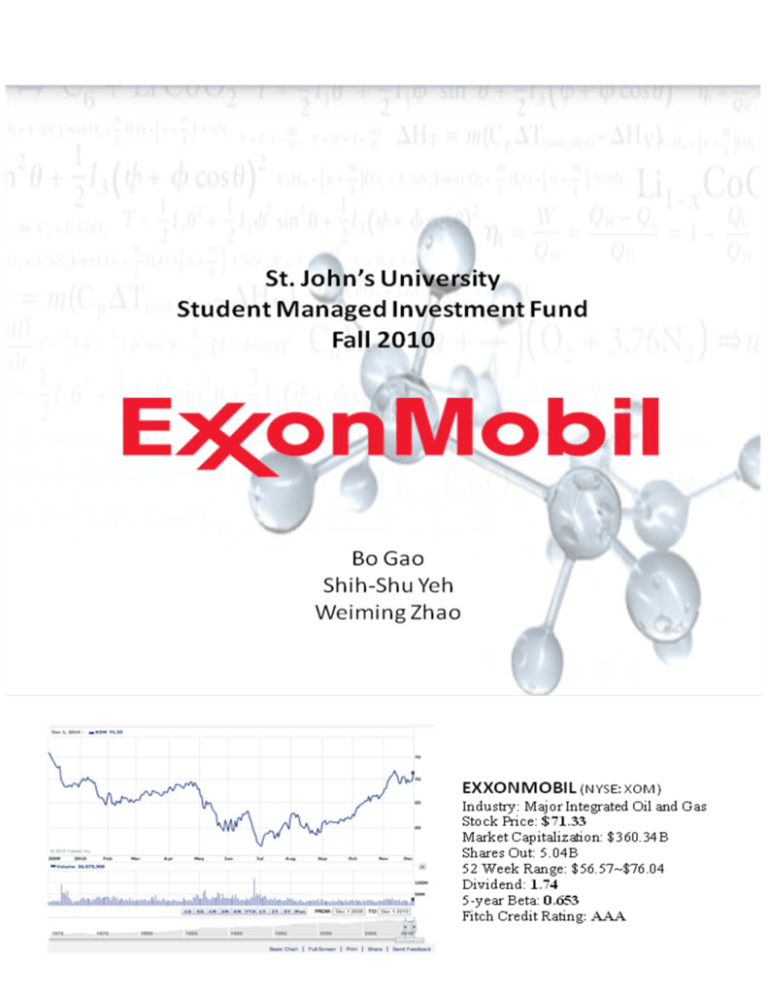

Exxon/Mobil - St. John's University

advertisement

Report Contents I. Executive Summary…………………………………………………………….…...…2 II. Company overview…………….…………………………………………..….…...…..2 1. Introduction …………….………………………………………..…………...…………….2 2. Business Activities .………………………..…………..……………..….……..…. 2 III. Industry Analysis ……………………………………………………….……………3 1. Projections of Economic Activity ………………………………………………….………3 2. Oil and Gas Industry Overview ………………………………………………..….......5 3. Industry Trend Analysis ………...……….……………………….…..….................6 4. SWOT Analysis .…………………………………………………..……...…...........8 VI. Fundamental Analysis .…………………………………………………...................10 1. Ratio analysis ……….…………………………………………..…........................11 2. Risk factors …………...……………………………………………………...........25 3. Earning Forecast…………….……………………………………..….....................26 V. Relative valuation ………...………………………………………...…......................30 VI. Absolute valuation ………..…………………………………….....….......................32 VII. Retrospective Analysis …..………………………………………..….....................35 VIII. Recommendation …………………………………………..…...............................36 IX. Bibliography ……..……………………………………..….......................................37 Page 1 I. Executive Summary After analyzing ExxonMobil and its position within the overall oil and gas industry, we find sufficient support to believe that this company is a worthwhile investment and thus recommend it as an addition to the St. John’s University Graduate Student Managed Investment Fund portfolio. This decision is based upon: the strength of the company in comparison to its peers and the oil and gas industry as a whole through ratio analysis, relative valuation, absolute valuation, analysis of the economy and current happenings within the company, and the analysis of future trends. This report will serve to support our recommendation to purchase shares of ExxonMobil as it is currently a viable option and will be a fruitful investment in the future. II. Company Overview 1. Introduction The ExxonMobil Corporation is an American multinational oil and gas corporation. It was formed on November 30, 1999, by the merger of Exxon and Mobil. Its headquarters are in Irving, Texas. ExxonMobil is one of the largest publicly traded companies in the world, having been ranked either number 1 or number 2 for the past 5 years. ExxonMobil Corporation is a manufacturer and marketer of commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics and a range of specialty products. It also has interests in electric power generation facilities. The Company has several divisions and hundreds of affiliates with names that include ExxonMobil, Exxon, Esso or Mobil. Divisions and affiliated companies of ExxonMobil operate or market products in the United States and other countries of the world. Their principal business is energy, involving exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation and sale of crude oil, natural gas and petroleum products. 2. Business Activities May 25, 2010, ExxonMobil Outlines Achievements in Environmental, Safety, Economic & Social Performance. June 07, 2010, Technology, Strong Partnerships Key to Meeting Future Energy Demand Growth, Albers Says. June 25, 2010, ExxonMobil Announces Completion of All-Stock Transaction For XTO. following approval by the stockholders of XTO Energy Inc. (XTO), ExxonMobil acquired XTO by merging a wholly-owned subsidiary of ExxonMobil with and into XTO Page 2 (the merger), with XTO continuing as the surviving corporation and wholly-owned subsidiary of ExxonMobil. July 14, 2010, ExxonMobil and Synthetic Genomics Inc. Advance Algae Biofuels Program with New Greenhouse. July 21, 2010, New Oil Spill Containment System to Protect Gulf of Mexico Planned By Major Oil Companies. July 27, 2010, XTO Energy Inc. Announces Purchase of $2.048 Billion Principal Amount of Its Debt Securities. December 1, 2010, ExxonMobil is planning to increase capacity by 10% at its hydrocarbon fluids plant in Antwerp, Belgium. December 6, 2010, ExxonMobil Corporation joined hands with PT Pertamina to develop the offshore East Natuna natural gas block in Indonesia. III. Industry Analysis Reference case refers to a series of historical and projection data in the appendix of Annual Energy Outlook 2010 from Energy Information Administration. 1. Projections of Economic Activity Real gross domestic product returns to its pre-recession level by 2011 1 The rate of growth in real GDP depends on assumptions about labor force growth and productivity. GDP growth is considerably slower in the near term as a result of the recent recession. The U.S. economy has seen 10 recessions since 1947. The 2007-2009 recession is projected to be the longest, with four consecutive quarters of negative growth, and also the deepest since 1957. EIA assumes that economic recovery accelerates in 2011, while employment recovers more slowly. Real GDP returns to its prerecessionary level by 2011, but unemployment rates do not return to pre-recessionary levels until 2019. 1 U.S. Energy Information Administration, Annual Energy Outlook 2010 with Projections to 2035, DOE/EIA-0383(2010), May 11, 2010 Page 3 Source: AEO2010 National Energy Modeling System runs AEO2010R.D111809A, HM2010.D020310A, and LM2010.D011110A. Inflation, interest rates remain low, unemployment exceeds 6 percent 2 In the Reference case, annual consumer price inflation averages 2.2 percent, the annual yield on the 10-year Treasury note averages 5.4 percent and the average unemployment rate is 6.3 percent. In the first 2 years of the Reference case projection, as the economy slowly recovers from the recession that began at the end of 2007, inflation and interest rates are below their 27-year projected averages of 2.2 and 5.4 percent, respectively, and unemployment rates are above their long-term average of 6.3 percent. The recession reduces household wealth, and unemployment remains high as people take longer than in past recessions to find employment. The unemployment rate returns to its 2007 rate of 5.8 percent in 2019. Annual gains in labor productivity average 2.0 percent, underpinning the projections for inflation and interest rates. Energy prices for U.S. consumers grow by 2.4 percent per year from 2008 to 2035 in the Reference case, compared with 2.2-percent annual growth in overall consumer prices. For energy commodities, annual price increases average 2.5 percent per year. 2 U.S. Energy Information Administration, Annual Energy Outlook 2010 with Projections to 2035, DOE/EIA-0383(2010), May 11, 2010 Page 4 Source: AEO2010 National Energy Modeling System, runs AEO2010R.D111809A, HM2010.D020310A, and LM2010. D011110A. 2. Oil and Gas Industry Overview There is no doubt that the oil/energy industry is extremely large. According to the Department of Energy (DOE), fossil fuels, including coal, oil and natural gas, make up more than 85% of the energy consumed in the U.S. Oil supplies 40% of U.S. energy needs as of 2008. There are two major sectors within the oil industry, upstream and downstream. Upstream is the process of extracting the oil and refining it. Downstream is the commercial side of the business, such as gas stations or the delivery of oil for heat. The Organization of Petroleum Exporting Countries (OPEC) is an intergovernmental organization dedicated to the stability and prosperity of the petroleum market. OPEC membership is open to any country that is a substantial exporter of oil and that shares the ideals of the organization. OPEC has 11 member countries. Output quotas placed by OPEC can send huge shocks throughout the energy markets. Page 5 Below is a chart of the world's top exporters of petroleum. (OPEC members are denoted by “*”) Top World Oil Net Exporters, 2008 (thousand barrels per day) Rank Country Exports 1 Saudi Arabia* 8,030 2 Russia 7,017 3 United Arab Emirates* 2,475 4 Iran* 2,342 5 Norway 2,338 6 Kuwait* 2,288 7 Nigeria* 2,062 8 Venezuela* 1,957 9 Algeria* 1,905 10 Angola* 1,709 11 Libya* 1,575 12 Iraq* 1,524 Source: U.S. Energy Information Administration 3. Industry Trend Analysis 3 Global Crude Oil and Liquid Fuels Overview: “Gradual tightening in global oil markets continues to support world oil prices. Projected liquid fuels consumption growth of 2 million barrels per day (bbl/d) in 2010 is almost double the growth in supply from countries outside of the Organization of the Petroleum Exporting Countries (OPEC), which has led to rising demand for OPEC crude oil production and declining global oil inventories. While overall commercial oil inventories in the Organization for Economic Cooperation and Development (OECD) countries remain high, stock levels are unevenly distributed with some regions experiencing tightness in recent months.” Global Crude Oil and Liquid Fuels Consumption: “Projected world liquid fuels consumption increases by 2 million bbl/d in 2010, following declines in 2008 and 2009. As a result, total global consumption in 2010 should be close to the 2007 level. Global oil consumption growth slows to 1.4 million bbl/d in 2011. Non-OECD 3 U.S. Energy Information Administration, “Short-Term Energy Outlook”, December 7, 2010 Page 6 regions, especially China, the Middle East, and Brazil, represent most of the expected growth in world oil consumption next year.” U.S. Liquid Fuels Consumption: “Projected total U.S. liquid fuels consumption increases by 320,000 bbl/d (1.7 percent) to 19.09 million bbl/d in 2010, which is about 60,000 bbl/d higher than forecast in last month's Outlook. A year-over-year decline in total liquid fuels consumption averaging 40,000 bbl/d in the first quarter of 2010 was followed by a year-over-year rise averaging 610,000 bbl/d in the second and third quarters led by increases in motor gasoline and distillate fuel oil consumption. During 2010 as a whole, projected gasoline consumption increases by 0.4 percent and distillate consumption increases by 4.0 percent. Total liquid fuels consumption increases by a further 160,000 bbl/d (0.8 percent) in 2011, as all of the major petroleum products register consumption growth. Gasoline consumption grows by 0.8 percent, and distillate fuel consumption increases by 1.7 percent in 2011.” Source: Short Term Energy Outlook, December 2010 U.S. Petroleum Product Prices: A projected regular-grade gasoline retail price rose from an average of $2.35 per gallon in 2009 to an average of $2.77 per gallon in 2010, and is expected to rise to $3.00 per gallon in 2011. On-highway diesel fuel retail prices, which averaged $2.46 per gallon in 2009, average $2.98 per gallon in 2010 and $3.23 in 2011 in the current forecast. Refining margins, which had been at their lowest levels since 2003, are expected to an average about $2 per barrel higher next year because of growing global product demand. Page 7 Source: U.S. Energy Information Administration, “Short-Term Energy Outlook – Real Energy Price”, December 7, 2010 4. SWOT Analysis A. Strengths Leading market position -- ExxonMobil is the world’s largest publicly traded integrated petroleum and natural gas company with market capitalization of $360.34Billion as of Dec 07, 2010. ExxonMobil has interests in 37 refineries located in 21 countries and markets its products through more than 29,000 retail service stations. In 2008, refinery throughput averaged 5.4 million barrels per day, and petroleum product sales were 6.8 million barrels per day4. ExxonMobil is the leading global supplier of lube based stock and marketing finished lubricants, asphalt, and specialty products. Diversified revenue stream -- ExxonMobil has wide presence across various regions. The company’s revenue stream is diversified in terms of geography. ExxonMobil divides its geographic divisions as US and non-US. The non-US region covers the countries of Japan, Canada, the UK, Germany, Belgium, Germany, Italy, Singapore, and France. 4 XOM 8-K filed Mar 11, 2009 Page 8 Geographic Sales and other operating revenue in 2009 (in billions) Non-U.S. 211.653 Significant non-U.S. revenue % of revenue sources include: Japan 22.054 10.42% Canada 21.151 9.99% United Kingdom 20.293 9.59% Belgium 16.857 7.96% Germany 14.839 7.01% Italy 12.997 6.14% France 12.042 5.69% Singapore 8.4 3.97% Total Source: XOM 10-K, 2010. 60.78% Steady financial performance -- ExxonMobil has delivered consistent financial results. The total revenues of the company have increased during FY2002-FY2008 from $178.909 billion in FY2002 to $345.289 billion in FY2010, excluding 2009 when the oil demand significantly decreased. Total Revenue (in billions) ExxonMobil 2002 178.909 2003 213.199 2004 263.989 2005 328.213 2006 335.086 2007 358.600 2008 425.071 2009 275.564 B. Weakness Legal proceedings -- ExxonMobil is involved in many legal proceedings. In October 2008, the company was fined by the European Commission along with eight other petrochemical companies for price fixing of paraffin wax. ExxonMobil was fined E83.6 million (approximately $123 million). In June 2008, ExxonMobil was sued by the attorney of San Francisco. The company faced an allegation that it failed to clean up hazardous pollutants from a fueling depot at Fisherman's Wharf. Mobil Oil operated a fueling facility at Fisherman's Wharf between 1938 and 1992. The suit alleges that ExxonMobil's neglect has contaminated the soil, groundwater, tidal water, and sediment of San Francisco Bay. The suit demands that Exxon clean the site and pay the damages. In another incident, a resident of Linden, NJ claimed to contract a rare form of stomach cancer as a result of conditions at the Bay way Refinery in Linden. This refinery was formerly owned by ExxonMobil. The jury found ExxonMobil responsible for the cancer called ‘peritoneal mesothelioma.’ The company paid $7.5 million as damages. Such cases result in huge penalties and can have adverse effects on the company’s profitability. 5 5 http://www.baseoilreport.com/20102211/conocophillips-resumed-crude-oil-processing-and-started-all-downstreamprocess-units-its-ba Page 9 2010 345.289 Declining production in the US -- The upstream division in the US has recorded a consistent decline in its production volumes. The crude oil and natural gas liquid production volumes in the region have been declining since FY2004. Upstream applies to the operation of exploration, drilling, hydrocarbon production, and transmission via truck, rail or ship or pipe line to the refinery intake valve. Downstream includes all work done at the refinery, distillation, cracking, reforming, blending storage, mixing and shipping. The net liquid production has declined at a CAGR of 10% from 557,000 barrels per day in FY2004 to 367,000 barrels per day in FY2008. The company recorded a 6.4% decline in its net liquid production in FY2008 compared with FY2007. A similar trend is noticed in the natural gas production volumes. The natural gas production has declined at a CAGR of 11% from 1,947,000 barrels per day in FY2004 to 1,246,000 barrels per day in FY2008.The company recorded a 15.1% decline in its natural gas production in FY2008 compared with FY2007. Unless they discover other reserves and establish production in foreign markets, a continuation of this trend is likely to have an adverse impact on the company's revenue growth rates. C. Opportunities Increasing demand for refined products in Asia -- Over the next 10 years, the company expects about 60% percent of the world’s petrochemical demand growth to occur in Asia, with more than one-third in China