Document

advertisement

CASCADES

CIBC High Yield

Conference

May 19, 2011

DISCLAIMER

Certain statements in this presentation, including statements regarding future results and performance, are

forward-looking statements within the meaning of securities legislation based on current expectations. The

accuracy of such statements is subject to a number of risks, uncertainties and assumptions that may cause

actual results to differ materially from those projected, including, but not limited to, the effect of general economic

conditions, decreases in demand for the Company’s products, the prices and availability of raw materials,

changes in the relative values of certain currencies, fluctuations in selling prices and adverse changes in general

market and industry conditions. This presentation also includes price indices as well as variance and sensitivity

analyses that are intended to provide the reader with a better understanding of the trends related to our business

activities. These items are based on the best estimates available to the Company.

The financial information included in this presentation also contains certain data that are not measures of

performance under Canadian GAAP or IFRS (“non-GAAP or non-IFRS measures”). For example, the Company

uses earnings before interest, taxes, depreciation and amortization (EBITDA) because it is the measure used by

management to assess the operating and financial performance of the Company’s operating segments. Such

information is reconciled to the most directly comparable financial measures, as set forth in the “Supplemental

Information on Non-GAAP or Non-IFRS Measures” section of our most recent annual report or earnings press

release.

Specific items are defined as items such as charges for impairment of assets, for facility or machine closures,

debt restructuring charges, gains or losses on sales of business units, unrealized gains or losses on derivative

financial instruments that do not qualify for hedge accounting, foreign exchange gains or losses on long-term

debt and other significant items of an unusual or non-recurring nature.

All amounts in this presentation are in Canadian dollars unless otherwise indicated.

2

AGENDA

1.

Business overview

2.

Financial review

3.

Current market conditions

4.

Recent strategic developments

5.

Concluding remarks

3

BUSINESS OVERVIEW

4

BALANCED PACKAGING AND TISSUE PLAY

($ in millions)

Cascades

2010 Sales: $3,959

2010 EBITDA: $398

Packaging

79% of Sales

79% EBITDA

Boxboard

31% of Sales

24% Adjusted EBITDA

Containerboard

27% of Sales

37% Adjusted EBITDA

Tissue Papers

21% of Sales

21% EBITDA

Specialty Products

21% of Sales

18% Adjusted EBITDA

Leading North American packaging and tissue manufacturer with substantial recycling capabilities

EBITDA excluding specific items. Share of Sales and EBITDA excluding the impact of inter-segment sales and corporate activities. Based on Canadian GAAP.

5

INTEGRATED

23 units

May be sent to

recycling centers

34 units

59 units

One of two North American public companies in packaging & tissue

with leading market positions

6

SUSTAINABLE

Lost times frequency rate (OSHA)

Relative Green House Gas Emissions

(kg/metric

tonne)

300

8.0

296

6.6

6.0

5.4

260

4.9

4.0

209

220

198

2.0

-

180

2008

2009

2010

2008

2009

2010

The right approach to benefit from the “green” demand

7

FINANCIAL REVIEW

8

SUMMARY OF ANNUAL RESULTS (2010/GAAP)

4,000

3,900

3,959

400

3,877

3,800

3,700

3,600

3,500

14.0%

398

350

12.0%

306

300

10.0%

200

8.0%

100

6.0%

4.0%

0

2007

(M CAN$)

2008

2009

2007

2010

(% of sales)

Cash flow from operations (adjusted)

327

11.0%

2008

260

202

183

9.0%

7.0%

5.0%

100

0

2007

2008

2009

2010

1.13

1.00

0.65

0.75

0.50

3.0%

0.25

1.0%

0.00

2010

2009

Earnings per share

(CAN$)

1.50

1.25

300

200

(% of sales)

465

500

4,017

3,929

EBITDA

(M CAN$)

Sales

(M CAN$)

4,100

0.23

0.04

2007

2008

2009

2010

Lower results compared to 2009 but significantly better than previous years.

EBITDA, cash flow from operations (adjusted) and net earnings excluding specific items.

9

KEY PERFORMANCE INDICATORS (2010/GAAP)

Total Shipments

('000 s.t.)

Capacity utilization rate

3,600

3,500

96%

3,515

94%

3,396

3,400

94%

92%

3,330

3,300

90%

88%

88%

3,200

86%

86%

3,082

3,100

84%

3,000

82%

2007

2008

2009

2010

2007

2008

2009

2010

Working capital (% of sales)

Return on assets

18.0%

13.0%

11.9%

12.0%

16.5%

10.5%

11.0%

10.0%

93%

15.4%

14.2%

9.1%

14.0%

9.0%

7.8%

8.0%

16.0%

13.6%

12.0%

7.0%

6.0%

10.0%

2007

2008

2009

2010

2007

2008

2009

2010

Rebound in demand and operating rate.

Working capital as a % of sales at its lowest level in 5 years.

See notes page 50.

