CA 1040 2011 - Services For CPA & Tax Preparers

advertisement

CA

GI

0145

FILING DUE DATE (IF OTHER THAN STANDARD)

PY TP LAST NAME IF DIFF

-

6580

6581

PREPARE CALIFORNIA FORM 540 2EZ

PREPARE CALIFORNIA FORM 540NR (PY / NR RETURN)

PREPARE FORM 540NR SHORT FORM

PREPARE CALIFORNIA FORM 540X

SSMC / RDP FILING STATUS:

1- SSMC Joint

2- SSMC Separate

FORCE SCHEDULE W-2CG

ADDRESS IS SAME AS LAST YEAR

PRIVATE MAILBOX NUMBER

DO NOT PRINT TAXPAYER'S EMAIL ADDRESS

FORCE NEW DCN

DO NOT ATTACH FEDERAL 1040 FOR PAPER FILING

TAXPAYER WAS INVOLVED IN A DISASTER LOSS (N, L, W OR F)

REPRESENTATIVE TYPE (FOR DECEDENT RETURNS)

USED FOR EF PURPOSES ONLY

2- Beneficiary

3- Executor

1

6049

6052

6180

6095

4 - Spouse

5 - Trustee

REPRESENTATIVE EXPLANATION:

[17]

6313

18 ITEMIZED/STANDARD DEDUCTIONS

19 CAPITAL CONSTRUCTION FUND

32 EXEMPTION CREDITS

34 TAX FROM FORM FTB 5870A

40 NONREFUNDABLE CHILD AND DEPENDENT EXPENSES

NONREFUNDABLE RENTER'S CREDIT: QUALIFIES

NONREFUNDABLE RENTER'S CREDIT: OVERRIDE

INTEREST ON DEFERRED TAX FROM INSTALLMENT

OBLIGATIONS

49

IRC SECTION 453A (DEFAULT = SECTION 453)

6216

6219

6210

6092

6612

6314

6254

6085

6013

[75]

6186

ROUTING NUMBER

YES

ACCOUNT TYPE:

YES

61 ALTERNATIVE MINIMUM TAX

62 MENTAL HEALTH SERVICES TAX

OTHER TAXES ON NONQUALIFIED DEFERRED COMP PLAN

OTHER TAXES FROM FTB 3501

OTHER TAXES FROM FTB 3805Z

AMOUNT

ACCOUNT NUMBER

YES

DIRECT DEPOSIT AMOUNT

YES

FOREIGN ACCOUNT

(Yes - No)

YES

ACCOUNT TYPE:

YES

ACCOUNT NUMBER

YES

DIRECT DEPOSIT AMOUNT

[6]

STATE UNEMPLOYMENT WITHHELD

FOREIGN ACCOUNT

(Yes - No)

YES

THRID PARTY DESIGNEE:

YES

CARRY 3RD PARTY DESIGNEE INFORMATION FROM FEDERAL RTN

YES

PREPARER IS 3RD PARTY DESIGNEE

YES

NAME:

74

OVERRIDE TP WAGE AMT TO CALCULATE EXCESS SDI

OVERRIDE SP WAGE AMT TO CALCULATE EXCESS SDI

75 CLAIM OF RIGHT AMOUNT

NO

YES

[20]

2

5128

5112

5175

5115

5496

5471

6100

5492

5222

6067

5130

5673

5422

3048

5356

5131

WITHHOLDINGS FROM OTHER THAN W-2, W-2G, 1099R

EXPLAIN (FOR ELECTRONIC FILING ONLY)

71

73 WITHHOLDINGS FROM FORMS 592-B & 593B

6346

6347

[9]

6349

CA FORM 540 - PAGE 3

CONTRIBUTIONS

400 CALIFORNIA SENIORS SPECIAL FUND

401 ALZHEIMER'S DISEASE OR RELATED DISORDERS

402 CALIFORNIA FUND FOR SENIOR CITIZENS

403 RARE AND ENDANGERED SPECIES PRESERVATION

404 STATE CHILDREN'S TRUST FUND FOR CHILD ABUSE PREVENT

YES

405 CALIFORNIA BREAST CANCER RESEARCH FUND

406 CALIFORNIA FIREFIGHTER'S MEMORIAL FUND

407 EMERGENCY FOOD ASSISTANCE PROGRAM FUND

YES

408 CA PEACE OFFICER MEMORIAL FOUNDATION FUND

410 CALIFORNIA SEA OTTER FUND

412 MUNICIPAL SHELTER SPAY-NEUTER FUND

413 CA CANCER RESEARCH FUND

414 ALS/LOU GEHRIG'S DISEASE RESEARCH FUND

415 ARTS COUNAL FUND

416 CA POLICE ACTIVITIES LEAGE FUND

417 CA VETERANS HOMES FUND

418 SAFELY SURRENDERED BABY FUND

419 CHILD VICTIMS OF HUMAN TRAFFICKING FUND

5482

5142

5143

5144

5145

5202

5212

5066

5147

5507

5598

5583

5597

5506

5581

5582

5584

5599

INTEREST AND PENALTIES

112 INTEREST, LATE RETURN & LATE PMT PENALTY

1099Q

1099S

1099SSA

1099RRB

[17]

6190

6191

5215

6341

(Checking - Savings)

6209

5133

3234

CALIFORNIA INCOME TAX WITHHELD

1099MISC

1099MSA

1099OID

1099PATR

[9]

6189

ROUTING NUMBER

6348

PAYMENTS

1099DIV

1099G

1099INT

1099LTC

[17]

6187

6188

5214

6340

(Checking - Savings)

PHONE NUMBER

CREDITS AND OTHER TAXES

W-2GU

1099A

1099B

1099C

[17]

DEPOSIT ACCOUNT 1

CA FORM 540 - PAGE 2

12 STATE WAGES FROM W-2, BOX 16

63

6183

[17]

DEPOSIT ACCOUNT 2

3- RDP Joint

4- RDP Separate

FILING STATUS CHANGED FROM FEDERAL RETURN

1- Administrator

2011

GENERAL INFORMATION

GUARDIAN / EXECUTOR NAME

PY SP LAST NAME IF DIFF

NOTE: THE FRANCHISE TAX BOARD NO LONGER SUPPORTS CA

FORM 540A FROM COMPUTER GENERATED RETURNS.

46

LAST NAME

CALIFORNIA 1040 DATA SHEET 1

5153

PENALTIES:

DATE OF LATE PAYMENT

DATE OF LATE FILING

6170

5527

5555

5557

5674

AMT OF TAX DUE TO COMPUTE PENALTIES & INT

113 UNDERPAYMENT OF ESTIMATED TAX

6245

6246

5541

5154

OVERPAID TAX

92 AMOUNT TO BE APPLIED TO NEXT YEAR'S ESTIMATED TAX

PURCHASES FROM OUT-OF-STATE OR INTERNET SELLERS

MADE WITHOUT PAYMENT OF CA SALES/USE TAX

95

APPLICABLE SALES & USE TAX RATE

SALES OR USE TAX PD TO ANOTHER STATE FOR PURCHASES

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

5139

5012

6137

5013

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT1

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 2

NR1

CA FORM 540NR - PAGE 1

NR3

6052

5128

5112

5175

5115

PREPARE NONRESIDENT RETURN

12 STATE WAGES FROM W-2, BOX 16

18 ITEMIZED/STANDARD DEDUCTIONS

19 CAPITAL CONTRIBUTION FUND

39 EXEMPTION CREDITS

2011

CA FORM 540NR - PAGE 3

YES

CONTRIBUTIONS

400 CA SENIORS SPECIAL FUND

401 ALZHEIMER'S DISEASE / RELATED DISORDERS

402 CA FUND FOR SENIOR CITIZENS

403 RARE AND ENDANGERED SPECIES PRESERVATION

404 STATE CHILDREN'S TRUST FUND FOR CHILD ABUSE PREVENT

NR2

41

CA FORM 540NR - NONRESIDENT RTN PG 2

5496

TAX FROM FORM FTB 5870A

SPECIAL CREDITS

NONREFUNDABLE CHILD AND DEPENDENT CARE

50

EXPENSES CREDIT AMOUNT

61

405 CA BREAST CANCER RESEARCH FUND

406 CA FIREFIGHTER'S MEMORIAL FUND

407 EMERGENCY FOOD ASSISTANCE PROGRAM FUND

5471

6100

5492

NONREFUNDABLE RENTER'S CREDIT: QUALIFIES

NONREFUNDABLE RENTER'S CREDIT: OVERRIDE

INTEREST ON DEFERRED TAX FROM INSTALLMENT

OBLIGATIONS

63

5222

6067

IRC SECTION 453A (DEFAULT = SECTION 453)

408 CA PEACE OFFICER MEMORIAL FOUNDATION FUND

YES

412 MUNICIPAL SHELTER SPAY-NEUTER FUND

413 CA CANCER RESEARCH FUND

414 ALS/LOU GEHRIG'S DISEASE RESEARCH FUND

YES

OTHER TAXES

72 MENTAL HEALTH SERVICES TAX

OTHER TAXES ON NONQUALIFIED DEFERRED COMP PLAN

OTHER TAXES FROM FORM FTB 3501

FORM FTB 3805Z

AMOUNT

5130

5673

5422

3048

5356

5131

417 CA VETERANS HOMES FUND

418 SAFELY SURRENDERED BABY FUND

419 CHILD VICTIMS OF HUMAN TRAFFICKING FUND

INTEREST AND PENALTIES

INTEREST, LATE RETURN & LATE PAYMENT PENALTIES

122 DATE OF LATE PAYMENT

5133

3234

STATE UNEMPLOYMENT WITHHELD

DATE OF LATE FILING

AMT OF TAX DUE TO COMPUTE PENALTIES & INTEREST

123 UNDERPAYMENT OF ESTIMATED TAX

WITHHOLDINGS FROM OTHER THAN W-2, W-2G, 1099R

EXPLAIN: (ELECTRONIC FILING ONLY)

81

1099DIV

1099G

1099INT

1099LTC

1099MISC

1099MSA

1099OID

1099PATR

1099Q

1099S

1099SSA

1099RRB

83 WITHHOLDINGS FROM FORMS 592-B AND 593B

85 CLAIM OF RIGHT AMOUNT

EZ

6170

5527

5674

9

TOTAL WAGES FROM FORM W-2, BOX 16

10 INTEREST INCOME FROM FORM 1099-INT, BOX 1

11 DIVIDEND INCOME FROM FORM 1099-DIV, BOX 1

12 TAXABLE PENSIONS

5139

13 ALL CAPITAL GAINS FROM MUTUAL FUNDS

14 UNEMPLOYMENT COMPENSATION

15 U.S. SOCIAL SECURITY OR RAILROAD RETIREMENT

19

6245

6246

5541

5154

CA FORM 540 2EZ

PREPARE FORM 540EZ

OVERPAID TAX

102 AMOUNT OF OVERPAYMENT TO BE APPLIED TO NEXT YR TAX

5153

PENALTIES:

