Technology Strategy for Target Grocery Guests

advertisement

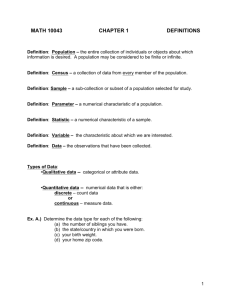

Technology Strategy for Target Grocery Guests “We have done an enormous amount of research with our guests on what would make their Target experience better, and we consistently heard feedback that if we would have fresh food as part of our product offering it would just make their life much easier and convenient.” ~Annette Miller, Target Senior Vice President, Grocery K nowing that customers want fresh food is not the same as knowing how to align the category with a company’s longstanding brand. With a brand position as an upscale discounter of high-quality, on-trend merchandise, Target Corporation faces several challenges when trying to align meat and potatoes with fashion and design. The phrase Grocery Tech had inhabited Target Senior Vice President, Grocery Annette Miller’s mind like a mantra since the day she was charged with leveraging technology to grow the company’s grocery business. Her long experience with food sales’ notoriously low margins—at least when compared with designer clothing—convinced her that she needed an ongoing strategy for harnessing technology to identify shoppers’ needs, and help meet those needs, while reducing costs. One immediate problem: with so many tools and apps and enterprise systems designed to exploit efficiencies, it could take months to analyze opportunities and map a strategy. The Client The Merchandising Mission of Target is to drive profitable market share growth by fulfilling its brand promise― Expect More. Pay Less. Target is dedicated to providing guests with the right merchandise mix, from everyday commodities and grocery offerings to trend-right home and apparel lines. Minneapolis-based Target Corporation (NYSE:TGT) serves guests at more than 1,700 stores in 49 states nationwide and at Target.com. Target is a publicly-owned, U.S.-based company with a global presence including a headquarters location in India and sourcing offices around the world. In addition, the company operates a credit-card segment that offers branded proprietary creditcard products and rewards programs. 2013 CoMIS Case Competition Joseph Moses wrote this case under the supervision of Professors Ravi Bapna and Norman Chervany for the 2013 CoMIS Case Competition. Content is a hybrid of historical fact and fiction designed for instructional purposes only and is not intended to illustrate effective or ineffective handling of managerial situations by anyone named in the case. Copyright 2013, Carlson School of Management 2013 CoMIS Case Competition 2 The Case Question How can Target better leverage technology to define and implement a food strategy so guests think of Target first when it comes to food? Target Stores The first Target store opened in 1962 in the Minneapolis suburb of Roseville, Minnesota with a focus on convenient shopping at competitive discount prices. Today, Target currently is the second largest general merchandise retailer in America, with Target.com consistently being ranked as one of the most-visited retail Web sites. Target provides quality merchandise at attractive prices in clean, spacious and guest-friendly stores. Target opens new stores three different times each year—in March, July and October— to align with the major merchandising themes: Spring, Back-to-School, and Holiday. New stores range in size from approximately 127,000 square feet to approximately 174,000 square feet. Additionally, Target operates 37 distribution facilities nationwide. Since 1946, the corporation has given 5 percent of its income to communities through grants and a variety of programs like Take Charge of Education®. Today, that giving equals more than $3 million a week, largely directed towards supporting education. As one of America's largest corporate philanthropists, volunteerism is at the heart of Target. Since Target first opened its doors, team members, retirees, family and friends have volunteered millions of hours to community projects. Additional information regarding Target’s commitment to corporate responsibility can be found at Target.com/HereForGood. Price Product Economy Target Grocery Guest Trends Presentation Brands Annette Miller reviewed the history of Target and crafted a schematic of variables impacting Target grocery guests (Fig. 1). Marketing Competitors Guest Experience Fig. 1. Variables impacting Target Grocery Guests 2013 CoMIS Case Competition 3 Annette’s Synthesis: The Typical Target Guest Target works to appeal to a range of guest segments, including women, kids, teens, young singles and families. Guests are young, well-educated, moderate-to-better income families who live active lifestyles. The median age of Target guests is 41, the youngest of major discount retailers. They have a median annual income of $63,000. 56 percent have completed college and 44 percent have children at home. As Figure 2 illustrates, Target retail sales, exclusive of credit-card revenues, break down into five major categories (Fig. 2). Fig. 2. Target retail sales. Does not include credit-card revenues. 