Corporate Tax Accounting for Regulated Telcos

advertisement

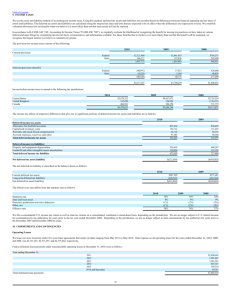

Corporate Tax Accounting for Regulated Telcos • The material appearing in this presentation is for informational purposes only and is not legal or accounting advice. Communication of this information is not intended to create, and receipt does not constitute, a legal relationship, including, but not limited to, an accountant-client relationship. Although these materials may have been prepared by professionals, they should not be used as a substitute for professional services. If legal, accounting, or other professional advice is required, the services of a professional should be sought. MossAdams • Firm established in 1913 – Serving telecom clients since 1957 • The 12th largest accounting & consulting firm in the U.S. – 250 Partners / 2,000 Staff – 22 Offices – West Coast, Kansas City • Telecom specialists based in Seattle, Spokane, Stockton, Vancouver, & Kansas City Housekeeping • Class Schedule – 9:00 am to 4:00 pm • Facilities – Restrooms – Telephones • CPE and Evaluation Forms • Binder • Participate CourseOutline • Income Tax Overview/Effect on Rate Base • Topic 740 (FAS 109) Basics • Case Study – Common Permanent Differences – Common Temporary Differences – Plant Accounting (Temporary Differences) from a Tax Perspective – Effect of Tax Calculations on Rate Base • Topic 740 (FAS 109) Additional Topics • Other Tax Considerations • Topic 740 re: FIN 48 – Accounting for Uncertainty in Tax Positions IncomeTaxOverview/ EffectonRateBase IncomeTaxOverview • Part 32 • Income tax accounting – Cooperative telco – discussed in depth in another course – Commercial telco • Deferred income taxes • Settlement issues WhatisPart32? • Uniform System of Accounts (USOA) – Added to Code of Federal Regulations May 15, 1986 • Purpose of regulated system of accounts – Provides comparable accounting information – Provides accounting information according to GAAP – Standardizes accounts & financial reports Part32 See Separate Part 32 RateBase Amounts Included in Typical Rate Base A/C # 2001 2002 2003 2005 1220 3100 3200 3600 4310 4100, 4340 4040 Description Telecommunications plant in service Property held for future use Telecommunications plant under construction Telecommunications plant adjustment Materials and supplies Accumulated depreciation Accumulated depreciation - held for future use Accumulated amortization - other Other long term liabilities Deferred income taxes Customer deposits Cash working capital xxxxxxxxx xxxxxx xxxxxxx xxxxx xxxxxx (xxxxxxx) (xxxxx) (xxxxx) (xxxxxxx) (xxxxxxx) (xxxxxxx) xxxxx Rate Base xxxxxxxxxx PART 32 ACCOUNTING Rate Base = $11,300,000 Expenses & Taxes = $6,175,000 PART 64 PROCESS Nonregulated Regulated RB = $300,000 E&T = $175,000 RB = $11,000,000 E&T = $6,000,000 PART 36 PROCESS Intrastate RB = $2,750,000 E&T = $1,500,000 RR = $1,809,375 @ 11.25% Interstate RB = $8,250,000 E&T = $4,500,000 RR = $5,428,125 @ 11.25% SEPARATIONS PROCESS Local $498,000 Access $1,300,000 PART 69 PROCESS Nonaccess $11,375 Access $5,393,000 Nonaccess $35,125 NonregulatedInvestments • What’s different for telephone companies? – Regulated vs. nonregulated • Are there joint & common costs? – If yes: • Assets recorded in regulated accounts • Revenues recorded in A/C 5280 • Expenses recorded in regulated accounts – If no: • Assets recorded in A/C 1406 • Revenues & expenses recorded in A/C 7990 AffiliatedTransactions • No subsidization of nonregulated by regulated • Sales of assets regulated to nonregulated affiliate – Tariffed rate – Prevailing price – Greater of NBV or FMV • Sales of assets affiliated to regulated – Tariffed rate – Prevailing price – Lower of NBV or FMV • There is a de minimus exception AffiliatedTransactions • Provision of services: – Regulated to nonregulated affiliate • Greater of fully distributed cost or FMV – Nonregulated to regulated • Lesser of fully distributed cost or FMV – There is a de minimis exception • Exception: Affiliate exists solely to provide services to carriers corporate family – Valued at fully distributed cost Part32IncomeTaxAccounts A/C # A/C Description 4070 Income taxes accrued 4100 Net current deferred operating income tax 4110 Net current deferred nonoperating income tax 4320 Unamortized operating investment tax credits, net 4330 Unamortized nonoperating investment tax credits, net 4340 Net noncurrent deferred operating income taxes 4341 Net deferred tax liability adjustments 4350 Net noncurrent deferred nonoperating income taxes 4361 Deferred tax regulatory adjustments, net Part 32IncomeTaxAccounts A/C # A/C Description 7210 Operating investment tax credits, net 7220 Operating federal income taxes 7230 Operating state & local income taxes 7250 Provision for deferred operating income taxes, net 7400 Nonoperating