10

HISTORICAL BUSINESS CONDITIONS

Selling

prices

1 250

Cascades North American manufacturing selling price

and raw material cost indices (US$)

Raw material

costs

700

600

1 150

500

1 050

400

300

950

200

Selling prices index (US$)

US$/CAN$

Natural Gas Henry Hub - US$/mmBtu

Q4 2010

Q3 2010

Q2 2010

Q1 2010

Q4 2009

Q3 2009

Q2 2009

Q1 2009

Q4 2008

Q3 2008

Q2 2008

Q1 2008

Q4 2007

Q3 2007

Q2 2007

100

Q1 2007

850

Raw materials index (US$);

2007

2008

2009

2010

$0.93

$0.94

$0.88

$0.97

$6.86

$9.03

$3.99

$4.39

Less favourable business conditions compared to 2009 as $CAN appreciated and

implementation of price increases lagged cost inflation.

See notes page 50. Source: Bloomberg.

11

ANNUAL SEGMENTED EBITDA (2010/GAAP)

(M CAN$)

(% of sales)

Boxboard

14.0%

150

115

125

101

100

44

6.0%

33

25

4.0%

0

2.0%

2007

2008

(M CAN$)

2009

2010

100

67

75

74

75

60

150

0

0

10.0%

2007

2008

2009

2010

2008

100

2009

2010

(% of sales)

(M CAN$)

150

2.0%

14.0%

12.0%

10.0%

4.0%

154

50

6.0%

25

145

100

12.0%

50

16.0%

130

200

8.0%

(% of sales)

176

2007

(% of sales)

Specialty products

200

Containerboard

10.0%

8.0%

75

50

12.0%

(M CAN$)

Tissue papers

22.0%

154

19.0%

16.0%

90

90

65

13.0%

10.0%

50

7.0%

0

4.0%

2007

2008

2009

2010

Stable results in packaging vs. last year.

Significant turnaround in boxboard compared to 2007 and 2008.

EBITDA excluding specific items.

12

2010 VS. 2008 COMPARISON

2008

2010

Change

$0.94

$0.97

4%

819

765

(7%)

Natural gas costs (CAN$/GJ)

$7.26

$5.09

(30%)

Capacity utilization rate

88%

93%

5%

Sales (M$)

4,017

3,959

(1%)

EBITDA (M$)

306

398

30%

Free cash flow (M$)

(78)

72

+150 M$

EPS

$0.04

$0.65

1,525%

ROA

7.8%

10.5%

2.7%

Net debt (M$)

1,800

1,449

(20%)

US$/CAN$

Selling price index/raw material cost index spread (in US$)

Compared to 2008, despite stable sales, Cascades’ profitability significantly improved as the turnaround of assets, cost

reduction and better efficiency more than offset the appreciation of the CAN$ and the reduction of the spread.

EBITDA and EPS excluding specific items. See notes page 50.

13

TRANSITION TO IFRS: BALANCE SHEET

IFRS balance sheet

As at December 31, 2010

(In millions of Canadian dollars)

Assets

Current assets

Cash and cash equivalents

Accounts receivable

Current income tax assets

Inventories

Financial assets

Future income tax assets

Long-term assets

Property, plant and equipment

Intangible assets

Other assets

Investments in associates and joint ventures

Goodwill

Financial assets

Future income tax assets

Liabilities and Shareholders’ equity

Current liabilities

Bank loans and advances

Accounts payable and accrued liabilities

Current income tax liabilities

Provisions

Future income tax liabilities

Current portion of financial liabilities

Current portion of long-term debt

Long-term liabilities

Long-term debt

Provisions for contingencies and charges

Other liabilities

Financial liabilities

Future income tax liabilities

Equity attributable to Shareholders

Capital stock

Contributed surplus

Retained earnings

Accumulated other comprehensive income

Non-controlling interest

Total equity

CDN GAAP

IAS 19

IAS 36

Employee Impairment

benefits

Preliminary impacts

IAS 21

IAS 39

CTA

Factoring

IAS 31

Joint

Ventures

Disclosure

and others

IFRS

10

561

21

534

–

7

-

-

-

14

-

(4)

(73)

(58)

-

(12)

12

(7)

6

490

21

476

12

-

1,133

-

-

-

14

(135)

(7)

1,005

1,777

150

350

314

-

(90)

-

(108)

(6)

-

-

-

(116)

(20)

(5)

108

(1)

-

(171)

152

14

82

1,553

124

84

260

313

14

82

3,724

(90)

(114)

-

14

(169)

70

3,435

64

569

4

5

12

-

-

-

14

-

(23)

(80)

(2)

(5)

(60)

23

(5)

12

-

41

443

2

23

12

7

654

-

-

-

14

(110)

(30)

528

1,383

234

172

76

(45)

(30)

-

-

(31)

(15)

(1)

(11)

2

37

(99)

84

80

1,354

37

196

83

166

2,443

31

(30)

-

14

(168)

74

2,364

496

14

701

46

(122)

1

(90)

6

88

(88)

-

-

(2)

(2)

496

14

575

(37)

1,257

24

1,281

3,724

(121)

(121)

(90)

(84)

(84)

(114)

-

14

(1)

(1)

(169)

(4)

(4)

70

1,048

23

1,071

3,435

14

TRANSITION TO IFRS: STATEMENT OF EARNINGS

Preliminary impacts

Impairment Employee

benefits

CDN GAAP

Joint

ventures

(In millions of Canadian dollars)

