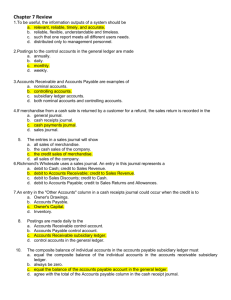

Special Journals

advertisement