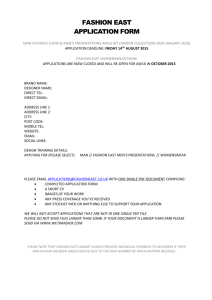

RUEHL No. 925, LLC

advertisement