ECO202: PRINCIPLES OF MACROECONOMICS FIRST MIDTERM

advertisement

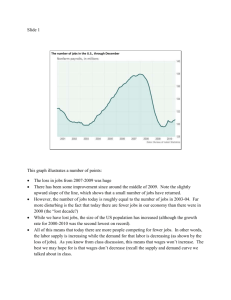

ECO202: PRINCIPLES OF MACROECONOMICS FIRST MIDTERM EXAM SPRING 2013 Prof. Bill Even FORM 2 Directions 1. Fill in your scantron with your unique id and form number. Doing this properly is worth the equivalent of 1 question. 2. There are 42 multiple choice questions. 3. Your grade is determined entirely upon the answers listed on your scantron. You will not receive your scantron back. Be sure to record your answers on your exam so that you will be able to check your answers once the key is posted. 5. You may use a calculator. Cell phones or other devices that may be used to store text are not allowed. 6. You have until the end of the period to finish the exam. Additional time may be purchased at a price of 5 percentage points per minute. 7. Academic dishonesty is a serious offense. In the event I find someone behaving in a dishonest manner, I will ask that the maximum penalty allowed by the university be imposed. To answer the next 5 questions, refer to the information for the U.S. economy provided below: Year Year Real GDP (in billions of $) GDP deflator 2000 11,033.6 88.0 Civilian Noninstitutionalized Working Age Population (in 1000s) 211,410 2011 12,947.6 112.4 2012 13,506.4 114.6 Employed (in 1000s) Unemployed (in 1000s) 136,559 5,708 238,704 139,471 13,992 242,269 140,896 12,748 1. Based on the information provided, the unemployment rate in 2011 was: a. 8.3% b. 9.1% c. 9.8% d. 10.0% 2. Based on the information provided, nominal GDP in 2012 was: a. $15.5 trillion b. $11.8 trillion c. $14.3 trillion d. 16.1 trillion 3. Based on the information provided, the average annual rate of inflation between 2000 and 2012 was a. 1.4% b. 1.9% c. 2.2% d. 2.7% 4. Based on the information provided, the labor force participation rate in 2012 was: a. 58.2% b. 61.1% c. 63.4% d. 64.7% 5. a. b. c. d. Which of the following equals the expenditure side of GDP? consumption + investment + government purchases + net exports. wages + rent + interest + profits wages + rent + interest + profits + indirect business taxes. consumption + government purchases + saving + taxes. 6. Which of the following would cause the growth in real GDP to overstate the improvement in the standard of living over time? a. if the average person reduces hours worked over time. b. if the environment is improving over time. c. if people increase the amount of household production over time. d. none of the above. 7. During the great recession, there was an increase in the number of “discouraged workers”. As the number of discouraged workers rises, the unemployment rate _____ and the labor force participation rate _____. a. falls; falls. b. fall; rises c. rises; rises d. rises; falls 8. a. b. c. d. During recessions, the labor force participation rate tends to fall, but not by as much as the employment-population ratio. fall by more than the employment-population ratio. rise but not by as much as the employment -opulation ratio rise more than the employment-population ratio. Suppose that an economy produces only apples and oranges and the prices and quantities of each are given in the table below. Year 2008 2009 Price of oranges 2 3 Quantity of Oranges 500 800 Price of apples 2 4 Quantity of Apples 1000 1500 9. Assuming that 2009 is the base year, nominal GDP in 2008 is _____ and real GDP in 2008 is _____. a. $3,000; $4,600 b. $3,000; $5,500. c. $8,400; $5,500 d. none of the above. 10. Assuming that 2009 is the base year, the GDP deflator is ____ in 2008 and _____ in 2009. a. 54.5; 100 b. 65.2; 100 c. 100; 153 d. 54.5; 153 11. In the fourth quarter of 2012 business inventories fell by $190 billion. This means that during the fourth quarter, a. production exceeded sales by $190 billion b. sales exceed production by $190 billion c. net investment was negative d. net investment was positive 12. The “traditional” CPI has several known biases that cause it to be a poor measure of the true growth in the cost of living. If these biases were removed in a new version of the CPI, the estimated growth in real wages would be ____ and the estimated rate of inflation would be _____. a. higher; higher b. higher; lower c. lower; lower d. lower; higher. Use the data in the table below to answer the next 3 questions. The reported nominal wage is the average hourly wage of production and nonsupervisory workers. The CPI is the consumer price index. Year 1970 1980 2010 Nominal Wage 3.31 6.57 18.92 CPI (1982-84=100) 37.9 78.0 217.5 13. Based on what happened to wages and prices, between 1970 and 2010, the purchasing power of wages a. rose by over 400%. b. rose by less than 400% but more than 100% c. fell by less than 10% d. fell more than 10% 14. Based on the information provided, $1 in 1970 would buy as much as _____ in 2010. a. $1.80 b. $2.18 c. $5.74 d. $9.76 15. Based on the information provided, the average annual rate of inflation between 1970 and 2010 was a. 2.1% b. 3.1% c. 4.5% d. 5.8% 16. When the economy is at full employment, a. there is no structural or cyclical unemployment. b. there is no frictional cyclical unemployment. c. there is no frictional or structural unemployment. d. there is no cyclical unemployment 17. If a worker quits her job because she wants to move to another state and begin looking for new work, this worker would be experiencing: a. frictional unemployment b. structural unemployment c. cyclical unemployment d. natural unemployment 18. It is well known that the growth in the CPI is a biased measure of the true growth in the cost of living. As noted in one of the assigned readings, there are proposals to eliminate some of this bias by switching to the “chained CPI”: If the switch to the chained CPI is approved, this would _____ future growth in Social Security payments and _____ future growth in federal income tax revenues. a. increase; increase b. increase; decrease c. decrease; increase d. decrease; decrease 19. If potential GDP is currently above actual GDP, employment is (above, below) full employment and the unemployment rate is (above, below) the natural rate of unemployment. a. above; above. b. above; below. c. below; below. d. below; above. 