Report from 5/5 – 17/5/2012

Tran Thi Thanh Thao

Research Analyst

T: +84 4 44568668

E:Thao.TranThiThanh@tls.vn

MONEY MARKET

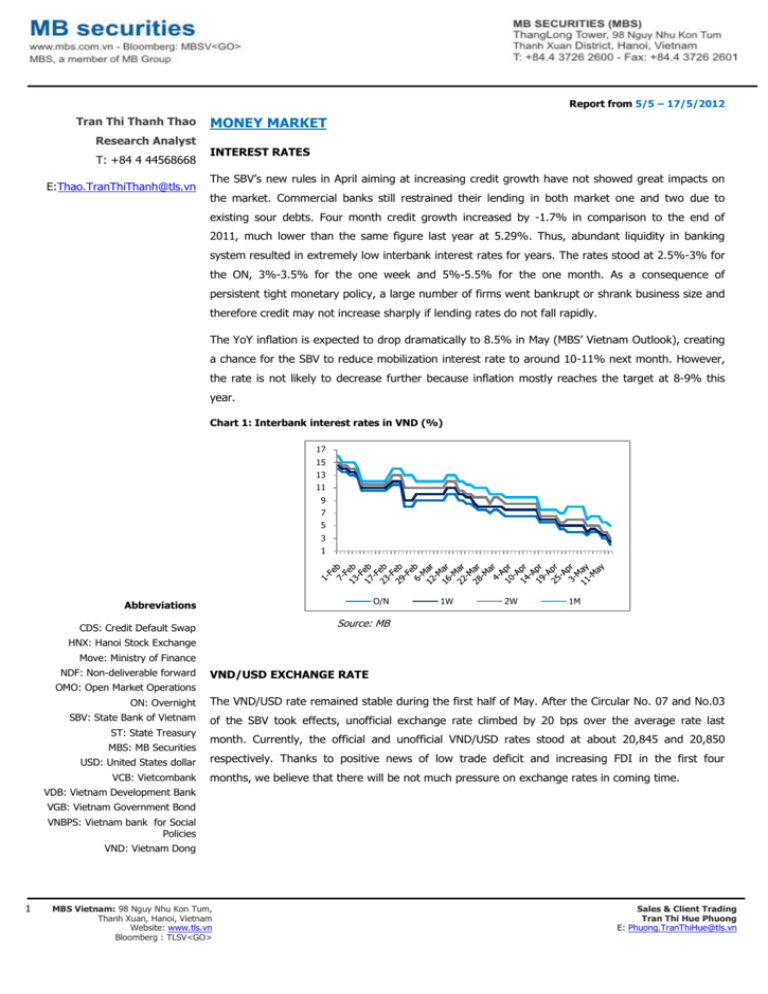

INTEREST RATES

The SBV’s new rules in April aiming at increasing credit growth have not showed great impacts on

the market. Commercial banks still restrained their lending in both market one and two due to

existing sour debts. Four month credit growth increased by -1.7% in comparison to the end of

2011, much lower than the same figure last year at 5.29%. Thus, abundant liquidity in banking

system resulted in extremely low interbank interest rates for years. The rates stood at 2.5%-3% for

the ON, 3%-3.5% for the one week and 5%-5.5% for the one month. As a consequence of

persistent tight monetary policy, a large number of firms went bankrupt or shrank business size and

therefore credit may not increase sharply if lending rates do not fall rapidly.

The YoY inflation is expected to drop dramatically to 8.5% in May (MBS’ Vietnam Outlook), creating

a chance for the SBV to reduce mobilization interest rate to around 10-11% next month. However,

the rate is not likely to decrease further because inflation mostly reaches the target at 8-9% this

year.

Chart 1: Interbank interest rates in VND (%)

17

15

13

11

9

7

5

3

1

O/N

Abbreviations

1W

2W

1M

Source: MB

CDS: Credit Default Swap

HNX: Hanoi Stock Exchange

Move: Ministry of Finance

NDF: Non-deliverable forward

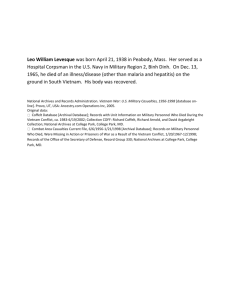

VND/USD EXCHANGE RATE

OMO: Open Market Operations

ON: Overnight

The VND/USD rate remained stable during the first half of May. After the Circular No. 07 and No.03

SBV: State Bank of Vietnam

of the SBV took effects, unofficial exchange rate climbed by 20 bps over the average rate last

ST: State Treasury

MBS: MB Securities

USD: United States dollar

VCB: Vietcombank

month. Currently, the official and unofficial VND/USD rates stood at about 20,845 and 20,850

respectively. Thanks to positive news of low trade deficit and increasing FDI in the first four

months, we believe that there will be not much pressure on exchange rates in coming time.