taxes IncomeTaxes‐ TheBasics • A/C 4070 – Provision for current year state & federal income tax due to IRS or State – Resulting from: • Operating state & federal income tax • Nonoperating state & federal income tax • Nonregulated state & federal income tax IncomeTaxes‐ TheBasics • On the books: – – – – Income before income tax State income tax expense Federal income tax expense Net Income 300 (15) (85) 200 • On the tax return: – – – – Net income per books Add federal income taxes Pre-tax income +/- book/tax differences: 200 85 285 • Permanent differences • Timing differences 15 (150) – Taxable income 150 IncomeTaxes‐ TheBasics Taxable income X Tax rates Tax Due (Estimated payments) Payable to tax authorities DeferredIncomeTaxes • Tax normalization – Required by Part 32 – Reflects the amount of income tax expense recorded on the books as if there were no temporary differences DeferredIncomeTaxes • What’s different for telephone companies? – Rate base accounts: • A/C 4100 - Net current deferred operating state & federal income taxes • A/C 4340 - Net noncurrent deferred operating tax liability – No rate base effect: • A/C 4110 - Net current deferred nonoperating state & federal income taxes • A/C 4350 - Net noncurrent deferred nonoperating tax liability DeferredIncomeTaxes • Deferred tax asset – Results in lower taxes in future years • Deferred tax liability – Results in increased taxes in future years SettlementIssues • Operating Tax Expense – Cost study calculations Rate Base (Fixed charges) (SIT deducted for FIT) Tax Base @ 35% = Regulated Tax Expense – USF calculations • Includes amounts recorded in A/C 7220 OtherAccounts • Income tax expense – Accounts 7220, 7230, 7250, 7400 – Financial Statement Income Tax Expense is composed of: • Taxes currently Payable (total tax from return) • +/- Change in Deferred Taxes HotTopics– Part32Accounting • Account coding is critical – Inventory and expenses • Segregate regulated from non-regulated – Inventory, customer deposits, pension/post-retirement benefits, and deferred tax liabilities • Affiliate transactions – Regulated will pay the least, nonregulated will pay the most • Consistent accounting between miscellaneous and non-operating on both revenues, expenses, and income tax accounts DoesRateBaseStillMatter? • With FCC changes in revenue and support mechanisms, does rate base still impact revenue? • Yes – rate of return regulation is still a key component of a regulated telephone company’s revenue Topic740(FAS109)Basics Topic740(FAS109)Basics • Accounting for Income Taxes – Basic Principles: • A current tax liability/asset for estimated taxes payable/refundable for the current year • A deferred tax liability/asset for estimated future effects attributable to temporary differences and carryforwards • Measurement of current and deferred liabilities/assets are based on provisions of enacted tax law – future changes are not anticipated • Measurement of deferred tax assets is reduced, if necessary, for amounts not expected to be realized (valuation allowances) Whyaretaxcalcsimportant? • The tax accounts are usually considered material to the financial statements • Easily misunderstood • Can be susceptible to error – Dependent on other financial statement numbers – Dependent on proper understanding of numerous complicated tax law – Dependent on comprehensive GAAP accounting rules for income taxes GAAPvs.Tax • GAAP objective is to provide useful information • Tax Code objective is to provide revenue to the government • A majority of the differences between GAAP and the Tax Code are temporary • Topic 740 (FAS 109) is a FASB requirement (GAAP) but is calculated based upon the tax code Temporaryvs.Permanent Differences • Permanent Differences – deductions that will never be allowed, and income that will never be taxable • Temporary Differences – result in Deferred Tax Assets/Liabilities because they will reverse TaxBalanceSheet • SFAS No. 109 is a Balance Sheet Oriented Statement • A Result of Temporary Differences • Example: – Depreciation - $800 NBV for book purposes and $700 NBV for tax purposes – Difference in basis multiplied by tax rate results in deferred tax asset/liability ComprehensiveCaseStudy TaxProvision Review of Case study template Federal Income Taxes are nondeductible, so the starting point of a tax provision is pre-tax income State taxes are deductible but are recalculated as part of the provision CommonPermanent Differences PermanentDifferences • • • • • • • • • Penalties Meals and entertainment Life insurance premiums Change in cash surrender value of life insurance policies Lobbying expenses Tax exempt interest income Political contributions Nondeductible dues Patronage Exclusion (for Cooperative entities) CommonTemporary Differences TemporaryDifferences • • • • • • Reserves Accrued