PAYMENTS

CALIFORNIA INCOME TAX WITHHELD

W-2GU

1099A

1099B

1099C

415 ARTS COUNCIL FUND

416 CA POLICE ACTIVITIES LEAGE FUND

71 ALTERNATIVE MINIMUM TAX

73

410 CA SEA OTTER FUND

5482

5142

5143

5144

5145

5202

5212

5066

5147

5507

5598

5583

5597

5506

5581

5582

5584

5599

NONREFUNDABLE RENTER'S CREDIT: QUALIFIES

NONREFUNDABLE RENTER'S CREDIT: OVERRIDE

22 TAX WITHHELD FROM FM W-2, BOX 17 OR 1099-R, BOX 10

PURCHASES FROM OUT-OF-STATE OR INTERNET SELLERS

MADE WITHOUT PAYMENT OF CA SALES / USE TAX

23

APPLICABLE SALES AND USE TAX RATE

SALES OR USE TAX PD TO ANOTHER ST FOR PURCHASES

6049

5128

5124

9108

9109

6182

5125

5157

6100

5492

5133

YES

YES

YES

5012

6137

5013

VOLUNTARY CONTRIBUTIONS

400 CA SENIORS SPECIAL FUND

401 ALZHEIMER'S DISEASE / RELATED DISORDERS

402 CA FUND FOR SENIOR CITIZENS

403 RARE AND ENDANGERED SPECIES PRESERVATION

404 ST CHILDREN'S TRUST FUND PREVENTION OF CHILD ABUSE

405 CA BREAST CANCER RESEARCH FUND

406 CA FIREFIGHTER'S MEMORIAL FUND

407 EMERGENCY FOOD ASSISTANCE PROGRAM FUND

408 CA PEACE OFFICER MEMORIAL FOUNDATION FUND

410 CA SEA OTTER FUND

412 MUNICIPAL SHELTER SPAY-NEUTER FUND

413 CA CANCER RESEARCH FUND

414 ALS/LOU GEHRIG'S DISEASE RESEARCH FUND

415 ARTS COUNCIL FUND

416 CA POLICE ACTIVITIES LEAGE FUND

417 CA VETERANS HOMES FUND

418 SAFELY SURRENDERED BABY FUND

419 CHILD VICTIMS OF HUMAN TRAFFICKING FUND

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

5482

5142

5143

5144

5145

5202

5212

5066

5147

5507

5598

5583

5597

5506

5581

5582

5584

5599

ADD-TO

11CADAT2

CA

NRS

DURING CURRENT YEAR

6519

STATE OF RESIDENCE

SPOUSE

402 CALIFORNIA FUND FOR SENIOR CITIZENS

6031

403 RARE AND ENDANGERED SPECIES PRESERVATION

DATE OF RESIDENCY:

404 STATE CHILDREN'S TRUST FUND CHILD ABUSE PREVENT

6029

6037

FROM

TO

-

-

6030

6038

-

-

405 CALIFORNIA BREAST CANCER RESEARCH FUND

406 CALIFORNIA FIREFIGHTER'S MEMORIAL FUND

ACTIVE MILITARY DUTY

6520

5005

STATE OF DOMICILE

TOTAL MILITARY PAY

407 EMERGENCY FOOD ASSISTANCE PROGRAM FUND

6032

5006

408 CA PEACE OFFICER MEMORIAL FOUNDATION FUND

410 CALIFORNIA SEA OTTER FUND

PAGE 1

412 MUNICIPAL SHELTER SPAY-NEUTER FUND

5128

5125

5480

12 STATE WAGES FROM W-2

14 UNEMPLOYMENT COMPENSATION

21 CA ADJUSTED GROSS INCOME

413 CA CANCER RESEARCH FUND

414 ALS/LOU GEHRIG'S DISEASE RESEARCH FUND

415 ARTS COUNCIL FUND

PAGE 2

NONREFUNDABLE RENTER'S CREDIT: QUALIFIES

NONREFUNDABLE RENTER'S CREDIT: OVERRIDE

43 CA INCOME TAX WITHHELD

X

PREPARE CA FORM 540X

ORIGINALLY FILED FORM 540 2EZ

FORM 540X FILED IN RESPONSE TO NOTICE OF PROPOSED ASSESS

ORIGINAL FED RETURN IS BEING OR WILL BE AUDITED

416 CA POLICE ACTIVITIES LEAGE FUND

6100

5492

5133

YES

1- Single

2- Married Filing Jointly

3- Married Filing Sep

C

4- Head of Household

5- Qualifying Widow(er)

DEPENDENT OF ANOTHER AT TIME OF AMENDING

419 CHILD VICTIMS OF HUMAN TRAFFICKING FUND

CA FORM 540X - AMENDED RETURN

6095

YES

STEP 4 - REFUND OR AMOUNT DUE

6015

YES

27 REFUND, IF ANY, AS SHOWN ON ORIGINAL RETURN

6127

YES

29 USE TAX PAYMENTS AS SHOWN ON ORIGINAL RETURN

6062

YES

30 VOLUNTARY CONTRIBUTIONS SHOWN ON ORIGINAL RTN

33

6217

6065

FIRST INITIAL AND LAST NAME OF QUALIFYING PERSON

RELATIONSHIP OF QUALIFYING PERSON

YES

6141

6142

a

STATE WAGES

b

FEDERAL AGI FROM ORIGINAL 540 RETURN

5052

5801

2

CA NONTAXABLE INTEREST INCOME

b

STATE INCOME TAX REFUND

c

UNEMPLOYMENT COMPENSATION

d

SOCIAL SECURITY BENEFITS

e

SPECIFY

5

8

5

CA AGI FROM SHORT OR LONG FORM 540NR

6

TAX SCH G-1 & FORM FTB 5870A FROM LONG FORM 540NR

SPECIAL CREDIT & NONREFUNDABLE RENTER'S CREDIT

FROM SHORT OR LONG FORM 540NR

1

[30]

5807

1- Tax Table / Rate Schedule

2- Form 3800

3- Form 3803

TAX ON ORIGINAL RETURN

EXEMPTION CREDITS

10 TAX FROM SCHEDULE G-1 AND FTB 5870A

12 SPECIAL CREDITS AND NONREFUNDABLE RENTER'S CREDIT

14 OTHER TAXES

15 MENTAL HEALTH SERVICES TAX

16

AGI FROM ALL SOURCES FROM SHORT/LONG FORM 540NR

ITEMIZED DEDUCTIONS/STANDARD DEDUCTIONS FROM

SHORT OR LONG FORM 540NR

5828

5829

5870

ALTERNATIVE MINIMUM TAX FROM LONG FORM 540NR

MENTAL HEALTH SERVICES TAX (TAX YEARS 2005 & AFTER)

FROM LONG FORM 540NR

5871

5872

5873

5874

PART II - EXPLANATION OF CHANGES

2

STEP 2 - TAX LIABILITY

b

3

5825

5826

5827

10 OTHER TAXES & CREDIT RECAPTURE LONG FORM 540NR

6143

ITEMIZED OR STANDARD DEDUCTION

a

FED AGI INCOME FROM SHORT OR LONG FORM 540NR

9

TAX METHOD ON ORIGINAL RETURN:

7

2

8

5802

5803

5804

5805

5806

OTHER INCOME

INTEREST INCLUDED IN PAYMENT

EXEMPTION AMT FROM SHORT OR LONG FORM 540NR

7

CALIFORNIA ADJUSTMENTS:

a

PENALTIES INCLUDED IN PAYMENT

b

1

4

STEP 1 - FEDERAL AGI & CA ADJUSTMENTS

1

a

5818

5798

5797

5053

5819

PART I - NONRESIDENTS OR PART-YEAR RESIDENTS ONLY

IF CLAIMED HEAD OF HOUSEHOLD ON ORIGINAL RETURN:

D

417 CA VETERANS HOMES FUND

418 SAFELY SURRENDERED BABY FUND

FILING STATUS ON ORIGINAL CALIFORNIA RETURN:

B

5142

5143

5144

5145

5202

5212

5066

5147

5507

5598

5583

5597

5506

5581

5582

5584

5599

401 ALZHEIMER'S DISEASE / RELATED DISORDERS

TAXPAYER

A

2011

CA FORM 540NRS - NONRESIDENT SHORT FORM

6180

YES

VOLUNTARY CONTRIBUTIONS

PREPARE FORM 540NR SHORT FORM

35

LAST NAME

CALIFORNIA 1040 DATA SHEET 3

NAME AND ADDRESS FROM ORIGINAL RETURN IF DIFFERENT:

6011

a

[73]

6063

6064

6061

REPORTING FINAL FEDERAL DETERMINATION

3

CA RETURN HAS, IS, OR WILL BE AUDITED

4

FILED FEDERAL AMENDED RETURN ON SIMILAR BASIS

YES

YES

NO

REASON FOR AMENDMENT (IF DIFFERENT FROM FEDERAL)

5824

5808

5809

5810

5811

5812

5700

5

6509

6510

6511

[73]

[73]

[73]

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

ONLY IF AMENDING FORM 540NR, OR FORM 540 2EZ:

AMOUNT FROM ORIGINAL 540NR OR 540 2EZ

5823

STEP 3 - PAYMENTS

17 CA INCOME TAX ORIGINALLY WITHHELD

18 CA REAL ESTATE OR NONRESIDENT WITHHOLDING

19 EXCESS CA SDI OR VPDI WITHHELD

20 ES TAX PMTS AND AMTS FROM FTB 3519 AND 3502

21 REFUNDABLE CREDITS

TAX PD WITH ORIGINAL RTN PLUS ADDITIONAL TAX

25

PAID AFTER IT WAS FILED

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

5813

5799

5814

5815

5816

5817

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT3

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 4

RDP

2011

CA RDP/SSMC WORKSHEET - FILING STATUS ADJUSTMENTS WORKSHEET

PART I - INCOME ADJUSTMENT WORKSHEET

A

TAXPAYER 1

SECTION A - INCOME

7

WAGES, SALARIES, TIPS, ETC

B

TAXPAYER 2

C

ADJUSTMENTS

9010

9011

9012

9013

9014

9018

9021

9024

9027

9030

9033

9019

9022

9025

9028

9031

9034

9026

9029

9032

9035

9038

9039

9040

9043

9046

9049

9052

9044

9047

9050

9053

9048

9051

9057

9060

9058

9061

9059

9062

TAXABLE INTEREST INCOME:

8

a

TAXPAYER 1

TAXPAYER 2

9106

9107

ORDINARY DIVIDENDS:

9

a

TAXPAYER 1

TAXPAYER 2

9016

9017

10 TAXABLE REFUNDS, CREDITS, OFFSETS OF STATE AND LOCAL INCOME TAXES

11 ALIMONY RECEIVED

12 BUSINESS INCOME OR (LOSS)

13 CAPITAL GAIN OR (LOSS)

14 OTHER GAINS OR (LOSSES)

TOTAL IRA DISTRIBUTIONS:

15

a

TAXPAYER 1

TAXPAYER 2

9036

9037

TOTAL PENSIONS AND ANNUITIES:

16

a

TAXPAYER 1

TAXPAYER 2

9041

9042

17 RENTAL REAL ESTATE, ROYALTIES, PARTNERSHIPS, S CORPORATIONS, TRUSTS, ETC

18 FARM INCOME OR (LOSS)

19 UNEMPLOYMENT COMPENSATION

SOCIAL SECURITY BENEFITS:

20

a

TAXPAYER 1

TAXPAYER 2

9055

9056

21 OTHER INCOME

SECTION B - ADJUSTMENTS TO INCOME

23 EDUCATOR EXPENSE

24 CERTAIN BUSN EXP OF RESERVISTS, PERFORMING ARTISTS, AND FEE-BASIS GOV OFFICIALS

25 HEALTH SAVINGS ACCOUNT DEDUCTION

26 MOVING EXPENSES

27 ONE-HALF OF SELF EMPLOYMENT TAX

28 SELF-EMPLOYED SEP, SIMPLE, AND QUALIFIED PLANS

29 SELF-EMPLOYED HEALTH INSURANCE DEDUCTION

30 PENALTY ON EARLY WITHDRAWAL OF SAVINGS

31 ALIMONY PAID

32 IRA DEDUCTION

33 STUDENT LOAN INTERST DEDUCTION

34 TUITION FEES DEDUCTION

35 DOMESTIC PRODUCTION ACTIVITIES DEDUCTION

9063

9066

9069

9072

9075

9078

9081

9084

9087

9090

9093

9096

9099

9064

9067

9070

9073

9076

9079

9082

9085

9088

9091

9094

9097

9100

9083

9089

9092

9095

9098

9105

38 QUALIFIED FEDERAL ITEMIZED DEDUCTIONS (SEE INSTRUCTIONS)

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

9068

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT4

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 5

CA

2011

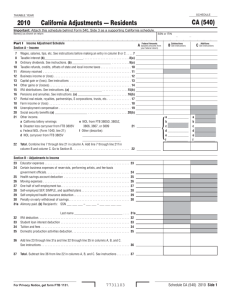

CA SCHEDULE CA (540) - CALIFORNIA ADJUSTMENTS

PART I - INCOME ADJUSTMENTS SCHEDULE

SECTION A - INCOME

ADJUSTMENTS

SUBTRACTIONS

7

WAGES, SALARIES, TIPS ETC.

