Yearli Desktop Release Notes - Q0 Setup

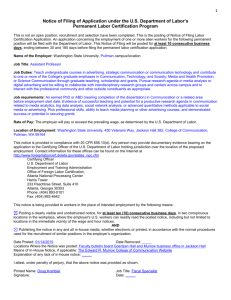

advertisement

Release Notes Yearli Desktop 2015, Quarter 4 Update 3 ENH ANCEM ENTS Affordable Care Act forms: o Recipient and Covered Individual SSN – 1095-B Health Coverage, and 1095-C Employer-Provided Health Insurance Offer and Coverage – We are now supporting an ITIN (Individual Taxpayer Identification Number) and ATIN (Adoption Taxpayer Identification Number) for the Recipient and Covered Individual SSN. Therefore, when entering the SSN, it can start with a “9”. Form Changes Federal G ov e rn ment Form Changes 940/Schedule A Employer’s Annual Federal Unemployment Tax Return – For electronic filing, the IRS now requires at least one state to be reported on Form 940 Line 1a or on Schedule A. State Gov ernm ent Form Ch anges Connecticut CT-W3 Annual Reconciliation of Withholding – Form printout was changed to a one-page scannable format, following new state requirements. Yearli Desktop 2015, Quarter 4 Update 2 ENH ANCEM ENTS 941 - Employer’s QUARTERLY Federal Tax Return – Corrected error that was preventing Line 5d Taxable wages and tips subject to Additional Medicare Tax Withholding from populating from forms W-2. Affordable Care Act forms: o E-file Corrections – 1095-B Health Coverage, 1095-C Employer-Provided Health Insurance Offer and Coverage, and 1094-C Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns - Form data can now be corrected after e-filing and the corrected forms can be e-filed. o Import – 1095-C Employer-Provided Health Insurance Offer – The Sample file has been updated and new validations implemented. Form Changes Federal G ov e rn ment Form Changes 940/Schedule A Employer’s Annual Federal Unemployment Tax Return - Form 940/Schedule A may now be filed electronically when no state unemployment tax was paid. 1 NOTICE FOR 1098 FILING The IRS has reinstated the reporting of Mortgage insurance premiums on Form 1098 for Tax Year 2015. Report Mortgage premiums using the blank area in Box 4. Enter data in the format “Mortg Ins Prem $123456.12” or “MIP $123456.12” to ensure that Mortgage Insurance Premium values are included in electronic reporting to the IRS. STATE E-FILE CHANGES Mississippi’s due date for annual 1099 filing was changed to March 31 (Mississippi’s W-2 due date is January 31). Vermont WHT-434 Annual Withholding Reconciliation – Form name changed from WH-434 to WHT-434, entry section completely changed; separate fields added for W-2 and 1099 data, and new Signer and Preparer data added. Vermont State ID – The expected format of the Vermont State ID for W-2 has changed to WHT12345678. Yearli Desktop 2015, Quarter 4 Update 1 ENH ANCEM ENTS 1096 Annual Summary and Transmittal of U.S. Information Returns – Form is now available to print for all 1099 return types. Yearli Desktop 2015, Quarter 4 ENH ANCEM ENTS Affordable Care Act forms: o 1095-B – Health Coverage – Form printouts and electronic filing is available, form data may now be imported via Excel or CSV, you may begin to key in your data by selecting this form in the Add Form drop down menu on the Recipient List page and Covered Individuals can be added in the Manage Recipient section. o 1095-C – Employer-Provided Health Insurance Offer and Coverage – Form printouts and electronic filing is available. Form data may now be imported via Excel or CSV, Covered Individuals can be added in the Manage Recipient section, additional validations have been added for Line 15, Covered Individual’s import errors have been corrected. Plan Start Plan Month was added to Returns Journal. o 1094-B – Transmittal of Health Coverage Return – Form printouts are available. o 1094-C – Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns – Form printouts and electronic filing is available, you may begin to key in your data by selecting this form in the Add Form drop down menu on the Manage Payer screen, and Form data may now be imported via Excel or CSV. Refer to “The 1094-C Prep Screen” in the help file for more information. E-file Center W-2 and 1099 services including State E-file are now available. TIN Truncation/Masking on 1095 printouts – Selecting the Truncate/Mask Recipient TIN checkbox on the Print 1095 Returns W indow will now truncate Recipient EINs (formatted as XX-XXX1234) as well as Recipient SSNs (formatted as XXX-XX-1234) on Recipient copies of 1095-B, and 1095-C forms. License Agreement – The license agreement has been modified, and users must agree before continuing to use Yearli. Form Changes Federal G ov e rn ment Form Changes 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. – Distribution Code K must be used only in combination with other codes. W-3C Transmittal of Corrected Wage and Tax Statements - Government Revision. 