alone. To capture the rising demand, the company has been making investments in Asia and the Middle East in projects in with long-term competitive advantages, including integration with other operations, advantaged feedstock, proprietary process and product technology, and market access. ExxonMobil is currently working on an integrated refining and petrochemical facility located in Quanzhou, China. This project includes 800,000 tons per year ethylene steam cracker and integrated polyethylene, polypropylene, and propylene units. The company is building a world-scale petrochemical complex at its integrated refining and chemical facility in Singapore. Capital investments -- ExxonMobil plans to invest between $25 billion and $30 billion annually over the next five years to deliver major projects to meet growing world energy demand. The demand for global energy is expected to increase approximately 35% from 2005 to 2030. These investments aim to develop new technology, bring on new upstream projects, increase the company’s base refining capacity, and grow its chemical business. These investments also reinforce ExxonMobil’s position as an industry leader in bringing new supplies to the market. D. Threats Economic slowdown in the US and the European Union -- The demand for energy and petrochemicals correlates closely with general economic growth rates. The occurrence of Page 10 recessions or other periods of low or negative economic growth will typically have a direct adverse impact on their results. For example, from 2008 to 2009, the revenues of both industry and company decreased by more than 35%, indicating that the oil industry is quite sensitive to the economic environment. Other factors that affect general economic conditions in the world or in a major region, such as changes in population growth rates or periods of civil unrest, also impact the demand for energy and petrochemicals. Economic conditions that impair the functioning of financial markets and institutions also pose risks to ExxonMobil, including risks to the safety of their financial assets and to the ability of their partners and customers to fulfill their commitments to ExxonMobil. Risks associated with conducting business outside the US -- The company operates in more than 200 countries under the names ExxonMobil, Exxon, Esso, and Mobil. The non-US countries accounted for more than 70.2% of the total revenues of the company in the FY2009. In these foreign locations, the company might experience fluctuations in exchange rates, complex regulatory requirements, and restrictions on its ability to repatriate investments and earnings from its foreign operations. The company might also face changes in the political or economic conditions in the foreign countries it operates in. Such instabilities could negatively impact the revenue growth of the company. Environmental regulations -- ExxonMobil’s businesses are subject to numerous laws and regulations relating to the protection of the environment. With rising awareness of the damage to the environment caused by industry, especially regarding global warming, regulatory standards have been continuously tightened in recent years. IV. Fundamental Analysis 1. Ratio Analysis (U.S Dollar in Billions except per share data. Industry average is the average of the following companies: ExxonMobil, Chevron, Royal Dutch Shell, ConocoPhillips, Marathon, and Hess. All data in 2010 is the actual YTD number plus last Q4 estimate.) Sales 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 178.909 213.199 263.989 328.213 335.086 358.600 425.071 275.564 345.298 Chevron 91.685 112.937 142.897 184.922 195.341 203.970 255.112 159.293 205.398 Royal Dutch Shell 179.430 201.727 265.191 306.728 318.846 355.784 458.361 277.829 337.947 ConocoPhillips 50.512 90.491 118.719 162.405 167.578 171.500 225.424 136.016 183.272 Marathon 31.464 40.963 45.135 58.271 59.917 59.389 72.128 48.546 67.384 Hess 11.932 14.311 16.733 22.747 28.067 31.647 41.165 29.614 32.512 Industry AVG* 90.655 112.271 142.111 177.214 184.139 196.815 246.210 154.477 195.302 Page 11 Sales Growth ExxonMobil 20022003 19.166% 20032004 23.823% 20042005 24.328% 20052006 2.094% 20062007 7.017% 20072008 18.536% 20082009 -35.172% 20092010 25.306% Chevron 23.179% 26.528% 29.409% 5.634% 4.417% 25.073% -37.560% 28.943% Royal Dutch Shell ConocoPhillips 12.426% 31.461% 15.663% 3.951% 11.585% 28.831% -39.386% 21.638% 79.148% 31.194% 36.798% 3.185% 2.340% 31.443% -39.662% 34.743% Marathon 30.190% 10.185% 29.104% 2.825% -0.881% 21.450% -32.695% 38.805% Hess 19.938% 16.924% 35.941% 23.388% 12.755% 30.076% -28.060% 9.785% Industry AVG* 30.675% 23.352% 28.541% 6.846% 6.206% 25.902% -35.423% 26.537% ExxonMobil is the key player in the oil and gas industry. It has experienced continuous growth in sales over the last five years except the recession year – 2009, which had a negative impact on the whole economy. Particularly during 2007-2008 periods, ExxonMobil achieved a growth of 18.536%, which was mainly resulted from the skyrocketing oil price in that year. The significant decrease in year 2009 could be attributed to a drop in the oil demand in the market as a result of poor economic environment. EBIT 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 14.970 23.183 35.872 49.002 56.939 57.655 66.290 26.239 43.118 Chevron 7.665 12.356 16.692 21.216 27.271 25.627 35.010 14.322 27.001 Royal Dutch Shell 15.396 19.699 27.472 37.629 37.885 41.371 44.530 16.404 26.103 ConocoPhillips 3.002 8.983 13.406 20.438 25.563 22.724 27.146 8.733 13.355 Marathon 1.11 1.836 2.405 4.883 8.414 5.985 7.059 2.921 4.436 Hess 1.157 0.958 1.406 1.995 3.588 3.683 5.038 1.927 3.347 Industry AVG* 7.217 11.169 16.209 22.527 26.610 26.174 30.846 11.758 19.560 EBIT Growth ExxonMobil 2002-2003 54.863% 2003-2004 54.734% 2004-2005 36.602% 2005-2006 16.197% 2006-2007 1.257% 2007-2008 14.977% 2008-2009 -60.418% 2009-2010 64.326% Chevron 61.200% 35.092% 27.103% 28.540% -6.028% 36.614% -59.092% 88.525% Royal Dutch Shell 27.948% 39.460% 36.970% 0.682% 9.202% 7.635% -63.162% 59.129% ConocoPhillips 199.234% 49.237% 52.454% 25.076% -11.106% 19.460% -67.830% 52.922% Marathon 65.405% 30.991% 103.035% 72.312% -28.869% 17.945% -58.620% 51.849% Hess -17.200% 46.764% 41.892% 79.850% 2.648% 36.791% -61.751% 73.679% Industry AVG* 65.242% 42.713% 49.676% 37.109% -5.483% 22.237% -61.812% 65.072% Page 12 EBIT is a measure of a company’s profitability that excludes interest and income tax. ExxonMobil profit is far stronger than the other competitors basically due to the large amount of revenue contribution. Over the past five years, ExxonMobil had consistently performed above both the industry average level and its major competitors. In terms of annual growth, the company had a relatively better year from 2006 to 2007, 1.257% versus -7.667% of industry average, as a result of the change in accounting policy of oil industry. Net Income 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 11.011 20.960 25.330 36.130 39.500 40.610 45.220 19.280 28.677 Chevron 1.134 7.598 13.037 14.099 17.138 18.688 23.931 10.483 14.802 Royal Dutch Shell 9.419 12.241 16.623 25.618 25.442 31.331 26.277 12.502 18.138 ConocoPhillips 0.762 4.593 8.107 13.64 15.55 11.891 16.998 4.858 11.031 Marathon 0.597 1.012 1.257 3.006 4.957 3.948 3.528 1.184 2.495 Hess 0.175 0.467 0.970 1.242 1.916 1.832 2.360 0.740 2.428 Industry AVG* 3.791 7.812 10.887 15.622 17.417 18.050 14.053 8.174 12.928 Net Income Growth ExxonMobil 2002-2003 90.355% 2003-2004 20.849% 2004-2005 42.637% 2005-2006 9.327% 2006-2007 2.810% 2007-2008 11.352% 2008-2009 -57.364% 2009-2010 48.737% Chevron 570.018% 71.585% 8.146% 21.555% 9.044% 28.055% -56.195% 41.204% Royal Dutch Shell 29.960% 35.799% 54.110% -0.686% 23.147% -16.131% -52.423% 