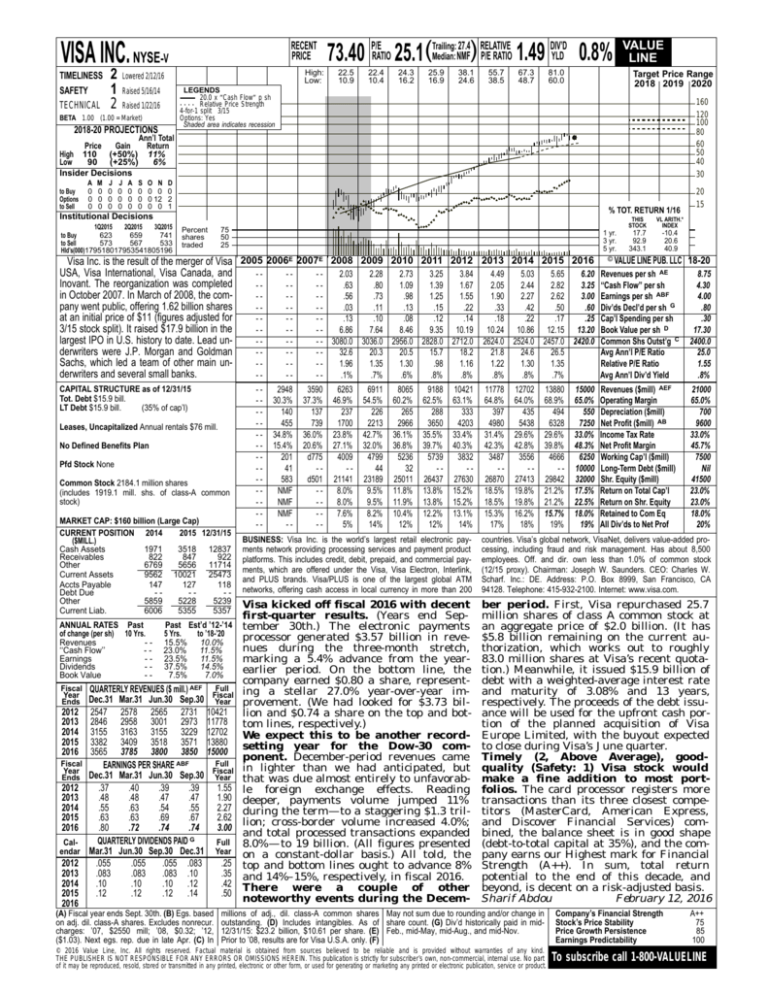

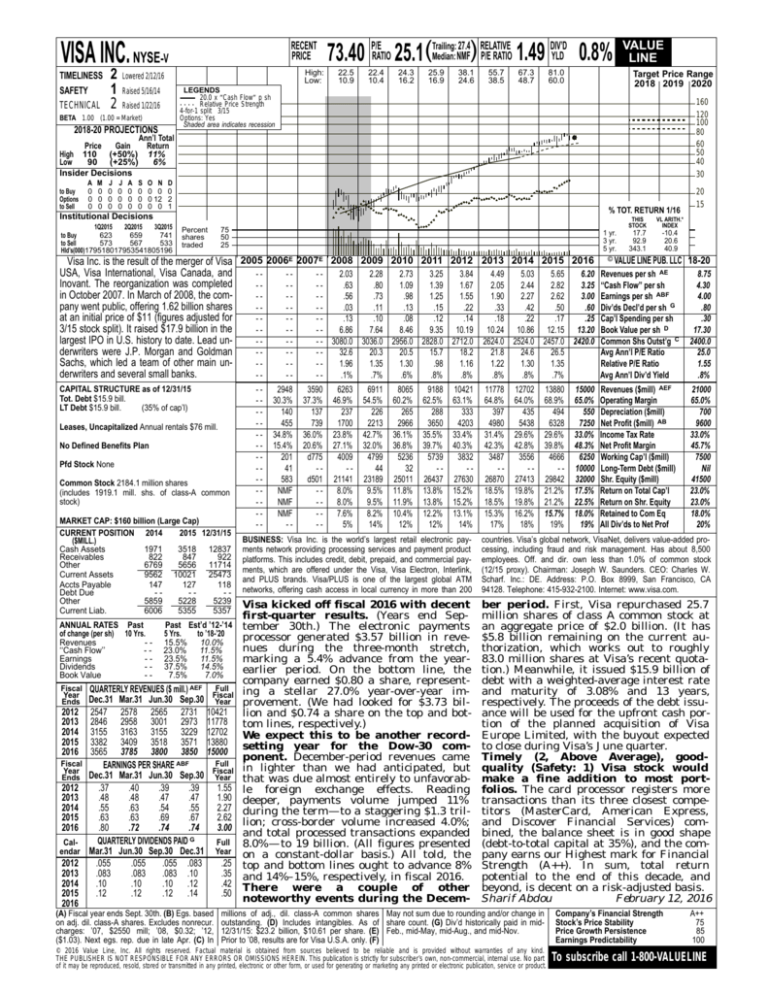

VISA INC. NYSE-V

TIMELINESS

SAFETY

TECHNICAL

2

1

2

RECENT

PRICE

High:

Low:

Lowered 2/12/16

27.4 RELATIVE

DIV’D

Median: NMF) P/E RATIO 1.49 YLD 0.8%

73.40 P/ERATIO 25.1(Trailing:

22.5

10.9

22.4

10.4

24.3

16.2

25.9

16.9

38.1

24.6

55.7

38.5

67.3

48.7

81.0

60.0

Target Price Range

2018 2019 2020

LEGENDS

20.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

4-for-1 split 3/15

Options: Yes

Shaded area indicates recession

Raised 5/16/14

Raised 1/22/16

BETA 1.00 (1.00 = Market)

2018-20 PROJECTIONS

VALUE

LINE

160

120

100

80

60

50

40

30

Ann’l Total

Price

Gain

Return

High 110 (+50%) 11%

Low

90 (+25%)

6%

Insider Decisions

to Buy

Options

to Sell

A

0

0

0

M

0

0

0

J

0

0

0

J

0

0

0

A

0

0

0

S

0

0

0

O N

0 0

0 12

0 0

D

0

2

1

% TOT. RETURN 1/16

Institutional Decisions

1Q2015

2Q2015

3Q2015

623

659

741

to Buy

to Sell

573

567

533

Hld’s(000)179518017953541805196

Percent

shares

traded

75

50

25

1 yr.

3 yr.

5 yr.

THIS

STOCK

VL ARITH.*

INDEX

17.7

92.9

343.1

-10.4

20.6

40.9

20

15