Vacation Advance billings Pension obligations Post-retirement health obligations Asset retirement obligations Reserves • Allowance for Doubtful accounts • Inventory obsolescence • Warranty reserves AccruedVacation/Leave • General Rule – Not deductible until paid • Exception – Deduction allowed for vacation accrued as of year end that has been paid out by 2.5 months after year end AdvanceBilling • General rule taxable when received • Exception for utility services– income taxable when services are provided – Utility services – includes telephone or other communication services • IRC Sec 451 (f) PensionObligations&Post RetirementHealth • ASC Topic 715 • Can have significant liabilities accrued on the books for these items • For tax purposes, not deductible until funded • May have previously been referred to as FAS 106 or FAS 87 PensionObligations&Post RetirementHealth • Topic 715 (FAS 158) – Requires an actuarial calculation of the liability – Upon initial implementation in 2007, the entry was to record a CR to liability and DR to Other Comprehensive Income • Since this initial entry didn’t hit the income statement, no income tax effect – Unrecognized amounts in OCI are amortized to expense in subsequent years • Entry is to record a DR to expense and CR to OCI • Income tax effect is to reverse expense until the liability is actually paid out in cash – Subsequent gains/losses in actuarial value can also be running through OCI AssetRetirementObligations • May generate book/tax differences • Book treatment: – DR Plant, CR Asset Retirement Obligation Liability – Plant asset is depreciated (CR A/D, DR Expense) – Liability is accreted (CR liability, DR Expense) • For tax purposes, depreciation expense and accretion expense are not deductible until the retirement obligation is actually paid BTOPfunds • May generate book/tax differences for nonregulated companies • Book treatment: – Recorded as a deferred liability/deferred revenue – Amortized into income over time – Plant added at full cost • For tax purposes, grant can potentially decrease cost basis of asset resulting in lower depreciation. Book income on deferred revenue is not taxable. PlantAccountingfromaTax Perspective TaxAccountingforPlant • Plant in Service Schedule – Additions – AFUDC capitalized for books – Contributions in Aid of Construction • Accumulated Depreciation Schedule – – – – Cost of Removal Salvage – plant Salvage – Inventory Depreciation methods • Tangible Property Regulations AFUDC Allowance for Funds Used During Construction • Book treatment DR Plant (CWIP) CR Interest Expense • Tax return – Required to capitalize interest under different rules (UNICAP) CapitalizedInterest • Tax return – Required to capitalize interest under different rules (UNICAP) – Capitalization required for long-lived assets (greater than 20 year life) and – For all assets that have a construction period of 2 years or more OR • Have a construction period of at least 1 year and a cost of $1Million or more CIAC Contributions in Aid of Construction • Nonrefundable amounts paid to utilities • Purpose is to defray construction costs for facilities that would not otherwise produce a sufficient return • Book treatment DR Cash CR Plant CIAC • Tax treatment – Taxable income when received – Higher tax basis to depreciate – Timing difference reverses as the asset is depreciated IRCSection118andCIAC • Contributions to capital – Excluded from gross income if meets requirements in Section 118 – Contributions in aid of construction don’t qualify under Section 118 – Road moves can qualify AdvancesinAidofConstruction • Refundable – usually as additional customers are added to the line, or a minimum quantity of telephone services are purchased • Book treatment DR Cash CR liability (deposit) • Treated as liability and reduction of rate base until final determination is made AdvancesinAid • Move to CIAC if advances will not be refunded • Tax treatment – Taxpayers’ position that advances are loans – IRS’ position is that advances are CIAC DepreciationDifferences Book treatment Cost of asset recovered ratably over economic life of asset. In practice achieved by combining costs for all years into a given classification times a composite rate DepreciationDifferences • Tax treatment Cost recovered on an accelerated basis over an arbitrary “recovery period” prescribed by law MACRS: • Telecom specific assets • Wireless • Mid-quarter convention DepreciationMethodSelection • Depreciation Method Selection – MACRS – Accelerated depreciation method – 200% or 150% depreciation over the appropriate lives, switching to S/L when it results in a higher deduction - this is the tax default unless an election is made to use another method – S/L – Straight line depreciation election – this election allows for utilization of the book method of depreciation