Sales

Cost of sales and expenses

Cost of sales (excluding depreciation and amortization)

Depreciation and amortization

Selling and administrative expenses

Losses on disposal and other

Net impairment and other restructuring costs

Gain on financial instruments

Operating income

Financing expense

Loss on refinancing of long term debt

Foreign exchange loss on long-term debt and financial instruments

Provision for (recovery of) income taxes

Share of results of associates and joint ventures

Net earnings (loss) from continuing operations including noncontrolling interest

Net loss from discontinuing operations

Net earnings including non-controlling interest for the year

Less: Non-controlling interest income

Net earnings (loss) for the year

EBITDA excluding specific items

Net earnings excluding specific items

EPS excluding specific items

IFRS

Others

(350)

-

-

-

3,173

212

395

8

50

(1)

3,837

122

109

3

4

6

(15)

(280)

(15)

(35)

(330)

(20)

(4)

(16)

(5)

(11)

(18)

(18)

(36)

36

36

7

-

(5)

(2)

14

7

(7)

2

(9)

(2)

-

(2)

21

(1)

20

3

17

-

29

(7)

(7)

(7)

2

3,959

398

(35)

63

-

0.65

-

29

29

-

2

2

-

7

3,609

2,888

179

358

22

32

(1)

3,478

131

107

3

4

17

(28)

45

(1)

44

3

41

370

14

3

1

81

0.15

0.03

0.01

0.84

15

TRANSITION TO IFRS: KEY RATIOS

(for the year ended December 31, 2010)

Cdn GAAP

IFRS

Change

EBITDA / Sales

10.0%

10.3%

0.3%

Return on assets

10.5%

10.6%

0.1%

Return on equity

5.0%

7.7%

2.7%

3.65

3.46

(0.19)

53.6%

57.1%

3.5%

3.65

3.77

0.12

Profitability ratios

Debt ratios

EBITDA / Interests

Net Debt / Capitalization

Net Debt / EBITDA

Not

adjusted

for

the sale

of

Dopaco

Overall, ratios remain relatively stable

All ratios excluding specific items.

16

SUMMARY OF Q1 2011 RESULTS (IFRS)

(In millions of CAN$, except amount per share)

Financial results

Sales

Excluding specific items

EBITDA

Net earnings (loss)

Net earnings (loss) per share

Cash flow from operations (adjusted)

EBITDA

(M CAN$)

2009

(Canadian

GAAP)

Year

Q1

Q2

Q3

Q4

Year

Q1

3,359

759

808

832

783

3,182

774

408

110

1.13

281

59

4

0.04

43

85

26

0.27

41

94

33

0.35

72

72

17

0.17

41

310

80

0.83

197

37

1

0.01

15

(% of sales)

100

80

10.0%

80

9.0%

60

7.0%

40

5.0%

20

3.0%

0

1.0%

6.0%

4.0%

Q2 2010

Q3 2010

Q4 2010

Q1 2011

(% of sales)

11.0%

40

Q1 2010

Cash flow from operations (adjusted)

100

8.0%

0

(M CAN$)

2011 (IFRS)

12.0%

60

20

2010 (IFRS)

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

As anticipated, profitability came down in Q1 due challenging business conditions

and operational difficulties in a few units.

EBITDA, net earnings and cash flow from operations (adjusted) excluding specific items.

17

Q4 2010- Q1 2011 EBITDA VARIANCE ANALYSIS

(M CAN$)

100

98

80

60

(16)

72

(10)

2

3

9

5

11

7

40

57

37

8

10

20

0

Q4 2010

Discontin.

Joint

(previous

operations

ventures

Canadian

(Dopaco)

GAAP)

(M CAN$)

Containerboard

37

Boxboard

24

(16)

(7)

Specialty products

16

(3)

Tissue papers

23

Corporate

(2)

Total

98

(16)

(10)

Others

3

(1)

(2)

-

Selling

Q4 2010

Shipments prices &

(IFRS)

mix

40

1

12

23

(4)

72

Variation

of the

CAN$

Energy

costs

Other

costs

(5)

2

1

(6)

(8)

(5)

2

(1)

1

(1)

3

(2)

(3)

(2)

(2)

(1)

(3)

(1)

(2)

(2)

(3)

(5)

(7)

Raw

material

costs &

mix

(9)

(1)

(10)

Discontin.

Q1 2011

Joint

operations

(IFRS)

ventures

(Dopaco)

19

5

7

10

(4)

37

11

7

2

11

9

Q1 2011

including

Dopaco

and JVs

19

23

9

10

(4)

57

The significant increase of input costs (with some lag from Q4 2010) and the CAN$ led to weaker

results in Q1. Also, Q4 2010 EBITDA was positively impacted by 6M$ in “one-time” items.

EBITDA excluding specific items.

