Trusts & Wills Outline

2013 FALL

BALLARD

TRUSTS & WILLS

Trusts & Wills Outline

Professor: Megan Ballard

Text: Wills, Trusts, and Estates (9th Edition) by Dukeminier

I.

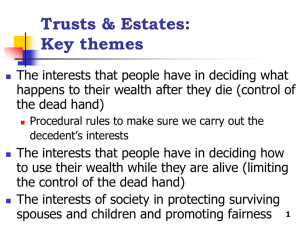

POLICY OF WILLS & TRUSTS

A. Testamentary Freedom

1. General: legal norm and legal culture of giving property away at death

2. Limits a) Disrupt or discourage family relationships b) Encourage a person to engage in a crime or tort c) Destruction of personal property

3. Shapira v Union National Bank a) Facts: Jewish Father’s will left property to three children including daughter and sons. Condition on the inheritance is that the sons marry a jewish woman w/jew parents b) Holding

(1) Freedom of testation allows this transfer because it does violate beneficiary’s rights

(2) Testator is able to

(3) Not invalid restraint on religion or marriage – he just might not get the money c) Issues

(1) Is the condition unconstitutional?

(a) No, there is no state action enforcing religious or marital action

(2) Is this an unreasonable restraint on marriage?

(a) No, the condition does not restrain or coerce the religious practice.

B. Testator’s (decedent’s) Intent

1. The courts will give weight to the testator’s intent when making decisions about will interpreting the law

2. Intent is ascertained by examining any a) Documentation, and b) Surrounding Circumstances, e.g.:

(1) Family Situation

Page 1 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(2) Acts done with knowledge of impending death

(3) Placement or management of property

C. Will Formation

1. Evidentiary Function

2. Ritual Function

3. Channeling Function

4. Protective Function

II.

INTESTACY

A. Mechanics of a Succession

1. Probate vs Nonprobate Property a) Probate

(1) Rule: all property is probate property unless specified otherwise

(2) Property is distributed under will or laws of intestacy b) NonProbate

(1) Rule: there needs to be some authority to take property outside of probate for it to be nonprobate

(2) Examples

(a) Inter vivos trusts

(b) Joint tenancies with the right of survivorship

(c) Contracts

(i) Life Insurance

(ii) Employee Benefit Plan

(iii) Pay On Death (POD) accounts

(3) Most Jurisdictions: a will cannot pass property out of probate

(a) Exception: in WA, a Super Will can transfer nonprobate property as well as probate

2. Probate Process a) Problems: probate is costly b) Whether or not to probate considerations:

(1) Type of property involved

(a) Is evidence of title necessary to transfer property?

(b) Real Property = probate

(2) Creditors

(a) Are there unknown creditors

(b) Probate excludes creditors who do not file claims

(3) Family Dynamics

(a) Is everyone amenable and likely to agree?

3. Community Property a) RCW 26.16.030: all property that is not separate property is

Page 2 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

community property b) Separate Property

(1) RCW 26.16.010: property is separate if acquired:

(a) Before Marriage

(b) After Marriage if by

(i) Gift

(ii) Bequest: personal property through will

(iii) Devise: real property through will

(iv) Descent: intestacy

(v) Inheritance: intestacy

(vi) Rent, issue, or profit of previously acquired separate property c) Commingling

(1) When separate property is mingled with community property

(2) Presumption that anything that cannot be proven as separate is therefore community d) Management & Control

(1) RCW 26.13.030: Neither spouse may

(a) Devise or bequeath by will more than one half of CP

(b) Give away CP without consent (express or implied)

(c) Sell, convey, or encumber real CP without spouse joining in execution of deed

(d) Contract to purchase real property without spouse

(e) Create security interest in CP without spouse

(f) Do any of the above for property of a business where both spouses share management e) Migration

(1) Migrated property may be either probate or nonprobate’

(2) Property retains separate/community identity after migration

4. Intestacy a) Generally: statute determines how property is passed on when the decedent has no will. b) UPC § 2102 & 103

(1) S; no D; no P = All to S

(2) S; D

(a) If all D are also S’s = All to S

(b) If D are also S’s & S has other D = $225,000 plus half to S, other half to D

(c) If one or more D are not S’s = $150,000 plus half to S,

Page 3 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

other half to D

(3) S; no D; P = $300,000 plus ¾ to S; other ¼ to P

(4) no S; D = all to D (per capita at each generation)

(5) no S; no D; P = all to P

(6) no S; no D; no P; DofP = all to DofP (per capita at each generation)

(7) no S; no D; no P; no DofP; G or GD

(a) If both maternal and paternal G & GD = half to paternal

G or GD and half to maternal G or GD (all to G or, if none, per capita to GD)