45.080% ConocoPhillips 502.756% 76.508% 68.250% 14.003% -23.531% -242.948% 128.580% 127.067% Marathon 69.514% 24.209% 139.141% 64.904% -20.355% -10.638% -66.440% 110.709% Hess 366.857% -107.709% -28.041% -54.267% 4.384% -28.821% 68.644% -228.095% Industry AVG* 271.577% 20.207% 47.374% 9.139% -0.750% -43.189% -5.866% 24.117% Net income is a measure of net profit in a company’s past periods. One portion of net income may be allocated to the shareholders as a form of dividend. The other portion can be kept by the company as retained earnings for the future operation. Due to the scale of ExxonMobil, it had comparatively very strong net income compared to the industry average level and other competitors. From the above chart we can conclude that ExxonMobil had relatively fluctuation in net income growth, particularly in 2006 Page 13 (2.810%) and 2009 (-57.364%), which were due to the accounting policy change and economic recession, respectively. From the long-run perspective, ExxonMobil will stay the same net income level due to the further oil wells exploration and drilling to keep its comparative advantage to the other competitor companies. CFO 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 21.268 28.498 40.551 48.138 49.286 52.002 59.725 28.438 47.094 Chevron 9.941 12.315 14.690 20.105 24.323 24.977 29.632 19.373 30.531 Royal Dutch Shell 16.365 21.719 26.038 29.852 31.397 34.451 43.559 20.943 29.575 ConocoPhillips 4.969 9.356 11.959 17.628 21.516 24.550 22.658 12.479 14.840 Marathon 2.405 2.761 3.730 4.738 5.488 6.521 6.782 5.268 4.582 Hess 1.965 1.581 1.903 1.840 3.491 3.507 4.567 3.046 4.061 Industry AVG* 9.485 12.705 16.479 20.383 22.584 24.335 27.821 14.924 21.781 CFO Growth ExxonMobil 2002-2003 33.995% 2003-2004 42.294% 2004-2005 18.710% 2005-2006 2.385% 2006-2007 5.511% 2007-2008 14.851% 2008-2009 -52.385% 2009-2010 65.602% Chevron 23.881% 19.285% 36.862% 20.980% 2.689% 18.637% -34.621% 57.595% Royal Dutch Shell 32.716% 19.887% 14.646% 5.177% 9.727% 26.437% -51.921% 41.217% ConocoPhillips 88.287% 27.822% 47.404% 22.056% 14.101% -7.707% -44.925% 18.919% Marathon 14.802% 35.096% 27.024% 15.829% 18.823% 4.002% -22.324% -13.014% Hess -19.542% 20.367% -3.311% 89.728% 0.458% 30.225% -33.304% 33.319% Industry AVG* 29.023% 27.459% 23.556% 26.026% 8.551% 14.408% -39.913% 33.940% Operating Cash Flow is the cash that a company generates through running its business. Cash flows are just as or a more important measurement of how well a company is doing because they need incoming cash to cover their debts and operate their business. ExxonMobil had sufficient operating cash flow, which is much more than the industry average level and its major competitors due to its scale playing a huge weight in the whole industry. Page 14 A. Profitability Ratios Gross Margin 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 38.683% 39.058% 38.048% 35.103% 36.358% 35.066% 32.056% 31.829% 31.524% Chevron 36.914% 36.111% 33.437% 30.397% 33.698% 33.994% 32.357% 36.598% 37.648% Royal Dutch Shell 19.222% 21.185% 19.942% 20.839% 20.894% 19.834% 16.238% 17.123% 16.885% ConocoPhillips 14.226% 16.983% 17.236% 17.399% 22.337% 21.213% 19.344% 16.220% 22.517% Marathon 24.174% 20.794% 11.045% 13.144% 19.245% 15.691% 15.398% 14.819% 13.684% Hess 30.464% 22.353% 21.813% 19.088% 22.635% 22.049% 21.798% 20.325% 25.254% Industry AVG* 27.281% 26.081% 23.587% 22.662% 25.861% 24.641% 22.865% 22.819% 24.585% . Gross Margin 60.00% 40.00% 20.00% Exxon Mobil 0.00% Industry AVG* Gross Margin represents the markup per dollar of sales. The higher the markup, the more the company retains on each dollar of sales to service its other costs and obligations. ExxonMobil did an excellent job on retaining revenue and minimizing costs associated with production. The company consistently performed far beyond industry average level and had fared well against most of its competitors. EBIT Margin 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 8.367% 10.874% 13.588% 14.930% 16.992% 16.078% 15.595% 9.522% 12.041% Chevron 8.360% 10.941% 11.681% 11.473% 13.961% 12.586% 13.723% 8.991% 13.367% Royal Dutch Shell ConocoPhillips 8.580% 9.765% 10.274% 12.268% 11.882% 11.628% 9.715% 5.904% 7.319% 5.943% 9.927% 11.292% 12.585% 15.254% 13.250% 12.042% 6.421% 7.654% Marathon 3.528% 4.482% 5.328% 8.380% 14.043% 10.078% 9.787% 6.017% 6.823% Hess 9.697% 6.694% 8.403% 8.770% 12.784% 11.638% 12.239% 6.507% 10.779% Industry AVG* 7.413% 8.780% 10.094% 11.401% 14.153% 12.543% 12.183% 7.227% 9.664% Page 15 EBIT MArgin 20.00% 15.00% 10.00% 5.00% 0.00% Exxon Mobil Industry AVG* EBIT Margin is calculated by dividing Earnings before Interest and Tax by Revenue. This measure helps evaluate operating profitability, and measures how much of each dollar in sales a company retains after operating expenses. ExxonMobil was relatively more profitable than other competitors and industry average, which matched its leader position as well. Net Profit Margin 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 6.155% 9.831% 9.595% 11.008% 11.788% 11.325% 10.638% 6.997% 8.547% Chevron 1.237% 6.728% 9.121% 7.624% 8.773% 9.162% 9.381% 6.581% 9.820% Royal Dutch Shell ConocoPhillips 5.249% 6.068% 7.048% 8.352% 7.979% 8.806% 5.733% 4.500% 4.989% 1.509% 5.076% 6.829% 8.399% 9.279% 6.934% 7.540% 3.572% 6.850% Marathon 1.897% 2.471% 2.785% 5.159% 8.273% 6.648% 4.891% 2.439% 3.809% Hess 1.467% 3.263% 5.797% 5.460% 6.827% 5.789% 5.733% 2.499% 8.316% Industry AVG* 2.430% 5.573% 6.862% 7.667% 8.820% 8.111% 4.806% 4.431% 7.055% Net Profit Margin 15.00% 10.00% 5.00% 0.00% Exxon Mobil Industry AVG* Page 16 Net profit margin is the amount left per dollar sales after all expenses and costs are deducted. ExxonMobil is consistently higher than the level of most of its competitors and industry average. From the upstream perspective, “as future development projects bring new production online, the Corporation expects a shift in the geographic mix of its production volumes between now and 2014. Oil and natural gas output from West Africa, the Caspian region, the Middle East and Russia is expected to increase over the next five years based on current capital project execution plans. Currently, these growth areas account for 42 percent of the Corporation’s production. By 2014, they are expected to generate about 50 percent of total volumes. The remainder of the Corporation’s production is expected to be sourced from established areas, including Europe, North America and Asia Pacific.” 6 As a result, we believe ExxonMobil will achieve a potential sales growth in the long run. ROE 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 14.904% 25.481% 26.431% 33.934% 35.106% 34.473% 38.530% 17.250% 16.596% Chevron 3.459% 22.380% 31.975% 26.131% 26.042% 25.595% 29.231% 11.742% 14.142% Royal Dutch Shell ConocoPhillips 16.208% 18.420% 23.627% 28.948% 25.876% 27.282% 20.917% 9.483% 9.401% 3.397% 14.301% 21.033% 28.579% 22.973% 13.857% 23.584% 8.260% 14.135% Marathon 11.914% 18.141% 17.722% 30.339% 37.679% 23.340% 17.366% 5.466% 8.227% Hess 3.823% 9.740% 17.738% 20.904% 26.617% 20.486% 21.376% 5.761% 14.199% Industry AVG* 7.677% 18.077% 23.088% 28.139% 29.049% 24.172% 17.306% 9.660% 12.783% ROE 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% Exxon Mobil Industry AVG* ROE is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. ExxonMobil got a tremendous gap over the industry average in year 2008 due to the amazing increase in crude oil price. Compared to the other competitors, ExxonMobil has also better performed than them. 6 10-K EXXONMOBIL CORP, February 26, 2010 Page 17 However, there is a huge decline in 2009 due to the economic recession and we believe it will recover to pre-recession level in the future except any special events (skyrocket