18

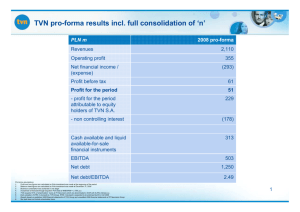

RENO DE MEDICI: FULL CONSOLIDATION IN Q2

Reno de Medici (RdM)

1. Cascades currently owns 40.99% of outstanding shares

2. Cascades can acquire up to 5% per year on the open market

3. Cascades has the option to acquire 9.07% from one shareholder « Industria Innovatione»

• Cascades has a call option to buy for €0.43 per share until Dec. 31, 2012

• Industria has a put option to sell for €0.41 per share from Jan 2013 to March 31, 2014

• Total potential investment of €14-15 M

4. Put / Call option for Cascades virgin assets in effect

• 2011 is reference year

• Paid in cash or in additional shares of RdM

• May represent 10%-20% of outstanding shares of RdM (depending on acquisition structure)

Due to the option in place (9.07%) and to its current position (41%), Cascades will begin to

fully consolidate RdM’s results in its financial statements in Q2 2011

19

RENO DE MEDICI: RECENT FINANCIAL RESULTS

2010

Q1

Q2

Q3

Q4

Year

Q1

115

7

106

235

127

11

118

239

125

10

110

227

137

12

107

245

504

40

107

946

138

11

99

241

(In millions of euro, except shipments)

Financial results

Sales

EBITDA

Net debt

Shipments ('000 m.t.)

EBITDA

(M euro)

(M euro)

14

120

12

115

10

110

8

105

6

100

4

95

2

90

0

85

Q1 2010

Q2 2010

Q3 2010

Q4 2010

2011

Q1 2011

Net debt

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Steady improvement in results and financial position in recent years.

20

CURRENT MARKET CONDITIONS

21

UPWARD SELLING PRICES

Y-o-Y Price increases, US$ or euro (Jan. 2010 / April 2011)

225

200

175

150

125

100

100

(12%)

110

(21%)

110

(22%)

120

(13%)

121

(16%)

130

(13%)

143

(25%)

182

(19%)

75

50

25

0

Fine paperLinerboard Medium Kraft paper CRB N.A. C. virgin

CRB

C. virgin

boxboard Europe boxboard

N.A.

Europe

Price increases implemented across the board in packaging in 2010,

still moving upward in boxboard.

External reference prices. Source: RISI

22

UPWARD SELLING PRICES

Segment

Capacity/

leverage

Announced

effective date

Announced Increase

Boxboard

North America

Recycled board

234,000 s.t.

April/May

40 US$/s.t.

Boxboard

Europe

Recycled board

1,010,000 m.t.

April

50 €/m.t.

222,000 m.t.

April

85 €/m.t.

80 M$.

March-June

4 to 8%

Kraft papers

110,000 s.t.

April

50 US$/s.t.(certain grades)

Deinked pulp

82,000 s.t.

May/June

5%

Uncoated board

103,000 s.t.

June

30 US$/s.t.

Parent rolls

220,000 s.t.

March/April

50 US$/s.t.

Away-from-home Canada

May

Up to 6%

Away-from-home U.S.

June

Up to 9%

July

7.5%

August

7.5%

Specialty

products

Tissue papers

Virgin board

Consumer prod. pack.

Retail Canada, branded

Retail Canada, pr. label

Price increases announced by Cascades.

425 M$

23

CONTAINERBOARD CONVERSION RISK

AbitibiBowater to Permanently Close Paper Production at Coosa Pines, Alabama

Operation

MONTREAL, Feb. 14 /CNW Telbec/ - AbitibiBowater announced today that it will

permanently close its paper machine at its Coosa Pines, Alabama operation and cease its

pilot project to manufacture recycled lightweight and ultra lightweight packaging and

linerboard grades within the next 30 days. AbitibiBowater remains committed to its fluff

pulp assets at the facility.

"Coosa Pines has made progress in the production of recycled lightweight and ultra

lightweight packaging and linerboard. Upon review, however, the substantial capital

investment that would be required at the site to make it low-cost in these grades could not

be justified," stated Richard Garneau, President and Chief Executive Officer.

Conversion to lightweight containerboard: not as easy as it looks!

24

NORTH AMERICAN TISSUE CAPACITY CHANGE

Company

Location

Notes

Furnish

Date

Tons

Fraser Papers

P&G

Irving Tissue

Total

Blue Heron

First Quality Tissue

Total

Georgia-Pacific

South Georgia Tissue

Clearwater Paper

First Quality Tissue

Georgia-Pacific

Total

Wausau Paper

P&G

Total

Gorham, NH

Box Elder, UT

Fort Edward, NY

Mill closure

New PM; TAD

New PM; TAD

R

V

V

2010:Q4

2010:Q4

2010:Q4

Mill shut-down

New greenfield TAD mill; first PM

V&R

V

2011:Q1

2011:Q3

Crossett, AR

undecided location

Shelby, NC

Anderson, SC

Port Hudson, LA

PM8 rebuild to f-TAD quality

New PM; parent rolls only

New greenfield TAD mill

New greenfield TAD mill, 2nd PM

PM8 rebuild to f-TAD quality

V

V&R

V

V

V

2012:Q2*

2012:Q2

2012:Q3

2012:Q3

2012:Q4*

Harrodsburg, KY

Box Elder, UT

New PM; Voith "ATMOS" PM

New PM; TAD

R

V

2013:Q1

2013:Q3*

(41 000)

