The 2014-2015 PA Grant & Resource Directory

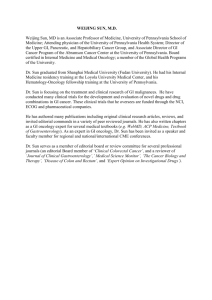

advertisement