(b) If only one side of G or GD: all to G or GD on that side

(8) no S; no D; no P; no DofP; no G; no GD = stepchildren or, if none, then escheat to the state c) Washington

(1) Spouse

(a) All of the decedent’s share of community property

AND

(b) Yes Issue: Half of decedent’s separate property

(c) No Issue/Yes Parents/Issue of P: ¾ of separate

(d) No Issue/No Parents/Issue of P: All separate

(2) Issue: split equally by right of representation (modern per stirpes)

(3) Parent: all to the parent or parents

(4) Issue of Parents: split equally by modern per stirpes

(5) Grandparents: split between maternal/paternal

(6) Issue of Grandparents: split equally between maternal & paternal then by modern per stirpes d) Representation

(1) Generally: Allows us to figure out who is going to take a share if someone in an inheriting class predeceased.

(2) Strict Per Stirpes (English Per Stirpes)

(a) Divide shares by giving 1 share to

(i) Each living child of decedent

(ii) Each deceased child of decedent who has living issue

(b) Divide shares at every generation

(3) Modern Per Stirpes (American Per Stirpes)

(a) Divide shares by giving 1 share to

(i) Each living child of decedent

Page 4 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(ii) Each deceased child of decedent who has living issue

(b) Skip any generation with no living descendants

(4) Per Capita at Each Generation (UPC)

(a) Divide shares by giving 1 share to each descendant in the generation nearest decedent

(b) For shares of a deceased descendant:

(i) Disperse equally to all descendants of the following generation

(ii) Repeat until all shares are distributed

(c) Example: A dies; B, C, D are A’s children; B and C are dead when A dies; E is B’s child; F & G are C’s children; D is A’s only living child.

(i) D takes 1/3

(ii) E, F, and G take 2/9 each e) Step Children

(1) Children of a spouse that have not been adopted

(2) UPC: 2103(b) Step children may take if the estate would otherwise escheat to the state. f) HalfBlood

(1) Siblings who only have a single parent in common

(2) UPC: 2107 Half blood relatives are considered full blooded relatives. g) Simultaneous Death

(1) Generally: the simultaneous death of people can complicate estate distribution and lead to undesired results

(2) UPC §§ 2104 & 2702: heir, devisee, or life insurance beneficiary who does not survive the decedent by 120 hours is deemed to predecease

(3) Washington

(a) RCW 11.05A.020: When people die simultaneously

(within 120 hours) the other individual is presumed to predecease

(b) Clear and convincing evidence required

(c) Does not apply if state would take intestate share as a result h) Transfers to Children

(1) UPC

(a) § 2116: a parent child relationship can be established

Page 5 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

by any showing of a relationship

(b) § 2118: adoption creates a parent child relationship

(c) § 2119: there is a rebuttable presumption that an adopted child does not take from genetic parents unless:

(i) Adopted by stepparent

(ii) Adopted by family member of genetic parent

(iii) Both parents died before adoption

(2) Adopted Children

(a) Hall v Vallandingham

(i) Issue: Do the Maryland laws of intestacy allow biological nephews or nieces to take through a biological father after being adopted by a stepfather?

(ii) Holding: No, adoption is a legal rebirth and so the child is severed from genetic parents

(iii) Reasoning

(a) State has absolute power to regulate intestacy

(b) Ties between adopted children and biological parents would allow

“doubledipping”

(3) Adopted Adult

(a) Minary v Citizens Fidelity Bank & Trust Co.

(i) Issue 1: should an adopted child, take through an adopted parent?

(ii) Issue 2: does the fact that the adopted child was an adult when adopted influence distribution?

(iii) Holding: Adoption of an adult for the purpose of bringing that person under the terms of a preexisting testament is not allowed.

(iv) Reasoning:

(a) Intent of the Testator

(b) Power of Appointment

(i) Flexible planning tool

(ii) Power granted by the donor

(iii) Most often placed in a trust

(iv) Enables that person to select

Page 6 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

that person to select the next generation of beneficiaries

(v) Must be optional

(4) Posthumously Born Children

(a) Generally: a child is alive from conception for purposes of inheritance

(b) Used to determine if an in utero child takes under intestacy or will

(c) Rebuttable presumption that the gestation period of a child is 280 days and as long as the child is born within

280 days of the date of death then they take.

(d) UPA if child born within 300 days of the death of the mother’s husband, baby is presumed to be husband’s child

(5) Posthumously Conceived Children

(a) Should PC children take from their parents? Yes.

(i) Uniform Parentage Act – If there is a signed record showing consent of the parent to conceive the child.

(ii) UPC – Consent and timing

(b) Should PC children take from other relative’s estates?

Maybe.

(i) In Re Martin B.

(a) Are PC children issue for the purpose of taking from Grandpa’s estate? Yes.