80,000

35,000

74,000

(32 000)

70,000

112,000

25,000*

33,000

70,000

70,000

35,000*

233,000

75,000

80,000

155,000

Oregon City, OR

Anderson, SC

% of total

current

capacity

0%

1%

0%

1%

0%

1%

1%

0%

0%

1%

1%

0%

3%

1%

1%

2%

V = Virgin

R = Recycled

TAD = Through-Air-Dried

* = estimated

New capacity in line with annual growth rate in the tissue industry

Source: RISI

25

RECENT STRATEGIC

DEVELOPMENTS

26

RECENT STRATEGIC DEVELOPMENTS

1. Management team:

• Appointment of Mario Plourde as Chief Operating Officer (COO)

2. Balance sheet:

• Refinancing of revolving credit facility

• Sale of Dopaco

3. Containerboard:

• Sale of the Avot-Vallée (FR) white-top linerboard mill

• Consolidation of operations in New England

4. Boxboard:

• Increased ownership in Reno De Medici

5. Tissue papers:

• Investment in new technology to develop high-end product offering

27

APPOINTMENT OF MARIO PLOURDE

• Appointed as COO of Cascades, effective February 23, 2011.

• Part of the transition process.

• Mr. Plourde to have the operating responsibility for Cascades’ North

American boxboard, containerboard, specialty products and tissue paper

segments.

• Mr. Plourde to remain President and COO of the Specialty Products Group

until the appointment of his successor.

• Joined Cascades in 1985 as a controller. Was appointed President and

COO of the Specialty Products Group in 2000.

28

DOPACO TRANSACTION HIGHLIGHTS

1. Cash consideration of US$400 million

• Purchase price of 7.0 times 2010 adjusted EBITDA (in US$) and 7.7 times

2008-2010 EBITDA (in US$) average

• Estimated proceeds of US$337 million net of cash tax payment and

transaction fees

• Net proceeds to be used to pay down debt

• Subject to customary working capital and net debt adjustments

2. Cascades to continue to provide boxboard to Dopaco through a five year

supply agreement

3. Closing of the transaction announced on May 2, 2011

EBITDA excluding specific items.

29

DOPACO TRANSACTION RATIONALE

1. Strengthened financial position and improved financial flexibility

• Net debt reduction of US$337 million

•

•

Net debt down almost CAN$700 million in the last 24 months

Future Capex needs significantly reduced

2. Unlocked value for shareholders

• Attractive EBITDA multiples

• Improving Cascades’ financial risk profile

3. Strategic decision

• Focus going forward on core tissue, packaging, and recycling activities

4. Limited integration with our boxboard manufacturing operations

• 46,000 tons shipped to Dopaco in 2010 on total shipments of 365,000 tons

• Stand-alone management team, very limited synergies with Cascades

30

NET DEBT VARIANCE

(M CAN$)

1,600

1,500

1,397

35

1,400

10

27

5

(1)

1,445

(28)

1,300

1,200

1,124

1,100

321

1,000

Net debt

Dec. 31,

2010

CAPEX

Other

Dividend,

F/X

Var. of Cash flow Net debt Sale of Net debt

assets & bbacks change & working from oper. March 31, Dopaco March 31,

investments

others

capital & disc. Op. 2011

2011,

adjusted for

the sale

Despite weaker quarter and usual seasonal increase in working capital, net debt relatively stable.

However, with the sale of Dopaco, net debt down 40% or almost $700 M in 2 years.

For Dopaco, net debt reduction using estimated net proceeds of US$337 M and an 1.0491 US$/CAN$ exchange rate.

31

BALANCE SHEET & KEY FINANCIAL RATIOS

2010

Q1

Q2

Q3

Q4

Q1

Total assets

Total debt

Net debt*

3,452

1,469

1,454

3,497

1,522

1,508

3,544

1,477

1,462

3,437

1,403

1,397

3,452

1,455

1,445

3,172

1,134

1,124

Shareholders' equity

Book value per share

1,067

$11.01

1,081

$11.18

1,101

$11.40

1,049

$10.86

1,038

$10.77

1,138

$11.80

436

102

422

104

410

106

369

109

345

109

288

109

LTM EBITDA

LTM Interest

Net debt / LTM EBITDA

Debt / Debt + Equity

60.0%

2011

Q1 djusted for

sale of Dopaco

57.2%

5.0

58.4%

4.5

55.0%

49.6%

50.0%

4.0

45.0%

3.5

40.0%

3.0

Q4 2010

Q1 2011

Q1 2011

adjusted for

sale of Dopaco

4.2

3.9

3.8

Q4 2010

Q1 2011

Q1 2011 adjusted

for sale of

Dopaco

With the sale of Dopaco, significant improvement in debt ratios.

For Dopaco, net debt reduction using estimated net proceeds of US$337 M and an 1.0491 $US/$CAN exchange rate. EBITDA excluding specific items.

