Special Journals

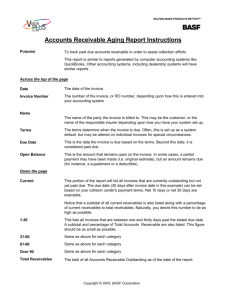

advertisement