Read the SALT Alert.

advertisement

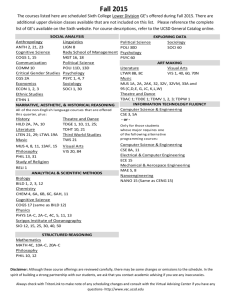

State & Local Tax Alert Breaking state and local tax developments from Grant Thornton LLP ________________________________________________________ Texas Comptroller Amends Revised Texas Franchise Tax Cost of Goods Sold Rule On June 5, the Texas Comptroller of Public Accounts amended the administrative rule governing the Revised Texas Franchise Tax (RTFT) cost of goods sold (COGS) deduction.1 The Comptroller’s amendments to the rule interpreting the existing statute that authorizes and defines the COGS deduction2 are effective retroactive to the January 1, 2008 effective date of the RTFT to the extent a taxpayer’s statute of limitations remains open. The most significant changes contained in the rule are the allowance of certain amended reports and the adoption of certain Internal Revenue Code (IRC) Section 263A (UNICAP) principles, which may allow indirect labor costs and property taxes to be treated as direct (100 percent) COGS deductions. However, there may be situations under which costs previously considered to be fully deductible could now be reclassified as service costs subject to a 4 percent COGS limitation. Significant Rule Changes Margin Computation Method Changes Allowed The amendment memorializes the relatively new Comptroller policy which allows taxpayers to file amended returns to change their margin computation method. Taxpayers now have the option to change their method of computing margin among the COGS deduction, the compensation deduction, 70 percent of total revenue or E-Z computation methods (to the extent the COGS and/or E-Z computation methods are available). Previously, the rule did not allow for taxpayers to amend their franchise tax reports to change their method to the COGS or compensation methods.3 The rule also confirms that an election may be changed as part of an audit. This policy shift was first adopted by the Comptroller in June 2012.4 Release date June 20, 2013 States Texas Issue/Topic Franchise Tax Contact details John LaBorde Houston T 832.476.3605 E john.laborde@us.gt.com Terry Gaul Houston T 832.476.5088 E terry.gaul@us.gt.com Adam Hines Houston T 832.476.3665 E adam.hines@us.gt.com Shelly Butler Houston T 832.476.5049 E shelly.butler@us.gt.com Pat McCown Dallas T 214.561.2350 E pat.mccown@us.gt.com Dan Manley Dallas T 214.561.2449 E dan.manley@us.gt.com Giles Sutton Dallas T 704.632.6885 E giles.sutton@us.gt.com Jamie C. Yesnowitz Washington, D.C. T 202.521.1504 E jamie.yesnowitz@us.gt.com Chuck Jones Chicago T 312.602.8517 E chuck.jones@us.gt.com 34 TEX. ADMIN. CODE § 3.588. TEX. TAX CODE ANN. § 171.1012. 3 34 TEX. ADMIN. CODE § 3.588(c)(3). 4 Letter No. 201206444L, Texas Comptroller of Public Accounts, June 12, 2012. 1 2 . www.GrantThornton.com/SALT Grant Thornton LLP - 2 Guidance on Direct and Indirect Labor Costs The Comptroller has concluded that the COGS statute5 allows taxable entities to include fully in their COGS deduction both direct and indirect labor costs, other than certain service costs, that are of the type of costs subject to capitalization or allocation under IRC Sections 263A and 460.6 The Comptroller does not directly address situations in which a taxable entity is not subject to IRC Sections 263A or 460; situations in which a taxable entity did not properly apply UNICAP principles on its federal tax return; or situations where a taxable entity has deducted current period UNICAP expenses on its federal tax return but has not reported the expenses on Treas. Form 1125-A. However, the Comptroller’s reference to the type of costs subject to capitalization or allocation under IRC Sections 263A and 460 and the preamble to the regulations7 would suggest the Comptroller’s intent to apply UNICAP principles to all of these situations. The allowance of indirect labor costs as direct COGS deductions is a significant shift in Comptroller policy, as this issue has been the source of many audit controversies.8 Labor costs have been expanded to include IRS Form W-2 wages, IRS Form 1099 payments for labor, temporary labor expenses, payroll taxes, pension contributions, and employee benefits expenses, including, but not limited to, health insurance and per diem reimbursements for travel expenses, to the extent those expenses are deductible for federal tax purposes.9 “Service Costs” Defined Pursuant to statute, indirect or administrative costs, including mixed service costs which are allocable to the acquisition or production of goods, may be considered COGS, though the includible amount cannot be more than 4 percent of the taxpayer’s total indirect or administrative overhead costs (including the mixed service costs.10 For the first time, the Comptroller has formally defined the term “service costs” in the amended rule, as follows: “. . . indirect and administrative overhead costs that can be identified specifically with a service department or function, or that directly benefit or are incurred by reason of a service department or function . . . [A] service department includes personnel (including costs of recruiting, hiring, relocating, assigning and maintaining personnel records or employees); accounting (including accounts payable, disbursements, any TEX. TAX CODE ANN. § 171.1012(c)(1) provides that COGS includes all direct costs of acquiring or producing goods, including labor costs. 6 34 TEX. ADMIN. CODE § 3.588(d)(1). The rule specifically references Treas. Reg. §§ 1.263A-1(e) and 1.460-5. 7 Texas Register, Vol. 38, No. 22, 3415 et seq., May 31, 2013. 8 See Letter No. 201108182L, Texas Comptroller of Public Accounts, Aug. 30, 2011, which guidance should now be rendered obsolete. 9 34 TEX. ADMIN. CODE § 3.588(d)(1)(A). 10 TEX. TAX CODE ANN. § 171.1012(f). 