32

RENEWAL OF CREDIT AGREEMENT

Before

After

Structure

$750 M revolving credit facility

$100 M term loan

$750 M revolving credit facility

Maturity

Credit facility: December 2011

Term loan: February 2012

February 2015

Interest rate

Credit facility: LIBOR + 275 bps

Term loan: LIBOR + 287.5 bps

LIBOR + 212.5 bps

Standby fees

70 bps

22.5% x (spread over LIBOR) = 48 bps

Funded Debt to Capitalization Ratio ≤ 65%

Interest Coverage Ratio ≥ 2.25x

Funded Debt to Capitalization Ratio ≤ 65%

Interest Coverage Ratio ≥ 2.25x

Covenants

Addressing upcoming maturities while reducing costs of borrowing and improving flexibility.

33

DEBT SCHEDULE

(M CAN$)

Long-term debt repayment schedule (Dec. 31, 2010)

600

500

400

7.75%

Not adjusted for

sale of Dopaco

L + 212.5 bps

300

7.875%

7.75%

200

100

0

6.75% / 7.25%

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Senior unsecured

notes (US$ 18M)

Revolver

(CAN$ 750M)

Senior unsecured

notes (US$ 500M)

Senior unsecured

notes (CAN$ 200M)

Senior unsecured notes

(US$ 250M)

With refinancing of revolver, all short term maturities are now addressed.

34

CONCLUDING REMARKS

35

RESULTS TO IMPROVE

• Demand and backlogs remain healthy.

• Selling price increases being implemented or announced in

boxboard, specialty products and tissue paper segments.

• Operational action plans underway aimed at:

• reducing fixed and SG&A costs;

• optimizing production and efficiencies

• proactively managing cash flow.

• At strategic level, question, analyze and make the difficult

decisions to:

• adjust our portfolio of assets;

• improve our competitiveness.

Recent initiatives

Closure of

Leominster box plant

Sale of Dopaco and

Avot-Vallée

Cascades will be able to rebound in the coming quarters,

as we have historically done so in the past.

36

PROACTIVELY ADJUSTING ASSET BASE

2006

Implementation of several restructuring measures in our fine paper operations

Acquisition of Domtar’s 50% stake in Norampac

Acquisition of recycled boxboard assets (Simkins, Caraustar)

Sale of our fine papers distribution assets

Closure of our pulp mill and sawmill

2007

Sale of our interest in two boxboard converting joint ventures

Sale of Red Rock, Ontario containerboard mill and Thunder Bay, Ontario fine papers mill

2008

Merger of our European recycled boxboard assets with Reno De Medici S.p.A

Closure of Toronto, Ontario recycled boxboard mill

Sale of our Greenfield, France deinked pulp mill

2009

Acquisition of Atlantic Packaging’s tissue paper assets

Acquisition of Yorkshire Paper Corporation and Sonoco’s Canadian Recycling Operations

2011

Sale of the Avot-Vallée white-top linerboard mill

Sale of Dopaco

Increased ownership in Reno De Medici S.p.A

Consolidation of New England corrugated box operations

Proactively adjusting asset base to reduce costs, improve financial flexibility and

redeploy capital towards core segments

37

CONCLUDING REMARKS

1. Proactively addressing issues

2. Cascades to maintain strong focus on financial ratios,

profitability and free cash flow

3. Future development of Cascades to come through strategic

investments (Capex and acquisitions) in core operations

• To position our asset base amongst the best in the industry

in terms of productivity and profitability

• To improve product offering and customer service

• To reduce financial and operational risk

Objective: continue to balance sound balance sheet with strategic investments

38

APPENDICES

39

CONTAINERBOARD MARKET

U.S. Corrugated box industry shipments and ISM correlation

70

65

60

55

50

45

40

35

30

15%

10%

5%

0%

-5%

-10%

-15%

Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan Apr

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11 11

Shipments

Canadian Corrugated box industry shipments

15%

10%

5%

0%

2.80

2.60

2.40

-5%

-10%

-15%

-20%

2.20

2.00

1.80

Jan Apr July Oct Jan AprJuly Oct Jan AprJuly Oct Jan AprJuly Oct Jan

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11

Shipments

ISM Manufacturing Index

U.S. Corrugated box shipments

Annual change 2010

YoY change YTD April 2011

(M MSF)

3.00

Annual change

Canadian Corrugated box shipments

3%

1%

Annual change 2010

YoY change YTD March 2011

1%

(3%)

Steady pick up in manufacturing activity in the U.S. leading improving box demand.

Slower start in produce market season impacted Canadian demand in Q1.

Source: Fiber Box Association, Paper Packaging Canada.

40

CONTAINERBOARD MARKET

(M s.t.)

U.S. containerboard inventories at box plants and mills

(weeks)

('000 s.t.)

2.8

5.5

3,250

2.6

5.0

3,000

2.4

4.5

2,750

2.2

4.0

2.0

3.5

1.8

3.0

Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan Apr

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11 11

Millions short tons

Weeks of supply

110%

100%

2,500

90%

2,250

80%

2,000

1,750

70%

Jan AprJuly Oct Jan AprJuly Oct Jan AprJuly Oct Jan AprJuly Oct Jan

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11

T otal Production

Containerboard inventories

Weeks of supply

YoY change April 2011 (weeks)

U.S. containerboard industry production and capacity

utilization rate

Capacity utilization rate

Containerboard production

3.8

0.2

Annual change 2010

YoY change YTD March 2011

Capacity utiliza. rate YTD March 2011

7%

2%

95 %

Market conditions remain healthy;

High operating rates and normal seasonal level of inventories.