price, recession, etc.). ROA 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 7.444% 12.823% 13.762% 18.036% 18.625% 17.734% 19.368% 8.430% 7.988% Chevron 1.472% 9.634% 15.045% 12.951% 13.333% 13.360% 15.618% 6.515% 8.063% Royal Dutch Shell 7.129% 7.632% 10.644% 12.758% 11.326% 12.570% 9.639% 4.414% 4.426% ConocoPhillips 1.361% 5.770% 9.254% 13.658% 11.448% 6.945% 10.606% 3.289% 6.052% Marathon 5.256% 5.437% 5.872% 11.626% 16.774% 10.770% 8.301% 2.646% 3.913% Hess 1.222% 3.467% 6.654% 7.516% 9.943% 8.101% 9.336% 2.774% 7.119% Industry AVG* 3.573% 7.461% 10.205% 12.757% 13.575% 11.580% 8.609% 4.678% 6.260% ROA 25.00% 20.00% 15.00% 10.00% Exxon Mobil 5.00% Industry AVG* 0.00% ROA is an indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings, calculated by dividing a company's annual earnings by its total assets. From the above chart we conclude that ExxonMobil generates more earnings per asset dollar than the other competitors, which is also an important competitive advantage for ExxonMobil to show their good operating efficiency. Page 18 B. Efficiency Ratios Asset Turnover 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 1.210x 1.304x 1.434x 1.638x 1.580x 1.566x 1.821x 1.205x 0.935x Chevron 1.190x 1.432x 1.649x 1.699x 1.520x 1.458x 1.665x 0.990x 0.821x Royal Dutch Shell 1.358x 1.258x 1.661x 1.739x 1.588x 1.584x 1.839x 1.019x 0.928x ConocoPhillips 0.902x 1.137x 1.491x 1.854x 1.678x 1.263x 1.317x 0.849x 0.921x Marathon 1.856x 2.201x 2.425x 2.722x 2.317x 2.010x 1.968x 1.142x 1.093x Hess 0.834x 1.062x 1.242x 1.560x 1.699x 1.642x 1.820x 1.172x 0.932x Industry AVG* 1.225x 1.399x 1.651x 1.869x 1.730x 1.587x 1.738x 1.063x 0.938x Asset Turnover 2 1.5 1 Exxon Mobil 0.5 Industry AVG* 0 Asset turnover measures a firm's efficiency at sales generated per dollar of assets - the higher the number the better. ExxonMobil’s asset turnover ratio is nearly the same level to the industry. Receivable Turnover 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 8.789x 9.377x 10.630x 12.422x 11.877x 10.968x 13.902x 10.528x 8.573x Chevron 10.381x 11.822x 12.902x 12.489x 11.223x 10.180x 13.321x 9.493x 7.833x Royal Dutch Shell 9.406x 8.588x 9.032x 6.145x 5.255x 5.544x 6.156x 4.142x 4.418x ConocoPhillips 17.805x 19.284x 17.214x 15.670x 12.868x 11.261x 15.903x 10.791x 10.191x Marathon 17.355x 18.688x 15.658x 17.217x 15.476x 11.728x 15.906x 12.276x 9.610x Hess 4.837x 7.388x 7.839x 7.555x 7.457x 7.376x 9.143x 7.204x 6.322x Industry AVG* 11.429x 12.524x 12.213x 11.916x 10.693x 9.509x 12.389x 9.072x 7.824x Page 19 Receivable Turnover 15 10 5 Exxon Mobil 0 Industry AVG* Receivable turnover is an activity ratio, measuring the number of times that receivables are collected during the period. From this point of view, ExxonMobil’s performance is around the industry average level. It is mainly result from the operating cycle of oil industry is very long and ExxonMobil has huge amount of receivables. Therefore, they may need more time than industry average to collect their receivables. Inventory Turnover 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 13.737x 15.263x 17.734x 22.650x 21.288x 21.360x 25.407x 16.195x 13.144x Chevron 10.128x 26.669x 33.783x 36.236x 29.512x 27.018x 28.373x 16.312x 14.944x Royal Dutch Shell ConocoPhillips 8.711x 13.832x 15.198x 13.815x 11.734x 10.425x 15.102x 9.852x 7.762x 6.704x 19.257x 25.779x 36.305x 29.322x 28.822x 39.025x 22.711x 16.622x Marathon 6.221x 16.482x 20.339x 20.100x 15.573x 15.526x 17.990x 11.601x 11.118x Hess 7.963x 20.751x 22.269x 25.369x 23.348x 21.879x 25.170x 17.185x 11.909x Industry AVG* 8.910x 18.709x 22.517x 25.746x 21.796x 20.838x 25.178x 15.643x Page 20 12.583x Inventory Turnover 30 25 20 15 10 5 0 Exxon Mobil Industry AVG* Inventory turnover is a measure of the number of times inventory is sold or used in a time period such as a year. From the above graph, we see that ExxonMobil’s inventory turnover ratio is below the industry average level from 2003 to 2006, which means ExxonMobil needs more time to sold or replace its inventory than other major competitors. After 2006 ExxonMobil kept the same pace with the industry average level due to the improvement of its operation. C. Liquidity Ratios Current Ratio 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 1.154 1.197 1.405 1.584 1.552 1.474 1.472 1.061 1.014 Chevron 0.894 1.206 1.517 1.373 1.278 1.165 1.139 1.422 1.657 Royal Dutch Shell ConocoPhillips 0.736 0.801 1.131 1.152 1.197 1.223 1.105 1.138 1.110 0.851 0.799 0.964 0.918 0.948 0.920 0.957 0.893 1.389 Marathon 1.224 1.436 1.688 1.151 1.252 0.940 1.084 1.174 1.208 Hess 1.080 1.194 0.923 0.821 0.868 0.863 0.949 1.166 1.346 Industry AVG* 0.990 1.105 1.271 1.166 1.183 1.098 1.117 1.142 1.287 Page 21 Current Ratio 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 Exxon Mobil Industry AVG* Current ratio measures a company's ability to pay short-term obligations. ExxonMobil has sufficient cash current assets to insure that they will able to meet their short-term obligations if required to do so. Quick Ratio 2 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 0.856 0.910 1.128 1.312 1.266 1.217 1.155 0.740 0.688 Chevron 0.662 0.930 1.233 1.133 1.023 0.904 0.794 1.012 1.211 Royal Dutch Shell 0.459 0.462 0.820 0.892 0.864 0.855 0.882 0.779 0.798 ConocoPhillips 0.366 0.392 0.653 0.663 0.565 0.663 0.585 0.581 0.957 Marathon 0.640 0.933 1.257 0.754 0.843 0.632 0.572 0.753 0.735 Hess 0.850 0.907 0.691 0.616 0.632 0.662 0.673 0.772 0.958 Industry AVG* 0.639 0.756 0.964 0.895 0.865 0.822 0.777 0.773 0.891 Quick Ratio 2 1.4 1.2 1 0.8 0.6 0.4 0.2 0 Exxon Mobil Industry AVG* Page 22 Quick Ratio measures the ability of a company to use its most liquid current assets to extinguish or retire its current liabilities immediately. The above chart shows that ExxonMobil was always far beyond the industry average level before 2009. From 2005, ExxonMobil began its repurchase program, which is the main reason they burned their cash. As a result, the quick ratio decreased gradually. From 2009, ExxonMobil increased the amount of repurchase, accompanying with some environmental lawsuit, which resulted in a sharp drop of quick ratio in this year. D. Long-term Solvency Ratios A Long-term Debt to Equity 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 0.089 0.053 0.049 0.056 0.058 0.059 0.062 0.064 0.105 Chevron 0.345 0.300 0.231 0.194 0.111 0.079 0.070 0.110 0.102 Royal Dutch Shell 0.113 0.125 0.103 0.083 0.092 0.100 0.108 0.226 0.246 ConocoPhillips 0.633 0.475 0.336 0.204 0.279 0.228 0.491 0.431 0.335 Marathon 0.868 0.672 0.500 0.316 0.210 0.316 0.331 0.385 0.336 Hess 1.171 0.724 0.676 0.598 0.462 0.401 0.310 0.323 0.352 Industry AVG* 0.537 0.392 0.316 0.242 0.202 0.197 0.229 0.257 0.246 Long-term Debt to Equity 0.6 0.4 Exxon Mobil 0.2 Industry AVG* 0 It measures the relative proportion of debt to equity in the capital structure, or the amount of debt for every dollar of equity. Because ExxonMobil has a lot of free cash, so it doesn’t need to issue debt to meet its operating activities, which is the reason why ExxonMobil is far below the industry average level. Page 23 Financial Leverage 2002 2003 2004 2005 2006 2007 2008 2009 2010* ExxonMobil 2.002 1.987 1.921 1.881 1.885 1.944 1.989 2.046 2.078 Chevron 2.350 2.323 2.125 2.018 1.953 1.916 1.872 1.802 1.754 Royal Dutch Shell 2.274 2.413 2.220 2.269 2.285 2.170 2.170 2.149 2.124 ConocoPhillips 2.497 2.478 2.273 2.093 2.007 1.995 2.224 2.511 2.336 Marathon 3.383 3.336 3.018 2.610 2.246 2.167 2.092 2.066 2.102 Hess 3.127 2.809 2.666 2.781 2.677 2.529 2.290 2.077 1.995 Industry AVG* 2.605 2.558 2.370 2.275 2.175 2.120 2.106 2.108 2.065 Financial Leverage 3 2 1 Exxon Mobil 0 Industry AVG* Financial leverage measures how a company is using its leverage of all types, including debt and payables. Companies that are highly leveraged may be at risk of bankruptcy if they are unable to make payments on their debt; they may also be unable to find new lenders in the future. Financial leverage is not always bad, however; it can increase the shareholders' return on their investment and often there is tax advantages associated with borrowing. E. DuPont Analysis 2002 2003 2004 2005 2006 2007 2008 2009 2010* Net Profit Margin 6.155% 9.831% 9.595% 11.008% 11.788% 11.325% 10.638% 6.997% 8.547% Asset Turnover 1.210x 1.304x 1.434x 1.638x 1.580x 1.566x 1.821x 1.205x 0.935x Financial Leverage 2.002 1.987 1.921 1.881 1.885 1.944 1.989 2.046 2.078 ROE 14.904% 25.481% 26.431% 33.934% 35.106% 34.473% 38.530% 17.250% 16.596% Page 24 From the above table we could see that the factor which drives ExxonMobil’s ROE higher than the other competitors is the net profit margin, which shows that ExxonMobil is the frontrunner in the industry. 