5 Grant Thornton LLP - 3 payroll functions); data processing; security; legal; general financial planning and management; and other similar departments or functions.11 While the definition in the rule definition parallels the definition contained in Treas. Reg. §1.263A-1(e)(4)(i), it should be noted that the Comptroller is defining the term “service costs,” and not “mixed service costs,” the term actually used in the statute. Further, the rule uses the terms “service costs” and “indirect or administrative overhead costs”12 interchangeably, which is distinct from the phrase “indirect or administrative overhead costs, including all mixed service costs” that is used in the statute. Inclusion of Property Taxes in COGS Deduction The inclusion of taxes in the COGS deduction has been expanded to include property taxes paid on buildings and equipment related to acquiring or producing any material.13 Although not stated in the rule, this inclusion logically could extend to property taxes paid upon inventory for sale. Similar to the allowance of indirect labor, the allowance of property taxes as a direct COGS deduction is a shift in policy by the Comptroller.14 Commentary The Comptroller’s policy changes with respect to amended returns, indirect labor costs, property taxes and the recognition and adoption of federal UNICAP principles present potential opportunities for taxpayers. Because the rule amendments apply retroactively, benefits may be recognized by amending prior year reports or revisiting prior audit results, to the extent the statute of limitations remains open. In addition, taxpayers should assess the potential ASC 740 impacts of the retroactively amended rule for financial reporting purposes. The distinction between indirect labor costs fully includible in the COGS deduction and service costs includible at 4 percent, at most, in the COGS deduction remains unclear. The Comptroller’s adoption of the definition of service costs in the rule, and the application of that term, potentially expands the law’s definition and application of “indirect or administrative overhead costs, including all mixed service costs.”15 The effect of this expansion is that more costs could be subject to the 4 percent limitation and may not be fully deductible under the rule, in contrast to what the law would suggest. Consider, for example, a taxpayer who has a single department responsible for hiring employees for both its headquarters and its manufacturing facility. Because this department handles both production and non-production hiring, the labor costs for this department should be considered mixed service costs.16 As a result, costs that previously 34 TEX. ADMIN. CODE § 3.588(b)(9). 34 TEX. ADMIN. CODE § 3.588(f). 13 34 TEX. ADMIN. CODE § 3.588(d)(11). 14 See Letter No. 201002890L, Texas Comptroller of Public Accounts, Feb. 2, 2010, which guidance should now be rendered obsolete. 15 TEX. TAX CODE ANN. § 171.1012(f). 16 Treas. Reg. § 1.263A-1(e)(4)(ii)(C). 11 12 Grant Thornton LLP - 4 may have been includible, in whole or in part, in the Texas COGS deduction could now be subject to the 4 percent indirect COGS deduction limitation under the amended rule.17 Alternatively, consider the example of a taxpayer that has a department solely responsible for hiring employees for its manufacturing facility or function. The labor costs for this department would be considered to be “service costs that directly benefit or are incurred by reason of the performance of the production or resale activities of the taxpayer.”18 The costs are not “mixed service costs” for federal UNICAP purposes, and are capitalizable service costs for federal tax purposes.19 The corollary to this treatment is that the costs would be fully includible in the RTFT COGS deduction.20 But as a result of the Comptroller’s application of “service costs” in lieu of “mixed service costs,” the subject costs may be limited to the 4 percent indirect COGS deduction limitation under the amended rule. The Comptroller’s changes to labor costs, service costs, and property taxes rely heavily on federal UNICAP principles. The allowance of property taxes as a direct COGS deduction results from the Comptroller’s recognition of IRC Section 263A principles. The reliance on UNICAP principles for labor costs and property taxes may allow for similar interpretations and treatment of other costs where taxpayers are lacking direct guidance. ____________________________________________________ The information contained herein is general in nature and based on authorities that are subject to change. It is not intended and should not be construed as legal, accounting or tax advice or opinion provided by Grant Thornton LLP to the reader. This material may not be applicable to or suitable for specific circumstances or needs and may require consideration of nontax and other tax factors. Contact Grant Thornton LLP or other tax professionals prior to taking any action based upon this information. Grant Thornton LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, re-keying or using any information storage and retrieval system without written permission from Grant Thornton LLP. 34 TEX. ADMIN. CODE § 3.588(b)(9), (f). Treas. Reg. § 1.263A-1(e)(4)(ii)(A). 19 Treas. Reg. § 1.263A-1(e)(4)(iii)(B). 20 TEX. TAX CODE ANN. § 171.1012(c)(1); 34 TEX. ADMIN. CODE § 3.588(d)(1). 17 18 Grant Thornton LLP - 5 Tax professional standards statement This document supports the marketing of professional services by Grant Thornton LLP. It is not written tax advice directed at the particular facts and circumstances of any person. Persons interested in the subject of this document should contact Grant Thornton or their tax advisor to discuss the potential application of this subject matter to their particular facts and circumstances. Nothing herein shall be construed as imposing a limitation on any person from disclosing the tax treatment or tax structure of any matter addressed. To the extent this document may be considered written tax advice, in accordance with applicable professional regulations, unless expressly stated otherwise, any written advice contained in, forwarded with, or attached to this document is not intended or written by Grant Thornton LLP to be used, and cannot be used, by any person for the purpose of avoiding any penalties that may be imposed under the Internal Revenue Code.

![[Name of Business]](http://s2.studylib.net/store/data/005439490_1-eb485795b6ab94ac46e88cc0426770e1-300x300.png)