Visa Inc. is the result of the merger of Visa 2005 2006E 2007E 2008 2009 2010 2011 2012 2013 2014 2015 2016 © VALUE LINE PUB. LLC 18-20

USA, Visa International, Visa Canada, and

---2.03

2.28

2.73

3.25

3.84

4.49

5.03

5.65

6.20 Revenues per sh AE

8.75

Inovant. The reorganization was completed

---.63

.80

1.09

1.39

1.67

2.05

2.44

2.82

3.25 ‘‘Cash Flow’’ per sh

4.30

in October 2007. In March of 2008, the com---.56

.73

.98

1.25

1.55

1.90

2.27

2.62

3.00 Earnings per sh ABF

4.00

pany went public, offering 1.62 billion shares

---.03

.11

.13

.15

.22

.80

.33

.42

.50

.60 Div’ds Decl’d per sh G

at an initial price of $11 (figures adjusted for

---.13

.10

.08

.12

.14

.18

.22

.17

.25 Cap’l Spending per sh

.30

3/15 stock split). It raised $17.9 billion in the

---6.86

7.64

8.46

9.35 10.19 10.24 10.86 12.15 13.20 Book Value per sh D

17.30

largest IPO in U.S. history to date. Lead un--- - 3080.0 3036.0 2956.0 2828.0 2712.0 2624.0 2524.0 2457.0 2420.0 Common Shs Outst’g C 2400.0

derwriters were J.P. Morgan and Goldman

---32.6

20.3

20.5

15.7

18.2

21.8

24.6

26.5

Avg Ann’l P/E Ratio

25.0

Sachs, which led a team of other main un---1.96

1.35

1.30

.98

1.16

1.22

1.30

1.35

Relative P/E Ratio

1.55

derwriters and several small banks.

