Chapter 8 - Rate of Return Analysis: Multiple Alternatives

advertisement

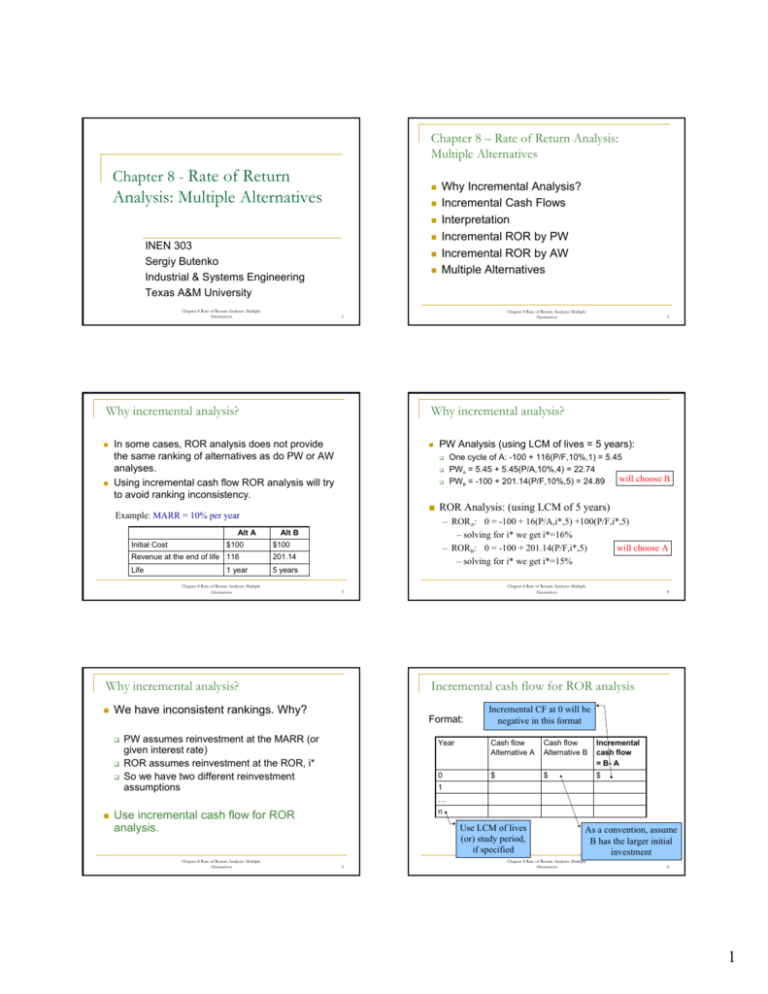

Chapter 8 – Rate of Return Analysis: Multiple Alternatives Chapter 8 - Rate of Return Analysis: Multiple Alternatives INEN 303 Sergiy Butenko Industrial & Systems Engineering Texas A&M University Chapter 8 Rate of Return Analysis: Multiple Alternatives $100 – RORA: 0 = -100 + 16(P/A,i*,5) +100(P/F,i*,5) – solving for i* we get i*=16% – RORB: 0 = -100 + 201.14(P/F,i*,5) will choose A – solving for i* we get i*=15% Alt B $100 201.14 Life 5 years Chapter 8 Rate of Return Analysis: Multiple Alternatives 4 Incremental cash flow for ROR analysis We have inconsistent rankings. Why? Chapter 8 Rate of Return Analysis: Multiple Alternatives 3 Why incremental analysis? One cycle of A: -100 + 116(P/F,10%,1) = 5.45 PWA = 5.45 + 5.45(P/A,10%,4) = 22.74 will choose B PWB = -100 + 201.14(P/F,10%,5) = 24.89 ■ ROR Analysis: (using LCM of 5 years) Revenue at the end of life 116 1 year PW Analysis (using LCM of lives = 5 years): Example: MARR = 10% per year Initial Cost 2 Why incremental analysis? In some cases, ROR analysis does not provide the same ranking of alternatives as do PW or AW analyses. Using incremental cash flow ROR analysis will try to avoid ranking inconsistency. Alt A Chapter 8 Rate of Return Analysis: Multiple Alternatives 1 Why incremental analysis? Why Incremental Analysis? Incremental Cash Flows Interpretation Incremental ROR by PW Incremental ROR by AW Multiple Alternatives Format: PW assumes reinvestment at the MARR (or given interest rate) ROR assumes reinvestment at the ROR, i* So we have two different reinvestment assumptions Incremental CF at 0 will be negative in this format Year Cash flow Alternative A Cash flow Alternative B Incremental cash flow = B- A 0 $ $ $ 1 … n Use incremental cash flow for ROR analysis. Chapter 8 Rate of Return Analysis: Multiple Alternatives Use LCM of lives (or) study period, if specified 5 As a convention, assume B has the larger initial investment Chapter 8 Rate of Return Analysis: Multiple Alternatives 6 1 Incremental cash flow for ROR analysis Incremental cash flow for ROR analysis Example 8.1: Machine A Initial cost - $15,000 Operating cost - $8200/yr 5% salvage value 25-year life Machine B Initial cost - $21,000 Operating cost - $7000/yr 5% salvage value 25-year life Example 8.1, Solution: Cash Flow Year 0 1-25 25 Total Machine A -15,000 -8,200 750 -219,250 Inc. Cash Flow Machine B -21,000 -7,000 1,050 -194,950 B-A -6,000 1,200 300 24,300 Create the Incremental Cash Flow Table. Chapter 8 Rate of Return Analysis: Multiple Alternatives 7 Chapter 8 Rate of Return Analysis: Multiple Alternatives 9 Chapter 8 Rate of Return Analysis: Multiple Alternatives 8 Incremental cash flow for ROR analysis Example 8.2: Type A Type B Initial cost - $70,000 AOC - $9000 Salvage Value - $5000 8-year life Initial cost - $95,000 AOC - $7000 Salvage Value - $10,000 12-year life Create the Incremental Cash Flow Table. Chapter 8 Rate of Return Analysis: Multiple Alternatives Interpretation 10 Interpretation The question is: Is it worth