25% Household Essentials 18% Home Furnishings & Décor 19% Food & Pet Supplies 2011 Sales Mix: $68.5 Billion 19% Hardlines 19% Apparel & Accessories Much of the information Annette had about customers came from existing enterprise systems and initial strategies for reaching retail customers with grocery promotions: • Mobile marketing: Apps for iPhone, iPad and Android, and at m.target.com make it easy for guests to find the nearest Target store, check product availability, view a Weekly Ad, create shopping lists, and refill prescriptions from mobile devices. • Digital coupons: Target.com/grocery offers weekly coupons and specials on food products available at SuperTarget and select Target stores. Guests can opt-in to the mobile coupon program on their PC at Target.com/mobile, on their phone at m.target.com or by texting COUPONS to 827438 (TARGET). 2013 CoMIS Case Competition 4 • Guest ID tracking: records everything guests buy, based on credit card or coupon information, surveys, mail-in refunds, calls to customer help, pushed e-mails or Web site visits. • Predictive analytics: behavioral research into shopping habits and personal habits that help the store understand how guests think. Annette drew up Target’s digital capabilities (Fig. 3) and app/store functionalities (Fig. 4)— which were well-established for retail operations—in order to analyze how they could be further leveraged for growth in the grocery business. Fig. 3. Target’s Digital Capabilities Supply Chain Management Mobile Web Data Warehousing Andriod App WiFi in all Stores Predictive Analytics Iphone App In-Store Customer Relationship Management Ipad App Text Alerts Point-of-Service Applications 2013 CoMIS Case Competition 5 Fig. 4. App/Store functionalities Barcode Scanner Store Finder •Price check •Product details Voice Recognition Mobile Coupons Weekly Circular Mobile Giftcards TargetLists •See if item is in stock •Prescription refills •iPhone Passbook Product Reviews Inventory tracking Mobile Pharmacy App/Store Functionalities QR Codes 2013 CoMIS Case Competition 6 To round out her analysis of strategies past and present, Annette also reviewed three recent research findings that suggested paths to the future. 1. Demand for self-service is growing Retailers in North America are expected to boost their use of self-service checkouts 8% to 10% in the next few years, according to IHL Consulting Group. A recent survey conducted for NCR Corp (a developer of self-service systems) by the NPD Group found that a majority of U.S. consumers believe the technology improves their store experience. About two-thirds of respondents want self-service options when shopping – and that figure is even higher for younger customers: nearly half of shoppers under 45 want self-service. Source: http://www.stores.org/STORES%20Magazine%20January%202012/man-vs-machineaff 2. Mobile Apps Pair Supply with Demand Grocery retailers are using technology worldwide. Minneapolis-based SuperValu began testing a mobile app with Cub Foods stores in November 2011 and equipped all SuperValu grocery chains with apps in February. One of the main features of the app is that it aggregates weekly ads for shoppers in one place. To find local deals, consumers can type in their ZIP code or use their device’s GPS to store nearby locations to the app. Consumers can also create lists to help manage their in-store shopping experience. Source: http://www.mobilecommercedaily.com/2012/03/06/supervalu-speeds-up-grocery-shopping-viamobile-app break a mostly shop for groceries in person. 3. Store Staff Still Matter PWC research states store staff can make or break a shopping experience. Customers still mostly shop for groceries in person. They value help from staff—and not just behind the register anymore. Promotions and high-tech gadgets draw customers in, but good experiences with staff all over the store are what keep customers coming back. Despite the rise of e-commerce, 98% of grocery shopping is done in store. As the #1 influencer, staff quality impacts where customers shop one-third of the time. Twenty-one per cent of customers do not repurchase after a bad experience. Rude employees have a permanent impact on business. Source: http://www.pwc.com/us/en/advisory/customer-impact/publications/2013-retail-grocery- experience-radar.jhtml About Target’s Grocery Offerings To answer the question, What technologies had Target yet to fully exploit in the service of guests and financial targets? Annette reflected on the cornerstone of any retail strategy: product. Since the former Dayton Co. department store chain opened its first Target discount store on May 1, 1962 in Roseville, Minnesota, food—namely snacks and beverages—has been a part of the mix. In 1995, the first Super Target opened in Omaha, Neb., featuring a full-scale grocery store attached to a Target general merchandise store. Today there are about 250 Super Targets nationwide, with each store averaging around 174,000 square feet. In 1995, Target also debuted Archer Farms as its first food private label. 