(b) All member s of the bloodline take a share

(c) Law strikes balance between finality in estate administration and rights of a descendant

(ii) UPC – Yes, if

(a) parent consented in writing or by clear and convincing AND

(b) the child is in utero within 36 months or born within 45 months of parent’s death

(6) Surrogacy and Same Sex Married Couples

(a) States are all over the board

(7) Advancements

(a) Generally: intervivos gift that counts against the heirs

Page 7 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

intestate share of

(b) Elements

(i) Lifetime Gift

(ii) Given to heir who would otherwise take

(c) UPC (§ 2109)

(i) Presumption that it is not an advancement

(ii) Presumption rebutted by contemporaneous writing from decedent or recipient, acknowledging that it is an advancement (word advancement not necessary)

(iii) Do not count a parent’s advancement against a child taking through that parent by representation

(a) if recipient dies before decedent

(b) Advancements are made to any heir

(d) Hotchpot: the means of accounting for an advancement in

(i) Option 1: decide to partake in the estate and have the advancement count against the inheritance

(ii) Option 2: take what was given and do not take any more from the estate.

(8) Property Management Options

(a) Guardianship of Property

(i) Guardian of Person: different from property

Guardianship.

(a) Person responsible for a minor’s care

(b) UPC § 5201 to 5210

(ii) Requires Court approval making it cumbersome and expensive

(iii) Like a continuous probate until the child reaches the age of majority.

(b) Conservatorship

(i) Conservator has similar powers to a trustee

(ii) Annual accounting with Court required

(iii) UPC Art. V

(iv) Uniform Guardianship and Protective

Proceeding Act (UGPPA)

(c) Custodianship

Page 8 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(i) Duty: use the property for the benefit of the minor

(ii) Uniform Transfer to Minor Act (UTMA)

(iii) Planning tool for nonwealthy families

(iv) Acts like a trust but easier

(v) Custodian does not have as onerous of a fiduciary duty as a trustee

(vi) Custodian must use the trust for the benefit of the beneficiary

(vii) When child turns 18 or 21 then the child gets the remaining (usually 21)

(d) Trusteeship

(i) Most flexible property arrangement i) Bars to Succession

(1) Slayer Rule

(a) Slayer: someone who is a principal or accessory in the willful and unlawful killing of another person

(b) UPC 2803

(i) victim/decedent’s estate

(c) RCW 11.84.030

(i) Slayer or Abuser is treated as having predeceased the victim/decedent

(d) In re Estate of Mahoney

(i) Essentially the first common law Slayer Rule.

(ii) Unjust enrichment policy

(iii) Court established a Constructive Trust after wife killed her husband. Her only responsibility was to immediately transfer the husband’s property to the rightful inheritors.

(2) Disclaimer

III.

WILLS

A. FORMATION

1. Attested Will a) Requirements

(1) In Writing

(2) Signed by Testator

(3) Attested

(a) Attested

Page 9 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(i) Signatures placed on will itself

(ii) No need for formal words of attestation

(iii) PROBLEM: witnesses may have to testify during will contest, but may be dead

(b) Attestation Clause

(i) Declaration of the circumstances around the will signing

(ii) Presumption of due execution

(iii) May have to testify about signing

(c) Affidavit of Attestation

(i) 1Step: Witnesses sign an affidavit only

(ii) 2Step: Witnesses

(a) sign affidavit AND

(b) sign will itself b) Witness’ Presence

(1) Line of Sight a witness must be within the testator’s line of sight when signing the will

(2) Conscious Presence if testator is conscious that the witness is signing the will

(3) UPC No presence requirement c) Will has no legal import until testator dies d) Ancillary probate may be required for real property in another state e) PURGING STATUTE

(1) Attestation of the will by an interested witness gives rise to a presumption of fraud unless there are two disinterested beneficiaries

(2) Witness may rebut the presumption (WA)

(a) IF not adequately rebutted, the witness may not take under the will (purged)

(3) UPC – No problem with interested witnesses attesting a will

(4) Morea: court determined that son may be considered a disinterested witness because he takes more under intestate than under the will

2. Holographic Will a) UPC 2502: valid if the signature and material portions of the document are in the testator’s handwriting. b) Holographic wills are not recognized as a valid will in Washington unless recognized by RCW 11.12.020.

3. Notarized Will a) UPC 2502(a)(3)

Page 10 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(1) the will is valid if it is acknowledged by the testator in front of a notary, as long as it meets the other requirements set forth in this section for attested wills. b) Pros of Notarized Wills:

(1) Notarized will serves the functions of the formalities.

(2) Other documents that accompany a will have to be notarized, but not witnessed. Therefore, it would logically follow that a will could or should be notarized as well.

(3) Everyone thinks you can do it, so the law should reflect the does. c) Cons of Notarized Wills:

(1) Notaries do not have to testify as much.