spending additional $(B-A) to move from investment A to investment B? Example 8.3 (MARR = 10%): Year Compute ROR of the incremental investment, ∆i*B-A, to see… If the ROR of the incremental cash flow equals or exceeds the MARR, the alternative associated with the extra investment should be selected. B B- A 0 $-30,000 -50,000 $-20,000 1 -15,000 10,000 25,000 2 20,000 30,000 10,000 3 40,000 25,000 -15,000 4 5,000 -2,000 PWA = $6,360,22 PWB = $1,301.14 A RORA = 16.36% RORB = 11.33% -7,000 So both feasible to be considered. RORB-A is infeasible (not positive) (see Excel file ch8) Conclusion: the incremental investment is not justified: select A Chapter 8 Rate of Return Analysis: Multiple Alternatives 11 Chapter 8 Rate of Return Analysis: Multiple Alternatives 12 2 Incremental ROR by PW Equation Incremental ROR by PW Mutually Exclusive Alternatives: Required elements 1. INDEPENDENT - Selection of one alternative does not effect the selection of others. 2. MUTUALLY EXCLUSIVE - Selection of one alternative precludes the selection of others. No incremental investment comparison needed. Select all projects with ROR ≥ MARR. Chapter 8 Rate of Return Analysis: Multiple Alternatives 13 Incremental ROR by PW Procedure 1. Order the alternatives by initial investment cost with the larger one being alternative B. 2. Develop the cash flow and incremental cash flow series over the LCM of lives. 3. Draw an incremental cash flow diagram, if needed. 4. Count the number of sign changes in the incremental cash flow series to determine if multiple ROR may be present. If necessary, use Norstrom’s criterion on the cumulative incremental cash flow series to determine if a single positive root exists. 5. Set up the PW equation for the incremental cash flows and determine ∆i*B-A. 6. Select the economically better alternative as follows: If ∆i*B-A < MARR, select alternative A. If ∆i*B-A > MARR, the extra investment is justified; select alternative B. Chapter 8 Rate of Return Analysis: Multiple Alternatives Example 8.4, Solution: (also see p284-286) Incremental Cash Flow Table: Year CF A CF B Inc. CF 0 -8000 -13,000 -5000 1 -3500 -1600 1900 2 -3500 -1600 1900 3 -3500 -1600 1900 4 -3500 -1600 1900 5 -3500 -1600 1900 5 2000 -13,000 -11,000 6 -3500 -1600 1900 7 -3500 -1600 1900 8 -3500 -1600 1900 9 -3500 -1600 1900 10 -3500 -1600 1900 10 2000 2000 Total -43,000 -38,000 5000 It is generally advisable to use PW or AW at MARR when multiple rates are indicated. If ∆i*B-A < MARR then select A, else select B. Independent Projects: Chapter 8 Rate of Return Analysis: Multiple Alternatives Incremental cash flow series LCM of lives 14 Example 8.4: Given the following information on Verizon’s choices for an equipment vendor, determine which vendor should be selected if MARR is 15% per year (Excel file ch8). Initial Cost, $ Annual Costs, $ Salvage Value, $ Life, years Vendor A -8,000 -3,500 0 10 Vendor B -13,000 -1,600 2,000 5 Chapter 8 Rate of Return Analysis: Multiple Alternatives 15 16 Chapter 8 Rate of Return Analysis: Multiple Alternatives Cum. Inc. CF -5000 -3100 -1200 700 2600 4500 Example 8.4, Solution (continue): Number of roots analysis: Descarte’s rule: Number of sign changes: 3 Î At most 3 roots -6500 -4600 -2700 -800 1100 3000 5000 10000 Norstrom’s rule: Number of sign changes of cumulative incremental cash flow: 3 Î so not applicable. 