Morningstar Emerging Markets

Bond Index Family

®

For More Information

http://indexes.morningstar.com

indexes@morningstar.com

11 312 384-3735

Bloomberg Tickers

Composite—MSBIECTR

Corporate—MSBIERTR

Sovereign—MSBIESTR

High-Yield—MSBIEHTR

Introduction

During the last two decades, the emerging market debt

universe has undergone rapid growth and transformation.

As emerging market economies have experienced steady

improvement in credit quality, much higher growth than

developed economies, and more sustainable fiscal deficit,

emerging market bonds have taken a more prominent

role in fixed-income portfolios.

A Fast-Growing Market

Real GDP growth rates in many of the emerging market

countries have far outpaced those of the world’s developed

economies. According to the International Monetary Fund,

GDP growth in emerging economies for 2012 is expected to

be 5.4% while that of advanced economies is expected to

be 1.2%. From 1980 to 1990, the split in world GDP between

advanced and developing economies was stable at

approximately 70% to 30%. Post 1990, growth in the developing world accelerated rapidly. In 2012, the developing

world is expected to surpass advanced economies in annual

GDP based on purchasing power parity.

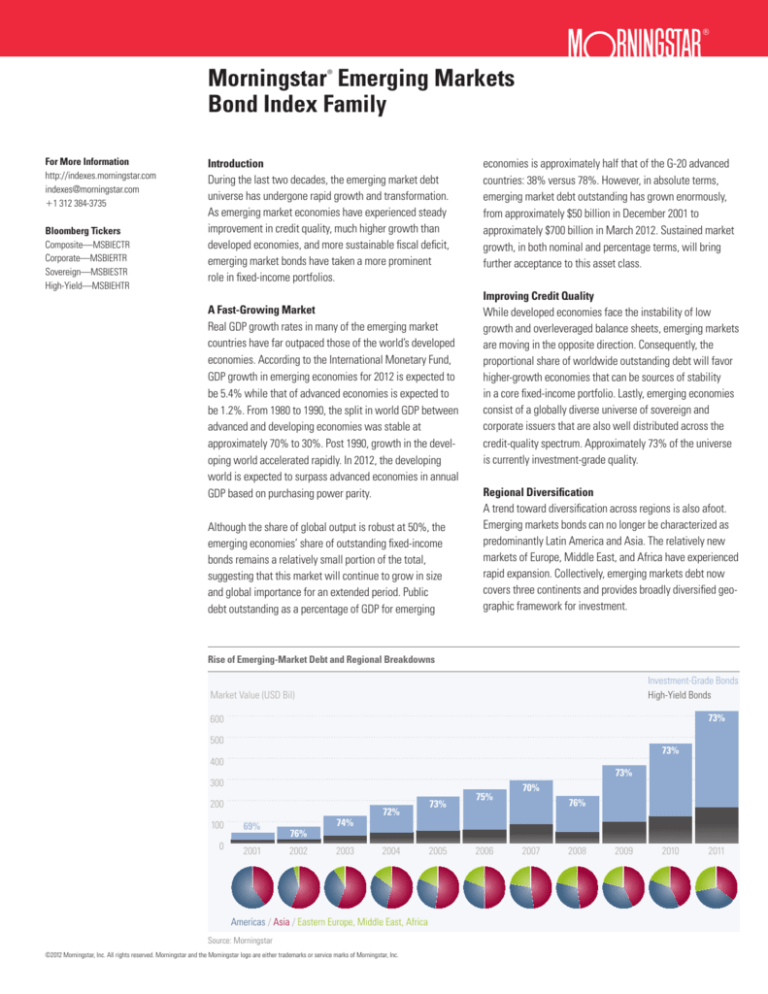

Although the share of global output is robust at 50%, the

emerging economies’ share of outstanding fixed-income

bonds remains a relatively small portion of the total,

suggesting that this market will continue to grow in size

and global importance for an extended period. Public

debt outstanding as a percentage of GDP for emerging

economies is approximately half that of the G-20 advanced

countries: 38% versus 78%. However, in absolute terms,

emerging market debt outstanding has grown enormously,

from approximately $50 billion in December 2001 to

approximately $700 billion in March 2012. Sustained market

growth, in both nominal and percentage terms, will bring

further acceptance to this asset class.

Improving Credit Quality

While developed economies face the instability of low

growth and overleveraged balance sheets, emerging markets

are moving in the opposite direction. Consequently, the

proportional share of worldwide outstanding debt will favor

higher-growth economies that can be sources of stability

in a core fixed-income portfolio. Lastly, emerging economies

consist of a globally diverse universe of sovereign and

corporate issuers that are also well distributed across the

credit-quality spectrum. Approximately 73% of the universe

is currently investment-grade quality.