---.1%

.7%

.6%

.8%

.8%

.8%

.8%

.7%

Avg Ann’l Div’d Yield

.8%

CAPITAL STRUCTURE as of 12/31/15

Tot. Debt $15.9 bill.

LT Debt $15.9 bill.

(35% of cap’l)

Leases, Uncapitalized Annual rentals $76 mill.

No Defined Benefits Plan

Pfd Stock None

Common Stock 2184.1 million shares

(includes 1919.1 mill. shs. of class-A common

stock)

MARKET CAP: $160 billion (Large Cap)

CURRENT POSITION 2014

2015 12/31/15

($MILL.)

Cash Assets

1971

3518 12837

Receivables

822

847

922

Other

6769

5656 11714

Current Assets

9562 10021 25473

Accts Payable

147

127

118

Debt Due

---Other

5859

5228

5239

Current Liab.

6006

5355

5357

--------------

2948

30.3%

140

455

34.8%

15.4%

201

41

583

NMF

NMF

NMF

--

3590

37.3%

137

739

36.0%

20.6%

d775

-d501

-----

6263

46.9%

237

1700

23.8%

27.1%

4009

-21141

8.0%

8.0%

7.6%

5%

6911

54.5%

226

2213

42.7%

32.0%

4799

44

23189

9.5%

9.5%

8.2%

14%

8065

60.2%

265

2966

36.1%

36.8%

5236

32

25011

11.8%

11.9%

10.4%

12%

9188

62.5%

288

3650

35.5%

39.7%

5739

-26437

13.8%

13.8%

12.2%

12%

10421

63.1%

333

4203

33.4%

40.3%

3832

-27630

15.2%

15.2%

13.1%

14%

11778

64.8%

397

4980

31.4%

42.3%

3487

-26870

18.5%

18.5%

15.3%

17%

12702

64.0%

435

5438

29.6%

42.8%

3556

-27413

19.8%

19.8%

16.2%

18%

13880

68.9%

494

6328

29.6%

39.8%

4666

-29842

21.2%

21.2%

15.7%

19%

15000

65.0%

550

7250

33.0%

48.3%

6250

10000

32000

17.5%

22.5%

18.0%

19%

Revenues ($mill) AEF

Operating Margin

Depreciation ($mill)

Net Profit ($mill) AB

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

21000

65.0%

700

9600

33.0%

45.7%

7500

Nil

41500

23.0%

23.0%

18.0%

20%

BUSINESS: Visa Inc. is the world’s largest retail electronic payments network providing processing services and payment product

platforms. This includes credit, debit, prepaid, and commercial payments, which are offered under the Visa, Visa Electron, Interlink,

and PLUS brands. Visa/PLUS is one of the largest global ATM

networks, offering cash access in local currency in more than 200

countries. Visa’s global network, VisaNet, delivers value-added processing, including fraud and risk management. Has about 8,500

employees. Off. and dir. own less than 1.0% of common stock

(12/15 proxy). Chairman: Joseph W. Saunders. CEO: Charles W.

Scharf. Inc.: DE. Address: P.O. Box 8999, San Francisco, CA

94128. Telephone: 415-932-2100. Internet: www.visa.com.

Visa kicked off fiscal 2016 with decent

first-quarter results. (Years end SepANNUAL RATES Past

Past Est’d ’12-’14 tember 30th.) The electronic payments

of change (per sh) 10 Yrs.