17 Chapter 8 Rate of Return Analysis: Multiple Alternatives 18 3 Example 8.4, Solution (continued): Use the ROR equation based on PW of the incremental cash flow. 0 = -5000 + 1900(P/A, ∆i,10) – 11,000(P/F, ∆i,5) + 2000(P/F, ∆i,10) Example 8.4, Solution (continue): Breakeven ROR Interpretation Assume the reinvestment rate is equal to the resulting ∆i*B-A. Solve for ∆i using trial/error, etc. ∆i = 12.65% Note: In theory, there are three roots to the equation, however, there is only one (12.65%) falling in the practically reasonable range. For example, the other one is –216%, falling out of the range of acceptable range of i* ( [-100%, +infinity)). This analysis assumes that PWB-A(i) > 0 for i < ∆i*B-A and PWB-A(i) < 0 for i > ∆i*B-A so that ROR analysis is consistent with PW analysis at MARR Since the ROR of 12.65% on the extra investment is less than the 15% MARR, the lower-cost vendor A is selected. Chapter 8 Rate of Return Analysis: Multiple Alternatives Chapter 8 Rate of Return Analysis: Multiple Alternatives 19 Incremental ROR by PW 20 Incremental ROR by PW The ∆i* can be interpreted as the breakeven rate of return value. Example 8.5 Select A for MARR in this range Select B for MARR in this range For MARR<12.65%, vendor B is justified. For MARR>12.65%, vendor A is selected. If MARR=12.65%, the alternatives are equally attractive. IBM is considering buying a chip placement machine. The machine cost 260K with annual operating expense 25K and a salvage value of 25K after 10 years. A slightly used machine is available for 150K with annual operating expense of 40K and a salvage value of 20K after 10 years. Which machine should be selected if MARR is 10% per year. PW for incremental cash flows, $ 0 ∆i* % Breakeven ∆i* Chapter 8 Rate of Return Analysis: Multiple Alternatives 21 Incremental ROR by PW Chapter 8 Rate of Return Analysis: Multiple Alternatives 22 Example 8.5, Solution (continue): ROR ANALYSIS: Example 8.5, Solution: PW Analysis -110 + 15(P/A, i*, 10) + 5(P/F, i*, 10) = 0 year Alt A Alt B B-A 0 1-10 10 -150K -40K 20K -260K -25K 25K -110K 15K 5K By trial and error, i* = 6.60 < 10% Additional investment is not justified PW = -110 + 15 (P/A, 0.1,10) + 5 (P/F, 0.1, 10) = -110 + 92.20 + 1.76 < 0 additional investment is not justified Chapter 8 Rate of Return Analysis: Multiple Alternatives 23 Chapter 8 Rate of Return Analysis: Multiple Alternatives 24 4 ROR evaluation by AW Incremental ROR by PW Using the AW relation, there are two equivalent ways for ROR analysis: Use incremental cash flows over the LCM of alternative lives 0 = AW 1. Conclusion: B-A If the ROR method is used to evaluate two or more alternatives, use the incremental cash flow and ∆i* to make the decision between alternatives. OR 2. Use actual cash flows for one life cycle, 0 = AWB -AWA Chapter 8 Rate of Return Analysis: Multiple Alternatives Example 8.6: Two