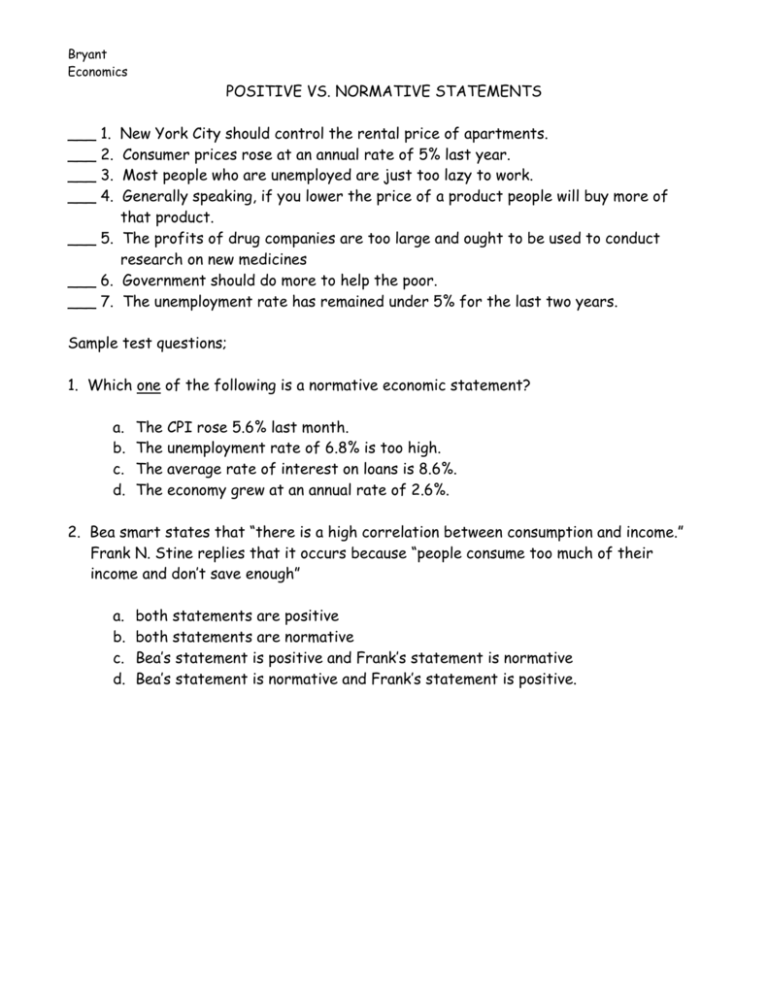

POSITIVE VS. NORMATIVE STATEMENTS

advertisement

Bryant Economics POSITIVE VS. NORMATIVE STATEMENTS ___ 1. ___ 2. ___ 3. ___ 4. New York City should control the rental price of apartments. Consumer prices rose at an annual rate of 5% last year. Most people who are unemployed are just too lazy to work. Generally speaking, if you lower the price of a product people will buy more of that product. ___ 5. The profits of drug companies are too large and ought to be used to conduct research on new medicines ___ 6. Government should do more to help the poor. ___ 7. The unemployment rate has remained under 5% for the last two years. Sample test questions; 1. Which one of the following is a normative economic statement? a. b. c. d. The CPI rose 5.6% last month. The unemployment rate of 6.8% is too high. The average rate of interest on loans is 8.6%. The economy grew at an annual rate of 2.6%. 2. Bea smart states that “there is a high correlation between consumption and income.” Frank N. Stine replies that it occurs because “people consume too much of their income and don’t save enough” a. b. c. d. both statements are positive both statements are normative Bea’s statement is positive and Frank’s statement is normative Bea’s statement is normative and Frank’s statement is positive. REVIEW OPPORTUNITY COST Definition: What one must give up when making a decision, the next best alternative not taken, what a person or society must give up when making a choice. Explicit cost: The actual cost of decision making. Implicit cost: What was given up as a result of a decision. Application: opportunity cost Explicit cost of college: Current status: * * * Work full time Annual salary: $10,000 Living expenses: $1,000 * * * Tuition: Books $2,000 $ 400 Living expenses: $5000 Dilemma: Work full time or attend college full time? If you were an economist, how would you determine the cost of each decision? Continue to work: Attend College: Suppose you have a friend who is currently working as a salesperson in a local store that sells computers. The friend is thinking about going back to school full time to complete work on a computer science degree. She explains to you that she earns $18,000 per year in her current job, and she estimates tuition will cost $1,100 per year. In addition, she estimates fees, supplies, books, and miscellaneous expenses associated with attending school will run $900 per year. She wants to attend a local university located directly across the street from the store where she currently works. She claims that she pays $300 per month for rent and utilities and that she spends about $225 per month on food. Thinking as an economist, calculate and explain to your friend the cost to her of another year at school full time. Consider both implicit and explicit cost.