2. Risk Factors 7 A. Supply and Demand Demand-related factors -- Other factors that may affect the demand for oil, gas and petrochemicals, and therefore impact their results, include technological improvements in energy efficiency; seasonal weather patterns, which affect the demand for energy associated with heating and cooling; increased competitiveness of alternative energy sources that have so far generally not been competitive with oil and gas without the benefit of government subsidies or mandates; and changes in technology or consumer preferences that alter fuel choices, such as toward alternative fueled vehicles. Supply-related factors -- Commodity prices and margins also vary depending on a number of factors affecting supply. World oil, gas, and petrochemical supply levels can also be affected by factors that reduce available supplies, such as adherence by member countries to OPEC production quotas and the occurrence of wars, hostile actions, or natural disasters that may disrupt supplies. Technological change can also alter the relative costs for competitors to find, produce, and refine oil and gas and to manufacture petrochemicals. Other market factors -- ExxonMobil’s business results are also exposed to potential negative impacts due to changes in currency exchange rates, interest rates, inflation, and other local or regional market conditions. B. Government and Political Factors Regulatory and litigation risks -- Even in countries with well-developed legal systems where ExxonMobil does business, the company remains exposed to changes in law (including changes that result from international treaties and accords) that could adversely affect their results, such as increases in taxes or government royalty rates (including retroactive claims); price controls; changes in environmental regulations or other laws that increase their cost of compliance; and expropriation. Government sponsorship of alternative energy -- Many governments are providing tax advantages and other subsidies and mandates to make alternative energy sources more competitive against oil and gas. Governments are also promoting research into new technologies to reduce the cost and increase the scalability of alternative energy sources. 7 XOM 10-k Page 25 C. Management Effectiveness In addition to external economic and political factors, their future business results also depend on their ability to manage successfully those factors that are at least in part within their control. The extent to which they manage these factors will impact their performance relative to competition. Exploration and development program -- Their ability to maintain and grow their oil and gas production depends on the success of their exploration and development efforts. Among other factors, they must continuously improve their ability to identify the most promising resource prospects and apply their project management expertise to bring discovered resources on line on schedule. Operational efficiency -- An important component of ExxonMobil’s competitive performance, especially given the commodity-based nature of many of their businesses, is their ability to operate efficiently, including their ability to manage expenses and improve production yields on an ongoing basis. This requires continuous management focus, including technology improvements, cost control, productivity enhancements and regular reappraisal of their asset portfolio. Research and development -- To maintain their competitive position, especially in light of the technological nature of their businesses and the need for continuous efficiency improvement, ExxonMobil’s research and development organizations must be successful and able to adapt to a changing market and policy environment. 3. Earning Forecast This section forecasts EPS for fiscal year 2011 by estimating the industry revenue and using the market share of ExxonMobil to estimate their 2011 revenue. Total Revenue ExxonMobil’s total revenue is expected to be $327.119 billion in 2011. We established a custom industry that includes other six major companies in Oil and Gas Integrated industry. By investigating the historical market share of XOM from 2001 to 2010, we estimate it will account for 23% of the custom industry revenue, which will be expected to increase by 10.82% next year. The growth rate of industry revenue comes from the IBIS World, a research company. 8 Gross Profit ExxonMobil’s Gross profit is expected to be $96.34 billion, or 25.89% of total revenue, while the total COGS incl. D&A will be 275.79 billion, or 74.11% of total revenue. COGS excl. D&A, 70.00% of total revenue for next year, will be higher than previous years, because the output of existing wells was decreasing and XOM needs to continually find and develop new fields in order to maintain or increase production. Based on the assumption that XOM will depreciate in the same way after they acquired 47.3 billion 8 http://www.dailyfinance.com/story/ten-industries-set-for-the-strongest-growth-through-2011/19473654/ Page 26 property, plant and equipment from XTO, the D&A for XOM will be $15.3 billion, or 4.11% of total revenue. Operating Expense SG&A and R&D expenses are estimated at around $17.20 billion, estimated at 4.62% of Total Revenue. Through analyzing historical SG&A as percent of total revenue, it is obvious that this expense in general keeps going down in percent, excluding 2009 when the oil demand significantly decreased. Therefore, we estimate the SG&A for XOM will be 4.3% of total revenue, or $16.00 billion for next year. R&D expense is expected to go up to $1.2 billion because the company intends to spend more money on the development of technology, in order to increase their downstream business, such as refining. EBIT ExxonMobil’s Earnings before Interest and Taxes are forecasted to be $38.6 billion. This was arrived after deducting all operating expenses from gross profit. EBT According to the return rate of 9.514% on total investment in last year, we assume that the range of target interest rate is constant and the Nonoperating Income is expected to be $1.369 billion. Equity in affiliates primarily derived from XOM’s subsidiaries which are not wholly owned companies. Assuming the total revenue of all subsidiaries will increase by the same rate as our custom industry, we expect income from equity affiliates will be $10.67 billion. Total debt is $18.3 billion at September 30, 2010, which included $8.0 billion of debt in connection with the XTO acquisition. Because XOM maintained a revolving commercial paper program, we assume they will issue another $2.11 billion short-term debt next year and accordingly the Gross Interest Expense is forecasted to be $0.73 billion. Based on our estimation above, the earnings before tax could be $52.17 billion for 2011. Tax Effective tax rate is expected to be 43%, higher than current year, with consideration of federal government’s ongoing discussion would increase oil and gas industry’s tax rate. Net Income Available to Common XOM does not have any preferred stock and the net income available to common shareholders is forecasted to be $28.787 billion. EPS ExxonMobil’s Expected Earnings per Share E(EPS) is expected to be $5.588. According to their announcement in third quarterly report, XOM will spend $5 billion to purchase outstanding shares in last quarter. We forecast the outstanding shares and diluted shares at the end of this year are 4,969 million and 5,151 million respectively. In order to be conservative, we assume that XOM would not keep purchasing stocks next year, even though the Corporation has announced their intention to resume purchases of shares of its Page 27 common stock for the treasury both to offset shares issued in conjunction with company benefit plans and programs and to gradually reduce the number of shares outstanding. 