Source: RISI.

41

BOXBOARD MARKETS

U.S. folding coated recycled boxboard industry production and

('000 s.t.)

capacity utilization rate

190

180

170

160

150

140

130

120

Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11

T otal Production

Coated recycled boxboard order inflow from Europe (WLC)

(m.t.)

70,000

105%

100%

95%

90%

85%

80%

75%

70%

Capacity utilization rate

U.S. coated recycled boxboard production

Annual change 2010

2%

YoY change YTD March 2011

(1 %)

Capacity utilization rate YTD March 2011 96 %

60,000

50,000

40,000

30,000

20,000

1

4

7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52

2008

2009

2010

2011

(weeks)

European coated recycled boxboard demand

Annual change 2010

YoY change YTD Week 18 2011

13 %

(7 %)

Strong demand for coated recycled boxboard in North America;

In Europe, market remains healthy and is readjusting following long delays in delivery in 2010.

Sources: RIS, CEPI. 5-week weekly moving average for European data.

42

TISSUE MARKET

Retail

('000 s.t.)

U.S. tissue paper industry

converted product shipments

Away-f-home ('000 s.t.) U.S. tissue paper industry production (parent rolls) and

capacity utilization rate

('000 s.t.)

10%

6%

4%

5%

2%

0%

-2%

0%

700

675

650

625

600

-5% 575

-4%

-6%

-10%

Jan AprJuly Oct Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11

For the retail market

550

98%

96%

94%

92%

90%

88%

86%

84%

Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan Apr July Oct Jan

07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11

Total parent roll production

Capacity utilization rate

For the away-from-home market

Tissue paper converted product shipments

Annual change (retail & AfH) 2010

2%

YoY change (ret. & AfH) YTD March 2011 2 %

Tissue paper production

Annual change 2010

2%

YoY change YTD March 2011

2%

Capacity utilization rate YTD March 2011 94 %

Overall demand continues to pick up and price increases announced for H2 2011

Source: RISI.

43

LESS CYCLICAL

U.S. Corrugated Box Shipments Industry Breakdown

Durable

goods &

freight; 14%

U.S. Folding Carton Industry Breakdown

Others; 14%

Food

products;

44%

Other non

durable;

42%

Durable

goods; 4%

Health,

beauty &

other non

durable;

19%

Food &

beverages;

63%

U.S. Tissue Paper Products Shipments Industry Breakdown

Away-fromhome

31%

Retail (at

home)

69%

Similar to industry, Cascades’ sales are mostly exposed to

relatively stable and less cyclical end-use markets

44

LEADERSHIP POSITIONS

RECOVERY

• #1 Canadian recycled paper collector

PACKAGING

• #1 Canadian containerboard producer (Norampac)

• #2 European in coated recycled boxboard

• #3 North American coated recycled boxboard

TISSUE

• #1 “green” tissue papers retail brand in Canada

• #2 Canadian producer and #4 in North America

One of two North American public companies in packaging & tissue

with leading market positions

45

DIVESTITURE OF DOPACO

1. Cascades has agreed to sell Dopaco to Reynolds Group Holdings Limited (“RGHL”).

2. Dopaco, a wholly owned subsidiary of Cascades, is a leading producer of cups and

folding cartons for the quick service restaurants and food distribution service

industries in North America

• Headquartered in Exton, PA, Dopaco operates six plants that convert

approximately 165,000 tonnes of boxboard annually.

London,

Ontario

Stockton, CA

Brampton,

Ontario

Downingtown, PA

Kinston, NC

St. Charles, IL

3. RGHL is a global manufacturer and supplier of consumer food and beverage

packaging and storage products.

46

DOPACO TRANSACTION FINANCIAL IMPACT

Revenue breakdown (2010)

Tissue

Papers

21%

Specialty

Products

21%

Boxboard

32%

Containerboard

26%

EBITDA breakdown (2010)

Tissue Papers

21%

Specialty

Products

18%

Boxboard

24%

Containerboard

37%

Revenue breakdown (2010 pro forma)

Tissue

Papers

23%

Specialty

Products

24%

Boxboard

23%

Containerboard

30%

EBITDA breakdown (2010 pro forma)

Tissue

Papers

25%

Specialty

Products

21%

Boxboard

11%

Containerboard

43%

47

MARKET PRICES AND COSTS SUMMARY

Change

These indexes should only be used as indicator of trends and they

be different than our actual selling prices or purchasing costs.