VDB: Vietnam Development Bank

VGB: Vietnam Government Bond

VNBPS: Vietnam bank for Social

Policies

VND: Vietnam Dong

1

MBS Vietnam: 98 Nguy Nhu Kon Tum,

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Client Trading

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

Chart 2: VND/USD exchange rate

21400

21300

21200

21100

21000

20900

20800

20700

20600

3-Jan

SBV

3-Feb

VCB bid

3-Mar

3-Apr

VCB ask

3-May

Unofficial

Source: MB, MBS

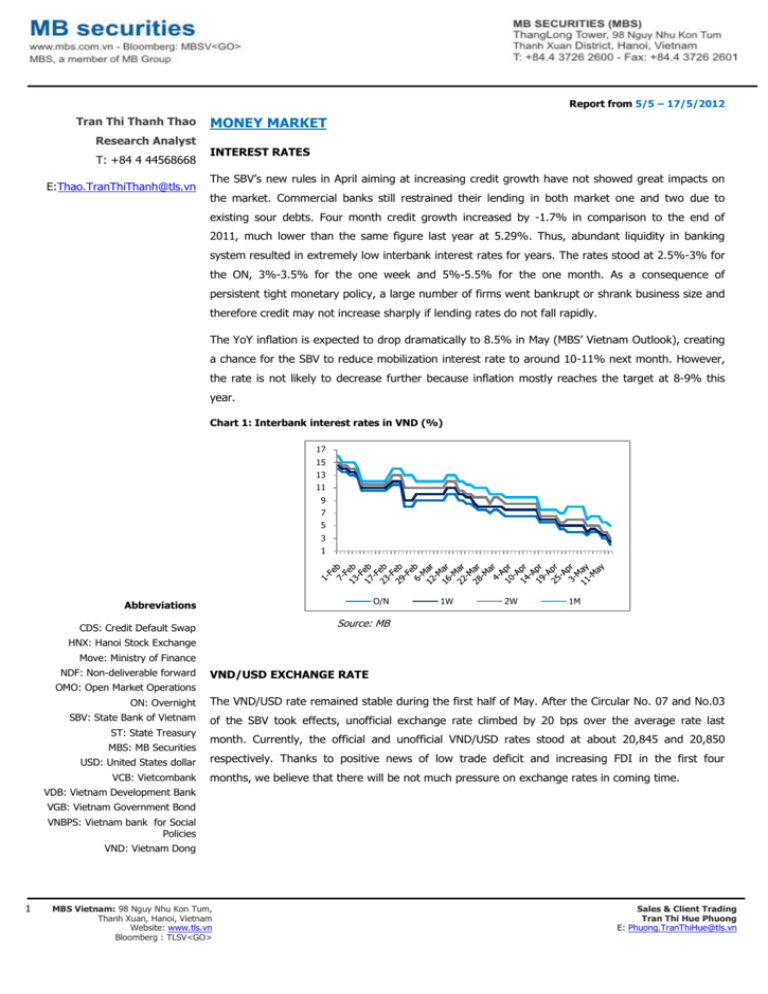

OPEN MARKET OPERATION

From March 15th to May 16nd, the SBV already issued VND95.8 trillion of Treasury bills. In which,

VND25.5 trillion of bills matured. The number of bill auctions was also decreased to only one time

per week on Wednesday. This implied that monetary policy is being loosen to encourage a strong

cut in interest rates, curing firms from temporary lack of capital.

In the first half of May, the SBV net injected about VN 261 billion via OMO after netwithdrawing for

a long time since February. Decreasing bid to cover ratio (about 27%) showed banks’ low demand

for borrowing as liquidity remained high and OMO rate was higher than interbank rates.