(2) Interested notary problems.

(3) More selfhelp wills and mistakes of law.

4. Out of State Wills a) Full Faith & Credit given to other states’ laws & wills b) WA: RCW 11.12.020 allows recognition of wills properly executed in the state of testator’s domicile or place where execution occurred.

5. Mistakes in Execution a) Strict Compliance (Pavlinko)(Groffman)(Casdorph)

(1) Definition: when execution must comply with all of the formalities without exception

(2) Court’s don’t have authority to reform wills

(3) Pavlinko

(a) Spouses sign each other’s wills

(b) Terms identical

(c) Probate refused b) Substantial Compliance (Snide)

(1) A will is valid if the court is convinced that the purposes of the formalities have been served.

(2) Clear and Convincing Evidence Standard

(3) Result: mistake in signatures is forgiven and intent is validated c) Harmless Error (Hall)

(1) UPC Clear and convincing evidence of the intent for a will

(2) Dispensing Power court is dispensing its power

(3) Undermines Formalities

6. TEDRA a) Ways of Resolving Disputes

(1) Unanimous voluntary agreement among interested parties, no court

(a) Beneficiaries

Page 11 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(b) Takers under intestacy

(c) Creditors

(2) Unanimous voluntary agreement among interested parties, with court approval

(3) Judicial proceeding

B. REVOCATION

1. UPC a) Subsequent Will: new will must conform with the requirements of proper execution

(1) Express:

(a) Entire or Part: Later will must specifically say that the previous will/part is revoked

(2) Inconsistency:

(a) Entire: a second will that is entirely inconsistent with the first

(b) Part: the second will distributes specific assets differently than did the first b) Revocatory Act: requires (1) an act of revocation and (2) intent to revoke

(1) Self

(a) Entire: the will as a whole was subject to a revocatory act and was intended to be revoked

(b) Partial: if one provision is crossed out with intent to revoke

(2) Third Party: third party must destroy in in Testator’s presence and at Testator’s direction.

(a) Entire: the entire will was revoked by third party

(b) Partial: part of the will was revoked by third party c) Minority: do not allow Partial Revocation by Physical Act because it essentially allows a bequest without following any formalities.

2. Acts of Revocation a) Physical Acts must touch the words on the will (Thompson) b) Acts of revocation include:

(1) Cutting

(2) Tearing

(3) Burning

(4) Obliterating

(5) Canceling

(6) Destroying

Page 12 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

c) UPC: no requirement of the physical act to touch the words on the will, harmless error rule applies to revocation

3. Revocation By Law – DIVORCE a) Statutes automatically revoke provisions within a will giving to a spouse b) UPC

(1) Extends the revocation to nonprobate assets

(2) Revokes provisions to any relatives of the exspouse c) Washington

(1) Relatives of the exspouse not revoked

4. Lost Will: When a will is lost or destroyed accidentally a) Can be used to prove a lost will:

(1) Duplicates

(2) Testimonies

(3) Computer Files

5. Dependant Relative Revocation (DRR) (LaCroix): a) Applies where a testator

(1) revokes all or part of her will

(2) under the mistaken assumption of law or fact,

(3) the revocation is ineffective if the testator would not have revoked the will but for the mistaken belief. b) When amount is lowered, DRR is rarely applied

6. Contracts Not to Revoke a) There must be an external contract not to revoke b) Joint or mutual wills do not imply a contract not to revoke c) There is no presumption when a couple creates a joint or mutual will not to revoke

C. REVIVAL

1. Revocation of a second will may imply that a first will should be revived.

2. UPC 2509 (pg.238) a) Previous will revived if circumstances show that testator intended such when

(1) Subsequent wholly revoked previous by

(2) Revocatory Act b) Previous will revived if circumstances show that testator intended such when

(1) Subsequent partially revoked previous by

(2) Revocatory Act c) Previous will revived if circumstances show that testator intended such when

Page 13 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(1) Subsequent wholly or partially revoked by

(2) Later Will

3. In Order: a) Previous b) Subsequent c) Later

D. WILL COMPONENTS

1. Integration a) for a part of the will to be integrated it must be

(1) Present at the time of execution, AND

(2) Testator intended it to be part of the will

(3) (Harmless Error Can Be Applied)

2. Republication by Codicil a) A validly executed will is reexecuted as of the date of a codicil publication unless the effect of so treating it would be inconsistent with testator’s intent. b) Codicil: supplemental added portion to a will

3. Incorporation by Reference (UPC 2510) (Greenhalge) a) A piece of paper that was not physically present at the time of execution may be incorporated by reference if:

(1) Already in existance

(2) Description in the will adequately describes the writing

(3) Testator’s intent to incorporate b) As if the writing was properly executed c) UPC 2513 Tangible Personal Property

(1) Must be signed by the testator

(2) Only may dispose of personal tangible property

(a) Not cash

(3) May be changed after the execution

4. Acts of Independent Significance a) Acts of independent significance can give testamentary effect to fact or circumstances that are not part of the executed will.

