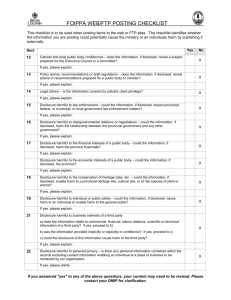

FINANCIAL DISCLOSURES CHECKLIST

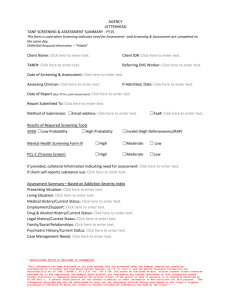

advertisement