8

TAXABLE INTEREST INCOME

9

DIVIDEND INCOME

ADDITIONS

5413

5158

5289

5155

10 STATE TAX REFUND

5414

5170

5551

5553

5295

5173

5561

5563

5564

5171

5567

11 ALIMONY RECEIVED

5294

5165

5560

5161

5162

5163

5566

5156

5157

12 BUSINESS INCOME OR (LOSS)

13 CAPITAL GAIN OR (LOSS)

14 OTHER GAINS OR (LOSSES)

15

b

TAXABLE IRA DISTRIBUTIONS

16

b

TAXABLE PENSIONS & ANNUITIES

17 RENTS, ROYALTIES, PARTNERSHIPS, ESTATES, ETC.

18 FARM INCOME OR (LOSS)

19 UNEMPLOYMENT COMPENSATION

20

b

TAXABLE SOCIAL SECURITY BENEFITS

OTHER

21

a

CALIFORNIA LOTTERY

b

DISASTER LOSS CARRYOVER FROM FTB 3805V

d

NOL CARRYOVER FROM FTB 3805V

e

NOL FROM FTB 3805Z, FTB 3806

f

5160

5418

5419

5570

5398

OTHER INCOME

5404

6007

DESCRIBE

[12]

SECTION B - ADJUSTMENTS

SUBTRACTIONS

ADDITIONS

5649

24 CERTAIN BUSINESS EXPENSES OF RESERVISTS, PERFORMING ARTISTS, AND FEE-BASIS GOVT. OFFICIALS

5650

5585

ALIMONY PAID

RECIPIENT'S LAST NAME

[30]

RECIPIENT'S SSN

-

31

AMOUNT PAID

-

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

5016

33 STUDENT LOAN INTEREST DEDUCTION

STUDENT LOAN INTEREST DEDUCTION WORKSHEET

5625

5015

TOTAL INTEREST PAID IN CURRENT YEAR ON QUALIFIED STUDENT LOANS

TOTAL MILITARY INCOME INCLUDED IN FEDERAL ADJUSTED GROSS INCOME

5675

35 DOMESTIC PRODUCTION ACTIVITIES DEDUCTION

OTHER ADJUSTMENTS

[32]

OTHER ADJUSTMENT ITEMS

FEDERAL

SUBTRACTIONS

ADDITIONS

36

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

PART II - ADJUSTMENTS TO FED ITEMIZED DEDUCTIONS

5178

5328

5004

38 FEDERAL ITEMIZED DEDUCTIONS FROM SCHEDULE A

39 FOREIGN INCOME TAXES PAID

CA LOTTERY LOSSES INCLUDED IN FEDERAL ITEMIZED DEDUCTIONS

OTHER ADJUSTMENTS

[89]

DESCRIPTION

AMOUNT

41

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

THE REMAINDER OF SCHEDULE CA (540) IS ON DATASHEET 6

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT5

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 6

NRA1

2011

CA FORM CA (540 NR) - ADJUSTMENTS PG 1

DURING CURRENT YEAR

MILITARY:

1

TAXPAYER

a

DOMICILED IN (2 LETTER STATE CODE)

b

STATIONED IN (STATE OR COUNTRY)

6520

6523

5005

TOTAL MILITARY PAY

SPOUSE

[2]

[10]

6032

6524

5006

[2]

[10]

BECAME RESIDENT:

2

6505

-

6035

-

6506

6507

-

6521

-

6508

STATE OF PRIOR RESIDENCE (2-LETTER STATE CODE)

DATE OF MOVE

[2]

6036

-

-

6522

-

-

[2]

BECAME NONRESIDENT:

3

NEW STATE OF RESIDENCE (2-LETTER STATE CODE)

DATE OF MOVE

4

[2]

[2]

NONRESIDENT ALL YEAR:

6519

5219

6079

STATE OR COUNTRY OF RESIDENCE

5

TOTAL NUMBER OF DAYS SPENT IN CALIFORNIA FOR ANY PURPOSE

6

OWNED HOME OR PROPERTY IN CALIFORNIA DURING CURRENT YEAR

[10]

[3]

YES

6031

5220

6080

[10]

[3]

YES

BEFORE CURRENT YEAR

TAXPAYER

7

6029

6037

6026

6025

DATE OF CALIFORNIA RESIDENCY : FROM

DATE OF CALIFORNIA RESIDENCY: TO

8

DATE ENTERED CALIFORNIA

9

DATE LEFT CALIFORNIA

-

SPOUSE

-

6030

6038

6027

6028

-

-

PART II - INCOME ADUSTMENT SCHEDULE

6479

PERCENT OF FEDERAL AMOUNTS ATTRIBUTABLE TO CA (OPTIONAL)

SECTION A - INCOME

ADJUSTMENTS

(B) SUBTRACTIONS

7

WAGES, SALARIES, TIPS, ETC.

8

TAXABLE INTEREST INCOME

9

DIVIDEND INCOME

5413

5158

5289

5155

10 STATE TAX REFUND

11 ALIMONY RECEIVED

5294

5165

5560

5161

5162

5163

5566

5156

5157

12 BUSINESS INCOME OR (LOSS)

13 CAPITAL GAIN OR (LOSS)

14 OTHER GAINS OR (LOSSES)

15

b

TAXABLE IRA DISTRIBUTION

16

b

TAXABLE PENSIONS AND ANNUITIES

17 RENTS, ROYALTIES, PARTNERSHIPS, ESTATES, TRUSTS, ETC.

18 FARM INCOME OR (LOSS)

19 UNEMPLOYMENT COMPENSATION

20

b

TAXABLE SOCIAL SECURITY BENEFITS

(C) ADDITIONS

5414

5170

5551

5389

5622

5391

5553

5295

5173

5561

5563

5564

5171

5567

5392

5393

5394

5396

5397

5399

5400

5401

5402

OTHER INCOME

21

(E) CALIFORNIA

AMOUNTS

a

CALIFORNIA LOTTERY

b

DISASTER LOSS CARRYOVER FROM FTB 3805V

d

NOL CARRYOVER FROM FTB 3805V

e

NOL FROM FTB 3805Z OR FTB 3806

f

OTHER DESCRIBE

6007

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

[15]

OPTIONAL

OVERRIDE

5160

5418

5419

5570

5398

KEYFIELD

5404

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT6

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 7

NRA2

2011

CA FORM CA (540 NR) - ADJUSTMENTS PG 2

PART II - INCOME ADJUSTMENT SCHEDULE

ADJUSTMENTS

SECTION B - ADJUSTMENTS

(B) SUBTRACTIONS

24

CALIFORNIA

(E) AMOUNTS

(C) ADDITIONS

CERTAIN BUSINESS EXPENSES OF RESERVISTS, PERFORMING ARTISTS, AND

FEE-BASIS GOVERNMENT OFFICIALS

5650

5652

5577

5407

5409

5408

5410

5411

26 MOVING EXPENSES

27 ONE-HALF SELF-EMPLOYMENT TAX

28 KEOGH OR SEP DEDUCTION

29 SELF-EMPLOYED HEALTH INSURANCE DEDUCTION

30 PENALTY EARLY WITHDRAWAL OF SAVINGS

5585

ALIMONY PAID

RECIPIENT'S LAST NAME

[30]

RECIPIENTS SSN

-

31

AMOUNT PAID

-

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

5405

5578

32 IRA DEDUCTIONS

33 STUDENT LOAN INTERST DEDUCTION

STUDENT LOAN INTEREST DEDUCTION WORKSHEET

TOTAL INTEREST PAID IN CURRENT YEAR ON QUALIFIED STUDENT LOANS. DO NOT INCLUDE INTEREST THAT WAS REQUIRED TO BE PAID AFTER THE

FIRST 60 MONTHS OR INTEREST FOR VOLUNTARY PAYMENTS

5625

5015

5677

TOTAL MILITARY INCOME INCLUDED IN FEDERAL AGI

5675

35 DOMESTIC PRODUCTION ACTIVITIES DEDUCTION

OTHER ADJUSTMENTS

OTHER ADJUSTMENT ITEMS

FEDERAL

[10] SUBTRACTIONS [10]

ADDITIONS

[10]

CA AMOUNTS

[10]

36

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

PART III - ADJUSTMENTS TO FEDERAL ITEMIZED DEDUCTIONS

5178

5328

5181

38 FEDERAL ITEMIZED DEDUCTIONS FROM FEDERALSCHEDULE A

39 FOREIGN INCOME TAXES PAID

41

OTHER ADJUSTMENTS

6008

SPECIFY

D

[19]

CAPITAL GAIN (LOSS) ADJUSTMENT

NOTE: LINE 1 PROPERTY ADJUSTMENTS ARE MADE ON THE FEDERAL SCHEDULE D (STATE

IF DIFFERENT) COLUMN. OTHER LINE 1 ADJUSTMENTS ARE LISTED BELOW. ENTER

AMOUNTS ONLY IF THEY ARE DIFFERENT FROM THE FEDERAL.