20. Suppose that a person’s wealth grows from $120,000 to $150,000 during 2010 and they had capital gains of $5,000. This implies that during 2010, the person’s savings were a. $25,000 b. $30,000 c. $35,000 d. none of the above 21. If everyone expects inflation of 3% over the next year and inflation actually turns out to be 5%, a. lenders would win and borrowers would lose. b. borrowers would win and lenders would lose. c. both lenders and borrowers would win. d. both lenders and borrowers would lose. 22. Suppose that the capital stock is $6,200 billion at the beginning of 2012. During 2012, net investment is $1,800 billion and capital consumption allowance is $600 billion. This implies that a. gross investment is $1,200 billion b. gross investment is $2,400 billion c. the capital stock will grow by $1,200 during 2012 d. none of the above 23. Suppose that Cambodia has a government budget deficit and investment equals saving. This implies that Cambodia’s imports are (greater, less) than their exports and Cambodia is (borrowing, lending) internationally. a. greater; borrowing. b. greater; lending. c. less; borrowing d. less; lending. 24. Suppose that the U.S. increases its exports and there is no change in imports or the government budget deficit. This would necessitate either: a. an increase in saving or investment. b. an increase in saving or a decrease in investment. c. a decrease in saving or an increase in investment. d. a decrease in saving or investment. 25. Suppose that personal consumption expenditure=150, private saving=20, government purchases of goods and services=30, net taxes=20, imports=20 and exports=30. What is the value of gross private investment? a. 10 b. 20 c. 30 d. 40 To answer the next 2 questions, refer to the diagram below. LS 20 LD PF 400 billion 10 billion 26. Based on the diagram above, if the economy is at full employment, the marginal product of labor will be ____ and productivity will be ____. a. 20; 40 b. 40; 20 c. less than 20; more than 40 d. none of the above 27. Based on the above diagram, if the real wage is currently $25, there will be a. downward pressure on real wages since there is a surplus in the labor market. b. downward pressure on real wages since there is a shortage in the labor market. c. upward pressure on real wages since there is a surplus in the labor market. d. upward pressure on real wages since there is a shortage in the labor market 28. When wages rise, the substitution effect will cause workers to work (more, less) hours and the income effect will cause them to work (more; less) hours. a. less; less. b. less; more. c. more; more. d. more; less. 29. Which of the following would simultaneously decrease the real wage and increase potential GDP? a. if transfer programs were made less generous. b. if more capital was added c. if better technology was added d. all of the above. 30. Which of the following would simultaneously increase the real wage and increase potential GDP? a. if workers become more skilled b. if more capital was added c. if better technology was added d. all of the above. 31. Suppose that a firm pays a wage of $10 the price of its product is $2 and the marginal product of another worker is 4 units of output. If this firm hires one more worker, its profits a. would rise by $2. b. would fall by $2 c. would rise by $8. d. could fall or rise. There is insufficient information to determine the effect on profits. 32. Assuming no Ricardo-Barro effect, a reduction in the government budget deficit should cause: a. higher interest rates and less investment. b. higher interest rates and more investment. c. lower interest rates and less investment. d. lower interest rates and more investment. 33. The Ricardo-Barro effect is that an increase in the government budget deficit by $1 billion will a. increase household saving in the economy by $1 billion and have no effect on interest rates. b. increase household saving in the economy by $1 billion and increase interest rates. c. decrease household saving in the economy by $1 billion and increase interest rates. d. decrease household saving in the economy by $1 billion and have no effect on interest rates. 34. Consider the market for loanable funds. Which of the following would lead to decreased investment and higher interest rates? a. a decrease in household saving. b. a decrease in investment demand. c. a decrease in the government budget deficit. d. none of the above. 35. If banks discover that the number of loans requested is far short of the number of loans that they have available, this is an indication that the interest rate is (above, below) the equilibrium interest rate and that there is a (shortage, surplus) of loans. a. above; shortage. b. above; surplus. c. below; shortage. d. below; surplus. 36. If the inflation rate is 3% and the nominal interest rate is 2%, the real interest rate must be: a. 1% b. 1.5% c. 5% d. -1% 37. Some Chinese politicians claim that the trade imbalance between the U.S. and China is not due to manipulation of its exchange rate. Rather, the trade imbalance is due to the fact that a. the U.S. runs large government budget deficits b. U.S. households have low savings rates c. the Chinese have high savings rates d. all of the above. 38. Some U.S. politicians claim that China manipulates its currency. The argument is that China has pursued policies to make the dollar (cheap, expensive) relative to the Chinese currency and this has caused the U.S. to import (more, less) from China than it exports to China. a. expensive; more b. expensive; less c. cheap; more d. cheap; less 39. If the federal government increases business tax credits for purchases of new equipment, this should cause: a. higher interest rates and less investment. b. higher interest rates and more investment. c. lower interest rates and less investment. d. lower interest rates and more investment. 40. Which of the following would lead to lower interest rates? a. households receive news that makes them believe that their incomes will rise in the future. b. the value of household wealth increases due to an unexpected increase in the value of their stock holdings. c. a technological innovation that results in a large increase in capital purchases by business. d. all of the above. 41. Which of the following would lead to less household saving? a. a permanent increase in household income b. a permanent decrease in household income c. a temporary increase in household income d. a temporary decrease in household income 42. If a country is a net lender to the rest of the world, the country a. must have a government budget deficit. b. must have a government budget surplus. c. must import more than it exports d. must export more than it imports