Different Types of Insurance Policies

advertisement

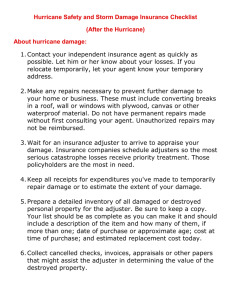

Different Types of Insurance Policies The American Association of Insurance Services (AAIS) plays a key role in the property casualty insurance industry, but it does not provide insurance. AAIS is a national insurance advisory and statistical organization that develops standardized policy forms and rating information for over 25 programs of personal, commercial, farm and inland marine insurance. Along with product innovation, AAIS is known for the expertise and accessibility of its staff; seasoned professionals who devote their time and attention to helping insurers adopt and maintain programs as easily as possible. While some insurers use their own forms, most of these are similar to ISO forms. Part of the Insurance Services Office, Inc. (ISO), homeowners forms portfolio, the HO-3 insures the described owner-occupied dwelling, private structures in connection with the dwelling, unscheduled personal property on and away from the premises, loss of use and additional living expense. Personal liability coverage and medical payments coverage are also provided by this policy. Coverage of the dwelling, related structures, and scheduled personal property is on an “all risks” basis, while coverage of unscheduled personal property is on a broad named perils basis. Losses to the dwelling and other structures are paid on a replacement cost basis, with no deduction for depreciation if certain conditions apply. Losses to personal property are paid on an actual cash value (ACV) basis, unless amended by endorsement. The HO-10 is the Specialty Homeowners Program designed for the owner occupied or seasonal home that would normally qualify for a homeowners policy in the Standard Market, however, the customer doesn’t qualify for the Standard Market based on prior loss, credit, protection class 9 or 10, or other select criteria. The HO-1,DP-1, MHO1, Standard CP-1010 policy (Basic Policy) ACV [1] includes perils [2] such as Fire, Lightning, Explosion, Windstorm, Wind/Rain roof or wall leaks from the rain that enters from an opening caused by wind. Hail, Riot or civil commotion, Aircraft, Vehicles, Smoke Vandalism, Theft, Volcanic eruption. The HO-2, HO-4, HO-6, DP-02, MH20, CP1020 policy (Broad Policy) ACV includes all of HO-1 perils and Falling object, Weight of ice and snow, Accidental discharge toilet overflow, sink overflow, tub overflow, water from a damaged pipe or pipe leak, back-up of plumbing system caused by a blockage, Freezing of plumbing, Artificially generated current and collapse. The HO-3, All Risk, Form 3 Form 5, DP-03, Deluxe, HO-05, MH03, CP1030 BP 00 02, Condo Policy Special Form (Special Form) RCV [3] includes all of perils of HO-1 and HO-2 with coverage to cracked tiles, spilled chemicals, and falling objects. It however does not need an opening of a direct physical damage to apply a named peril. This policy also known as an “all risk” is the most comprehensive of coverage, more than the common policy sold. It gets the name because they are policies for owners of fairly modern and expensive homes, from the least coverage of the HO-2 policy to the most comprehensive policy of HO-5. These 3 policies also cover other physical structures on the property and personal property for the same covered perils for the main residence. The HO-4 policy is generally used by renters to indemnify against loss not covered by the landlord. Also called a “hazard” policy or “dwelling” policy. The HO-5 (Comprehensive Form) policy is also an open perils policy, but also includes RCV of direct damage or loss to personal property. The HO-06 (Condominium Form) (HO-06 form) policy covers the real property interest and the personal property of the property owner who own a unit in a condominium or share an ownership interest in a cooperative building. It also provides personal liability coverage and medical payments coverage. This form is similar to the HO-3 in many ways but provides less real property. The HO-8 (Modified Coverage Form) policy is for older homes that have a replacement cost that are much higher than its market value. To prevent a moral hazard, insurers will not insure a home for more than what it is worth. The HO-8 policy solves this problem by paying what it would cost to repair or replace damaged property. When dealing with insurance companies on a claim, you have to negotiate with a highly trained insurance adjuster who is there representing the insurance company, NOT YOU. The “burden of proof” for your loss falls on you, the homeowner or business owner. You are expected to know how to present your claim. It will be extremely tedious, time-consuming, and downright frustrating. The truth is most people don’t know what their rights are, what they are covered for or what to say. If you accidentally or inadvertently say something wrong or inaccurate to the insurance adjuster or telephone claims processor, your claim could be denied or “lowballed”. A Public Adjuster is a licensed professional that advocates (works solely) for the consumer. Most Public adjusters offer free consultation. Always seek a thorough consultation from a licensed and bonded public adjuster before reporting a loss to your insurance company. For more information visit our Website: www.EastCoastAdjustersLLC.com