940/Schedule A Employer’s Annual Federal Unemployment (FUTA) Tax Return – 2015 Credit Reduction States for Schedule A are CA, CT, OH, and VI. 943 Employer’s Annual Federal Tax Return for Agricultural Employees – Government Revision. 944 Employer’s Annual Federal Tax Return – Government Revision. 945 Annual Return of Withheld Federal Income Tax - Government Revision. 940/941/944 PIN Application is available again for data entry. The IRS now requires additional information to be included on the PIN Application: Employer’s Name Control (entered on the Manage Payer screen), Email Address, and the Title, Phone Number, and Social Security Number of the person who is applying to be an authorized signer of Forms 940/941/944. 940 and 944 – Electronic filing changes for 2015: o Fields were added on prep screen for required Reporting Agent Information. o Paid Preparer: The Preparer’s Date Signed is now required when including paid preparer information. o Date Signed (for Taxpayer and Preparer if applicable) must be after the end of the tax year (January 1, 2016 or later). STATE E-FILE CHANGES Alabama’s due date for annual W-2 and 1099 filing was changed to January 31. Connecticut’s due date for annual 1099 electronic filing was changed to March 31. Connecticut’s due date for annual W-2 electronic filing was changed to January 31. Indiana’s due date for annual W-2 and 1099 filing was changed to January 31. Mississippi’s due date for annual W-2 and 1099 filing was changed to January 31. Missouri MO-W-3 - Address Update checkbox was removed. North Carolina’s due date for annual W-2 and 1099 filing was changed to January 31. Utah’s due date for annual 1099 electronic filing was changed to March 31. Utah TC-941R due date changed to January 31. 2 State Gov ernm ent Form Ch anges Alabama A-3 Annual Reconciliation of Income Tax Withheld - Due date changed to January 31. Connecticut CT-941 Quarterly Reconciliation of Withholding – Form printout was changed to a scannable format, following new state requirements. Connecticut CT-W3 Annual Reconciliation of Withholding – Due date changed to January 31. Connecticut forms - reminder CT-941 and CT-W3 may only be filed on paper by employers that have obtained an electronic filing waiver from the state. Nebraska W3-N Reconciliation of Income Tax Withheld – Government Revision. Checkbox was added for Combined Fed/State 1099 filing. New York NYS-45/ATT Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance Return – o Electronic Payments – Bank account number fields will now accept alpha characters and hyphens; entry in Payment Settlement Date fields now accommodates an extended due date, when the due date falls on a weekend. o Due Date – changed due date to be the “next business day” when the calendar due date falls on a weekend. North Carolina NC-3 - Annual Withholding Reconciliation – Due date was changed to January 31. Philadelphia City of Philadelphia Annual Reconciliation of 2015 Employer Wage Tax – Added new field for Line 3 “Taxable income paid to employees earnings tips on which City Wage Tax was not withheld”, all other lines incremented by one, and numerous other field changes. Resident and nonresident tax rates were updated for 2015. Utah TC-941R Annual Withholding Reconciliation – Printed form has changed to a “Record Copy” because data must be filed electronically. Scanline, Partner ID, and Vendor Id no longer print. REMINDERS FOR STATE E-FILE Through the E-file Center, you are able to file W-2, 1099-MISC, 1099-R, 1099-DIV, and 1099-INT forms directly to the appropriate state agency. To help facilitate this for you, it is required that you file all your state forms through Yearli Desktop’s E-file Center at least 48 HOUR PRIOR TO THE STATE FILING DEADLINE. State Reconciliation Forms: Because the E-file Center prepares state reconciliation forms for the single return type (W-2, 1099-DIV, 1099-INT, 1099-MISC, or 1099-R) that is selected for filing, any data that you enter on a reconciliation form should apply only to the single return type selected. This is especially important for any Tax Withheld or Tax Paid through the year that is reported on a reconciliation form; be sure to include only the tax that applies to the return type that you are filing. State Specific Information for filing your W-2 and 1099 forms to states is included in the help file. Yearli Desktop 2015, Quarter 3 Update 1 ENH ANCEM ENTS Import – 1095-C Employer-Provided Health Insurance Offer and Coverage - Form data may now be imported via Excel or CSV. 1095-C Employer-Provided Health Insurance Offer and Coverage – A new field is available in Part II Employee Offer and Coverage to select a 2-digit number for Plan Start Month. 