machines are being considered for purchase. If MARR is 10%, which machine should be bought? Determine ∆i*B-A· Select the economically better alternative as follows: If ∆i*B-A < MARR, select alternative A. If ∆i*B-A > MARR, the extra investment is justified; select alternative B. 26 ROR evaluation by AW ROR evaluation by AW Chapter 8 Rate of Return Analysis: Multiple Alternatives 25 Machine B $200 $700 Annual benefit 95 120 Salvage value 50 150 6 12 Useful life, in years Note: The same assumptions still exist. Chapter 8 Rate of Return Analysis: Multiple Alternatives Machine A Initial cost Chapter 8 Rate of Return Analysis: Multiple Alternatives 27 28 a) Use incremental cash flows with LCM of lives=12 years Year A B B-A 0 -200 -700 -500 1 95 120 25 2 95 120 25 3 95 120 25 4 95 120 25 5 95 120 25 6 -55 120 175 7 95 120 25 8 95 120 25 9 95 120 25 10 95 120 11 95 120 25 25 12 145 270 125 ROR 43.26% 14.32% 1.32% b) Use actual cash flows for one life cycle. 0 = AWB-A = -500(A/P,∆i*,12)+25+ + 150(P/F,∆i*,6)(A/P,∆i*,12) + + 100(A/F,∆i*,12) Solve for ∆i*, ∆i*=1.32% Select Machine A AWA = -200(A/P,i*,6) + 95 + 50(A/F,i*,6) AWB = -700(A/P,i*,12) + 120 + 150(A/F,i*,12) Set 0 = AWB -AWA And solve for i*, i*=1.32% -55= (95+50-200), since it is beginning of second cycle Select Machine A Salvage value added Chapter 8 Rate of Return Analysis: Multiple Alternatives 29 Chapter 8 Rate of Return Analysis: Multiple Alternatives 30 5 ROR evaluation by AW ROR evaluation by AW Example 8.7: Given the following information on Verizon’s choices for an equipment vendor, determine which vendor should be selected if MARR is 15% per year. Vendor A -8,000 -3,500 0 10 Initial Cost, $ Annual Costs, $ Salvage Value, $ Life, years Vendor B -13,000 -1,600 2,000 5 Chapter 8 Rate of Return Analysis: Multiple Alternatives Example 8.7, Solution: AWA = -8,000(A/P,i,10) – 3,500 AWB = -13,000(A/P,i,5) + 2,000(A/F,i,5) – 1,600 AWB - AWA = 0 -13,000(A/P,i,5) + 2,000(A/F,i,5) + 8,000(A/P,i,10) +1,900 = 0 Using trial and error, i* = 12.65% < MARR ÎSelect vendor A. Chapter 8 Rate of Return Analysis: Multiple Alternatives 31 Multiple Alternatives (more than two) 32 Multiple Alternatives For example, suppose there are six alternatives to evaluate: Alternative: A B C D E F i*B i*C i*D i*E i*F ROR: i*A Compute i* for each alternative individually and discard those with i* < MARR. Do incremental pairwise comparison for the accepted alternatives in order of smallest-to-largest initial investment. Suppose only i*A, i*C, i*D, i*F >= MARR, so discard B and E. Sort by decreasing initial investment, suppose the result is: A D F(largest cost) C(smallest cost) better better Best of four alternatives Chapter 8 Rate of Return Analysis: Multiple Alternatives 33 Example 8.8: Four Alternative Building Locations B -275,000 35,000 30 34 Multiple Alternatives Multiple Alternatives A Initial Cost, $ -200,000 Annual CF, $ 22,000 Life, years 30 Chapter 8 Rate of Return Analysis: Multiple Alternatives C -190,000 19,500 30 D _ -350,000 42,000 30 Example 8.8, Solution: 1. The alternatives are ordered by increasing initial cost. 2. Compare C with DN (Do-Nothing). 