so that tracking of book-tax differences is not required • May make sense if there are large net operating loss carryforwards, if the entity doesn’t pay tax due to cooperative structure, etc. – Others – ADS, Units of production, etc. DepreciationConvention • Depreciation Convention – Under MACRS there are two depreciation conventions: • Half Year (HY) – Every asset is considered to be added and disposed at the mid-point of the year, so in the first and last year ½ of the yearly depreciation is allowed. • Mid-Quarter (MQ) – Depreciation is calculated based upon which quarter the asset was placed in service – Other conventions – Mid-month, Full-month, etc. Mid‐quarterConvention • If more than 40% of additions in last quarter, mid-quarter convention applies • Common problem for utilities – Large work orders left open until the end of the year – Weather often causes projects to be completed in the fall & closed in the last quarter NewTangiblePropertyRegulations • What can be capitalized vs. expensed? – – – – Materials & Supplies Acquisition costs Improvements to existing assets Retirements ScopeofNewTemporary Regulations Acquisitionof tangible property Improvement oftangible property Dispositionof tangible property • Material& supply • Capitalized acquisitioncosts • Deminimisrule • Unitof property • Repairvs. improvement • Routine maintenance • Structural components • Generalasset accounts 64 Rev.Procs.2012‐19and2012‐20 • 19 automatic changes added to Rev. Proc. 2011-14 based on temporary regulations – -19 applies to §§162,263(a)changes – ‐20appliesto§§167, 168 changes • All scope limitations waived for first two years • Effective for tax years beginning on or after January 1, 2012 • Mix of §481(a)and“modifiedcut‐off” • 3115scan/shouldbecombined • ManynecessitatepropercapitalizationforUNICAP 65 MaterialsandSupplies:Overview IstheItema Materialand Supply? WhatKindof Materialand Supplyisit? Evaluate Optionsfor CostRecovery andMake Appropriate Elections 66 WhatareMaterialsandSupplies? Tangible property used or consumed in the taxpayer’s business that is not inventory and that is: 1) A component acquired to maintain, repair, or improve a unit of tangible property that is not acquired as part of any single unit of property; 2) Fuel, lubricants, water, and similar items that are reasonably expected to be consumed within 12 months after use begins; 3) A unit of property that has an economic life of 12 months or less after use begins; or – Useful life on AFS or from facts and circumstances 4) A unit of property that has an acquisition cost of $100 or less. 67 AcquisitionofTangibleProperty: Overview • General – Taxpayer must capitalize amounts paid to acquire or produce a unit of real or personal property. • Costs required to be capitalized: 1) Invoice price 2) Facilitative transaction costs – – Amts paid to pursue or investigate transaction 11 “inherently facilitative” costs 3) Work performed prior to placing property in service 4) Defending or perfecting title to real or personal property 68 RepairExpensevs.Capital Improvements:Overview Identifythe Unitof Property (UoP)to Measurethe Possible Improvement BARTest: • Betterment • Adaptation • Restoration ApplyRoutine Maintenance SafeHarboror DeMinimis Rule,if Applicable 69 WhatistheUnitofProperty? Buildings • Building & structural components are the UoP • Improvement standards applied at building structure or building system level Plant Property • Functionally interdependent machinery used to perform an industrial process • Separate UoP for equipment performing “discrete and major function” Network Assets • Based on facts and circumstances • Separate guidance Leased Property • UoP cannot exceed leased portion (lessee) • Building and building systems subject to lease Other Property • Functional interdependence test 70 UnitofPropertyforImprovement Standards:Buildings Building structure • Consists of the building and its structural components other than building systems. • This includes: walls, floors, partitions, ceilings, windows, doors, etc. Building systems 1. 2. 3. 4. 5. 6. HVAC system Plumbing system Electrical system All escalators All elevators Fire protection and alarm systems 7. Security systems 8. Gas distribution systems 9. Other structural components identified in guidance 71 ThreeImprovementTests(BAR Test) Adaptation Betterment Restoration Capital Improvement 72 GroupDepreciationand MassAssetElections • Telephone companies are allowed to use group depreciation calculations for book (regulatory purposes) • For tax purposes the same rules apply – One asset can be depreciated for each group Single Asset Account (SAA) Multiple Asset Account (MAA) Used for >1 Asset Single Asset OR One Asset (w/ same depreciation factors) >1 Asset (w/ same depreciation factors) Dispositions AccountingforMACRSProperty