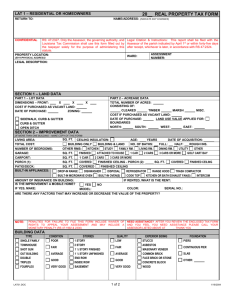

Personal Property Audit Seminar Manual

advertisement