Regional Diversification

A trend toward diversification across regions is also afoot.

Emerging markets bonds can no longer be characterized as

predominantly Latin America and Asia. The relatively new

markets of Europe, Middle East, and Africa have experienced

rapid expansion. Collectively, emerging markets debt now

covers three continents and provides broadly diversified geographic framework for investment.

Rise of Emerging-Market Debt and Regional Breakdowns

Investment-Grade Bonds

High-Yield Bonds

Market Value (USD Bil)

73%

600

500

73%

400

73%

300

200

100

69%

0

2001

76%

2002

74%

2003

72%

2004

Americas / Asia / Eastern Europe, Middle East, Africa

Source: Morningstar

©2012 Morningstar, Inc. All rights reserved. Morningstar and the Morningstar logo are either trademarks or service marks of Morningstar, Inc.

73%

2005

75%

2006

70%

76%

2007

2008

2009

2010

2011

Morningstar ® Emerging Markets Bond Index Family

The Morningstar Emerging Markets Bond Index Family

Morningstar®

Emerging Markets

Composite Bond

Index

Morningstar®

Emerging Markets

Sovereign Bond

Index

Composite

The Morningstar Emerging Markets Composite Bond Index

includes the most liquid sovereign and corporate

bonds issued in U.S. dollars by the governments and

corporations of emerging market countries.

Sovereign

The Morningstar Emerging Markets Sovereign Bond

Index includes the most liquid sovereign bonds

issued in U.S. dollars by the governments of emerging

market countries.

SM

SM

Morningstar®

Emerging Markets

Corporate Bond

Index

SM

Corporate

The Morningstar Emerging Markets Corporate Bond

Index includes corporate bonds issued in

U.S. dollars by corporations domiciled in emerging

market countries.

Morningstar®

Emerging Markets

Investment Grade

Bond Index

SM

Morningstar®

Emerging Markets

High Yield Bond

Index

SM

Investment Grade

The Morningstar Emerging Markets Investment Grade

Bond Index combines the Emerging Markets Sovereign

and Emerging Markets Corporate Bond Indexes,

with an additional credit rating restriction to isolate

investment-grade debt.

High Yield

The Morningstar Emerging Markets High Yield Bond Index

combines the Emerging Markets Sovereign and Emerging

Markets Corporate Bond Indexes, with an additional credit

rating restriction to isolate below-investment-grade debt.

Construction Rules for Morningstar Emerging Markets Bond Indexes

Morningstar Emerging Markets

Composite Bond Index

Morningstar Emerging Markets Sovereign Bond Index

Morningstar Emerging Markets Corporate Bond Index

Inclusion Criteria

• Fixed-rate bonds denominated in USD

• Bonds with embedded options and with sinking funds.

• Bonds must have a minimum of 36 months maturity at time

of issuance and a minimum of 13 months to maturity.

• Minimum $1 bil issuer amount outstanding.

• Minimum $500 mil issue amount outstanding.

• Includes regulation S or 144a private placement securities.

Inclusion Criteria

• Fixed-rate bonds denominated in USD

• Bonds with embedded options and with sinking funds.

• Bonds must have a minimum of 36 months maturity at time

of issuance and a minimum of 13 months to maturity.

• Minimum $1 bil issuer amount outstanding.

• Minimum $500 mil issue amount outstanding.

• Includes regulation S or 144a private placement securities.

Exclusion/Removal Criteria

• Bonds issued in local currency and subordinated debt

are excluded.

• Fixed-to-floating rate bonds are removed at the

next rebalancing.

Exclusion/Removal Criteria

• Bonds issued in local currency and subordinated debt

are excluded.

• Fixed-to-floating rate bonds are removed at the

next rebalancing.

Pricing Sources

• IDC.

Pricing Sources

• IDC.

Rules for Defaulted Securities

• Bonds are not removed if the default occurs after inclusion.

Rules for Defaulted Securities

• Corporate issuers in default are removed at the next rebalancing.

Ratings Requirements

• Sovereign bond rating is the lower of Standard & Poor’s

and Moody’s.

• At least one rating must be present for inclusion in the index.

• Issuers must be rated A+ or below.

Ratings Requirements

• At least one rating

• Corporate bond rating is the average of Standard & Poor’s, Moody’s and Fitch.

• There is no rating restriction.

Weighting Methodology

• No one country has a par amount greater than 15% of

the par amount of the overall index.

©2012 Morningstar, Inc. All rights reserved. Morningstar and the Morningstar logo are either trademarks or service marks of Morningstar, Inc.

Weighting Methodology

• No one issuer has a par amount greater than 5% of

the par amount of the overall index.