Chart 3: OMO net injection (trillion VND)

60

200%

180%

40

160%

140%

20

120%

-20

100%

6-Jan

13-Jan

20-Jan

27-Jan

3-Feb

10-Feb

17-Feb

24-Feb

2-Mar

9-Mar

16-Mar

23-Mar

30-Mar

6-Apr

13-Apr

20-Apr

27-Apr

4-May

11-May

0

-40

80%

60%

40%

20%

-60

0%

Net injection

Bid to cover ratio

Source: MB & Bloomberg

BOND MARKET

The bond market in May kept attracting investors as expectation. Auction on May 11th issued about

VND 7 trillion of VGBs successfully including 2, 3 and 5 year bonds with winning rate of 100%. Bond

yields of 2, 3 and 5 year bond decreased by about 140 bps to around 8.95%-9.45%. Besides,

VNBPS and VDB also issued approximately VND 250 billion and VND 1.4 trillion of guaranteed bonds

respectively in May. Demand for VGBs increased strongly this month because banks are abundant of

VND while issued number of Treasury bills declines and interbank interest rates go down

dramatically. Thanks to high banking liquidity, we believed that the next VGBs auction will continue

2

MBS Vietnam: 98 Nguy Nhu Kon Tum,

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Client Trading

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

to be active. Because investors’ demand for VGBs remains high and key interest rates probably

decrease further, bond yields are likely to drop in coming time.

Chart 4: Reference VGBs’ yields (%)

11.5

11.0

10.5

10.0

9.5

9.0

8.5

8.0

1y

2y

3y

This week

5y

7y

Last Week

10y

15y

Last Month

Source: Bloomberg

Chart 5: Monthly issued VGBs (VND1,000 bn)

18000

16000

14000

12000

10000

8000

6000

4000

2000

0

Đáo hạn

phát hành

Source: MBS, Bloomberg

Domestic bond market

Table 1: Recent VGBs auctions in HNX

3

MBS Vietnam: 98 Nguy Nhu Kon Tum,

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Date

Issuer

Tenor

16/5

NHPTVN

5

16/5

NHPTVN

3

11/5

KBNN

3

11/5

KBNN

5

11/5

KBNN

2

10/5

NHCSXH

10/5

9/4

Winning

amount

(VND bn)

800

Registered

amount

(VND bn)

2532

Offered

amount

(VND bn)

3000

Winning

IR (%)

600

4100

2000

9.5

3000

10900

3000

9.15

3000

5152

3000

9.45

1000

6320

1000

8.95

5

150

350

700

10.7

NHCSXH

3

100

1350

300

10.6

NHCSXH

3

500

1100

1000

12,03

9/4

NHCSXH

5

0

200

1000

0

16/4

KBNN

2

1979

4579

2000

11,06

Ceiling

rate (%)

9,8

Sales & Client Trading

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

16/4

KBNN

3

2000

7400

2000

10,8

16/4

KBNN

5

2000

6500

2000

10,8

Source: HNX

Table 2: Outright transactions on HNX

Date

MBS Vietnam: 98 Nguy Nhu Kon Tum,

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Remaining

tenor

Coupon

(%)

(%)

Volume

Price

(VND)

Yield

(%)