SHORT-TERM

FORM 2119 CA GAIN IF DIFF

1

a

FORM 6252 CA GAIN IF DIFF

FORM 8824 CA GAIN IF DIFF

5359

5360

5216

CA GAIN (LOSS) FROM 4797 IF DIFFERENT

b

QUALIFIED SMALL BUSN STOCK SALES PRICE

QUALIFIED SMALL BUSN STOCK COST OR BASIS

LONG-TERM

5571

5572

5217

5575

5093

5094

LOSS

2

CA GAIN OR LOSS FROM

SCHEDULES K-1 IF DIFFERENT

3

CA CAPITAL GAIN IF DIFFERENT

4

TOTAL CURRENT YEAR GAINS FROM ALL SOURCES

5

TOTAL CURRENT YEAR LOSSES

6

5361

CA CAPITAL LOSS CARRYOVER FROM PRIOR YEAR

CA CAP LOSS CARRYOVER FROM 1041 K-1 RECEIVED

10 AMOUNTS FROM FEDERAL FORM 1040, LINE 13

FULL YEAR NONRESIDENTS ONLY:

PRIOR YR CAPITAL LOSS CARRYOVER BASED OFF OF

AMOUNTS EARNED OR RECEIVED FROM CA SOURCES

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

GAIN

5573

5574

5196

5197

5198

5635

5226

5017

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT7

CA

G1

CA SCH G-1 - TAX ON LUMP SUM DISTRIBUTIONS

CR

PART II - CAPITAL GAIN ELECTION

USE 5.5% CAPITAL GAIN ELECTION

CAPITAL GAIN FROM BOX 3 OF

6

FEDERAL FORM 1099-R

6058

YES

5327

PART III - 10-YEAR AVERAGING

ORDINARY INCOME (FROM

1099-R, BOX 2 MINUS BOX 3)

5329

9

DEATH BENEFIT EXCLUSION

CURRENT ACTUARIAL VALUE

11

OF ANNUITY

6093

5421

PRISON INMATE LABOR CREDIT (FORM FTB 3507)

ENTERPRISE ZONE EMPLOYEE CREDIT (FORM FTB 3553)

NONREFUNDABLE CHILD AND DEPENDENT CARE EXPENSES

SECTION A2 - HAVE CARRYOVER PROVISIONS

CA SCH P (540) - ALT MIN TAX & CREDIT LIMITATIONS

6077

FORCE PRINTING OF SCHEDULE P

COMMUNITY DEVELOPMENT FINANCIAL INSTITUTION DEPOSITS CR

DISABLED ACCESS CREDIT (FTB 3548)

YES

PART I - ADJUSTMENTS AND PREFERENCES

MEDICAL AND DENTAL EXPENSE

3

PERSONAL AND REAL PROPERTY TAXES

HOME MORTGAGE INTEREST NOT USED TO BUY, BUILD

OR IMPROVE THE HOME

MISCELLANEOUS ITEMIZED DEDUCTIONS FROM

SCHEDULE A, LINE 24

4

5

6

REFUND OF PERSONAL AND REAL PROPERTY TAXES

7

INVESTMENT INTEREST EXPENSE

8

POST - 1986 DEPRECIATION

9

ADJUSTED GAIN OR (LOSS)

10 INCENTIVE STOCK OPTIONS

11 PASSIVE ACTIVITIES

12 BENEFICIARIES OF ESTATES AND TRUSTS

13

a

CIRCULATION EXPENDITURES

b

DEPLETION

c

INSTALLMENT SALES

d

INTANGIBLE DRILLING COSTS

e

LONG-TERM CONTRACTS - AFTER 02-28-1986

f

LOSS LIMITATIONS

g

MINING COSTS

h

PATRON'S ADJUSTMENT

i

QUALIFIED SMALL BUSINESS STOCK

j

RESEARCH AND EXPERIMENTAL

k

TAX SHELTER FARM ACTIVITIES

l

RELATED ADJUSTMENTS

17 AMTI EXCLUSION

20 ALTERNATIVE MINIMUM TAX NOL DEDUCTION

DONATED AGRICULTURAL PRODUCTS TRANSFER CR (FTB 3547)

EMPLOYER CHILD CARE PROGRAM CREDIT

5298

5299

5301

EMPLOYER CHILD CARE CONTRIBUTION CREDIT

ENHANCED OIL RECOVERY (FTB 3546)

ENVIROMENTAL TAX

5203

JOINT STRIKE FIGHTER - WAGES

JOINT STRIKE FIGHTER - PROPERTY COSTS

5300

5302

5303

5304

5310

5204

5313

5314

5305

5316

5309

5320

5307

5311

5306

5319

5388

5318

5312

5205

5520

5166

FARM WORKER HOUSING CR (NEW CONSTR/REHAB LOANS)

LAMBRA HIRING, SALES & USE TAX CREDIT (FTB 3807)

MEA HIRING CREDIT (FTB 3808)

MOTION PICTURE AND TELEVISION PRODUCTION CREDIT

NEW JOBS CREDIT (FTB 3527

PRIOR YEAR ALT MINIMUM TAX CREDIT (FTB 3510)

RICE STRAW CREDIT

SOLAR ENERGY SYSTEM CARRYOVER

AGRICULTURAL PRODUCTS CREDIT CARRYOVER

CARRYOVER

RIDESHARING

CREDIT

CARRYOVER

FORM FTB 3540

LARGE EMPLOYER PROGRAM CARRYOVER

SMALL EMPLOYER PROGRAM CARRYOVER

TRANSIT PASSES CARRYOVER

EMPLOYEE CARRYOVER

ENERGY CONSERVATION CREDIT CARRYOVER (FTB 3540)

LOW EMISSION VEHICLES CREDIT CARRYOVER (FTB 3540)

POLITICAL CONTRIBUTIONS CREDIT CARRYOVER (FTB 3540)

RECYCLING EQUIPMENT CREDIT CARRYOVER (FTB 3540)

RESIDENTIAL RENTAL & FARM SALES CREDIT C/O (FTB 3540)

SALMON STEELHEAD TROUT HABITAT RESTORATION C/O (FTB 3540)

SOLAR ENERGY CREDIT CARRYOVER (FTB 3540)

SOLAR PUMP CREDIT CARRYOVER (FTB 3540)

PART II - ALTERNATIVE MINIMUM TAXABLE INCOME

22 EXEMPTION AMOUNT

5321

5322

5323

5238

5239

5472

PRIOR YEAR NEW HOME CREDIT

P

2

SECTION A1 - HAVE NO CARRYOVER PROVISIONS

2009 NEW HOME CREDIT

FIRST TIME BUYER CREDIT

5331

YES

SECTION A - CREDITS THAT REDUCE EXCESS TAX

YES

5325

5330

STANDARD DEDUCTION (FORM 540, LINE 18)

CA SCH P, PART III - CREDITS THAT REDUCE TAX

6197

SPOUSE

5326

5420

1

2011

FORCE PRINTING OF SCHEDULE P CREDITS PAGE

TAXPAYER

8

LAST NAME

CALIFORNIA 1040 DATA SHEET 8

WATER CONSERVATION CREDIT CARRYOVER (FTB 3540)

5025

YOUNG INFANT CREDIT CARRYOVER (FTB 3540)

5036

5033

5034

5253

5254

5035

5026

5027

5028

5037

5032

5268

5308

5040

5267

5038

5029

5256

5244

5245

5246

5247

5248

5251

5241

5242

5255

5252

5031

5265

5250

5249

5243

SEC. B - CREDITS THAT MAY REDUCE TAX BELOW TENTATIVE MIN TAX

SECTION B1 - HAVE NO CARRYOVER PROVISIONS

JOINT CUSTODY HOH CREDIT

DEPENDENT PARENT CREDIT

SENIOR HEAD OF HOUSEHOLD CR

NONREFUNDABLE RENTER'S CREDIT

6096

6097

6091

6100

5235

5236

5237

5492

YES

YES

YES

YES

SECTION B2 - HAVE CARRYOVER PROVISIONS

CHILD ADOPTION CREDIT

ENTERPRISE ZONE HIRING/SALES & USE TAX (FTB 3805Z)

LOW INCOME HOUSING CREDIT (FTB 3521)

NATURAL HERITAGE PRESERVATION (FTB 3503)

RESEARCH CREDIT (FTB 3523)

TARGETED AREA HIRING AND SALES OR USE TAX (FTB 3809)

MANUFACTURER'S INVESTMENT CREDIT CARRYOVER (FTB 3540)

COMMERCIAL SOLAR ENERGY CREDIT CARRYOVER

COMMERCIAL SOLAR ELECTRIC SYSTEMS CR CARRYOVER

LA REVITALIZATION ZONE HIRING / SALES USE TAX (FTB 3806)

ORPHAN DRUG CREDIT CARRYOVER (FTB 3540)

SOLAR ENERGY CREDIT CARRYOVER (FTB 3540)

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

5257

5258

5262

5240

5264

5259

5030

5266

5263

5260

5261

5265

ADD-TO

11CADAT8

CA

PNR1

LAST NAME

CALIFORNIA 1040 DATA SHEET 9

CA SCH P(540NR) - ALT MIN TX/CR LIMIT PG1

6077

FORCE PRINTING OF SCHEDULE P(NR)

2011

YES

PART I - ADJUSTMENTS AND PREFERENCES

1

STANDARD DEDUCTION (FORM 540NR, LINE 18)

2

MEDICAL AND DENTAL EXPENSE

3

PERSONAL AND REAL PROPERTY TAXES

HOME MORTGAGE INTEREST NOT USED TO BUY,

BUILD OR IMPROVE THE HOME

MISCELLANEOUS ITEMIZED DEDUCTIONS

FROM SCHEDULE A, LINE 24

4

5

6

REFUND OF PERSONAL AND REAL PROPERTY TAXES

7

INVESTMENT INTEREST EXPENSE

8

POST - 1986 DEPRECIATION

9

ADJUSTED GAIN OR (LOSS)

10 INCENTIVE STOCK OPTIONS

11 PASSIVE ACTIVITIES

12 BENEFICIARIES OF ESTATES AND TRUSTS

13

a

CIRCULATION EXPENDITURES

b

DEPLETION

c

INSTALLMENT SALES

d

INTANGIBLE DRILLING COSTS

e

LONG-TERM CONTRACTS - AFTER 02-28-1986

f

LOSS LIMITATIONS

g

MINING COSTS

h

PATRON'S ADJUSTMENT

i

QUALIFIED SMALL BUSINESS STOCK

j

RESEARCH AND EXPERIMENTAL

k

TAX SHELTER FARM ACTIVITIES

l

RELATED ADJUSTMENTS

17 AMTI EXCLUSION

20 ALTERNATIVE MINIMUM TAX NOL DEDUCTION

PNR2

5298

5299

5301

5203

5300

5302

5303

5304

5310

5204

5313

5314

5305

5316

5309

5320

5307

5311

5306

5319

5388

5318

5312

5205

5520

5166

CA SCH P(540NR) - ALT MIN TAX/CR LIMIT PG2

PART II - ALTERNATIVE MINIMUM TAX

22 EXEMPTION AMOUNT

26 NOL DEDUCTION INCLUDED ON SCHEDULE CA(NR)

27 AMTI EXCLUSION

29

a

INVESTMENT INTEREST EXPENSE

b

POST - 1986 PROPERTY DEPRECIATION

c

ADJUSTED GAIN OR LOSS

d

INCENTIVE STOCK OPTIONS

e

PASSIVE ACTIVITY LOSS

f

BENEFICIARIES OF ESTATES AND TRUSTS

g

CIRCULATION EXPENDITURES

h

DEPLETION

i

INSTALLMENT SALES OF CERTAIN PROPERTIES

j

INTANGIBLE DRILLING COSTS

k

LONG-TERM CONTRACTS ENTERED AFTER 02-28-1986

l

LOSS LIMITATIONS

m

MINING COSTS

n

PATRONS' ADJUSTMENTS

o

QUALIFIED SMALL BUSINESS STOCK

p

RESEARCH AND EXPERIMENTAL

q

TAX SHELTER FARM ACTIVITES

r

RELATED ADJUSTMENTS

31 CA ALTERNATIVE MINIMUM TAX NOL DEDUCTION

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

5025

5376

5522

5395

5284

5274

5207

5277

5278

5269

5279

5273

5283

5271

5275

5270

5521

5282

5234

5276

5164

5166

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT9

CA

S

CA SCH S - CR FOR TAXES PD TO OTHER ST

MULTIPLE

3511

ENTRY REQUIRED ON 1ST MULTIPLE ONLY (LINES 2, 4, & 12)

AUTOMATE CREDIT

6006

5288

5370

(DEFAULT = YES)

2

CALIFORNIA TAX LIABILITY

4

CA AGI PLUS LUMP SUM DISTRIBUTIONS

TOTAL OTHER STATE TAX CREDIT

(OVERRIDES TOTAL FROM ALL MULTIPLES)