Stop depreciating and recognize G/L using adjusted basis Stop depreciating and recognize G/L using adj. basis on portion disposed; adj. remaining basis Continue depreciating asset; ordinary income on proceeds – no loss recognized (unless elect out) General Rule (Default) General Asset Account (GAA) If Elected 74 CostofRemoval • Definition – Costs incurred to remove an asset from service • If accruing for cost of removal on the books, this results in a temporary difference. • For tax purposes amounts are deductible when incurred or realized. • Book entry upon disposal DR A/D CR cash CashSalvage • Proceeds realized on disposal of plant • Book entry DR Cash CR A/D • Tax treatment – salvage proceeds should be included in the disposal calculation as a component of the gain/loss SalvageTransferredtoInventory • Plant removed from service can be transferred to inventory • Book entry DR Inventory (FMV) CR A/D • For tax purposes no gain or loss recognized – different book/tax basis for inventory LikeKindExchanges • Most common on vehicles that are traded in for newer vehicles • Book treatment of sale – generally recognized as disposal and Cash Salvage • Tax Purposes – No gain or loss is recognized on the trade-in – Cost basis of the new asset is reduced by deferred gain on old asset NonoperatingItems Nonoperating/Nonregulated DeferredTaxItems • Goodwill – Not amortizable for Books, but amortizable for tax purposes • Nonregulated depreciation differences • Partnerships/Pass-through investment basis differences – A variety of methods may be used for book purposes (equity method, cost method, etc.) – Tax purposes – original cost plus Schedule K-1 income/loss items CaseStudy Complete the reconciliations related to Operating/Nonoperating Deferred Assets/Liabilities Review the current calculation of nonoperating and nonregulated tax expense FINISHED WITH CASE STUDY!! COMMERCIAL TELEPHONE Reconciliation of income tax accounts Cash Federal liability A/C 1120 A/C 4070 Monthly estimate accruals 20xx estimated payments: Pay 1Q estimate Pay 2Q estimate Pay 3Q estimate Pay 4Q estimate Balance pre-audit (100,000) (25,000) (25,000) (25,000) (25,000) 25,000 25,000 25,000 25,000 (100,000) 0 Audit adjustments: Reverse estimate accruals Record federal income tax Allocate nonoperating/nonregulated Balance per audit 100,000 (120,190) (100,000) (20,190) Operating Nonoperating federal federal Nonregulated A/C 7220 A/C 7400.1 A/C 7990 50,000 40,000 10,000 50,000 40,000 10,000 (50,000) 120,190 (36,210) (40,000) (10,000) 31,110 5,100 83,980 31,110 5,100 Total tax expense 120,190 Topic740– AdditionalTopics Topic740– othertopics • • • • • • State Income Taxes Net Operating Losses Valuation Allowances Change in Valuation Allowances Change in Tax Status Financial Statement Presentation/Disclosures StateIncomeTaxConsiderations • Consider Apportionment Among States for MultiState Taxpayers • Franchise Tax/Income Tax – Some state taxes based upon items other than income • Many Companies use a Blended Rate to Calculate Deferred State Income Taxes StateIncomeTaxConsiderations • State versus Federal Net Operating Losses – Different Carryforward Periods (5 yr for federal) – Consider Deferred Rates • Depreciation Differences for State Purposes • Other Additions/Subtractions for State – State income tax expense – Tax Exempt Interest • State Credits NetOperatingLosses • If the Corporation Generates a Net Operating Loss it is treated as a Deferred Asset/Liability • NOL’s are available to be carried back 2 years and forward 20 years (Federal) – Election to carryback 5 years or 4 prior tax years for federal – States may or may not conform NetOperatingLosses • Allocation between members of a consolidated group: – Be consistent in application – Group should document tax sharing agreements – Example Situation: Sub 1, 2, and 3 have taxable losses, Sub 4 has taxable income, consolidated there is taxable losses – how to allocate current losses to each subsidiary? ValuationAllowances • Deferred Tax Assets must be reduced by a valuation allowance if the benefits of the asset are not expected to be realized. • Deals with “realizability” of the assets rather than existence • “More-likely-than-not” standard for recognizing a valuation allowance ValuationAllowances • Evaluating the need for an allowance – Review sources of taxable income: • Future reversals of existing temporary differences • Taxable income in prior carryback years, if carryback is permitted under the tax law • Tax planning strategies • Future taxable income – Evaluate positive and negative evidence • History of unused NOL’s • Losses expected in early future years • Carryback or carryforward periods ChangeinaValuationAllowance • General rule – adjust the valuation allowance and expense • Exceptions: – Valuation allowance initially recognized