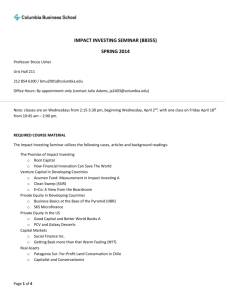

The Impact of Sustainable and Responsible Investment

advertisement