12

INCOME ITEM DESCRIPTION

[23]

6010

6046

6047

6571

AGI TAXABLE TO OTHER STATE

OTHER STATE TAX CREDIT

12

(OVERRIDES THIS MULTIPLE ONLY)

1

ULTRA LOW SULFUR DIESEL FUEL PRODUCED (IN GALLONS)

3

QUALIFIED CAPITAL COSTS LIMITATION

TOTAL ULTRA LOW SULFUR DIESEL FUEL PRODUCTION

CREDITS ALLOWED FOR ALL PRIOR YEARS

ULTRA LOW SULFUR DIESEL FUEL PRODUCTION CREDITS

FROM PASS-THROUGH ENTITIES

4

7

6009

5228

5230

9

6573

[20]

PART I - CURRENT YEAR CREDIT

PART II - COMPUTATION OF OTHER STATE TAX CREDIT

TAX AMOUNT PAID TO OTHER STATE

[30]

SECRETARY OF STATE NUMBER

5493

5494

5495

STATE TO WHICH TAXES WERE PAID

[50]

ZIP CODE, CITY AND STATE

OTHER ST INC

5489

5490

5491

CA FORM 3511 - ENVIRONMENTAL TAX CR

6570

NO

5233

CA INCOME

2011

ADDRESS OF FACILITY

PART I - COMPUTATION OF DOUBLE TAXED INCOME

7

LAST NAME

CALIFORNIA 1040 DATA SHEET 10

[2]

9

CREDIT CARRYOVER FROM PRIOR YEAR(S)

1

CREDIT RECAPTURE

9001

9002

9003

9004

9005

PART II - CREDIT RECAPTURE

5359

9006

EXT

CA FORM 3519 - PAY VOUCHER FOR EXT

6128

6129

PREPARE CALIFORNIA EXTENSION WITH FULL RETURN

1 TAX EXPECTED TO OWE

5208

a CALIFORNIA INCOME TAX WITHHELD

5209

2

b CALIFORNIA ESTIMATED INCOME TAX PAYMENTS

5210

c OTHER PAYMENTS AND CREDITS

5211

5497

FORM 3519 EXTENSION PAYMENT AMOUNT

PREPARE CALIFORNIA EXTENSION ONLY

35061

CA FORM 3506 - CHILD & DEP CARE EXP - PG 1

SUPPRESS FORM 3506

6312

YES

PART I - EARNED INCOME & OTHER FUNDS RECEIVED IN CURRENT YEAR

6300

CARRY UNEARNED INCOME FROM FEDERAL

YES

UNEARNED INCOME DESCRIPTION & AMOUNTS

SOURCE OF INCOME/FUNDS

[35]

AMOUNT

YES

YES

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

PART II - PERSONS OR ORGANIZATIONS WHO PROVIDED CARE IN CA

IF CARE WAS PROVIDED IN A LOCATION OTHER THAN THE PROVIDER'S ADDRESS:

CARE PROVIDER #1:

ADDRESS:

CITY/ST/ZIP:

6301

6302

[25]

[25]

CARE PROVIDER #2:

ADDRESS:

CITY/ST/ZIP:

6303

6304

[25]

[25]

CARE PROVIDER #3:

ADDRESS:

CITY/ST/ZIP:

6305

6306

[25]

[25]

CARE PROVIDER #4:

ADDRESS:

CITY/ST/ZIP:

6307

6308

[25]

[25]

CARE PROVIDER #5:

ADDRESS:

CITY/ST/ZIP:

6309

6310

[25]

[25]

PART III - CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES

4

TAXPAYER'S EARNED INCOME

5

SPOUSES' EARNED INCOME (IF MARRIED FILING JOINT)

35062

5601

5602

CA FORM 3506 - CHILD & DEP CARE EXP - PG 2

WORKSHEET - CR FOR PY EXPENSES PAID IN CY

1

PRIOR YEAR QUALIFIED EXPENSES PAID IN PRIOR YEAR

2

PRIOR YEAR QUALIFIED EXPENSES PAID IN CURRENT YEAR

ANY DEPENDENT CARE BENEFITS RECEIVED FOR PRIOR

YEAR & EXCLUDED FROM INCOME

5

7

TAXPAYER'S PRIOR YEAR EARNED INCOME

SPOUSE'S PRIOR YEAR EARNED INCOME

9

AMOUNT FROM PRIOR YEAR FORM FTB 3506, LINE 6

11 PRIOR YEAR FEDERAL AGI

14 PRIOR YEAR CALIFORNIA AGI

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

5608

5609

5610

5611

5612

5613

5614

5615

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT10

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 11

3567

CA FORM 3567 - INSTALL AGREE REQUEST

6005

5074

TOTAL ACCOUNT BALANCE FROM PRIOR YEARS

TOTAL BALANCE FOR INSTALLMENT AGREEMENT

5082

PREPARE INSTALLMENT AGREEMENT FORM 3567

1

2

3

4

AMT TO BE PAID EACH MONTH. INTEREST & PENALTY

CHARGES WILL CONTINUE UNTIL THE BALANCE IS PAID

PROPOSED DAY OF MONTH FOR BANK TRANSFER OF FUNDS

(DATE BETWEEN THE 1ST & 28th)

BANK ROUTING OR TRANSIT NO.

CHECKING OR SAVINGS ACCT. NO.

TYPE OF ACCOUNT: 1- Checking

NAME OF BANK

PART I - CHILD'S NET INVESTMENT INCOME

NUMBER OF EXEMPTIONS CLAIMED ON PARENT'S RETURN

1

CHILD'S INVESTMENT INCOME

2

CHILD'S ITEMIZED DEDUCTIONS OR $1900

6

PARENT'S TAXABLE INCOME FROM FORM 540

7

TOTAL INVESTMENT INCOME - ALL OTHER CHILDREN

5292

5454

5455

[2]

PART II - TENTATIVE TAX BASED ON PARENT'S TAX RATE

6133

[19]

10 PARENTS TAX FROM FORM 540

6138

[50]

ADDRESS OF BANK

TAX ON LINE 8 BASED ON THE PARENT'S FILING STATUS

15 TAX ON LINE 14 BASED ON THE CHILD'S FILING STATUS

18 PARENT'S 540(NR), LINE 25a PERCENTAGE

6134

5456

5457

5458

NONRESIDENT FILERS ONLY

9

6132

5

CA FORM 3800 - TAX COMP FOR DEP FILERS

YES

5075

6135

6136

2- Savings

3800

2011

5290

5291

6299

[50]

CITY, STATE, ZIP

6480

[50]

I HAVE READ AND AGREE TO THE TAXPAYER INSTALLMENT

CONDITIONS ON PAGE 1 OF THE 3567 BOOKLET AND IF MY

BALANCE IS GREATER THAN $10,000 OR PAYMENT IS OVER

36 MONTHS, I CERTIFY I HAVE A FINANCIAL HARDSHIP

6481

CA FORM 3576 - INDIV TAX DEPOSIT VOUCHER

6192

6193

PREPARE FORM 3576 WITH FULL RETURN

6175

TAXABLE YEAR

YES

3576

PREPARE FORM 3576 ONLY

YES

YES

PAYMENT DUE TO

1- Federal audit

2- CA audit

3- Other

AMOUNT OF PAYMENT

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

6176

5476

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT11

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 12

2011

USE 2106 DATA SHEET FOR ALL EMPLOYEE BUSINESS DEPRECIATION

3885A

MULTIPLE

TYPE OF ACTIVITY:

1

CA FORM 3885A - DEPRECIATION AND AMORTIZATION ADJUSTMENTS

6550

BUSINESS ACTIVITY

[28]

1- Schedule C Activity

6082

6549

2- Schedule F Activity

PASSIVE ACTIVITY

YES

PART II - ELECTION TO EXPENSE CERTAIN TANGIBLE PROPERTY (SECTION 179)

NOTE:

THE ASSET MANAGER AUTOMATICALLY CALCULATES LINES 5, 7, 11, AND 13. IF THE ASSET MANAGER IS NOT USED FOR THIS RETURN, MAKE ENTRIES HERE.

DESCRIPTION OF PROPERTY

[25]

6535

6536

TOTAL COST

ELECTED COST

5896

5898

5897

5899

5061

5062

5060

5063

CARRYOVER OF DISALLOWED DEDUCTIONS

TAXABLE INCOME

2

OVERRIDE SECTION 179 CALCULATION

TOTAL COST OF SECTION 179 PROPERTY PLACED IN SERVICE DURING THE CURRENT TAX YEAR

PART III - DEPRECIATION

DESCRIPTION OF PROPERTY PLACED

IN SERVICE DURING CURRENT YEAR

[25]

DEPRECIATION

DATE PLACED

CA BASIS

IN SERVICE

-

METHOD

[5]

LIFE / RATE

[4]

CURRENT YEAR

CA DEPRECIATION

-

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

5

CA DEPRECIATION FOR ASSETS BEFORE CURRENT YEAR

7

TOTAL FEDERAL DEPRECIATION

5187

5189

PART IV - AMORTIZATION

DESCRIPTION OF COSTS

AMORTIZABLE DURING CURRENT YEAR

[25]

AMORTIZATION

DATE PLACED

CA BASIS

IN SERVICE

-

CODE

SECTION

[5]

PERIOD OR %

[4]

CURRENT YEAR

CA AMORTIZATION

-

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

5415

5193

11 CALIFORNIA AMORTIZATION COSTS FOR ASSETS BEFORE CURRENT YEAR

13 TOTAL FEDERAL AMORTIZATION

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT12

CA

3526

1

2

4

CA FORM 3526 - INVEST INT EXPENSE DEDUCT

INTEREST EXPENSE ON INVESTMENT DEBTS PAID OR

INCURRED IN CURRENT YEAR

DISALLOWED INVESTMENT INTEREST EXPENSE

GROSS INCOME FROM PROPERTY HELD FOR

a

INVESTMENT

NET GAIN FROM DISPOSITION OF PROPERTY HELD

b

FOR INVESTMENT

NET CAPITAL GAIN FROM DISPOSITION

c

OF PROPERTY HELD FOR INVESTMENT

e

5

AMT OF LINE 4c INCLUDED IN INVEST INCOME

INVESTMENT EXPENSES

3553

LAST NAME

CALIFORNIA 1040 DATA SHEET 13

5805

CA FORM 5805 - UNDERPAYMENT OF ES TAX

6099

SUPPRESS PRINTING OF FORM 5805/5805F

6172

90% OF CA WAGES SUBJECT TO CA WITHHOLDING

6102

CARRY PENALTY TO FORM 540

6218

PREPARE FORM 5805-F

6249

FORCE PRINTING OF FORM 5805/5805F

5285

5429

5286

5095

REQUEST WAIVER

REQUESTED WAIVER AMOUNT

1

CA FORM 3553 - ENT ZONE EMPLOYEE CR

2

STEP 1 - QUALIFICATION CHECKLIST

2

TAXPAYER OR SPOUSE WORK FOR THE UNITED STATES

GOVERNMENT, THE STATE OF CA, OR A CITY OR COUNTY

GOVERNMENT LOCATED IN CA

6236

50% OR MORE OF THE HOURS WORKED FOR THE EMPLOYER

WERE PERFORMED AT THE EMPLOYER'S LOCATION IN

THE ENTERPRISE ZONE:

6237

6

1

2

STEP 2 - FORM 3553

TOTAL AMOUNT OF WAGES THE TAXPAYER EARNED

WORKING IN AN ENTERPRISE ZONE

TOTAL AMOUNT OF WAGES THE SPOUSE EARNED WORKING

IN AN ENTERPRISE ZONE

5514

TOTAL AMOUNT OF EMLOYEE BUSINESS EXPENSES PAID

11

RELATING TO WORK IN THE ENTERPRISE ZONE

5529

YES

2

3

CHILD'S ORDINARY DIVIDENDS

CHILD'S DIVIDEND INCOME FROM NOMINEE

DISTRIBUTIONS

CHILD'S CAPITAL GAIN DISTRIBUTIONS

CHILD'S CAPITAL GAIN NOMINEE DISTRIBUTIONS

EQUAL INSTALLMENTS NOT APPLICABLE

ESTATES & TRUSTS: DATE OF DEATH WAS LESS THAN 2

YEARS FROM END OF TAX YEAR

6086

5371

0- Not applicable, enter

Prior Year tax above

1- No Prior Year tax liability

2- PY return not filed / tax

liability unknown (CY tax only)

3- PY was less than 12 month

(penalty based CY tax only)

CURRENT YEAR ADJUSTED GROSS INCOME

12 NUMBER OF DAYS PAID BEFORE 04-15-2012

JAN 1 - MAR 31

1

YES

4

3200

3201

3202

3203

CA AGI FOR

EACH PERIOD

ITEMIZED DED

EACH PERIOD

FED AGI

EACH PD

CA AMTS INCL IN

FED SCH A LNS

4, 13 &19 PLUS

GMBLNG LOSS

TAX PER

10

PERIOD

11 EXEMPT

3204

3205

3018

13 CR AMOUNTS

APR 1 - MAY 31

CA FORM 3805P - ADDL TAX ON IRA'S ETC

6121

EARLY DISTRIBUTIONS PENALIZED AT 6% ('S' ON 1099R)

DISTRIBUTIONS EXCEPTED FROM ADDITIONAL TAX

2

NUMBER FOR EXCEPTION

SIMPLE DISTRIBUTIONS EXCEPTED FROM ADD'L TAX

5830

5831

5832

5834

5835

5836

5854

5855

5856

5858

5859

5860

5838

5842

5846

5839

5843

5847

5840

5844

5848

5377

5378

5379

5380

3RD QUARTER ENDING 09-15-2011

YES

4TH QUARTER ENDING 01-15-2012

OVERRIDE WITHHOLDING AND ESTIMATED PAYMENTS

5468

5057

5281

5467

5058

WITHHOLDING PAYMENTS (IF NOT EQUAL)

TAXABLE AMT FROM FORM 1099-Q INCL IN INCOME

6

DISTRIBUTIONS EXCEPTED FROM ADDITIONAL TAX

2ND QUARTER ENDING 06-15-2011

3RD QUARTER ENDING 09-15-2011

4TH QUARTER ENDING 01-15-2012

UNDERPAYMENT PENALTY (OVERRIDE CALCULATION)

5059

5051

5085F - UNDERPAYMENT FOR FARMERS AND FISHERMEN

9

TAXABLE MSA DISTRIB FROM FORM 8853 LINE 10

a MEET ANY EXCEPTIONS TO 10% TAX

ADDITIONAL TAX DUE FROM MEDICARE+CHOICE

11

MSA DISTRIBUTIONS (FORM 8853)

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

5460

CY TAX AFTER CREDITS - FORM 540, LINE 34

PART III - TAX ON DISTRIBUTIONS FROM MSAs

10

5381

5382

5383

5384

5154

1ST QUARTER ENDING 04-15-2011

PART II - TAX ON DISTRIB FROM EDUCATIONAL IRAs NOT USED FOR EDU

5

6247

5019

5100

OVERRIDE TAX LIABILITY

PART I - TAX ON EARLY DISTRIBUTIONS

1

YES

JUNE 1 - AUG 31

1ST QUARTER ENDING 04-15-2011

FILING FORM 3805P BY ITSELF AND NOT WITH TAX RETURN

EARLY DISTRIBUTION INCLUDED IN GROSS INCOME

YES

PART III - ANNUALIZED INCOME INSTALLMENT METHOD

2ND QUARTER ENDING 06-15-2011

3805P

YES

PRIOR YEAR TAX OPTIONS:

YES

FIGURE CHILD'S INTEREST & DIVIDEND AMOUNTS TO REPORT

CHILD'S TAX EXEMPT INTEREST INCOME

4

5

CA FORM 3803 - CHILD'S INT & DIV(S)

6204

b

6084

5020

5021

5022

5023

6179

2ND QUARTER

3RD QUARTER

YES

SUPPRESS PRINTING OF FORM 3803

CHILD'S TAXABLE INTEREST

CHILD'S INTEREST INCOME FROM

NOMINEE DISTRIBUTIONS

YES

[70]

1ST QUARTER

YES

6239

10 TOTAL AMOUNT OF ENTERPRISE ZONE WAGES

a

NO

YES

6083

5445

6104

USE ANNUALIZED INCOME INSTALLMENT METHOD

PRIOR YEAR TAX LIABILITY

5515

5528

1

YES

WAIVER EXPLANATION:

4TH QUARTER

6238

3803

YES

3

90% OR MORE OF THE HOURS WORKED FOR THE EMPLOYER

RELATED TO THE EMPLOYER'S BUSINESS ACTIVITY

WERE LOCATED IN THE ENTERPRISE ZONE

THE TAXPAYER AND SPOUSE BOTH WORKED IN AN

ENTERPRISE ZONE AND QUALIFY FOR THE CREDIT

MULTIPLE

YES

IF CA WITHHOLDING NOT WITHHELD EQUALLY, AMOUNT WITHHELD PER QUARTER:

6235

TAXPAYER OR SPOUSE WORKED IN AN ENTERPRISE ZONE

4

YES

PART I - QUESTIONS

5096

5097

5287

1

3

2011

PRIOR YEAR TAX OPTIONS:

5067

6107

9

YES

5070

0- Not applicable, enter

PY tax above

1- No PY tax liability

2- PY return not filed / tax

liability unknown (CY tax only)

3- PY was less than 12 months

(penalty based CY tax only)

10

a PY TAX ON LUMP SUM DISTRIB - FORM 540, LINE 34

DATE UNDERPAYMENT PAID OR 04-15-2012, WHICHEVER IS

15

EARLIER

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

6248

5461

6041

ADD-TO

11CADAT13

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 14

3527

2011

CA FORM 3527 - NEW JOBS CREDIT

6338

SECRETARY OF STATE (SOS) FILE NUMBER

[12]

PART 1 - NET INCREASE IN QUALIFIED FULL-TIME EMPLOYEES

SECTION A - PRIOR TAXABLE YEAR

1

NUMBER OF QUALIFIED FULL-TIME HOURLY AND SALARIED EMPLOYEES THAT WERE EMPLOYED FOR THE ENTIRE TAXABLE YEAR

2

NUMBER OF QUALIFIED FULL-TIME HOURLY EMPLOYEES THAT WERE EMPLOYED FOR LESS THAN 52 WEEKS DURING THE TAXABLE YEAR

3

TOTAL NUMBER OF HOURS WORKED BY EMPLOYEES IN LINE 2 (NOT TO EXCEED 2,000 HOURS PER EMPLOYEE)

5

NUMBER OF QUALIFIED FULL-TIME SALARIED EMPLOYEES THAT WERE EMPLOYED FOR LESS THAN 52 WEEKS DURING THE TAXABLE YEAR

6

TOTAL NUMBER OF WEEKS WORKED BY EMPLOYEES IN LINE 5

9215

9216

9217

9218

9219

[4]

9210

9211

9212

9213

9214

[4]

[4]

[6]

[4]

[4]

SECTION B - CURRENT TAXABLE YEAR

9

NUMBER OF QUALIFIED FULL-TIME HOURLY AND SALARIED EMPLOYEES THAT WERE EMPLOYED FOR THE ENTIRE TAXABLE YEAR

10 NUMBER OF QUALIFIED FULL-TIME HOURLY EMPLOYEES THAT WERE EMPLOYED FOR LESS THAN 52 WEEKS DURING THE TAXABLE YEAR

11 TOTAL NUMBER OF HOURS WORKED BY EMPLOYEES IN LINE 10 (NOT TO EXCEED 2,000 HOURS PER EMPLOYEE)

13 NUMBER OF QUALIFIED FULL-TIME SALARIED EMPLOYEES THAT WERE EMPLOYED FOR LESS THAN 52 WEEKS DURING THE TAXABLE YEAR

14 TOTAL NUMBER OF WEEKS WORKED BY EMPLOYEES IN LINE 13

[4]

[6]

[4]

[4]

PART II - CREDIT COMPUTATION

9205

9209

9220

19 PASS-THROUGH NEW JOBS CREDIT(S) FROM SCH K-1 (100S, 541, 565, OR 568)

20 CREDIT CARRYOVER FROM PRIOR YEAR

22

b

CREDIT ASSIGNED TO OTHER CORPORATIONS WITHIN COMBINED REPORTING GROUP FROM FTB 3544, COLUMN G

EF

CA FORM 8453/8879 - EFILE INFO

FORCE NEW DCN

CARRY FED PIN INFORMATION TO CALIFORNIA

IMPERFECT RETURN

SUPPRESS ERO PTIN/SSN ON CA 8453 IF PP AND EIN IS ENTERED

8454

6254

6195

6181

6345

PART I: TAXPAYER INFORMATION

YES

TO INDICATE THE ELECTION NOT TO E-FILE, CHECK THE BOX BELOW

YES

TAXPAYER ELECTION

YES

REASON (OPTIONAL):

FIRST ESTIMATE PAYMENT

SECOND ESTIMATE PAYMENT

THIRD ESTIMATE PAYMENT

FOURTH ESTIMATE PAYMENT

6256

6257

6258

6259

-

PART II: TAX PREPARER INFORMATION

5008

5009

5010

5011

TAXPAYER

6260

YES

EXPLANATION:

4204

4205

4206

6268

SERVICE MILITARY INDICATOR:

Military overseas, Combat zone/ QHDA,

National Guard

4203

REASONABLE CAUSE

MILITARY INDICATORS

ACTIVE DUTY MILITARY

YES

[35]

AMOUNT

-

4201

4202

PART III - MAKE ES PAYMENTS FOR NEXT TAXABLE YEAR

DATE

CA FORM 8454 - E-FILE OPT-OUT RECORD

YES

[35]

[50]

[50]

YES

SPOUSE

6261

BEGINNING DATE

ENDING DATE

TP DEPLOYED OVER

SEAS OR ENTERED

COMBAT ZONE/QHDA

6262

-

-

6263

-

-

SP DEPLOYED OVER

SEAS OR ENTERED

COMBAT ZONE/QHDA

6264

-

-

6265

-

-

TP COMBAT ZONE / QHDA OPERATION OR AREA SERVED:

6266

[50]

SP COMBAT ZONE / QHDA OPERATION OR AREA SERVED:

6267

[50]

DEPOSIT ACCOUNT 1:

6186

ROUTING NUMBER

ACCOUNT NUMBER

[9]

6187

ACCOUNT TYPE: Checking or Savings

6188

[17]

5124

DIRECT DEPOSIT AMOUNT

DEPOSIT ACCOUNT 2:

6189

ROUTING NUMBER

ACCOUNT TYPE: Checking or Savings

ACCOUNT NUMBER

[9]

6190

6191

DIRECT DEPOSIT AMOUNT

JVA COPYRIGHT FORMS(SERVICESFORTAXPREPARERS.COM)

[17]

5215

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT14

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 15

2011

.