16/5

TD1214029

2

11,00

1.400.000

104.213

8,50

16/5

VDB111010

14

11,50

112.04

110.821

10,00

16/5

VDB110019

8

11,50

551.6

107.934

10,00

16/5

TP4A3005

18

9,25

877.2

95.7

10,00

16/5

TP4A3205

18

9,25

75.2

95.697

10,00

15/5

TD1215001

3

12,10

2.000.000

106.964

9,00

15/5

CPB0813005

1

8,50

2.000.000

99.136

9,75

15/5

TB1013040

1

11,25

400

100.892

10,25

15/5

TD1114049

2

12,34

1.000.000

106.505

8,90

15/5

TD1013038

1

11,25

1.000.000

101.511

9,60

14/5

B1013040

1

11,25

1.600.000

101.4

9,70

14/5

TD1217002

5

12,15

600

109.519

9,50

14/5

TD1214011

2

11,59

200

103.49

9,30

14/5

TD1215032

3

10,80

200

103.524

9,35

14/5

TD1013049

1

10,60

2.000.000

100.552

10,00

11/5

TD1217036

5

10,80

2.000.000

102.691

10,07

11/5

VDB110025

3

11,40

2.000.000

103.511

10,00

11/5

VDB111003

4

11,50

2.000.000

103.126

10,40

11/5

TD1113038

1

12,42

200

103.496

8,90

10/5

VDB111016

2

11,30

4.000.000

101.902

10,00

10/5

QHB1020028

8

11,50

12.000.000

102.533

11,00

10/5

TD1215001

3

12,10

1.000.000

106.395

9,25

10/5

TD1121021

9

11,50

1.000.000

108.415

10,00

10/5

TD1217036

5

10,80

600

100.071

10,77

9/5

TB1013042

1

11,02

2.000.000.000

100.801

10,15

9/5

TD1114053

2

12,28

2.000.000.000

103.683

10,35

9/5

TD1217036

2

10,80

2.000.000.000

101.151

10,48

9/5

TD1214029

2

11,00

2.000.000.000

99.865

11,06

Source: HNX

4

Code

Sales & Client Trading

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

Regional bond market

Table 3: Local Government bond yields (%) as of May 2012

1N

USA

2N

3N

5N

7N

10N

0.2935

0.4183

0.8702

1.408

2.0104

Singapore

1.48

0.62

1.48

Vietnam

11.65

11.56

11.53

11.56

11.62

11.56

Indonesia

4.274

5.609

4.793

4.948

5.436

5.609

2.867

3.473

2.966

3.227

3.385

3.473

3.0381

5.311

3.9769

4.825

4.8481

5.311

Japan

0.112

0.993

0.14

0.298

0.562

0.993

China

2.95

3.57

3.06

3.23

3.47

3.57

Thailand

3.09

3.447

3.219

3.405

3.446

3.447

0.162

1.342

0.31

0.541

0.937

1.342

Malaysia

Philippines

Hong Kong

Source: Bloomberg

Chart 6: Vietnam 5 year CDS

800

600

400

200

Jan-00

Aug-06

Nov-06

Mar-07

Jun-07

Sep-07

Dec-07

Apr-08

Jul-08

Oct-08

Feb-09

May-09

Aug-09

Dec-09

Mar-10

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Sep-11

0

Source: Bloomberg

Chart 7: Yields of international government bonds issued in 2005 (%)

Vietnam

8

Indonesia

7

6

5

4

3

2

1

0

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Source: Bloomberg

5

MBS Vietnam: 98 Nguy Nhu Kon Tum,

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Client Trading

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

PRODUCT

This product is weekly published, focusing on Vietnam’s fixed income market. In this report, we link our macroeconomic

findings and money market changes to the bond market performance. Discussions are written by Tran Thi Thanh Thao

(Master of Finance, Deakin University, Australia). MBS publishes this report, but all errors if any are the author’s. We

thank clients for reading our research products and giving us constructive feedbacks.

MBS RESEARCH TEAM

We offer economic and equity research. The Economic Research Team offers periodic reports on macroeconomics,

monetary policies and fixed income markets. The Equity Research Team offers reports on listed firms, private equities

and sector reviews. MBS Research Team also offers regular market commentaries - The Investor Daily.

MB SECURITIES (MBS)

Established in 2000, MBS was one of the first securities firms operating in Vietnam. MBS provides a full range of

services including brokerage, research and investment advisory, investment banking and capital markets underwriting.

With 400 employees located throughout an expansive network of offices in Hanoi, Ho Chi Minh City, Hai Phong, Da

Nang and other strategic locations, MBS is one of the best known securities firms in Vietnam. Our client base consists of

retail and institutional investors, financial institutions and corporations. As a member of the MB Group, including MB

Bank, MB Land, MB Asset Management and MB Capital, MBS is able to leverage substantial human, financial and

technological resources to provide its clients with tailored products and services that few securities firms in Vietnam can

match. Since its establishment, MBS has become widely regarded throughout Vietnam as:

A leading brokerage firm – ranked No.1 in terms of brokerage market share since 2009;

A renowned research firm with a team of experienced analysts that provides market-leading research products

and commentaries on equity markets and the economy; and

A trusted provider of investment banking services for corporate clients.

OFFICES

Headquarter: Level 5,6,7 ThangLong Tower, 98 Nguy Nhu Kon Tum, Thanh Xuan District, Hanoi. Phone: +84 4

37262600.

HCMC Office: Level 2, Petro Vietnam Tower, 1-5 Le Duan, District 1, Ho Chi Minh City. Phone: +84 8 39106411.

DISCLAIMER

The views expressed in this report are those of the authors and not necessarily related, by any sense, to those of MBS.

The expressions of opinions in this report are subject to changes without notice. Authors have based this document on

information from sources they believe to be reliable but which they have not independently verified. Any

recommendations contained in this report are intended for general/public investors to whom it is distributed. This report

is not and should not be construed as an offer or the solicitation of an offer to purchase or subscribe for any investment.

This report may not be further distributed in whole or in part for any purpose. No consideration has been given to the

particular investment objectives, financial situation or particular needs of any recipient.

Copyrights. MBS 2000-2010, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a

retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying recording, or

otherwise, without the prior written permission of MBS.

6

MBS Vietnam: 98 Nguy Nhu Kon Tum,

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Client Trading

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn