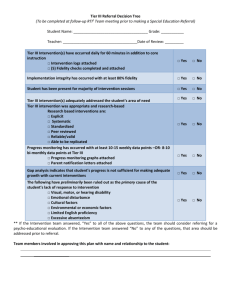

million Amounts Subject to Pre-Basel III Treatment Ref No. Common

advertisement

` million Amounts Subject to Pre-Basel III Treatment DF 11 - Composition of Capital as at March 31, 2014 Ref No. Common Equity Tier 1 capital: instruments and reserves 1 Directly issued qualifying common share capital plus related stock surplus (share premium) 147,850.0 2 Retained earnings 151,764.7 3 Accumulated other comprehensive income (and other reserves) 141,532.8 7 Directly issued capital subject to phase out from CET1 (only applicable to non-joint stock companies) Public sector capital injections grandfathered until 1 January 2018 Common share capital issued by subsidiaries and held by third parties (amount allowed in group CET1) Common Equity Tier 1 capital before regulatory adjustments Common Equity Tier 1 capital: regulatory adjustments Prudential valuation adjustments 8 Goodwill (net of related tax liability) 4 5 6 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 26a 26b 26c 26d 27 28 29 Intangibles other than mortgage-servicing rights (net of related tax liability) Deferred tax assets Cash-flow hedge reserve Shortfall of provisions to expected losses Securitisation gain on sale Gains and losses due to changes in own credit risk on fair valued liabilities Defined-benefit pension fund net assets Investments in own shares (if not already netted off paid-in capital on reported balance sheet) Reciprocal cross-holdings in common equity Investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation, net of eligible short positions, where the bank does not own more than 10% of the issued share capital (amount above 10% threshold) Significant investments in the common stock of banking, financial and insurance entities that are outside the scope of regulatory consolidation, net of eligible short positions (amount above 10% threshold) Mortgage servicing rights (amount above 10% threshold) Deferred tax assets arising from temporary differences (amount above 10% threshold, net of related tax liability) Amount exceeding the 15% threshold of which : significant investments in the common stock of financial entities of which : mortgage servicing rights of which : deferred tax assets arising from temporary differences National specific regulatory adjustments Investments in the equity capital of unconsolidated insurance subsidiaries Investments in the equity capital of unconsolidated non-financial subsidiaries Shortfall in the equity capital of majority owned financial entities which have not been consolidated with the bank Unamortised pension funds expenditures Regulatory adjustments applied to Common Equity Tier 1 due to insufficient Additional Tier 1 and Tier 2 to cover deductions Total regulatory adjustments to Common equity Tier 1 Common Equity Tier 1 capital (CET1) a= a1 + a2 b c= c1 + c2 + c3 + c4 + c5 NA - - d 441,147.5 180.7 271.0 622.2 933.3 e= e1 + e2 7,674.2 - 11,511.4 - - 14.1 - - 11,115.7 19,606.9 421,540.6 - - f ` million Amounts Subject to Pre-Basel III Treatment DF 11 - Composition of Capital as at March 31, 2014 Ref No. Additional Tier 1 capital : instruments 30 Directly issued qualifying Additional Tier 1 instruments plus related stock surplus (31+32) - 31 of which : classified as equity under applicable accounting standards (Perpetual Non-Cumulative Preference Shares) - 32 of which : classified as liabilities under applicable accounting standards (Perpetual debt Instruments) - 33 34 35 36 Directly issued capital instruments subject to phase out from Additional Tier 1 Additional Tier 1 instruments (and CET1 instruments not included in row 5) issued by subsidiaries and held by third parties (amount allowed in group AT1) of which : instruments issued by subsidiaries subject to phase out Additional Tier 1 capital before regulatory adjustments Additional Tier 1 capital: regulatory adjustments 1,600.0 - 1,600.0 37 Investments in own Additional Tier 1 instruments - 38 Reciprocal cross-holdings in Additional Tier 1 instruments - 39 Investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation, net of eligible short positions, where the bank does not own more than 10% of the issued common share capital of the entity (amount above 10% threshold) - 40 Significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation (net of eligible short positions10) - 41 41a 41b National specific regulatory adjustments Investments in the Additional Tier 1 capital of unconsolidated insurance subsidiaries Shortfall in the Additional Tier 1 capital of majority owned financial entities which have not been consolidated with the bank Regulatory adjustments applied to Additional Tier 1 in respect of Amounts Subject to Pre-Basel III Treatment of which : capital charge for illiquid positions of which : goodwill on consolidation of which : deferred tax assets arising from temporary differences 42 43 44 44a 45 46 47 Regulatory adjustments applied to Additional Tier 1 due to insufficient Tier 2 to cover deductions Total regulatory adjustments to Additional Tier 1 capital Additional Tier 1 capital (AT1) Additional Tier 1 capital reckoned for capital adequacy11 Tier 1 capital (T1 = CET1 + AT1) (row 29 + row 44a) Tier 2 capital : instruments and provisions Directly issued qualifying Tier 2 instruments plus related stock surplus Directly issued capital instruments subject to phase out from Tier 2 - 271.0 933.3 11,511.4 12,715.7 (11,115.7) 421,540.6 121,891.6 48 Tier 2 instruments (and CET1 and AT1 instruments not included in rows 5 or 34) issued by subsidiaries and held by third parties - 49 of which : instruments issued by subsidiaries subject to phase out - 50 Provisions 51 Tier 2 capital before regulatory adjustments g 32,349.6 154,241.2 h i j = j1 + j2 + j3 + j4 ` million Amounts Subject to Pre-Basel III Treatment DF 11 - Composition of Capital as at March 31, 2014 52 Tier 2 capital: regulatory adjustments Investments in own Tier 2 instruments 53 Reciprocal cross-holdings in Tier 2 instruments 54 Investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation, net of eligible short positions, where the bank does not own more than 10% of the issued common share capital of the entity (amount above the 10% threshold) - 55 Significant investments in the capital banking, financial and insurance entities that are outside the scope of regulatory consolidation (net of eligible short positions) - 56 National specific regulatory adjustments (56a+56b) - 56a 56b of which: investments in the Tier 2 capital of unconsolidated subsidiaries of which: shortfall in the Tier 2 capital of majority owned financial entities which have not been consolidated with the bank 18.1 - 57 Total regulatory adjustments to Tier 2 capital 18.1 58 58a Tier 2 capital (T2) Tier 2 capital reckoned for capital adequacy Excess Additional Tier 1 capital reckoned as Tier 2 capital Total Tier 2 capital admissible for capital adequacy (row 58a + row 58b) 154,223.1 154,223.1 Total capital (TC = T1 + T2) (row 45+row 58c) 575,763.7 58b 58c 59 60a 60b Risk Weighted Assets in Respect of Amounts Subject to Pre-Basel III Treatment of which : [Insert Name of Adjustment] of which : … Total risk weighted assets (row 60a +row 60b +row 60c) of which : total credit risk weighted assets of which : total market risk weighted assets 60c of which : total operational risk weighted assets 60 61 Capital ratios Common Equity Tier 1 (as a percentage of risk weighted assets) 154,223.1 3,598,291.1 3,170,467.9 115,590.9 312,232.3 11.72% 62 Tier 1 (as a percentage of risk weighted assets) 11.72% 63 Total capital (as a percentage of risk weighted assets) 16.00% 64 Institution specific buffer requirement (minimum CET1 requirement plus capital conservation and countercyclical buffer requirements, expressed as a percentage of risk weighted assets) 5.00% 65 of which : capital conservation buffer requirement 0.00% 66 67 68 69 70 71 of which : bank specific countercyclical buffer requirement of which : G-SIB buffer requirement Common Equity Tier 1 available to meet buffers (as a percentage of risk weighted assets) National minima (if different from Basel III) National Common Equity Tier 1 minimum ratio (if different from Basel III minimum) National Tier 1 minimum ratio (if different from Basel III minimum) National total capital minimum ratio (if different from Basel III minimum) - 5.50% 7.00% 9.00% Ref No. ` million Amounts Subject to Pre-Basel III Treatment DF 11 - Composition of Capital as at March 31, 2014 72 73 74 75 76 77 78 79 Amounts below the thresholds for deduction (before risk weighting) Non-significant investments in the capital of other financials Significant investments in the common stock of financial entities 544.2 311.7 Mortgage servicing rights (net of related tax liability) NA Deferred tax assets arising from temporary differences (net of related tax liability) Applicable caps on the inclusion of provisions in Tier 2 Provisions eligible for inclusion in Tier 2 in respect of exposures subject to standardised approach (prior to application of cap) Cap on inclusion of provisions in Tier 2 under standardised approach Provisions eligible for inclusion in Tier 2 in respect of exposures subject to internal ratings-based approach (prior to application of cap) Cap for inclusion of provisions in Tier 2 under internal ratings-based approach Capital instruments subject to phase-out arrangements (only applicable between April 1, 2018 and March 31, 2022) NA 32,349.6 NA NA Current cap on CET1 instruments subject to phase out arrangements NA 81 Amount excluded from CET1 due to cap (excess over cap after redemptions and maturities) NA 82 Current cap on AT1 instruments subject to phase out arrangements 83 Amount excluded from AT1 due to cap (excess over cap after redemptions and maturities) 85 Current cap on T2 instruments subject to phase out arrangements Amount excluded from T2 due to cap (excess over cap after redemptions and maturities) Notes to the Template Row # of template Particular 1,600.0 19 26b 44a 50 58a Deferred tax assets (excluding those associated with accumulated losses) net of deferred tax liability 121,891.6 23,702.9 Rs. in crores 19,185.6 If investments in insurance subsidiaries are not deducted fully from capital and instead considered under 10% threshold for deduction, the resultant increase in the capital of bank NA of which: Increase in Common Equity Tier 1 capital NA of which: Increase in Additional Tier 1 capital of which: Increase in Tier 2 capital NA NA If investments in the equity capital of unconsolidated non-financial subsidiaries are not deducted and hence, risk weighted then: NA (i) Increase in Common Equity Tier 1 capital (ii) Increase in risk weighted assets NA NA Excess Additional Tier 1 capital not reckoned for capital adequacy (difference between Additional Tier 1 capital as reported in row 44 and admissible Additional Tier 1 capital as reported in 44a) - of which: Excess Additional Tier 1 capital which is considered as Tier 2 capital under row 58b - Eligible provisions included in Tier 2 capital Eligible revaluation reserves included in Tier 2 capital Total of row 50 Excess Tier 2 capital not reckoned for capital adequacy (difference between Tier 2 capital as reported in row 58 and T2 as reported in 58a) g 400.0 Deferred tax associated with accumulated losses 10 j = j1 + j2 + j3 + j4 39,630.8 80 84 Ref No. 32,349.6 32,349.6 - h ` million DF 12 - Composition of Capital - Reconciliation Requirements Step 1 A Capital and Liabilities Paid-up capital Reserves & surplus Minority interest Total capital Balance sheet as in consolidated financial statements Balance sheet under regulatory scope of consolidation As on 31-Mar-14 As on 31-Mar-14 4,798.1 436,868.3 1,517.3 443,183.7 4,798.1 436,558.3 917.0 442,273.4 3,670,803.3 27,593.0 3,643,210.3 - 3,671,254.5 27,593.0 3,643,661.5 - 495,967.2 214,315.4 495,967.2 214,315.4 37,520.0 37,520.0 of which: Others of which: Capital instruments 69,401.3 174,730.5 69,401.3 174,730.5 Other liabilities & provisions 426,245.4 426,255.5 5,036,199.6 5,035,750.6 253,572.2 253,572.2 145,562.1 145,562.1 399,134.3 399,134.3 Investments of which: Government securities of which: Other approved securities of which: shares of which: Debentures & Bonds of which: Subsidiaries, Joint Ventures, Associates of which: Others (including Commercial Papers, Mutual Funds etc.) 1,195,710.6 946,400.2 1,488.8 36,358.6 1,195,290.3 946,400.2 1,377.2 36,358.6 544.5 311.8 210,918.5 210,842.5 iii Loans and advances of which: to banks of which: to customers 3,154,188.6 8,646.8 3,145,541.8 3,154,188.6 8,646.8 3,145,541.8 iv Fixed assets 30,262.8 30,262.8 Other assets of which: (a) goodwill and intangible assets (b) deferred tax assets 255,354.8 255,326.1 v 19,185.6 19,185.6 vi Goodwill on consolidation 1,548.5 1,548.5 vii Debit balance in Profit & Loss account i ii Deposits of which: Deposits from banks of which: Customer deposits of which: Other deposits Borrowings of which: from RBI of which: From banks iii iv of which: From other institutions & agencies Total Capital and Liabilities B i ii Assets Cash and balances with RBI Balance with banks and money at call and short notice Total Total Assets 5,036,199.6 5,035,750.6 ` million DF 12 - Composition of Capital - Reconciliation Requirements Step 2 A Capital and Liabilities Paid-up capital Reserves & surplus of which: Share premium Balance in Profit/Loss A/c of which: (a) balance in profit/ loss account (relating to associates) not considered under regulatory scope of consolidation i Statutory Reserves General Reserve Amalgamation Reserve Capital Reserve Investment Reserve Account Foreign Currency Translation Reserve Minority interest of which considered under capital funds Total capital ii Deposits of which: Deposits from banks of which: Customer deposits of which: Other deposits Borrowings of which: from RBI of which: From banks of which: From other institutions & agencies iii of which: Others of which: Capital instruments of which: (a) Eligible AT1 capital i As on 31-Mar-14 As on 31-Mar-14 Ref. No. 4,798.1 436,868.3 4,798.1 436,558.3 a1 143,051.9 152,074.7 143,051.9 151,764.7 a2 b 310.0 91,883.5 34,687.4 10,635.6 4,395.9 208.9 (69.6) 1,517.3 - - 91,883.5 34,687.4 10,635.6 4,395.9 208.9 (69.6) - 443,183.7 442,273.4 3,670,803.3 27,593.0 3,643,210.3 - 3,671,254.5 27,593.0 3,643,661.5 - 495,967.2 214,315.4 495,967.2 214,315.4 37,520.0 37,520.0 69,401.3 174,730.5 69,401.3 174,730.5 d 1,600.0 g - 121,891.6 h (c) Eligible T2 capital issued by subsidiaries - - i 426,245.4 426,255.5 Provisions against standard assets 12,938.7 12,929.8 j2 Country risk provisions Floating provisions 39.7 19,193.8 39.7 19,171.2 j3 j4 5,036,199.6 5,035,750.6 253,572.2 253,572.2 145,562.1 145,562.1 Assets Cash and balances with RBI Balance with banks and money at call and short notice Total 399,134.3 Investments of which: Government securities of which: Other approved securities of which: shares of which: Debentures & Bonds of which: Subsidiaries, Joint Ventures, Associates of which good will on acquisition of IARC included as part of carrying amount as per AS 23 of which: Others (including Commercial Papers, Mutual Funds etc.) 1,195,710.6 946,400.2 1,488.8 36,358.6 1,195,290.3 946,400.2 1,377.2 36,358.6 544.5 311.8 7.0 7.0 210,918.5 210,842.5 iii Loans and advances of which: to banks of which: to customers 3,154,188.6 8,646.8 3,145,541.8 3,154,188.6 8,646.8 3,145,541.8 iv Fixed assets 30,262.8 30,262.8 255,354.8 255,326.1 v c5 917.0 399,134.3 ii c1 c2 c3 c4 j1 - Total Capital and Liabilities B Balance sheet under regulatory scope of consolidation (b) EligibleT2 capital issued by Bank Other liabilities & provisions of which: iv Balance sheet as in consolidated financial statements Other assets of which: (a) goodwill and intangible assets Out of which: Goodwill Other intangibles (excluding MSRs) (b) deferred tax assets vi Goodwill on consolidation vii Debit balance in Profit & Loss account Total Assets - - - - - e1 - 19,185.6 19,185.6 f 1,548.5 1,548.5 e2 5,036,199.6 5,035,750.6