HOH

CA SCH 4803E - HEAD OF HOUSEHOLD PG1

HOH2

ELECTRONIC FILING ONLY

6271

RELATIONSHIP CODE:

1

CODES

1- Son, Daughter, Stepson, or Stepdaughter

4- Father or Mother

2- Grandchild, Brother, Sister, etc.

5- Grandfather, Grandmother, etc.

3-Eligible foster child

6- Other (Please explain)

NAME

6293

6206

[38]

[38]

6281

-

6282

[27]

AGE IN YEARS AS OF 12-31 OF THE CURRENT YEAR

IF LESS THAN 1 YEAR OLD, AGE IN MONTHS

3

QUALIFYING PERSON'S INC WAS LESS THAN $3700 IN CY

4

PROVIDED MORE THAN 1/2 SUPPT FOR QUAL PERSON IN CY

5

-

QUALIFYING PERSON WAS A FULL-TIME STUDENT AT A

RECOGNIZED EDUCATIONAL INSTITUTION FOR AT LEAST

5 MONTHS DURING CURRENT YEAR

QUALIFYING PERSON LIVED WITH TP ENTIRE YEAR

5524

5525

6272

6278

FROM

6273

6275

-

[32]

IF QUALIFYING PERSON WAS A FOSTER CHILD, THE CHILD

WAS PLACED BY AN AUTHORIZED PLACEMENT AGENCY OR

BY A JUDGEMENT, DECREE, OR OTHER COURT

6274

6276

NO

10

OR: TOTAL # DAYS (MORE THAN 12 HOURS EACH DAY)

5526

YES

IF YES, QUAL PERSON FILED A JOINT RTN FOR CURRENT YEAR

QUALIFYING PERSON WAS A CITIZEN OF U.S., OR RESIDENT

OF U.S., CANADA, OR MEXICO

a TP WAS MARRIED OR AN RDP AS OF 12-31 OF CY

YES

11

-

YES

6295

6283

YES

YES

YES

FROM

b

6285

6287

-

TO

-

6286

6288

-

-

BEST TIME TO CALL (MILITARY TIME)

[3]

OPTIONAL

6294

6296

BEGINNING & ENDING DATES THAT THE TP LIVED WITH THEIR SPOUSE IN CY

6326

6327

ENTER HOUR

ENTER MINUTES

PHONE NUMBER

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

YES

[50]

QUALIFYING PERSON WAS MARRIED AS OF 12-31

TO

-

6280

6289

9

NO

[32]

IF YES, NAME OF THE PLACEMENT AGENCY OR COURT

[2]

DATES OF EACH PERIOD QUALIFYING PERSON LIVED WITH TP IN CURRENT YEAR:

6

8

[3]

6279

6270

E- College

F- Lived with other parent

G- Moved out

H- Other (please explain)

IF CODE H, EXPLAIN:

6330

6205

QUALIFYING PERSON'S SSN

A- Lived away at school

B- Military service

C- Hospital / Convalescence

D- Birth or Death

7

IF CODE 6, EXPLAIN:

2

CA SCH 4803E - HEAD OF HOUSEHOLD PG 2

6269

REASON WHY QUAL PERSON DID NOT LIVE WITH TP ENTIRE YR

OVERRIDE

KEYFIELD

[2]

[2]

6329

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT15

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 16

LLC

2011

CA FORM 568 - LLC RETURN OF INCOME PG 1

CORRESPONDING FEDERAL FORM

1- Schedule C

2- Schedule E

LLC INCOME WORKSHEET

6350

6351

6352

3- Schedule F

MULTIPLE NUMBER

STATE FILING DATE (IF DIFFERENT FROM FEDERAL)

[3]

6431

6353

6435

LLC NAME

DOING BUSN AS

NUMBER & ST

[35]

[45]

2

6354

6436

ZIP

[20]

6439

A

PRINCIPAL BUSINESS ACTIVITY NAME (SAME AS FED)

B

PRINCIPAL PRODUCT OR SERVICE (SAME AS FED)

C

PRINCIPAL BUSINESS ACTIVITY CODE (SAME AS FED)

D

SECRETARY OF STATE FILE NUMBER

E

DATE BUSINESS STARTED

F

TOTAL ASSETS AT THE END OF THE YEAR

CASH

ACCRUAL

OTHER

H

FEIN

INITIAL

I

FINAL

AMENDED

1

TOTAL INCOME FROM LLC INCOME WORKSHEET

2

LLC COMPANY FEE

3

CURRENT YEAR ANNUAL LLC TAX

4

NONCONSENTING NONRES MEM TAX LIABILITY FROM SCH T

6

AMOUNT PAID WITH EXTENSION FROM 3537 & CY 3522

7

OVERPAYMENT FROM PY ALLOWED AS CREDIT

8

CY NONRESIDENT WITHHOLDING CREDIT

12

AMOUNT TO CREDIT TO NEXT YEAR TAX OR FEE

CREDIT ENTIRE REFUND TO NEXT YEAR TAX OR FEE

PURCHASES FROM OUT-OF-STATE OR INTERNET SELLERS

MADE WITHOUT PAYMENT OF CALIFORNIA SALES/USE TAX

13

APPLICABLE SALES & USE TAX RATE (ENTER AS A % )

SALES OR USE TAX PAID TO ANOTHER STATE FOR PURCHASES

15 PENALTY AND INTEREST

6358

6359

6360

6437

6361

6362

6363

9500

9501

9502

9503

9504

9505

9506

9507

6364

9738

9701

9740

9702

b

9741

c

LLC'S DISTRIBUTIVE SHARE OF DEDUCTIONS FROM

OTHER PASS-THROUGH ENTITIES ASSOCIATED WITH

THE RECEIPT ASSIGNED TO CA

9708

d

ENTER AS A NEGATIVE, ANY ALLOCATIONS,

DISTRUBUTIONS, OR GAINS FROM ANOTHER LLC

THAT WAS ALREADY SUBJECT TO THE LLC FEE

9709

CA RENTAL REAL ESTATE:

a

8

b

CHECK ACCOUNTING METHOD (DEFAULT IS FEDERAL)

G

GROSS INC FROM DISREGARDED BUSINESS ENTITES

COST OF GOODS SOLD OF THE DISREGARDED ENTITY

ASSOCIATED WITH THE RECEIPT ASSIGNED TO CA

LLC'S DISTRIBUTIVE SHARE OF GROSS ORDINARY INC

FROM PASS-THROUGH ENTITY

LLC'S DISTRIBUTIVE SHARE OF COST OF GOODS SOLD

FROM THE OTHER PASS-THROUGH ENTITIES ASSOC

WITH THE RECEIPT ASSIGNED TO CA

3

9696

6432

6433

6434

6355

6356

6357

2012 VOUCHER AMOUNT

b

[2]

6428

PREPARE 2012 FTB 3522

b

CA COST OF GOODS SOLD FROM FORM 568, SCH B, LN 2

AND FROM FED SCH F (PLUS CA ADJ) ASSOCIATED

WITH THE RECEIPTS ASSIGNED TO CA LINE 1a

a

6438

STATE

TOTAL CA INCOME FROM FORM 568, SCH B

a

[35]

PMB (PRIVATE MAILBOX) NUMBER

CITY

1

9700

a

YES

c

ENTER GROSS RENTS FROM FED 8825, LINE 17

GROSS RENTS OF DISREGARDED BUSINESS ENTITY

FROM RENTAL REAL ESTATE

LLC'S DISTRIBUTIVE SHARE OF GROSS RENTS FROM

RENTAL REAL ESTATE

YES

13 CA CAPITAL GAINS (NOT LOSSES) INCLUDED ON SCH D (568)

YES

15 OTHER CA PORTFOLIO INCOME (NOT LOSS) INCL ON SCH K

9705

9706

9707

9717

9718

FORM 3537 - PAYMENT VOUCHER FOR AUTOMATIC EXTENSION FOR LLC

YES

PREPARE CALIFORNIA EXTENSION ONLY

YES

PREPARE CALIFORNIA EXTENSION WITH FULL RETURN

YES

BOX 1 LLC FEE DUE

BOX 2 TOTAL MEMBERS' TAX DUE

BOX 3 AMOUNT OF PAYMENT

6429

6430

9697

9698

9699

YES

YES

YES

9508

6365

9509

9510

SINGLE MEMBER LLC INFORMATION AND CONSENT

SOLE OWNER'S NAME

ADDRESS

6366

[25]

6367

[35]

6368

6369

FEDERAL TIN

SOS FILE NUMBER

-

RETURN FILED BY OWNER:

1- Form 540

2- Form 100

3- Form 565

4- Other

5- Form 541

6- Form 100S

7- Form 568

IF OTHER, SPECIFY

TITLE OF OFFICER SIGNING CONSENT STATEMENT

9511

6370

6371

FTB MAY DISCUSS RETURN WITH PREPARER

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

[14]

6444

YES

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT16

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 17

2011

LLC

J

K

L

M

CA FORM 568 - LLC RETURN OF INCOME PG 2

9512

2 LLC HAS A NONRESIDENT (DOMESTIC) MEMBER(S)

P

THE LLC IS AN INVESTMENT PARTNERSHIP

6372

YES

3 FORM 592, 592-A & 592-B WERE FILED FOR THESE MEM.

THERE IS A MEMBER(S) IN THIS LLC THAT IS AN LLC(S) OR

6373

1 THE LLC IS APPORTIONING INCOME TO CA USING SCH R

YES

Q

NUMBER OF K-1'S ATTACHED

IF NO, LLC WAS REGISTERED IN CA W/O EARNING INCOME

SOURCED IN THIS STATE DURING THE TAXABLE YEAR

THERE WAS A DISTRIBUTION OF PROPERTY OR A TRANSFER

OF AN LLC INTEREST DURING THE TAXABLE YEAR

LLC OR SUBSIDIARIES HAD TRANSFER OR ACQUISITION

1

GREATER THAN 50% IN CONTROL

2

2

THIS LLC ACQUIRED CONTROL OR MAJORITY OWNERSHIP OF ANY OTHER LEGAL ENTITY THAT OWNED OR

LEASED REAL PROPERTY IN CALIFORNIA

3

THIS LLC OWNED OR LEASED REAL PROPERTY IN CA

HAD MORE THAN 50% OF THE LLC OWNERSHIP

INTEREST CUMULATIVELY TRANSFERRED IN ONE

OR MORE TRANSACTIONS SINCE MARCH 1, 1975

O

P

1

PARTNERSHIP(S)

6445

YES

6374

YES

6375

YES

6376

THIS LLC HAS A FOREIGN NONRESIDENT MEMBER(S)

LLC IS UNDER AUDIT BY THE IRS OR HAS BEEN AUDITIED IN PY

S

LLC IS A MEMBER OR PARTNER IN ANOTHER LLC/PARTNERSHIP

T

THIS LLC IS A PTP AS DEFINED IN IRC SECTION 469(K)(2)

1

U

V

YES

6377

6378

R

LLC IS A BUSN ENTITY DISREGARDED FOR TAX PURPOSES

2 IF YES, THERE ARE CR ATTRIBUTABLE TO THE ENTITY

LLC HAS INCLUDED A REPORTABLE TRANSACTION, LISTED

TRANSACTION, OR REGISTERED TAX SHELTER IN RETURN

W THIS LLC FILED THE FED SCH M-3 (FED FORM 1065)

THIS LLC IS A DIRECT OWNER OF AN ENTITY THAT FILED A

X

FED SCHEDULE M-3

THIS LLC HAS A BENEFICIAL INTEREST IN A TRUST OR IS A

Y

GRANTOR OF A TRUST

YES

YES

6379

6380

YES

6381

6446

6382

6383

6384

6385

YES

6386

6387

YES

6388

YES

6389

YES

YES

YES

YES

YES

YES

YES

YES

TRUST INFORMATION

NAME OF TRUST

[20]

