Research in Emerging Markets Finance

advertisement

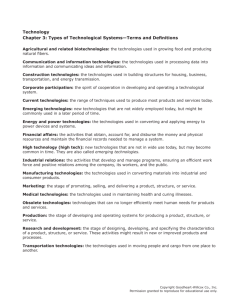

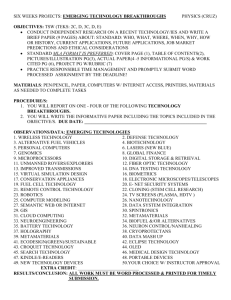

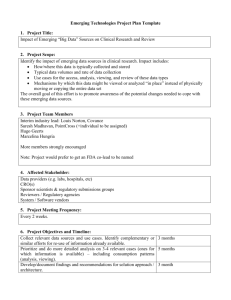

Research in Emerging Markets Finance: Looking to the Future Much has been learned about emerging markets finance over the past 20 years. These markets have attracted a unique interdisciplinary interest that bridges both investment and corporate finance with international economics, development economics, law, demographics and political science. Our paper focuses on the research areas that are ripe for exploration. We provide new evidence on how emerging market returns, volatility, betas, correlations, skewness and kurtosis have changed as these markets become more financially open. Emerging markets; International Cost of Capital, Financial openness, dating integration, market segmentation, market integration, capital flows, contagion, market correlations, emerging market volatility, emerging return skewness, emerging return kurtosis, F30, F15, F43, F22, F36, International Finance Economic integration Economic growth of open economies Interational Investment, Long-term capital movements Financial aspects of economic integration G15, G12, G18, G20, International Financial Markets Asset Pricing Government Policy and Regulation General Financial Institutions F30, F36, G12, G15,G18, G20