2013 CoMIS Case Competition 7 PFresh: Easy Access to More Fresh Offerings In 2008, Target began testing a new format selling a more extensive line of grocery within the four walls of a conventional Target store, dubbed PFresh [P for prototype]. The first test stores were in Minnesota, and were remodeled to add about 10,000 square feet of food space to the conventional 135,000 square foot traditional Targets. No departments were eliminated, but home, apparel and accessories areas were shrunk. PFresh stores carry 90% of the product categories that are carried in Super Targets. An expanded selection of the freshest grocery offerings is available at many general merchandise Target stores. At these PFresh Target locations, guests find a selection of fresh produce, meat and baked goods – making fresh groceries even more accessible and convenient. The expanded food layout includes an open-market grocery feel, creating an environment that provides greater ease of food shopping. A Lot of Choices for Very Little New food additions include items that are on Target guests’ shopping lists every week, such as bananas, strawberries, and bagged lettuce, ground beef, chicken, pork, and baked goods such as breads and pastries. Stores also offer a dairy and frozen assortment, snacks, and beverages. Do More in One Store The expanded fresh food selection offers families grocery shopping in the convenience of their local Target store. Busy guests can pick up a handpicked selection of fresh food during midweek shopping trips. Analysts cited in Grocery Headquarters say PFresh remodels have resulted in a 6% lift in sales. Currently Target has five Own-Brand lines Archer Farms. Premium, affordable brand that offers more than 1,600 items including premium groceries, fine cooking ingredients, organics, baked goods, frozen pizzas and appetizers. Contain zero grams of added trans fat. Market Pantry. More than 1,900 items offering the quality of national brands at 10% to 30% lower price. Includes cheese, milk, eggs, flour, sugar, cereal, poultry, seafood, fruit snacks, and granola bars. Sutton & Dodge. This brand offers a full menu of marbled, premium quality USDA Choice Angus beef, naturally aged and hand-trimmed. Wine Cube. Boxed wine available in varietals—many of them award-winning— including Merlot, Chardonnay, Cabernet Sauvignon, Pinot Grigio, Sauvignon Blanc, Cabernet/Shiraz blend, Red Sangria, White Sangria and Riesling. 2013 CoMIS Case Competition 8 up & up. More than 900 non-grocery products span more than 40 categories, including household cleaners, paper goods, health care, beauty, baby and personal care. Target’s Positioning Statements In order for all Target personnel to literally be on the same page, Target distributes the following statements to individuals who are assigned to speak about grocery with the media. Positioning statements are designed to promote distinctive features or benefits of the Target brand. • It’s easy to stock-up on grocery essentials at Target throughout the week. Every Target location carries milk and bread. • New Target PFresh stores also include an expanded food section where busy moms can fulfill their weekly shopping lists. Guests will find an expanded food layout that includes bananas and bagged lettuce, fresh meat and bakery-fresh breads. PFresh stores are convenient for midweek fill-in trips, too, offering pre-packaged, pre-priced fresh foods that let busy families and household chefs “grab and go.” • In 2006, SuperTarget became a certified organic produce retailer, offering superior quality and prices on produce such as strawberries, apples, and other fruits and vegetables. As a certified organic produce retailer, SuperTarget adheres to strict U.S. Department of Agriculture (USDA) compliance guidelines to provide the best in organic produce for its guests. • Target Wine Cubes are not only a perfect low-cost answer for everyday wine lovers, but many varietals have won numerous awards: • A gold medal and Judge’s Choice for the Cabernet/Shiraz Wine Cube at the January 2010 San Francisco Chronicle Wine Competition • A platinum medal for the Riesling Wine Cube at the March 2010, New World International • A gold medal for the Sauvingnon Blanc Wine Cube at the January 2009 San Francisco Chronicle Wine Competition The Media Release With Annette’s analysis and Target positioning strategy in mind, Shawn Gensch, Senior Vice President, Marketing, asked for a media release that would make the strategy accessible to the public at the first of the year, 2013. Fox Business New picked it up and ran with the following article (on the next page): 2013 CoMIS Case Competition 9 Target wants to make groceries fashionable With a new ad campaign that carries its "cheap chic" message to food and other necessities, Target Corp. (TGT) is crossing a divide that was once only used to sell apparel. Ads, which began airing at the start of the year, feature models swathed in white against white backgrounds holding everyday grocery items in a tongue-in-cheek