(1) Can occur before or after testator’s death b) NOT ALLOWED if the act was done, or looks like it was done, for the express purpose of testamentary distribution c) Rationale: if there is an independent motivation for the act it is deemed reliable d) A will may determine beneficiaries and/or property by looking outside of the will.

Page 14 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

E. MENTAL CAPACITY

1. General Capacity a) Impairs the sound mind requirement for formation b) A testator MUST have some idea of the

(1) The nature and extent of her property

(2) The natural objects of her bounty

(3) Disposition making with the property

(4) Relay these ideas to form an orderly desire to create a will

(5) Will represents her wishes c) Without capacity the testator could not have proper intent d) Foibles and weird idiosyncrasies do not establish incapacities

2. Insane Delusion (Breeden) a) Impairs the sound mind requirement for formation b) Definition:

(1) A persistent belief

(2) Believed beyond all reason

(3) That materially affects the disposition of the will c) The insane delusion must CAUSE will dispositions

3. Once a will is proposed, the burden is on the contestants to prove incapacity

F. TORTIOUS BEHAVIOR

1. UNDUE INFLUENCE a) Elements

(1) Confidential relationship existed between testatrix and defendant;

(2) Defendant received bulk of testatrix' estate;

(3) Testatrix had weakened intellect when challenged will was executed b) Process

(1) First, proponent of will presents formally executed will

(2) Second, person challenging the will must then prove by clear and convincing

(3) Finally, the burden shifts back to proponent to prove by clear and convincing that c) Confidential Relationship

(1) Trust Relationship: when one person is trusting another person to

(2) Formal Fiduciary: attorney/client, doctor/patient, power of attorney/elder

(3) Dominant Subservient: when one person is ill or weakened and

Page 15 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

has relinquished power to another

(4) When there is a fiduciary relationship or other confidential relationship d) Washington Rule

(1) Confidential Relationship

(2) Suspicious Circumstances

(a) Unnatural disposition

(b) Lack of legal advice

(c) Secrecy

(d) Sudden change in doctor’s attitude

(e) Bulk of Estate + Weakened Intellect e) DURESS: overly coercive Undue Influence

2. FRAUD a) Generally:the creation, modification or revocation b) Intentional Deception of the Testator

(1) Fraud in the inducement: misrepresentation about facts

(2) Fraud in the execution: misrepresentation about the documents c) By Someone Else d) That materially affects the terms of the will e) Distinguished from Undue Influence

(1) Undue Influence: the influencers intent is channelled

(2) Fraud: testator’s intent but misled by deception

3. TORTIOUS INTERFERENCE (Schilling) a) Generally: third party can recover when interference involved tortious conduct. b) Elements of Intentional Interference with an Expected Inheritance

(1) Existence of an expectancy

(2) Intentional Interference by Tortious Conduct

(a) Undue Influence

(b) Duress

(c) Fraud

(3) Causation

(4) Damages c) SOME JURISDICTIONS: parties may not bring tort claim when the probate remedies have not been exhausted

G. WILL DRAFTING

1. Correcting Mistakes in Wills a) Plain Meaning Rule: if the language in a will exhibits an unambiguous plain meaning, the court is not going to infer that the testator intended

Page 16 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

another meaning. (Mahoney)

(1) Latent Ambiguity: not on the face of the will

(a) Extrinsic Evidence Okay

(2) Patent Ambiguity: apparent from will alone

(a) No Extrinsic Evidence b) Ad Hoc Relief on Mistaken Terms: the court “has no power to reform” but court reforms anyway. (Arnheiter)

(1) When there are details included that are highly susceptible to mistake and it is clearly shown that there was a mistake (Gibbs) c) Open reformation; extrinsic evidence (Herceg; UPC 2805)

(1) Court may reform the terms even in unambiguous to conform to testator’s intent I

(a) clear and convincing evidence shows testator’s intent

AND

(b) terms were affected by a mistake of fact or law

H. ANTILAPSE

1. Common Law a) Generally: a specific or general bequest to a beneficiary who predeceases the testator lapses b) RULES

(1) Applies to specific bequests & general bequests

(2) Does not apply to residuary bequests

(3) A residuary bequest that lapses is distributed through intestacy

(4) If the gift is part of a class gift then lapsed share split between surviving class members

(5) If a class member predeceases the testator, her share is shared among the surviving class members unless the will specifies otherwise.

