Building Businesses in the 21 Century st Wednesday 4

advertisement

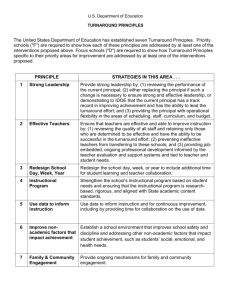

Building Businesses in the 21st Century Wednesday 4th July 2012 Andy Nash – Turnaround Specialist Simon Peckham - CEO, Melrose PLC Jon Moulton - Founder, Better Capital LLP Jeremy Davis - Partner, K&L Gates LLP Chris Smith - Partner, Clearwater Corporate Finance Copyright © 2012 by K&L Gates LLP. All rights reserved. Buy Improve Sell Strictly private and confidential Melrose PLC Seminar – 4th July 2012 Simon Peckham, Chief Executive Introduction “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is usually the reputation of the business that remains intact” Warren Buffett You can only build from the right “foundations” There are no short cuts (if there ever were) Buy Improve Sell 2 Our approach to value creation We buy, improve and sell over a timeline We create time pressure upon businesses We operate with a small head office Decisions are quick Head office is to devolve the maximum possible Buy Improve Sell 3 Our approach Buy Improve Sell Buy Improve Sell 4 Buy Good manufacturing businesses Must be underperforming Low technology risk Cash generative Available at a fair price Buy Improve Sell 5 Improve Look to speed up and remove politics Set a 3 – 5 year strategy Expect operational improvement and margin gains Invest heavily in businesses Drive new product introduction Analyse the profitability of sectors, products, etc The hard decisions are made Buy Improve Sell 6 Sell Timescales are flexible, open and management are involved Return substantial sale proceeds to our shareholders Will only sell when we have a business that has been improved Buy Improve Sell 7 Melrose Small, tight head office Quick and responsive decisions ‒ Share the responsibility As much as possible devolved to businesses As little time as possible spent on Group issues by operational management We want to invest / improve Buy Improve Sell 8 Conclusion If you buy businesses then the right price is the most important thing Once you own the businesses ‒ Must have strong markets ‒ Must have momentum ‒ Must drive product innovation ‒ Must understand what makes a profit There are fewer easy wins now Buy Improve Sell 9 Conclusion “The investor of today does not profit from yesterday’s growth” Warren Buffett Buy Improve Sell 10 Building a Business in Confusing Times – Survival & Turnaround Jon Moulton Better Capital 4th July 2012 Better Capital • Full Listed share – c. £500m market cap. • 9 base deals, 9 add ons since start of 2010. • Nearly £1bn in revenues. • Shares trade at a premium! 2 The essence of the analysis Is there a decent business here? Is there a transaction structure that facilitates extracting it? Are there a few controllable steps to move to profit? Can the foundations be created that will allow it to thrive? 3 Value transformation The value we add allows us to pay a premium to break-up price - even for materially loss-making businesses 4 A little thought experiment... What would you do with a company which... • Always misses forecasts? • Has unhappy owners who distrust the board? • Has a huge unfunded pension deficit? • Has increased overheads in real terms for 13 years straight? • Has had negative cash flow for 20 years .... and projects further negative cash flow? • Can only make ends meet by charging customers more and borrowing more to pay the interest. No credible plan to breakeven? • Is betting everything on growth when there isn’t any? • Has recently made two large lossmaking acquisitions without any turnaround plan? • Cooks the books by missing out liabilities? • Has an appalling record on senior management expenses? • Bails out its competitors? • Had an unqualified finance director of bizarre appearance and a Trotskyist background? • Put 2 Public Relations men in charge who have recently found out what a pasty is?? 5 Current Headlines 6 Current Headlines 7 Why do turnarounds? • Most PE firms don’t • Less competition • Lower price superior returns large rapid losses • Intellectual challenge • Fun 8 Key steps 1. Buy cheap 2. Early violence required 3. Get stable 4. Grow business 5. Exit 9 • Private Equity people look for good management. • Right? 10 • Wrong. • Not if you are looking for turnarounds! • Bad is good. 11 Bad Managers • Don’t know figures • Don’t visit • Usually bad presenters - but… • Divorcees, lovers (RBS ...) • Often present in good businesses too 12 Turnaround actions Key areas: – Products, markets, production, sales, marketing Fast actions: – Loss elimination (sales, closure) – Cost reduction – Cash control Longer term: – Restore growth – Restore margins 13 Evaluating turnarounds • Risks – – – – – – – Financing Commercial Contingent liabilities Receivership deals Imperfect knowledge Timetable Increasing technical complexity – pensions, employee law • Opportunities – – – – Low valuations Returns Compressed timetable Increasing technical complexity – pensions – Maybe less competition 14 History as a predictor of potential future opportunities Liquidations in England & Wales as % of Active Companies 15 Questions 16 Questions and panel discussion Copyright © 2012 by K&L Gates LLP. All rights reserved.