Are you maximising the benefits available under the PIC Scheme?

advertisement

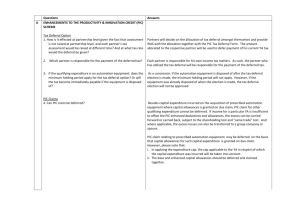

Are you maximising the benefits available under the PIC Scheme? Examples of qualifying expenditure For each activity, there are specified “qualifying expenditures” that will qualify for PIC benefits. Some examples have been listed below for your reference:- Activity Qualifying Expenditure Purchase or leasing of PIC Information Technology (IT) and Automation Equipment • This refers to an automation equipment that is either:- included within a prescribed “PIC IT and Automation Equipment List” maintained by the IRAS e.g. fax machine, laser printer, computer hardware and software, Cloud computing payment; or - approved by the Minister or the Comptroller of Income Tax on a case-by-case basis • New additions to the prescribed list include website development costs (effective from YA 2014), Bi-directional Mass Flow Metering System (MFM) installed on bunker tankers that are approved by the Marine & Port Authority of Singapore (MPA) (effective from YA 2015) Training of employees Examples include:• external course fees for employees (including training conducted by related companies) • in-house training - salaries of trainers, meals & refreshments, training materials and stationery • training of individuals deployed under a centralised hiring arrangement (effective from YA 2014) Acquisition and In-licensing of Intellectual Property Rights (“IPR”) Examples include:• payment to buy a patented technology for use in manufacturing process • price paid for a copyright Registration of patents, trademarks, designs and plant varieties Examples include • fees paid to register patent, trademark in Singapore or other countries • professional fees for preparing documents / giving advice on the validity or infringement of patent, trademark Research and development activities Examples include: • salaries for R&D personnel • fees to R&D institute for creating a novel product • consumables Design projects approved by DesignSingapore Council Examples include: • fees to engage in-house eligible designers • fees to eligible external design service providers to carry out approved design activities Page 2 What are the benefits? Under the Scheme, an eligible business may claim PIC benefits via either of the 2 options:- Option 2 PIC Cash Payout** Option 1 PIC enhanced deductions / allowances Claim PIC deductions allowances at 400% / Opt to convert qualifying expenditure of up to S$100,000 per YA at a rate of 60% into a non-taxable PIC cash payout. [i.e. 100% (base) + 300% (enhanced)] on qualifying expenditure of up to S$400,000 per YA* PIC Scheme Additional PIC benefit PIC Bonus** Only applicable for YAs 2013 to 2015, a dollar-for-dollar matching PIC Bonus will be given based on the qualifying expenditure, subject to a combined cap of S$15,000 for all 3 YAs. This is given on top of the 400% PIC tax deductions/allowances or 60% PIC cash payout chosen by the business. The PIC Bonus is taxable. * The expenditure cap of S$400,000 applies for each of the 6 qualifying activities i.e. PIC can be claimed on a maximum expenditure of S$2.4 million (S$400,000 x 6) for each YA. For the benefit of a large investment in a single-year, the expenditure cap of S$400,000 per activity can be combined as follows:- YAs 2013 to 2015 - $1.2 million per qualifying activity YAs 2016 to 2018 - $1.2 million per qualifying activity **Qualifying conditions To be eligible for the PIC Cash Payout and PIC bonus, the company must have:a) b) c) d) Active business operations in Singapore Incurred qualifying expenditure For PIC bonus, incurred at least S$5,000 in qualifying expenditure for the YA At least 3 local employees (Singapore citizens or Singapore permanent residents with CPF contributions) excluding sole-proprietors, partners under contract for service and shareholders who are directors of the company. A business is considered to have met the 3-local-employees condition if it contributes CPF on the payroll of at least 3 local employees in the relevant month #. # From YA 2016, the 3-local-employees condition will have to be met for a consecutive period of at least three months prior to claiming the PIC cash payout. Page 3 Directors Associate Director Senior Managers Managers Lim Peng Huat phlim@complete-corp.com.sg Shirley Lim shirleylim@complete-corp.com.sg Lim Mei Khim limmeikhim@complete-corp.com.sg Law Pei Serh lawpeiserh@complete-corp.com.sg Eileen Koh eileenkoh@complete-corp.com.sg Audrey Ong audreyong@complete-corp.com.sg Jacqueline Ng jacquelineng@complete-corp.com.sg Janice Ng janiceng@complete-corp.com.sg Agnes Sim agnes_sim@complete-corp.com.sg Laura Goh lauragoh@complete-corp.com.sg