5 Yrs.

to ’18-’20

processor generated $3.57 billion in reveRevenues

- - 15.5% 10.0%

nues during the three-month stretch,

‘‘Cash Flow’’

- - 23.0% 11.5%

Earnings

- - 23.5% 11.5%

marking a 5.4% advance from the yearDividends

- - 37.5% 14.5%

earlier period. On the bottom line, the

Book Value

-7.5%

7.0%

company earned $0.80 a share, representFiscal QUARTERLY REVENUES ($ mill.) AEF

Full

Year

Fiscal ing a stellar 27.0% year-over-year imEnds Dec.31 Mar.31 Jun.30 Sep.30 Year provement. (We had looked for $3.73 bil2012 2547 2578 2565 2731 10421 lion and $0.74 a share on the top and bot2013 2846 2958 3001 2973 11778 tom lines, respectively.)

2014 3155 3163 3155 3229 12702 We expect this to be another record2015 3382 3409 3518 3571 13880 setting year for the Dow-30 com2016 3565 3785 3800 3850 15000

ponent. December-period revenues came

Fiscal

Full

EARNINGS PER SHARE ABF

Year

Fiscal in lighter than we had anticipated, but

Ends Dec.31 Mar.31 Jun.30 Sep.30 Year that was due almost entirely to unfavorab2012

.37

.40

.39

.39

1.55 le foreign exchange effects. Reading

2013

.48

.48

.47

.47

1.90 deeper, payments volume jumped 11%

2014

.55

.63

.54

.55

2.27 during the term—to a staggering $1.3 tril2015

.63

.63

.69

.67

2.62 lion; cross-border volume increased 4.0%;

2016

.80

.72

.74

.74

3.00

and total processed transactions expanded

QUARTERLY DIVIDENDS PAID G

CalFull 8.0%—to 19 billion. (All figures presented

endar Mar.31 Jun.30 Sep.30 Dec.31 Year on a constant-dollar basis.) All told, the

2012

.055

.055

.055 .083

.25 top and bottom lines ought to advance 8%

2013

.083

.083

.083 .10

.35 and 14%–15%, respectively, in fiscal 2016.

2014

.10

.10

.10 .12

.42 There were a couple of

other

2015

.12

.12

.12 .14

.50

noteworthy events during the Decem2016

ber period. First, Visa repurchased 25.7

million shares of class A common stock at

an aggregate price of $2.0 billion. (It has

$5.8 billion remaining on the current authorization, which works out to roughly

83.0 million shares at Visa’s recent quotation.) Meanwhile, it issued $15.9 billion of

debt with a weighted-average interest rate

and maturity of 3.08% and 13 years,

respectively. The proceeds of the debt issuance will be used for the upfront cash portion of the planned acquisition of Visa

Europe Limited, with the buyout expected

to close during Visa’s June quarter.

Timely (2, Above Average), goodquality (Safety: 1) Visa stock would

make a fine addition to most portfolios. The card processor registers more

transactions than its three closest competitors (MasterCard, American Express,

and Discover Financial Services) combined, the balance sheet is in good shape

(debt-to-total capital at 35%), and the company earns our Highest mark for Financial

Strength (A++). In sum, total return

potential to the end of this decade, and

beyond, is decent on a risk-adjusted basis.

Sharif Abdou

February 12, 2016

(A) Fiscal year ends Sept. 30th. (B) Egs. based

on adj. dil. class-A shares. Excludes nonrecur.

charges: ’07, $2550 mill; ’08, $0.32; ’12,

($1.03). Next egs. rep. due in late Apr. (C) In

millions of adj., dil. class-A common shares May not sum due to rounding and/or change in

outstanding. (D) Includes intangibles. As of share count. (G) Div’d historically paid in mid12/31/15: $23.2 billion, $10.61 per share. (E) Feb., mid-May, mid-Aug., and mid-Nov.

Prior to ’08, results are for Visa U.S.A. only. (F)

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A++

75

85

100

To subscribe call 1-800-VALUELINE