STREET ADDRESS

[20]

ZIPCODE

[5]

FEIN

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

Z

6443

THIS LLC OWNS A MEMBERSHIP IN A BUSINESS ENTITY DISREGARDED FOR TAX PURPOSES

YES

NAME OF DISREGARDED ENTITY

FEIN

ADDITIONAL LINES ARE AVAILABLE ON INPUT SCREEN

AA THERE IS A MEMBER OF THE LLC RELATED (AS DEFINED IN IRC SECTION 267 (c )(4)) TO ANOTHER MEMBER OF THE LLC

BB THERE IS A MEMBER OF THE LLC THAT IS A TRUST FOR THE BENEFIT OF ANOTHER PERSON RELATED (AS DEFINED IN IRC SEC. 267 (c )(4)) TO ANOTHER MEM

CC DURING THE YEAR THIS LLC DEFERRED GAINS FROM THE DISPOSITION OF ASSETS

6452

DD THE LLC IS REPORTING PREVIOUSLY DEFERRED INCOME FROM:

INSTALLMENT SALE

6453

IRC 1031

6454

IRC 1033

EE1 THIS LLC GENERATED A NEW JOBS CREDIT

EE2 NEW JOBS CREDIT GENERATED AMOUNT

THIS LLC OR AN ENTITY IN WHICH THIS LLC HAS AN OWNERSHIP INTEREST ELECTS TO DEFER INCOME FROM THE DISCHARGE OR INDEBTEDNESS AS

FF1

DESCRIBED IN IRC 108(i) FOR FEDERAL PURPOSES

6451

9743

FF2 IF YES, PORTION OF THE DISCHARGE OF INDEBTEDNESS ATTRIBUTABLE TO THE LLC

LLC

2

INVENTORY AT BEGINNING OF YEAR

PURCHASES LESS COST OF ITEMS WITHDRAWN FOR

PERSONAL USE

3

COST OF LABOR

4

ADDITIONAL IRC SECTION 263A COSTS

5

OTHER COSTS

DEPRECIATION

7

INVENTORY AT END OF YEAR

COST

LOWER OF COST OR MARKET AS DESCRIBED IN TREAS.

REG. SECTION 1.471-4

WRITE DOWN OF "SUBNORMAL" GOODS AS DESCRIBED

IN TREAS. REG. SECTION 1.471-2 (c )

OTHER

9

b

c

d

YES

YES

OTHER

YES

YES

SCHEDULE B - INCOME AND DEDUCTIONS

9513

1

9514

9515

9516

9517

9539

9518

CHECK ALL METHODS USED FOR VALUING CLOSING INVENTORY:

a

YES

CA FORM 568 - LLC RETURN OF INCOME PG 3

PART III - SCHEDULE A - COST OF GOODS SOLD

1

6447

6448

6449

6455

6450

9742

SPECIFY METHOD & ATTACH

6440

CHECK THIS BOX IF THE LIFO INVENTORY METHOD WAS

ADOPTED THIS TAXTABLE YEAR FOR ANY GOODS

DO THE RULES OF IRC SEC 263A (WITH RESPECT TO

PROPERTY PRODUCED OR ACQUIRED FOR RESALE)

APPLY TO THE LLC?

THERE WAS A CHANGE (OTHER THAN FOR IRC SEC

263A) IN DETERMINING QUANTITIES, COST, OR

VALUATIONS BETWEEN INVENTORIES

6390

YES

6391

YES

6392

6393

YES

YES

[21]

6394

a

GROSS RECEIPTS OR SALES

b

LESS RETURNS AND ALLOWANCES

4

ORDINARY INC FROM OTHER PARTNERSHIPS & FIDUCIARIES

5

ORDINARY LOSS FROM OTHER PARTNERSHIPS & FIDUCIARIES

6

TOTAL FARM PROFIT (ATTACH SCHEDULE F)

7

TOTAL FARM LOSS (ATTACH SCHEDULE F)

8

NET GAIN FROM LINE 18

9

TOTAL LOSS INCLUDED

10 OTHER INCOME

11 OTHER LOSS

13 SALARIES AND WAGES (OTHER THAN TO MEMBERS)

14 GUARANTEED PAYMENTS TO PARTNERS

15 BAD DEBTS

16 DEDUCTIBLE INT EXPENSE NOT CLAIMED ELSEWHERE

17

YES

a

DEPRECIATION AND AMORTIZATION

b

LESS DEPR CLAIMED ON SCH A AND ELSEWHERE

18 DEPLETION

6395

YES

6396

YES

19 RETIREMENT PLANS, ETC

20 EMPLOYEE BENEFIT PROGRAMS

21

OTHER DEDUCTIONS

TAXES

9519

9520

9521

9522

9523

9524

9525

9526

9527

9528

9529

9530

9531

9532

9533

9534

9535

9536

9537

9538

9730

PAGE 3 CONTINUED ON DATA SHEET 18

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

OPTIONAL

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

ADD-TO

11CADAT17

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 18

LLC

2011

CA FORM 568 - LLC RETURN OF INCOME PG 3 CONT

SCHEDULE T - NONCONSENTING NONRESIDENT MEMBER'S TAX LIABILITY

MEMBER'S NAME

[16]

6397

6398

6399

6400

6401

SSN

6402

6403

6404

6405

6406

-

FEIN

-

LLC

6407

6408

6409

6410

6411

SHARE INCOME

-

9540

9541

9542

9543

9544

AMT WITHHELD

S CORP

9545

9546

9547

9548

9549

6412

6413

6414

6415

6416

YES

YES

YES

YES

YES

CORP

6417

6418

6419

6420

6421

YES

YES

YES

YES

YES

CA FORM 568 - LLC RETURN OF INCOME PG 4

SCHEDULE K - DISTRIBUTIVE SHARE ITEMS

COLUMN B

1

ORDINARY INCOME

2

NET INCOME (LOSS) FROM RENTAL REAL ESTATE ACTIVITIES (FORM 8825)

3

a

GROSS INCOME - OTHER RENTAL ACTIVITIES

b

LESS EXPENSES

4

GUARANTEED PAYMENTS

5

INTEREST INCOME

6

DIVIDEND INCOME

7

ROYALTY INCOME

8

NET CAPITAL GAIN (LOSS) (SCHEDULE D)

9

OTHER PORTFOLIO INCOME (LOSS)

10

11

a

TOTAL GAIN IRC SEC 1231 (NOT CASUALTY OR THEFT)

b

TOTAL LOSS IRC SEC 1231 (NOT CASUALTY OR THEFT)

a

OTHER PORTFOLIO INCOME (LOSS)

b

TOTAL OTHER INCOME (ATTACH SCHEDULE)

c

TOTAL OTHER LOSS (ATTACH SCHEDULE)

COLUMN D

9550

9551

9552

9553

9559

9554

9555

9556

9557

9558

9560

9561

9734

9562

9563

9583

9584

9585

9586

9592

9587

9588

9589

9590

9591

9593

9594

9735

9595

9596

9565

9564

9736

9577

6422

9566

9567

9598

9597

9737

9616

INCOME (LOSS)

12 RECOVERY PROPERTY EXPENSE DEDUCTION

13

15

17

18

19

20

a

CHARITABLE CONTRIBUTIONS

b

INVESTMENT INTEREST EXPENSE

c

1

TOTAL IRC SECTION 59(E) ELECTION EXPENDITURES

2

TYPE OF EXPENDITURES

d

PORTFOLIO INCOME DEDUCTION (NOT INVESTMENT INTEREST EXPENSE)

e

OTHER DEDUCTIONS (ATTACH SCHEDULE)

a

WITHHOLDING ON PARTNERSHIP/LLC ALLOCATED TO ALL PARTNERS/MEMBERS

b

LOW-INCOME HOUSING CREDIT

c

CREDITS OTHER THAN LINE 13b RELATED TO RENTAL REAL ESTATE ACTIVITIES

d

CREDITS RELATED TO OTHER RENTAL ACTIVITIES

e

NONCONCENTING NONRESIDENT MEMBERS TAX PAID BY LLC

f

OTHER CREDITS (ATTACH SCHEDULE)

g

NEW JOBS CREDIT

a

DEPRECIATION ADJUSTMENT ON PROPERTY PLACED IN SERVICE AFTER 1986

b

ADJUSTED GAIN OR LOSS

c

DEPLETION (OTHER THAN OIL AND GAS)

d

GROSS INCOME FROM OIL, GAS AND GEOTHERMAL PROPERTIES

e

DEDUCTIONS ALLOCABLE TO OIL, GAS AND GEOTHERMAL PROPERTIES

f

OTHER ADJUSTMENTS AND PREFERENCE ITEMS (ATTACH SCHEDULE)

a

TAX-EXEMPT INTEREST INCOME

b

OTHER TAX-EXEMPT INTEREST INCOME

c

NONDEDUCTIBLE EXPENSES

a

DISTRIBUTIONS OF MONEY

b

DISTRIBUTION OF PROPERTY OTHER THAN MONEY

a

INVESTMENT INCOME

b

INVESTMENT EXPENSE

c

OTHER INFORMATION

JVA COPYRIGHT FORMS (SERVICESFORTAXPREPARERS.COM)

OPTIONAL

9571

9572

9573

9574

9575

9576

9578

9579

9580

9581

9582

9569

9570

9568

OVERRIDE

KEYFIELD

ASSET MGR [ # ] MAX CHAR

[17]

9599

9600

9604

9605

9606

9607

9733

9608

9744

9610

9611

9612

9613

9614

9615

9617

9618

9619

9620

9621

9602

9603

9601

ADD-TO

11CADAT18

CA

LAST NAME

CALIFORNIA 1040 DATA SHEET 19

LLC

2011

CA FORM 568 - LLC RETURN OF INCOME PG 5

6441

6442

ENTITY MEETS ALL REQUIREMENTS FOR SCHEDULE B, QUESTION 5 OF FEDERAL FORM 1065

FORCE PRINT SHCEDULE L, M-1, M-2

YES

YES

SCHEDULE L - BALANCE SHEETS

ASSETS

1

2

a

TRADE NOTES AND ACCOUNTS RECEIVABLE

b

LESS BAD DEBT ALLOWANCE

INVENTORIES

4

U.S. GOVERNMENT OBLIGATIONS

5

TAX-EXEMPT SECURITIES

6

OTHER CURRENT ASSETS

7

MORTGAGE AND REAL ESTATE LOANS

8

OTHER INVESTMENTS (ATTACH SCHEDULE)

10

a

BUILDINGS AND OTHER DEPRECIABLE ASSETS

b

LESS ACCUMULATED DEPRECIATION

a

DEPLETABLE ASSETS

b

LESS ACCUMULATED DEPLETION

9623

9624

a

INTANGIBLE ASSETS (AMORT ONLY)

b

LESS ACCUM AMORTIZATION

9632

9633

9635

9636

9637

9638

9662

9665

9666

9667

9668

9641

9642

13 OTHER ASSETS (ATTACH SCHEDULE )

9653

9654

9655

9656

9657

9658

9659

9660

9661

9663

9664

9634

9639

9640

LIABILITIES AND CAPITAL

9650

9651

9652

9625

9626

9627

9628

9629

9630

9631

11 LAND (NET AMORTIZATION )

12

END OF TAXABLE YEAR

9622

3

9

BEGINNING OF TAXABLE YEAR

CASH