(a) Class Gift is a group of takers or where the amount of the takers is not fixed

(b) The amount taken depends on the members of the class

(c) Class closes when the first member of the class can take

2. UPC a) UPC 2604(b)

(1) Abrogates common law no residue of a residue rule

(2) Split bequest of dead residuary beneficiary among surviving residuary beneficiary

(3) Subject to antilapse statute

Page 17 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

b) UPC 2605 ANTI LAPSE STATUTE

(1) Devise does not lapse IF the deceased beneficiary is a lineal descendant of the testator's grandparent (including stepchildren)

AND

(2) Has surviving descendants

(3) Class gift to deceased beneficiary is not lapsed

I. ADEMPTION

1. Identity Rule a) Generally: if a specific bequest in a will does not belong to the testator when the testator dies, the bequest is adeemed b) Policy: testator has the opportunity

2. Intent Theory a) Generally: a specific bequest adeems UNLESS the beneficiary shows that the testator intended otherwise b) A bequest is not adeemed if a testator does not have the knowledge or opportunity to rewrite a will after specifically bequested property has been sold. (Anton)

(1) An appointed guardian/power of attorney does not equate with knowledge and understanding of the sale of specific property. c) UPC Adopts intent theory

IV.

TRUSTS

A. CREATION

1. Intent Bifurcation (Jiminez) a) Intent that one person hold property for the benefit of someone else b) Must have intent to take on powers and duties of trustee

2. Property a) Property must be identifiable at the time of creation (Unthank)

(1) Identifiable: separate trust assets from general assets b) Future Profits: profits or interest in future profits are required to become identifiable (Brainard) c) UPC 2511: Will May Fund Trust When

(1) Trust is established or

(2) At testator’s death if

(a) Trust is identified in the will

(b) Executed concurrently or before will

3. Definite Beneficiaries a) UTC: trustee may decide who qualifies as a beneficiary b) Person’s having right to hold trustee responsible and must be ascertainable

Page 18 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

c) Animals are not proper definite beneficiaries

(1) Statutorily Allowed

(a) Rule Against Perpetuities problem (ignored by courts)

(2) Honorary Trust

(a) Common law allowed trusts for the care of indefinite beneficiaries

(b) IF the trustees agree to the duties upon their honor d) Property may not be a beneficiary

(1) Exception: Purpose Trust

(a) Statutorily allowed

(b) Policy Arguments

(c) RCW 11.98.015

4. Writing a) Not necessary legally BUT b) NOT PRACTICAL TO CREATE ORAL TRUST c) Technical requirement that notification is in writing may be ignored by the court

5. Resulting Trusts: equitable reversionary interest arises when a) if an express trust fails or makes an incomplete disposition or b) if one person pays the purchase price for property and causes title to the property to be taken in the name of another person who is not a natural object of the purchaser’s bounty

6. Constructive Trust: when property ownership would result in unjust enrichment, the owner of legal title becomes trustee for benefit of deserving party

B. CONTENTS

1. Generally: a trust may hold any form of property

2. Principal a) The corpus of the trust b) Usually the trust is designed to protect the principal/corpus

3. Income a) Money that the trust earns through rents/interest/etc

C. MODIFICATION AND TERMINATION

1. Settlor Alive a) Revocable Living Trust: settlor may unilaterally revoke the trust b) Irrevocable Trust: modification may be done by consent of all beneficiaries and the settlor

2. Settlor Dead a) Common Law

(1) Material Purpose Doctrine: If there is no material purpose or

Page 19 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

the purpose is unaffected by termination. (Claflin)

(a) A trust cannot be terminated if:

(i) Spendthrift Trust

(ii) Enjoyment Postponed: the beneficiary is not to receive the principal until attaining a specified age

(iii) Discretionary Trust OR

(iv) Support Trust

(b) Must have consent of all beneficiaries.

(2) Equitable Deviation / Changed Circumstances: changed circumstances not anticipated by the settlor that would defeat or substantially impair the accomplishment of the purposes of the trust. b) UTC

(1) A spendthrift clause will not automatically be a material purpose

(2) Unanimous consent of the beneficiaries is not required as long as the dissenters rights were protected and the material purpose is not compromised.

D. FIDUCIARY ADMINISTRATION

1. Duty of Loyalty (UTC 802) a) A trustee shall administer the trust SOLELY in the interests of the beneficiaries b) Self Dealing

(1) Transaction voidable by court if trustee transacts in a way that benefits the trustee

(a) EXCEPT: approved by court, permission by beneficiary, prior to contemplating trusteeship

(2) No Further Inquiry Rule if a trustee engages in self dealing then the court will inquire no further and liability attaches c) Conflicts of Interest

(1) UTC: Conflict between personal interest and the beneficiary’s best interest.