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 YTD 2011 Industry Revenues 665.285 722.653 906.197 1053.737 1312.749 1370.743 1465.256 1838.403 1167.889 1,076.272 1617.910 Market Share 28.185% 24.757% 23.527% 25.053% 25.002% 24.446% 24.474% 23.122% 23.595% 23.056% 23.000% Sales/Revenue $ 187.510 $ 178.909 $ 213.199 $ 263.989 $ 328.213 $ 335.085 $ 358.600 $ 425.071 $ 275.564 $ 248.150 $ 372.119 COGS D&A $ 111.631 $ 109.701 $ 129.928 $ 163.547 $ 213.002 $ 213.255 $ 232.852 $ 288.810 $ 187.854 $ 171.515 $ 260.484 Depreciation & Amortization $ 7.944 $ 8.310 $ 9.047 $ 9.767 $ 10.253 $ 11.416 $ 12.250 $ 12.379 $ 11.917 $ 10.490 $ 15.301 Total COGS inl. D&A $ 119.575 $ 118.011 $ 138.975 $ 173.314 $ 223.255 $ 224.671 $ 245.102 $ 301.200 $ 199.771 $ 182.005 $ 275.785 GROSS PROFIT $ 67.935 $ 60.898 $ 74.224 $ 90.675 $ 104.958 $ 110.414 $ 113.498 $ 123.882 $ 75.793 $ 66.145 $ 96.335 COGS excl. D&A as % of Rev 59.53% 61.32% 60.94% 61.95% 64.90% 63.64% 64.93% 67.94% 68.17% 69.12% 70.00% Research & Development $ 0.603 $ 0.631 $ 0.618 $ 0.649 $ 0.712 $ 0.733 $ 0.814 $ 0.847 $ 1.050 0 $ 1.200 Other SG&A $ 12.297 $ 11.725 $ 12.778 $ 13.200 $ 13.690 $ 13.540 $ 14.076 $ 15.026 $ 13.685 $ 10.828 $ 16.001 Total SGA, Operating Expenses $ 12.900 $ 12.356 $ 13.396 $ 13.849 $ 14.402 $ 14.273 $ 14.890 $ 15.873 $ 14.735 $ 10.828 $ 17.201 Op Exp as % of COGS 10.8% 10.5% 9.6% 8.0% 6.5% 6.4% 6.1% 5.3% 7.4% 5.9% 6.24% Op Exp as % of Revenue 6.56% 6.55% 5.99% 5.00% 4.17% 4.04% 3.93% 3.53% 4.97% 4.36% 4.30% Other Operating Expenses $ 33.377 $ 33.572 $ 37.645 $ 40.954 $ 41.554 $ 39.203 $ 40.953 $ 41.719 $ 34.819 $ 26.488 $ 38.600 OPERATING INCOME $ 21.658 $ 14.970 $ 23.183 $ 35.872 $ 49.002 $ 56.938 $ 57.655 $ 66.290 $ 26.239 $ 28.829 $ 40.534 $ 0.000 $ 1.491 $ 5.311 $ 1.822 $ 4.142 $ 5.138 $ 5.323 $ 6.699 $ 1.943 $ 1.728 $ 1.369 $ 4.071 $ 2.066 $ 4.373 $ 4.961 $ 7.583 $ 6.985 $ 8.901 $ 11.081 $ 7.143 $ 7.224 $ 10.674 excl. OTHER INCOME (EXPENSE) Nonoperating Income(Expens e)-Net Equity Affiliates in Page 28 Gross Interest Expense $ 0.811 $ 0.824 $ 0.697 $ 1.138 $ 0.930 $ 1.184 $ 0.957 $ 1.183 $ 0.973 $ 0.729 Interest Capitalized $ 0.518 $ 0.426 $ 0.490 $ 0.500 $ 0.434 $ 0.530 $ 0.557 $ 0.510 $ 0.425 $ 0.321 Net Interest Income (Expense) $ 0.293 $ 0.398 $ 0.207 $ 0.638 $ 0.496 $ 0.654 $ 0.400 $ 0.673 $ 0.548 $ 0.150 $ 0.408 Unusual Exp. (Income) - Net $ 0.748 $ 0.410 $ 0.000 $ 0.000 $ 0.000 $ 0.000 $ 0.000 $ 0.000 $ 0.000 $ 0.000 $ 0.000 EBT $ 24.688 $ 17.719 $ 32.660 $ 42.017 $ 60.231 $ 68.407 $ 71.479 $ 83.397 $ 34.777 $ 37.631 $ 52.169 Income Taxes $ 9.014 $ 6.499 $ 11.006 $ 15.911 $ 23.302 $ 27.902 $ 29.864 $ 36.530 $ 15.119 $ 15.750 $ 22.433 EAT $ 15.674 $ 11.220 $ 21.654 $ 26.106 $ 36.929 $ 40.505 $ 41.615 $ 46.867 $ 19.658 $ 21.881 $ 29.736 Minority Interest Expense $ 0.569 $ 0.209 $ 0.694 $ 0.776 $ 0.799 $ 1.051 $ 1.005 $ 1.647 $ 0.378 $ 0.672 $ 0.949 NET INCOME $ 15.105 $ 11.011 $ 20.960 $ 25.330 $ 36.130 $ 39.454 $ 40.610 $ 45.220 $ 19.280 $ 21.209 $ 28.787 NI available to Common $ 15.105 $ 11.011 $ 20.960 $ 25.330 $ 36.130 $ 39.454 $ 40.610 $ 45.220 $ 19.280 $ 21.209 $ 28.787 Wgt Avg Diluted Shares 6941 6803 6662 6519 6322 5970 5577 5203 4848 4838 5151 EPS $ 2.18 $ 1.62 $ 3.15 $ 3.89 $ 5.71 $ 6.61 $ 7.282 $ 8.691 $ 3.977 $ 4.384 $ 5.588 36.51% 36.68% 33.70% 37.87% 38.69% 40.79% 41.78% 43.80% 43.47% 41.85% 43.00% Realized Rates Tax Page 29 V . R elative V aluation As shown in the following table, we have collected the historical trailing P/E ratio of ExxonMobil from 2002 to 2010 as well as its comparables, which includes Chevron Corp.(CVX), Royal Dutch Shell Plc(RDS.B), ConocoPhillips(COP), Marathon Oil Corp.(MRO), Hess Corp.(HES), and S&P 500 Energy Sector. Based on these comparable companies, we calculated the average as our custom industry’s P/E. 2002 2003 2004 2005 2006 2007 2008 2009 2010 YTD Comparables As of 11/30 ExxonMobil 21.702x 13.016x 13.177x 9.837x 11.576x 12.870x 9.186x 17.133x 12.330x Chevron Corp. 62.131x 12.099x 8.552x 8.680x 9.427x 10.642x 6.338x 14.693x 9.660x Royal Dutch Shell Plc 16.593x 14.618x 10.880x 8.513x 8.961x 8.300x 6.022x 14.248x 12.390x ConocoPhillips 32.918x 9.787x 7.505x 6.042x 7.448x 12.230x -- 15.762x 8.570x Marathon Oil Corp. 11.089x 10.150x 10.083x 7.181x 6.737x 10.715x 5.527x 15.155x 10.730x Hess Corp. -- 10.285x 8.608x 10.621x 8.166x 17.571x 7.409x 26.652x 9.450x Industry Avg 28.886x 11.659x 9.801x 8.479x 8.719x 12.055x 6.897x 17.274x 10.522x S&P 500 or Index 18.559x 13.738x 11.850x 10.655x 10.442x 13.025x 7.587x 24.911x xxxxxxxxx In order to estimates the current price, we divided XOM’s historical P/E by each of its comparables and accordingly calculated both the mean and median to form our adjustment factor. During this calculation, we excluded some outliers which cannot accurately reflect the most recent trend. Proportion between XOM and each competitor 2002 2003 2004 2005 2006 2007 2008 2009 2010 XOM/CVX 34.93% 107.57% 154.08% 113.33% 122.79% 120.93% 144.93% 116.61% 127.64% XOM/RDS.B 130.79% 89.04% 121.12% 115.55% 129.18% 155.06% 152.54% 120.25% 99.52% XOM/COP 65.93% 133.00% 175.59% 162.82% 155.41% 105.23% -- 108.70% 143.87% XOM/MRO 195.71% 128.23% 130.69% 136.98% 171.82% 120.11% 166.20% 113.05% 114.91% XOM/HES -- 126.56% 153.08% 92.62% 141.75% 73.24% 123.99% 64.28% 130.48% XOM/Industry Avg. 75.13% 111.64% 134.45% 116.01% 132.76% 106.76% 133.20% 99.19% 117.19% XOM/S&P 500 116.94% 94.74% 111.20% 92.32% 110.86% 98.80% 121.08% 68.78% xxxxxxxxx Page 30 Arithmetic Mean Median Chevron Corp. 121.97% 120.93% Royal Dutch Shell Plc 123.67% 121.12% ConocoPhillips 140.66% 143.87% Marathon Oil Corp. 113.98% 113.98% Hess Corp. 113.25% 125.28% Industry Avg 121.72% 116.60% S&P 500 or Index 106.56% 110.86% From tables, you can see the 2011 forward P/E for XOM and its comparables. In addition, we assume the industry’s P/E is mean-reverting and use both average and median of historical data as the expected P/E of industry for 2011. Forward P/E for 2011 Chevron Corp. 8.530x Royal Dutch Shell Plc 8.140x ConocoPhillips 9.550x Marathon Oil Corp. 7.830x Hess Corp. 12.500x Industry Avg 9.310x S&P 500 or Index 11.811x Expected P/E of Industry for 2011 Mean 10.676x Median 10.161x By using Current Price = E(EPS2011)*Forward(P/E)*Mean/Median of Historical relative proportion, we get the estimate prices of XOM based on each comparable. Page 31 Estimate of Current Price Mean Median Chevron Corp. $58.14 $57.64 Royal Dutch Shell Plc $56.25 $55.09 ConocoPhillips $75.06 $76.78 Marathon Oil Corp. $49.87 $49.87 Hess Corp. $79.10 $87.50 Industry Avg $63.32 $60.66 S&P 500 or Index $70.33 $73.17 Expected mean of Industry $72.61 $69.56 Expected median of Industry $69.11 $66.21 Estimate of the Price Mean of Proportion Median