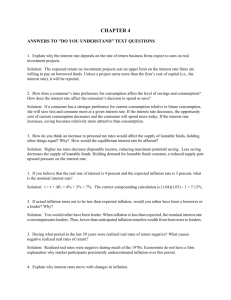

Inflation Expectations and Risk Premiums in an Arbitrage

advertisement