in a purchase business combination – Certain transactions that are recognized in equity ChangeinTaxStatus • Example – Change from tax-exempt entity to a taxable entity or from taxable to a flow-through entity – Tax Exempt Cooperative to a Taxable Cooperative – Nonprofit or S corporation to a C corporation – C corporation to an S corporation or LLC • Effect is recorded at the date the change occurs – Record or remove deferred tax assets/liabilities – S Corporations – Built-in-gains tax is a deferred tax liability and must be retained on the books FinancialStatement Presentation/Disclosures • Components of Tax Expense • Deferred Asset/Liability Components • Rate Reconciliation FinancialStatement Presentation/Disclosures • Significant components of income tax expense must be disclosed: – – – – – – – Current tax expense/benefit Deferred tax expense/benefit Investment tax credits Government grants Benefits of operating loss carryforwards Allocation of tax benefits to capital/goodwill Change to deferred asset/liability due to changes in tax law or rates – Change in Valuation allowance FinancialStatement Presentation/Disclosures • Deferred Asset/Liability Components: – Current and noncurrent deferred income taxes are reported separately • Determination of current and noncurrent is based upon the life of the underlying asset giving rise to the temporary difference • Current deferred assets can be netted with current deferred liabilities and noncurrent can be netted only if related to a particular jurisdiction FinancialStatement Presentation/Disclosures • Rate Reconciliation: – Public – Rate reconciliation – Nonpublic – explanation of reconciling items • Other – Total valuation allowance – Public – approximate tax effect of each type of temporary difference and carryforward – Nonpublic – disclose the types of significant temporary difference and carryforwards (don’t have to disclose the tax effect) – Amounts and expiration dates for all NOL’s and credit carryforwards FinancialStatement Presentation/Disclosures • SAMPLE FOOTNOTE OtherTaxConsiderations OtherTaxConsiderations • Tax Rates • Tax Credits • Section 199 Deduction • S Corporation Election • Alternative Minimum Taxes RegularIncomeTaxRates (CCorporations) • Tax rates are tiered based upon net taxable income – 15% for first 50,000 – 25% for next 25,000 – 34% for next 25,000 – 39% for 100,000-335,000 – 34% up to 10 million – 35% for 10-15 million – 38% for 15-18.333 million – 35% above TaxCredits • Dividends received deduction • Alternative minimum tax credit • R&D credit • Renewable electricity credit – Wind, Hydropower, etc. • General Business Credits • Some will expire at the end of 2012 Section199Deduction (ElectricityProducers) • Domestic Production Activities Deduction – Eligible for Producers – Various calculation methods – NOT eligible for Transmission or Distribution income only for Production income – Calculated as 3% (for 2006) or 6% (2007-2009) and 9% thereafter, of the lesser of QPAI or net taxable income, limited to W-2 wages SCorporationElection • Requirements – – – – Must be a domestic corporation Must not be an ineligible corporation Must have less than 100 shareholders All shareholders must be individuals, decedents’ estates, bankruptcy estates, some trusts, or a tax exempt 501(c)(3) (some others may qualify) – No shareholder may be a nonresident alien – Must have only one class of stock SCorporations • Benefits of an S Corporation – No double taxation – Net income flows through to the shareholders and is reported on their individual returns – Sale of stock generally results in a lower taxable gain AlternativeMinimumTax • Separate tax calculation required • Was designed to prevent taking advantage of the regular tax system • NOL carryovers limited to 90% of taxable income • Depreciation methods and lives differ for AMT purposes • 20% tax rate • Allowed a credit for any AMT that is paid that carries to future years TelecomAcquisitions • Telephone Plant purchases from another telephone company – Regulated telephone companies record the purchase of another companies’ plant as follows: • DR Plant (at original cost per prior companies’ records) • CR Accumulated Depreciation (at amount depreciated through the purchase date) • CR Cash (for the purchase of the plant and/or company) • DR/CR – Goodwill/Acquisition Adjustment – Goodwill versus Acquisition Adjustment • Acquisition Adjustment is determined by PUC, is part of rate base, and amortizable on the books • Goodwill is the remainder, not part of rate base, not amortizable TelecomAcquisitions • For tax purposes the cost of the assets are depreciable over the useful lives as defined by the Internal Revenue Code (IRC) • Acquisition adjustment and Goodwill are both amortizable for tax purposes • How to treat a purchase of plant from another