(2) Rebuttable presumption that the transaction is void

2. Duty of Prudence (UTC 804) a) Distribution Function

(1) Distributing income or principal to the beneficiary in accordance with the terms of the trust.

(a) Mandatory: must make specified distributions

(b) Discretionary: has discretion over when, to whom, and

Page 20 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

in what amount

(2) Duty To Inquire: where a trustee has discretion to distribute to the beneficiary then the

(3) In Good Faith: regardless of the extent of discretion that the trustor gives the trustee the trustee must act reasonably and in good faith.

(4) Exculpatory Clause: exonerates trustee except for

(a) clauses that were obtained by overreach OR

(b) willful neglect or default b) Investment Function

(1) Former Investment Standard Prudent Man Rule

(a) A prudent man would not invest in a risky investment

(b) Problem: courts use hindsight bias in holding fiduciary’s liable when they shouldn’t have been.

(c) Every investment was judged as speculative and not viewed as a whole

(2) Current Investment Standard Prudent Investor Rule

(a) Uniform Prudent Investor Act

(b) Trust investments are evaluated not in isolation but in the context of the trust portfolio as a whole and as part of an overall investment strategy having risk and return objectives reasonably suitable

(c) Diversification: a trustee must diversify a trust portfolio unless the trustee determines purpose is best served otherwise

(d) Risk & Return c) Duties of a Trustee

(1) Delegation

(2) Impartiality

(3) Collect & Protect

(4) Earmark

V.

NON PROBATE ASSETS

A. Generally

(5) Do Not Commingle

(6) Duty to Inform

1. Rapid rise of nonprobate succession transfers

2. Legal Issues raised a) Is it okay to make transfers at death without observing the will formalities

Page 21 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(1) Answer: NO b) To what extent do we apply the substantive law of wills to will substitutes?

(1) Answer: Still evolving. Trend is toward uniformity

(2) UPC: discusses revoking a “governing instrument” c) Various beneficiary designations are difficult to coordinate.

(1) Solution: revocable trust created as the beneficiary

B. Application of the Law of Wills

1. Creditors of Settlors a) Creditors have a right to have debts satisfied by the estate assets AND a vested intervivos trusts. (Reiser) b) Problem: can a creditor satisfy debts from the vested interest of successor trustee/beneficiaries. c) It is not fair to allow a person to live off assets during his life and then shield them from his creditors on his death. d) Creditors may or may not reach, Joint Tenancies, Life Insurance,

Retirement Benefits, US Savings Bond, or POD Account.

2. Revocation on Divorce a) Some Jurisdictions: Statutes that revoke distribution to divorced spouses in wills may also revoke the exspouse’s rights under a revocable trust. (Clymer) b) UTC: revokes nonprobate transfers to a spouse after divorce c) ARISA: federal law may preempt the exspousal revocation

3. Capacity a) UTC: capacity to create trust identical to law of wills

C. Revocable Living Trust

1. Requirements a) Majority of states presume that an inter vivos trust is revocable b) Language that the trust is “revocable” in title and “reserving the right to revoke

(1) Must reserve the right to revoke or else it defaults to irrevocable

2. Bifurcation of Title a) OLD RULE: beneficiary has a present interest in the right to hold the trustee accountable b) NEW/UTC RULE: settlor has complete control and the beneficiary may not hold trustee accountable. (Moon)

(1) Contingent beneficiary does not have standing to bring claim against the trustee

Page 22 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(2) Vesting of the contingent beneficiary’s interest is subject to

3. Contemporary Uses a) Pour Over Will b) Coordination

(1) Funnell nonprobate and probate funds into trust

(2) One device to amend distributions c) Manage property for next generation d) NOT self executing requires trustee to transfer and manage

D. Life Insurance

E. PayOnDeath Accounts

F. TransferOnDeath

VI.

PLANNING FOR INCAPACITY

A. Generally

1. Default Rule: when a person becomes incapacitated then a conservator is appointed by the court

2. Most people want to choose the person who makes decisions for them

3. Creditors of the beneficiary may collect from the beneficiary property that the beneficiary has a right to.

B. Revocable Trust

1. Can help property management in case of incapacity a) Successor or Co Trustees b) Triggering Mechanism that Decides

(1) What incapacity is AND

(2) Who determines incapacity

2. Rights of Beneficiary’s Creditors a) Common Law

(1) Discretionary Trusts

(a) Definition: trust where the settlor has given the trustee discretion over distributions to the beneficiary

(b) Purely Discretionary

(i) Beneficiary’s Creditors have no right to seize the assets from the trust

(ii) Beneficiary cannot alienate property in trust

(iii) “absolute and uncontrolled discretion”

(c) Support Trust

(i) Ordinary Creditors cannot seize assets from trust

(ii) Creditors who provide necessities may seize assets

Page 23 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(iii) Also, people suing for child support or spousal maintenance may collect against the trust