Selling prices

Cascades North American US$ index (index 2005 = 1,000)1

PACKAGING

Boxboard

North America (US$/ton)

Recycled boxboard - 20pt. Clay coated news (transaction)

Europe (Euro/tonne)

Recycled white-lined chipboard (GD2) index2

Virgin coated duplex boxboard (GC2) index3

Containerboard (US$/ton)

Linerboard 42-lb. unbleached kraft, East US (transaction)

Corrugating medium 26-lb. Semichemical, East U.S. (transaction)

Specialty products

(US$/ton, tonne for deinked pulp)

Recycled boxboard - 20pt. Bending chip (transaction)

Deinked pulp (f.o.b; U.S. air-dried & wet-lap, post-consumer)

Unbleached kraft paper, Grocery bag 30-lb.

Uncoated white 50-lb. offset, rolls

TISSUE PAPERS

Cascades Tissue papers (index 1999 = 1,000)4

Raw materials

Cascades North American US$ index (index 2005 = 300)5

RECYCLED PAPER

North America (US$/ton)

Corrugated containers, no. 11 (New England)

Special news, no. 8 (ONP - Chicago & NY average)

Sorted office papers, no. 37 (SOP - Chicago & NY average)

Europe (Euro/tonne)

6

Recovered paper index

VIRGIN PULP (US$/tonne)

Bleached softwood kraft Northern, East U.S.

Bleached hardwood kraft Northern mixed, East U.S.

WOODCHIPS – Conifer eastern Canada (US$/odmt)

Sources: RISI, Dow Jones, Random Lengths and Cascades. See notes p. 50.

2009

Average Average Average

Q1

Q2

Average Average

Q3

Q4

Change

Q12011 Q12011 Q12011 Q12011

2010

2011 Q12010 Q12010 Q42010 Q42010

Average Average

Q1

(unit)

(%)

(unit)

(%)

1,109

1,106

1,180

1,223

1,234

1,186

1,238

132

12%

4

0%

754

790

825

843

855

828

880

90

11%

25

3%

592

985

580

976

631

1,025

656

1,063

690

1,155

639

1,055

690

1,155

110

179

19%

18%

0

0

0%

0%

547

517

580

550

640

610

640

610

640

610

625

595

640

610

60

60

10%

11%

0

0

0%

0%

565

601

926

855

575

708

960

868

625

752

1,020

917

625

755

1,047

938

650

755

1,060

933

619

743

1,022

914

667

748

1,025

930

92

40

65

62

16%

6%

7%

7%

17

-7

-35

-3

3%

-1%

-3%

0%

1,617

1,617

1,623

1,615

1,620

1,619

1,631

14

1%

11

1%

258

426

409

397

452

421

470

44

10%

18

4%

68

56

120

149

90

225

146

92

198

131

78

218

170

95

216

149

88

214

182

128

223

33

38

-2

22%

42%

-1%

12

33

7

7%

35%

3%

53

100

120

126

132

120

146

46

46%

14

11%

718

609

121

880

776

125

993

908

121

1000

900

120

967

840

124

960

856

123

970

820

123

90

44

-2

10%

6%

-2%

3

-20

-1

0%

-2%

-1%

48

HEDGING PORTFOLIO 2011

1. Cash flow USD, net exposure including interest ($170 M$):

• US$ 52.5 M at $1.14 (31% of exposure)

2. Natural gas:

• Canada:

• 2011: 75% at around 6.30 CAN$/GJ

•

U.S.:

• 2011: 75% at around 6.50 US$/mmBtu

49

NOTES

1.

2.

3.

4.

5.

6.

7.

8.

9.

The Cascades North American selling prices index represents an approximation of the Company’s manufacturing selling prices in North America (excluding

Converting products). It is weighted according to shipments and is based on the average selling price of our North American manufacturing operations of

boxboard, containerboard, specialty products and tissue paper. It considers the change in the mix of products sold. This index should only be used as a trend

indicator.

The Cascades North American raw materials index represents the average weighted cost paid for some of our manufacturing raw materials namely, recycled fiber,

virgin pulp and woodchips in North America. It is weighted according to the volume of purchase. This index should only be used as an a trend indicator and it may

differ from our actual manufacturing purchasing costs and our purchase mix.

The capacity utilization rate is defined as: Shipments/Practical capacity. Paper manufacturing only.

Return on assets is a non-GAAP measure and is defined as: LTM EBITDA excluding specific items/ LTM Average of total quarterly assets. It includes discontinued

operations.

Working capital includes accounts receivable plus inventories less accounts payable. It excludes an unpaid provision for closure and restructuring costs. It also

excludes the current portion of derivatives financial instruments and the current portion of future taxes liability.

The Cascades recycled white-lined chipboard selling prices index represents an approximation of Cascades’ recycled grades selling prices in Europe. It is

weighted by country.

The Cascades virgin coated duplex boxboard selling prices index represents an approximation of Cascades’ virgin grades selling prices in Europe. It is weighted

by country.

The Cascades Tissue paper selling prices index represents a mix of primary and converted products, and is based on the product mix at the end of 2006.

The Cascades recovered paper index represents an approximation of Cascades’ recovered paper purchase prices in Europe. It is weighted by country based on

the recycled fibre supply mix of 2009.

50

For more information:

www.cascades.com/investors

Didier Filion

Director, Investor Relations

didier_filion@cascades.com

514-282-2697

51

CREDIT: IMAGE ECOterre