telephone company for tax purposes: – Practical TIP - Set up two assets • One asset that is fully depreciated equal to the A/D on that asset • A second asset that is equal to the NBV of the asset purchased • This results in having a tax depreciation schedule that ties out to the books for cost, but treats the purchase correctly for tax purposes in that you depreciate the amount you paid for GoodwillandPurchaseAccounting • Goodwill and Purchase Accounting – If purchasing the stock of a company this company will then become a subsidiary of the purchasing company • In this case the goodwill on the books of the company will not be depreciable (for tax purposes) – If purchasing the assets of a company the amount that exceeds the NBV of the assets that you purchased is considered goodwill (or acquisition adjustment, as discussed previously) • This goodwill is depreciable for tax purposes FIN48– AccountingforUncertainty inTaxPositions FIN48– AccountingforUncertainty inTaxPositions • This Interpretation shall be effective for fiscal years beginning after December 15, 2006. (Delayed for non-public entities for tax years beginning after December 15, 2008) • The provisions of this Interpretation shall be applied to all income tax positions upon initial adoption of this Interpretation. • Only tax positions that meet the more-likely-than-not recognition threshold at the effective date may be recognized or continue to be recognized upon adoption of this Interpretation. • The cumulative effect of applying the provisions of this Interpretation shall be reported as an adjustment to the opening balance of retained earnings for that fiscal year, presented separately. • The cumulative-effect adjustment does not include items that would not be recognized in earnings, such as the effect of adopting this Interpretation on tax positions related to business combinations. FIN48Background • This Interpretation requires the affirmative evaluation that it is more likely than not, based on the technical merits of a tax position, that an enterprise is entitled to economic benefits resulting from positions taken in income tax returns. • If a tax position does not meet the more-likely-than-not recognition threshold, the benefit of that position is not recognized in the financial statements. FIN48Objectives • Standardize the accounting for uncertain tax positions • Enhance relevance and comparability of financial statement reporting • More transparency desired by SEC FIN48Scope • Applies to all income tax positions, including federal, state/local, and foreign – FAS 5 will continue to apply to other tax positions, i.e. – sales tax or property tax • Applies to all U.S. GAAP reporters, public, private, and non-profit • Applies to income tax positions recorded in a business combination FIN48UncertainTaxPositions • It can result in a permanent reduction of income taxes payable, a deferral of income taxes otherwise currently payable to future years, or a change in the expected realizability of deferred tax assets. • Tax position also encompasses, but is not limited to: – – – – A decision not to file a tax return An allocation or a shift of income between jurisdictions The characterization of income or a decision to exclude reporting taxable income in a tax return A decision to classify a transaction, entity, or other position in a tax return as tax exempt. FIN48UncertainTaxPositions • This Interpretation provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, and disclosure. • An enterprise shall initially recognize the financial statement effects of a tax position when it is morelikely-than-not, based on the technical merits, that the position will be sustained upon examination. The term “more likely than not” means a likelihood of more than 50 percent. FIN48 Recognition/Measurement • The evaluation of a tax position in accordance with this Interpretation is a two-step process. The first step is recognition: – The enterprise determines whether the tax position will be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. – In evaluating whether a tax position has met this recognition threshold, the enterprise should presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information. FIN48 Recognition/Measurement – The second step is measurement: A tax position that meets the recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The tax position is measured at the largest amount of benefit that is greater than 50 percent likely of being realized upon ultimate settlement. CaseStudy– QuickCalc • Let’s complete this together Closingcomments • Topic 740 is complex • It is difficult to stay up to speed with tax law changes & GAAP changes • Client & accounting firm should work closely together to proactively review these calculations WrapUp • Evaluations • CPE Certificates THANK YOU