of Proportion Mean $65.98 $66.28 Median $69.11 $66.21 From the two tables above, the estimate range of current price is $65.98~$69.11, indicating the current market price of $71.33 is fairly valued. Conclusion: Neutral VI. Absolute Valuation The goal of the absolute valuation is to determine the intrinsic value of a security, based on future cash flows which are discounted back to present. Due to the fact that ExxonMobil has continuously paid dividends, we choose the Dividend Discount Model to analyze its intrinsic value. In order to decrease the impact of bias on our final conclusion, we will use three different costs of capital during the scenarios analysis. For the first one, we collected the ask yield of 10-year Treasury Principal Strip as the risk-free rate that is collected on Dec 7, 2010. During the top-down analysis, we have predicted that the economy will definitely grow but at a sluggish rate from the current recession. As a result, compared with the 10-year Beta, we think the 5-year adjusted Beta could appropriately reflect the current economic environment. For the second cost of capital, based on the same Beta and risk-free rate in calculation of K1, we used the U.S. market premium from McGraw-Hill, a consultant Page 32 company. For the last cost of capital, we added the equity risk premium of 3.5% on the yield to maturity 4.008% of XOM’s corporate bond, which is due in 2021. CAPM Market Return 11.069% 10-year Treasury Principal Strip 3.203% 5-year Beta 0.653 10-year Beta 0.681 K1=8.339% McGraw-Hill U.S. Market Premium 5.950% K2=7.088% YTM of XOM Corporate Bond Due in 2021 4.008% Equity Risk Premium 3.500% K3=7.508% From the following table, you can see the historical EPS, DPS and dividend payout ratio from 1999 to 2010, clearly showing that the XOM’s dividend constantly increased. 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 EPS 1.119 2.272 2.176 1.619 3.146 3.886 5.715 6.616 7.282 8.691 3.977 5.874 DPS 0.835 0.880 0.920 0.920 0.980 1.060 1.140 1.280 1.370 1.550 1.660 1.740 Payout Ratio 74.60% 38.73% 42.29% 56.84% 31.15% 27.28% 19.95% 19.35% 18.81% 17.83% 41.74% 29.62% Geometric growth rate for dividend Geometric average of historical growth rate of dividend 1999~2010 6.902% 2002~2010 8.292% 2005~2010 8.825% Page 33 The geometric average growth rate of DPS from 2005 to 2010 is higher than the other two periods which are 6.902% and 8.292%. We assume the company’s payout policy will not be changed in near future and therefore chose the growth rate of the most recent period 2005~2010 as the one in next five years. Then, we calculated the estimate dividend from 2011 to 2015 and discount them based on each cost of capital. E(DPS) 2011 2012 2013 2014 2015 1.894 2.061 2.243 2.440 2.656 2011 2012 2013 2014 2015 SUM K1 1.748 1.756 1.763 1.771 1.779 8.818 K2 1.768 1.797 1.826 1.856 1.886 9.133 K3 1.761 1.783 1.805 1.827 1.849 9.025 Based on the PV of dividend from 2011 to 2015 and three costs of capital, we created a scenario analysis in which we assume the 2016 dividend will grow at the different rates from 1% to 9%. Then, we calculated the terminal value of post-2015 dividends as of 2015 and discounted them to now. By adding the sum of PV of dividends in next five years, we tried to find out which growth rate could make the estimate intrinsic value equal to current price of $71.33. Terminal Value Intrinsic Value Growth Rate E(DPS) k1 k2 k3 k1 k2 k3 1.000% 2.682 36.547 44.057 41.216 33.303 40.415 37.724 2.000% 2.709 42.731 53.237 49.181 37.447 46.934 43.270 3.000% 2.735 51.231 66.909 60.680 43.142 56.641 51.277 3.935% 2.760 62.670 87.535 77.254 50.806 71.287 62.817 4.000% 2.762 63.648 89.434 78.735 51.461 72.635 63.848 4.408% 2.773 70.529 103.451 89.447 56.071 82.588 71.307 5.000% 2.789 83.503 133.530 111.187 64.763 103.946 86.445 5.340% 2.798 93.269 160.014 129.041 71.307 122.751 98.876 6.000% 2.815 120.331 258.661 186.680 89.438 192.795 139.010 7.000% 2.842 212.146 3216.406 559.389 150.953 2292.941 398.527 8.000% 2.868 844.851 -314.622 -582.978 574.856 -214.265 -396.902 9.000% 2.895 -438.274 -151.430 -194.022 -284.820 -98.390 -126.073 Page 34 As shown in the table above, we found that the post-2015 growth rate of 5.340%, 3.935% and 4.408% lead the intrinsic value to current price, respectively based on K1, K2 and K3. Consequently, for any growth rate higher than 5.340%, XOM is undervalued. Conclusion: BUY VII. Retrospective analysis Based on the relative valuation method, the ExxonMobil is around 10% overvalued. However, the historical growth rate of dividends over the last 5 years, which includes the 2009 down year, is 8.825%, higher than the highest growth rate of 5.340% which we found in scenario analysis, indicating that it is definitely undervalued. There is a slight contradiction between two valuation models, probably because there are some bias in the estimate of EPS and our relative analysis. Firstly, we assume that XOM would not keep purchasing stocks next year, while in fact the Corporation has announced their intention to resume purchases of shares of its common stock for the treasury. As a result, we believe that the company’s EPS will absolutely higher than the worst situation we created. Another bias is that the mean and the median of proportion are based on the historical P/E, some of which could not accurately reflect the most recent trend because of the outliers. In addition, there are a couple of comparables making the proportion more fluctuated, and consequently it is hard to correctly find the suitable adjustment factor in the relative valuation. The following table represents the return on stock price of ExxonMobil and its comparable companies for the last two years. The index chart started at the same level, while ExxonMobil has the lowest return during this period. Through the previous ratio analysis, we have known that ExxonMobil has a leading position in profitability ratios. Moreover, according to the company’s documents, ExxonMobil has continued to maintain a large portfolio of exploration and development opportunities, which enables the Corporation to maximize shareholder value and mitigate political and technical risks. And corporation said that future development projects will further the profitability of existing oil and gas production. We think there is no reason for the company to keep such lower return on stock price, comparing with its competitors which have lower profitability. Page 35 Indexed Total Return Dec 9, 2008 - Dec 9, 2010 U.S. Dollar (Split / Spinoff -Adjusted) ConocoPhillips (COP) Marathon Oil Corp. (MRO) Royal Dutch Shell PLC ADS (RDS.B) Hess Corp. (HES) Chevron Corp. (CVX) Exxon Mobil Corp. (XOM) 180 160 140 120 100 80 12/08 3/09 6/09 9/09 12/09 3/10 6/10 9/10 Data Source: IDC / Exshare Based on the absolute valuation and ratio analysis and combined with this advantageous information, we believe that it is an opportune time to buy ExxonMobil. VIII. Recommendation: Buy 200 shares Page 36 IX. Bibliography 1. Fitch Affirms ExxonMobil's IDR at 'AAA'; Outlook Remains Stable Thursday, June 03, 2010 <http://www.istockanalyst.com/article/viewiStockNews/articleid/4178055> 2. FT Global 500, 2010 <http://media.ft.com/cms/8ec77a3e-d549-11df-8e86- 00144feabdc0.pdf> 3. ExxonMobil, News Release, <http://www.businesswire.com/portal/site/exxonmobil/> 4. Form 8-K. Yahoo Finance. Jun 25, 2010. 5. ExxonMobil 10-K Document. 6. U.S. Energy Information Administration, “Short-Term Energy Outlook – Real Energy Price”, December 7, 2010 7. Source: Shot Term Energy Outlook, December 2010. 8. U.S. Energy Information Administration. Short-Term Energy Outlook. Dec 7, 2010. 9. U.S. Energy Information Administration, Annual Energy Outlook 2010 with Projections to 2035, DOE/EIA-0383(2010), May 11, 2010. Page 37