfers in general If gift-giving is a normal activity, the price and wealth effect work in opposite directions If the price effects is stronger, gift-giving should be positively correlated with e Literature Joulfaian (2000) – finds evidence of a significant tax effect on private transfers, but assumption of exogeneity of state-level transfer tax rates is questionable McGarry (2001), Poterba (2001) – the tax system ordinarily provides strong incentives to transfer resources through gifts rather than bequests Data Surveys of Consumer Finance Administered three years apart: 1989, 1992, 1995, 1998, 2001 By the Board of Governors of the Federal Reserve System Surveys are independent cross-section (meaning they do not follow the same individuals) Intentionally oversamples wealthy households (ideal for this study) Samples roughly 4,000 households 1989 and 1992 samples are pooled as this precedes serious discussion of estate tax changes Tax Legislation Changes Unified exemption was $600k (single), $1.2 million (married) from 1986-1997 1997: Unified exemption increased to $1 million (single), $2 million (double) by 2006 in stages Lowered maximum tax rate on capital gains from 28% to 20% (counteracts the effect of the increased exemption) The author does not believe this counteraction to be significant Therefore, “TRA97 should have reduced the frequency of inter vivos giving” 2001: Unified exemption increased immediately to $1 million (single), and in stages to $3.5 million (single) by 2009 The author believes that this did not further alter incentives for households transferring < $1 million (single) Classifying Households 1st group: Will pay no transfer taxes before nor after 1997 legislation Projected estate is below the original exemption 2nd group: Paid transfer taxes before 1997, but will not pay after increase of unified exemption Projected estate is between the original and new exemption 3rd group: Will pay transfer taxes before and after 1997 legislation Projected estate is above the new exemption Projected Estate The life expectancy of almost every household in 1998 SCF extended beyond 2006 and therefore only fully phased in provisions should factor into their estate planning. Three ways of calculating projected estate: 1. Adjusting net worth based on life expectancy (which also depends on # of factors), assumes estate tax does no influence net worth 2. Classify families based on educational attainment, which is correlated with net worth and exogenous w.r.t. estate tax reform 3. Projected estate = current net worth Empirical Model Examines gift-giving in each household group, defined by predicted net worth at the time of death, controlling for variables that may influence transfer decisions Restricted to households with net worth > $300k, head of household btwn 50 and 79, and with children (these restrictions relaxed during sensitivity analysis) Probit model: the dependent variable is either 0 or 1, and coefficients of independent variables signify the change in likelihood of giving for a one unit change in the variable A function of: age, age2, income, income2, net worth, net worth2, the % of net worth attributable to unrealized capital gains, and binary variables measuring education, health, marital status, gender, receipt of inheritance, year of survey, and household group Results/Conclusion The probability of making a gift for group 2 fell by… 89/92 1995: 4.5 percentage points* 89/92 1998: 10.8 percentage points 89/92 2001: 13.7 percentage points* Group 3 coefficients were not significantly significant, supporting the hypothesis that this group would NOT respond to the estate tax changes *statistically significant