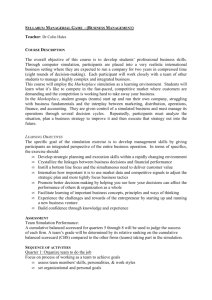

Introduction to Business

advertisement