take off of high-fashion advertisements. The ads, which air on television as well as a myriad of other venues, are meant to build awareness and sales. "We want to surprise and delight our guests and bring them into stores," said Target spokeswoman Jamie Bastian. Target would not disclose cost of the ad campaign, which will run all year [2013], including four new spots on the Golden Globes, but the price is easily in the millions of dollars. Aside from television, the ads will take the form of newspaper inserts, radio spots, and digital films that will appear online. The ads are the latest salvo for Target's grocery efforts that consist of the PFresh program which was started in October 2008 at general merchandise stores with a test run. Target had been offering snacks, beverages and candy, and under the PFresh program [the P stands for prototype] it remodeled stores to add such foods as fresh produce, meats and baked goods. Target has 1,100 stores under the PFresh model and 250 SuperTargets that offer a full range of groceries. Groceries may seem an odd pairing with a retailer that goes out of its way to play up its fashion acumen. The merchandise also tends to carry low margins--at least a lot less than a Missoni dress, a limited edition line that Target famously carried. But groceries are neck-in-neck with apparel at the retailer, according to its latest annual report. Food, along with pet supplies, and apparel each accounted for 19% of sales. Two years before food and pet supplies were 16% of sales to apparel's 20%. Carrying groceries "is a good strategy because driving traffic and building the basket is the name of the game," said Jim Hertel, a supermarket consultant with Willard Bishop LLC. And the ad campaign is like a cherry on the cake, said Thom Blischok, chief retail strategist for Booz & Co. "Target is beginning to extend its banner promise of chic to food," Mr. Blischok said. "They're making food shopping aspirational--in advertising I believe it is the first of its type." Target could use the positive play. The retailer recently appeared to strike a sour chord in a holiday merchandising partnership with Neiman Marcus. Designers were engaged to produce one-of-a-kind gifts that appeared in both stores, but just days before Christmas Target marked the products down by 50%. The food business proved its mettle in December, though, with the category having the strongest comparable-store sales--amid single-digit increase. Apparel experienced a low single-digit increase. Source: http://www.foxbusiness.com/news/2013/01/11/target-builds-grocery-business-with-unusualads/#ixzz2KRLHJFlh 2013 CoMIS Case Competition 10 Focusing Questions for Case Competitors The following topics and questions are derived from Annette’s initial analysis and define a number of perspectives that could be used in making recommendations. The list is not meant to be exhaustive, and you may decide that others should be considered instead or in addition. Most importantly, students must determine which topics and questions are most critical to the case and prioritize them accordingly. Price: What factors drive price the most in food? How does the grocery guest assess value? How can Target remain competitive on price while upholding its commitment to freshness? How can technologies be used to manage, control, or alter factors that drive food prices? Product: What food categories drive consumer loyalty? How can Target continue to differentiate its assortment while ensuring guests find the brands they expect? What role should regionalized food preferences or specialties play in each store’s food assortment? How can technologies be used to analyze customer decision making and habits? Presentation: How can Target use presentation to better highlight its upscale offerings as well as its commitment to freshness? How does presentation drive sales in food? How can technology enhance food presentation? Marketing: How can Target leverage technology to better execute its food strategy? What additional marketing tools should be employed? Guest Experience: How does the grocery guest shop? What do guests value in a grocery shopping experience? How can Target use technology to improve the shopping experience in food? Competitors: Who are the competitors in the grocery industry? Whom should Target benchmark? How are these competitors leveraging technology? Brands: Do brands matter in all food categories? How can Target better position its ownedbrand items alongside national brands? Which external brands complement Target’s brand image? How can technology be leveraged to capture and analyze guest preferences? Trends: What are some current and emerging trends in retail grocery technology? Which trends complement Target’s brand image? Economy: What economic factors will drive change in the grocery industry? How can social media or other technologies assist in predictive analytics for grocery shopping? Target Executives Annette Miller Shawn Gensch Senior Vice President, Merchandising, Grocery Senior Vice President, Marketing