(d) Hybrid / Discretionary Support Trust

(i) Treated the same as a purely discretionary trust

(2) Mandatory Income Trust

(a) Trustee has no discretion regarding distributions

(b) Beneficiary’s creditors may collect a debt against the income distribution

(3) Spendthrift Clause

(a) Alters the general rule to prevent a beneficiary from voluntarily or involuntarily alienate mandatory distributions

(i) Does not apply to self settled trusts

(ii) Self Settled Trust: trust created with settlor as beneficiary

(b) Exception: Under UTC and Common Law Child

Support and Spousal Maintenance may collect against the trust despite the spendthrift provision

(c) Tort creditors may not collect from the trust for the tortfeasor beneficiary’s debt

(d) Tax Liens may be executed against trust

(e) Minority: Health/Food

(f) Policy: settlor has continued property interest in the property

(i) Similar to testamentary freedom b) UTC

(1) No Distinction between support, purely discretionary, and discretionary support trusts.

(2) Only child support and spousal maintenance creditors may demand payment from the trustee

(3) Beneficiary has no right to a discretionary distribution and therefore cannot alienate discretionary trust property

3. Necessary Support a) Traditionally

(1) Medical Care

(2) Food b) Commonly

(1) Maintenance

(2) Education

Page 24 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

(3) Support

(4) Health

4. Self Settled Asset Protection Trust a) General: grantor creates trust to protect assets through the placement of spendthrift, shields from assets b) 14 Jurisdictions allow Domestic Self Settled Asset Protection Trust c) Restrictions

(1) 4 year waiting period

(2) Child Support may collect

(3) Bankruptcy Act will dip into trust created within last 10 years d) Killer Rabbit Trust

(1) Trust automatically transfers to foreign location

(2) “If there are any problems with this trust in this jurisdiction then it shall automatically be held in trust in the Cayman Islands”

5. Supplemental / Special Needs Trust a) General: used to qualify person for medicaid or medicare b) Elements

(1) Contain a spendthrift clause

(2) Third party trustee

(3) Beneficiary is disabled

(4) Must Be Purely Discretionary

(5) Trustee may provide direct services that supplement what the state provides

(a) E.g. cell phone, occupational therapy, transport, education, Ipad

(6) NOT giving beneficiary funds c) Disabled family member that relies on significant medical support may require medicaid and cannot qualify with large assets d) Trustee is usually a family member e) SelfSettled SNT: remainder must go to the state to compensate the state for services provided during the beneficiary’s lifetime f) Third Party SNT: remainder may be distributed as the settlor wills so long as the trust is a new (not funding a selfsettled trust)

C. Durable Power of Attorney

1. Formation a) Usually Notarized b) Capacity Required c) Best Practice: appoint multiple agents

2. Types

Page 25 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

a) Financial: written document that authorizes another person to make financial decisions on the creators behalf b) Medical: created in a health care directive to appoint a health care proxy

3. Dangers a) Agents abusing their power b) No beneficiaries to hold the agent accountable c) Agents may decline to act

4. Triggering Mechanism

5. Durable Power of Attorney & Revocable Trust used together a) PoA catches property outside of trust b) RLT

D. Health Care Directive

1. Instructional Directive a) Nutrition / Hydration b) Pain Medication c) Ventilation

2. Health care proxy powers are typically optional powers

3. Do Not Resuscitate a) WA: Physician Order of Life Sustaining Treatment (POLST)

VII.

LIMITS ON FREEDOM OF DISTRIBUTION: PROTECTION OF SPOUSE AND

CHILDREN

A. Elective Share of a Separate Property Surviving Spouse a)

B. Protection Against Unintentional Omission

1. Timing: an omitted child or spouse might be eligible to receive an elective share if the timing works a) If a child is born after the will is made then the law assumes that the testator wanted the child to receive

C. UPC 2301 Community & Separate Property Jurisdictions

1. Spouse receives intestate share if testator married spouse after executing the will

UNLESS a) devised to a child of the Testator who was born before the marriage

OR b) devised to a child under UPC 2603 () or 2604 ()

2. EXCEPTIONS a) Evidence shows will was made in contemplation of testator’s marriage b) Will shows intent to be effective notwithstanding a subsequent marriage c) Testator provided for the spouse by transfer outside of the will AND

Page 26 of 27

2013 FALL

BALLARD

TRUSTS & WILLS

evidence shows that testator intended it to be in lieu of will provision

EXAM INFO

Forum On Twen “Your Exam Questions”

Exam Prep

Sample Essay Question

December 18 1:30 3:45 Q/A & Review Sample Essay

Essay Questions

Word/Character Limit

Multiple Choice Questions

2 Pieces of Paper Cheat Sheet

Page 27 of 27