Contractual Savings, Stock and Asset Markets

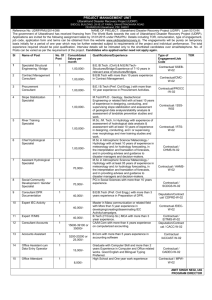

advertisement