3 Yearli Desktop 2015, Quarter 3 ENH ANCEM ENTS TIN Truncation/Masking on 1099 printouts – Selecting the Truncate/Mask Recipient TIN checkbox on the Print 1099 Returns W indow will now truncate Recipient EINs (formatted as XX-XXX1234) as well as Recipient SSNs (formatted as XXX-XX-1234) on Recipient copies of 1099, 1098, and 5498 forms. W-2 State Specific Tab – For W ashington, the values for “Reason for reporting zero hours” have been updated. Please review your selections. Affordable Care Act – Form 1095-C is now available in Yearli. You may begin to key in your data by selecting this form type in the Add Form drop down menu on the Recipient List page. Covered Individuals can be added for 1095-B or 1095-C reporting in the Manage Recipient section 94x PIN Application – Per the IRS, PIN registrations for 940, 941, and 944 electronic filing will not be issued for Tax Year 2015 till after September 15, 2015. The PIN application form (data-entry and e-file) will not be available in the Yearli 2015 software starting with Quarter 3. Generic Import Utility – Forms 1098, 1099-DIV, 1099-INT, 1099-MISC, 1099-R, and 1099-S are no longer available. They are available in the “Import via CSV” and “Import via Excel” options. Security Updates – In an effort to improve security and to comply with SSAE-16 SOC 2 standards, you will be prompted to enable security for the Yearli software. You can choose to enable or disable based on your preference. If you already set up the security feature, you may be prompted to change your password to comply with stricter password standards. Import From YES Software (New port Wave) – New import option available. FATCA Program Error – The error that was occurring due to changes for the new FATCA Indicator has been resolved. IL UI-3/40 Employer’s Contribution and Wage Report – W hen printing the form, the data on lines 5A and 5B was different from what was presented on the prep screen. This has been resolved. New York NYS-45 / ATT Quarterly Combined W ithholding, W age Reporting, And Unemployment Insurance Return – Electronic Pa yments – Error checking was added to Line 3 (W ages Subject to Contribution) to prevent errors when filing electronically. Printing 1099 Forms – 1099 printouts now have the ability to Truncate/Mask EINs on Recipient copies. 4 Form Changes Federal G ov e rn m ent Form Changes 1099 Forms – 2015 forms are available for printing. This includes all Forms 1098, 1099, 5498, and 1096. 1096 Annual Summary and Transmittal of U.S. Information Returns – Changes to summarization for Line 5. 1099-CAP Changes in Corporate Control and Capital Structure – Form is available again. 1099-LTC Long-Term Care and Accelerated Death Benefits – Form is available again. Information for the insured individual is now required on 1099-LTC (name, address, and TIN). Insured’s TIN may be with an SSN or EIN. 1099-SA Distributions From an HSA, Archer MSA, or Medicare Advantage MSA – Form is available again. 5498-ESA Coverdell ESA Contribution Information – Form is available again. 5498-SA HSA, Archer MSA, or Medicare Advantage MSA Information – Form is available again. W-2 – The 2015 Blank Form Copy A is available for printing. W-3 - The 2015 Blank Form Copy A is available for printing. State Gov ernm ent Form Ch anges Maryland MW508 Annual Employer Withholding Reconciliation Return – Government revision. Washington 5208A/5208B Quarterly Unemployment Insurance – Tax Summary & Wage Detail – Government revision, and numerous field changes. Looking Ahead Affordable Care Act – Form printouts and electronic filing will be available in Yearli for the following new forms: 1095-C – Employer-Provided Health Insurance Offer and Coverage. 1095-B – Health Coverage 1094-C – Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns 1094-B – Transmittal of Health Coverage Return Reminder Microsoft ended support the Server 2003 operating system, Server 2003 in July of 2015. Yearli ended support of Server 2003 as of July 14, 2015. 