0 = -190,000 + 19,500(P/A, ∆i*,30) ∆i*= 9.61% < MARR; Location C eliminated. MARR = 10% Now, compare A with DN. ∆i*= 10.44% > MARR; DN eliminated. Location A-defender; Location B-challenger Use incremental ROR AW analysis to select the best location. Chapter 8 Rate of Return Analysis: Multiple Alternatives 35 Chapter 8 Rate of Return Analysis: Multiple Alternatives 36 6 Example 8.8, Solution (cont.): 3. Compare B with A. 0 = -275,000 – (-200,000) + (35,000-22,000)(P/A, ∆i*,30) Î (P/A, ∆i*, 30) = 5.7692 Î ∆i*=17.18%. > MARR, so Alternative B is justified incrementally; A eliminated. Chapter 8 Rate of Return Analysis: Multiple Alternatives 37 Multiple Alternatives B -275,000 35,000 D _ -350,000 42,000 Compared C to DN A to DN B to A D to B Incr. Cost, $ Incr. CF, $ -190,000 19,500 -200,000 22,000 -75,000 13,000 -75,000 7000 9.0909 10.44 5.7692 17.18 10.7143 8.53 Yes No B B Incr. Justified? No Yes Alt. Selected DN A Chapter 8 Rate of Return Analysis: Multiple Alternatives 38 Example 8.9, Solution: EXAMPLE 8.9 : A pipeline is to be laid, the cost for the various size pipe are shown below. MARR is 8% and the life of the pipeline is 15 years. B C 10,510 13,180 800 1,400 5,800 5,200 A -200,000 22,000 (P/A,∆i*,30) 9.7436 ∆i*, % 9.61 4. Compare D with B. 0 = -75,000 + 7000(P/A, ∆i*,30) P/A value = 10.7143, ∆i*=8.53% < MARR Location D eliminated; only Location B remains. Location B is selected. A Initial Cost 9,180 Installation 600 Ann. Cost 6,000 C Initial Cost, $ -190,000 CF, $ 19,500 D 15,850 1,500 4,900 A vs. B (i.e B-A) Initial Cost - 11,310 + 9,780 = -1,530 Ann. Cost - 5,800 + 6,000 = 200 E 30,530 2,000 4,800 0 = 200(P/A, i*, 15) - 1530 (P/A, i*, 15) = 7.65 (P/A, .08, 15) = 8.56, therefore, i* > 8% A is removed and B is the new defender Chapter 8 Rate of Return Analysis: Multiple Alternatives 39 Example 8.9, Solution (continue): Chapter 8 Rate of Return Analysis: Multiple Alternatives 40 Example 8.9, Solution (continue): C vs. D Initial Cost 14,580 - 17,350 = -2,770 Ann. Cost 5,200 - 4,900 = 300 B vs. C Initial Cost 11,310 - 14,580 = -3270 Ann. Cost 5800 - 5200 = 600 0 = 300 (P|A, i*, 15) - 2770 (P/A, i*, 15) = 9.23 > 8.56 = (P/A, .08, 15) 0 = 600(P|A, i*, 15) - 3270 (P/A, i*, 15) = 5.45 < 8.56 = (P/A, .08, 15) D is removed and C is the defender B is removed and C is the new defender Chapter 8 Rate of Return Analysis: Multiple Alternatives 41 Chapter 8 Rate of Return Analysis: Multiple Alternatives 42 7 Example 8.9, Solution (continue): Example 8.9, Solution (continue): PW(A) = -9,780 - (P/A, .08, 15) 6,000 = -61,137 C vs. E Initial Cost 14,580 - 32,530 = -17,950 Ann. Cost 5200 - 4800 = 400 PW(B) = -11,310 - (P/A, .08, 15) 5,800 = -60,955 PW(C) = -14,580 - (P/A, .08, 15) 5,200 = -59,089 0 = 400 (P|A, i*, 15) - 17,950 (P/A, i*, 15) = 44.87 > 8.56 = (P/A, .08, 15) PW(D) = -17,350 - (P/A, .08, 15) 4,900 = -59,291 PW(E) = -32,530 - (P/A, .08, 15) 4,800 = -73,615 C is the successful final alternative Choose Largest PW, Alternative C Chapter 8 Rate of Return Analysis: Multiple Alternatives 43 Chapter 8 Rate of Return Analysis: Multiple Alternatives 44 8