5 Yearli Desktop 2015, Quarter 2 ENH ANCEM ENTS 940, 941 and 944 Reporting Agent E-File Updates –The Settings Menu has been modified to add a new IRS Reporting Agent tab. The ‘Reporting Agent for 940/941/944 Electronic Filing’ fields from the Preparer tab were moved to the new IRS Reporting Agent tab. Note: the IRS now requires additional information from Reporting Agents when filing Forms 941, 944, and 940 electronically: - IRS Reporting Agent Name Control (Typically the first four characters of the Reporting Agent’s name) - IRS Reporting Agent EIN - IRS Reporting Agent Business Name - IRS Reporting Agent Address (including City, State, and Zip code) Form 941 Employer’s Quarterly Federal Tax Return – Electronic Filing changes for Quarter 2: - Fields were added on prep screen for new Reporting Agent information - Paid Preparer: the Preparer’s Date Signed is now required when including paid preparer information New York NYS-45 / ATT Quarterly Combined W ithholding, W age Reporting, And Unemployment Insurance Return – Electronic Pa yments – New York’s tax department is transitioning to a new bank starting June 25, 2015. If you plan to submit UI or W T electronic payments for NYS-45 through the E-file Center, you must provide some new information to your bank to prevent your payments from being rejected. See Help topic “New York NYS-45” for more information. Also an override checkbox was added to “W ages subject to contribution” on Line 3 to allow a manual entry (such as reimbursing employers reporting 0.00 for wages subject to contribution.) Universal Import – Functionality was improved and updated for 2015. Pa yer Notes – Functionality was improved so when saving all Payers are not updated. 1098-T Tuition Statement - Government revision. 1099-G Certain Government Payments - Government revision. 1099-DIV Dividends and Distributions – Added field for FATCA filing requirement. 1099-INT Interest Income – Added fields for FATCA filing requirement and Bond premium on tax-e xempt bond. 1099-MISC Miscellaneous Income – Added field for FATCA filing requirement. 1099-OID Original Issue Discount – Added field for FATCA filing requirement. 941-X Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund - Updated lines 4a, 4b, 5a, 5b, 5c, and 11. 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund – Updated Part 1 line 1 & 2, Part 2 lines 4a, 5a, 5b, 5c, Parts 3 and 4 lines 8, COBRA, 18, 19, 20. Removed lines 10a, 10b, 17, 18c, 18d. 944-X Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund - Updated Part 1 line 1 & 2, Part 2 lines 4a, 5a, 5b, 5c, Part 3 and 4 lines 11, COBRA, 17, 19, 22. Removed lines 12a, 12b, 19, 20c, 20d. W-2 - The 2015 W -2 is available for printing. W-3 - The 2015 W -3 is available for printing. State Gov ernment Form Ch anges Georgia G-1003 Income Statement Return – Government revision. Kansas 100 Quarterly Wage Report & Unemployment Tax Return – Government revision. Nebraska UI-11T / 11W Combined Tax Report/Wage Report 11W - Added field to 11W for Email Address. North Carolina NC-3 Annual W ithholding Reconciliation - Government revision. This is a prior year form and will be updated in a future release of Yearli. Oregon WR Annual Withholding Tax Reconciliation Report - Government revision. 6 Yearli Desktop 2015, Quarter 1 ENH ANCEM ENTS Recipient List - Filtering – The option to filter the list of recipients by a specific form is now available. Simply select a W -2/1099 form or All Recipients in the Filter by Form Type list at the top of the Recipient List screen. TIN Matching – Only Recipients with valid TINs will be included for TIN Matching. Recipients with the following TINs will be e xcluded from TIN Matching submissions – Blank TINs (containing 9 spaces), TINs containing the same repeated digit (000000000, 111111111, 222222222, etc.), and TINs of 123456789. E-file Center – State Quarterly filing added for New York NYS-45 / ATT – New York Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return/Attachment – New York has mandated that the NYS-45 / ATT be filed electronically for Q1 2015. Feel free to contact us if you have any questions. Maine – New forms for Maine (ME UC-1 Unemplo yment Contributions Report) and 941ME Emplo yer’s Return of Maine Income Tax Withholding) are available in Yearli. These two forms replace Maine Form 941/C1-ME for 2015 W hen a user’s DPI settings are at 125% there is an issue with the Forms List for Manage Payer and Recipient. This has been corrected. Form Changes Federal G ov e rn m ent Form Changes Form 941 Employer’s Quarterly Federal Tax Return – Government revision. Form 941-V Employer’s Quarterly Federal Tax Return Payment Voucher – Government revision. Form 943-A Agricultural Employer’s Record of Federal Tax Liability – Government revision. Form 945-A Annual Record of Federal Tax Liability – Government revision. State G ov ernm ent Form Changes Connecticut CT-941 Connecticut Quarterly Reconciliation of Withholding – Government revision. Connecticut CT-W3 Connecticut Annual Reconciliation of Withholding – Government revision. Due Date is now 03/31/2016. Connecticut UC-2/UC-5A Employer Contribution Return/Employee Quarterly Earnings Report – Form UC-5B is no longer available so form UC-5A will be used as the continuation sheet. Employee Taxable W ages Paid This Quarter and Employee Ta xable W ages This Page were added. Employee list will now display/print 20 per page. Florida RT-6/RT-6A Employer’s Quarterly Report/Continuation Sheet – Government revision. Georgia G-7 Quarterly Return for Monthly Payer – Government revision. IL 941 Withholding Income Tax Return – Government revision. Michigan UIA 1028 Employer’s Quarterly Wage/Tax Report - Form pages have changed to “record copy only” due to state E-file mandate. Nebraska 941N Income Tax Withholding Return – Government revision. New York NYS-1 Return of Tax Withheld – Form has changed to “record copy only” due to state E-file mandate for due dates on or after April 30, 2015. A fileable copy of NYS-1 may be printed for due dates before April 30, 2015. This form will not be able to be e-filed via Yearli Desktop. New York NYS-45 / ATT – New York Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return/Attachment – Changed to Record Copy due to state E-file mandate. North Carolina NC-5Q Quarterly Income Tax Withholding Return – Government revision. Oklahoma OES-3 Employer’s Quarterly Contribution Report – Ta xable W age Limit is now $17,000. Vermont C-101 Employer’s Quarterly Wage & Contribution Report – The standard premium for employer Health Care Contributions has changed to $140.84. Washington EMS 5208 A/EMS 5208 B Quarterly Tax Report/Quarterly Wage Detail Report – Government revision. 7 Yearli Desktop 2015, Setup ENH ANCEM ENTS Form W-2G Certain Gambling Winnings – the 2015 form is available to print in the Setup release. Installation location – the default folder when installing Yearli 2015 w ill be: C:\Program Files (x86)\Greatland Corporation\Yearli\2015 (on 64-bit Operating Systems) C:\Program Files\Greatland Corporation\Yearli\2015 (on 32-bit Operating Systems) Form Changes Federal G ov e rn m ent Form Changes W-2, W-2c – Government revision: 2015 Social Security W age Limit: $118,500.00 2015 Social Security Ta x W ithheld Ma ximum: $7,347.00 Form 1098-C Contributions of Motor Vehicles, Boats, and Airplanes – the 2015 form is available to print. State G ov ernm ent Form Changes California DE 9 Quarterly Contribution Return and Report of Wages – The DI Wage Limit w as updated. Georgia GA-V Withholding Payment Voucher – Government revision. Iow a 44-105 Withholding Payment Voucher – Government revision. Maine 941/C1-ME Combined Filing for Withholding and Unemplo yment Contributions – This form is obsolete for 2015. New Jerse yNJ927 / NJ927W Employer’s Quarterly Report – Worker rates for Disability Insurance and Famil yLea ve Insurance w ere updated. Oregon OQ/Schd B/132 Quarterly Tax Report – rates for Special Pa yroll Tax offset w ere updated. Reminder For Importing Data Import from Previous Version: If installing Yearli on a network, the import must be done on the server. Install a W orkstation on the Server to perform this import. Reminder For Printing Forms Prior Year Forms: Annual and quarterly Federal and State Payer forms, W -2 Forms, and 1099 Series Forms that have not been updated for 20 15 cannot be printed in the Setup program; however, you may enter data for these forms. Forms will be enabled for printing as they are available from government agencies. Remember to update your program quarterly to receive 2015 forms. Looking Ahead Support for Server 2003 ending - Microsoft is ending support for the operating system, Server 2003 in July of 2015. Yearli will no longer su pport Server 2003 as of July 14, 2015. 8 Technical Support Internet: http://yearlidesktop.greatland.com Email: desktop.support@greatland.com Phone: 920.339.3200 Customer Service and Sales Internet: www.greatland.com/category/software+%26+online +filing/yearli+desktop.do Phone: 800.968.1099 Normal Hours: Monda y through Friday: 8:00 AM to 5:00 PM Central Ti me Normal Hours: Monday through Friday: 8:30 AM to 5:30 PM Eastern Time Extended Hours for January: Monday - Friday (Jan. 4, 2016 through Feb. 1, 2016): 8:00 AM to 6:00 PM Central Time Saturday (Jan. 9, 2016 through Jan. 30, 2016) 8:00 AM to 12:00 PM Central Time 9