Productivity and Innovation Credit (PIC) Scheme

advertisement

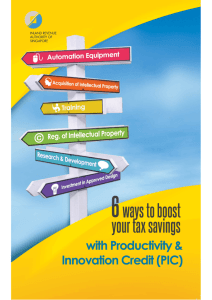

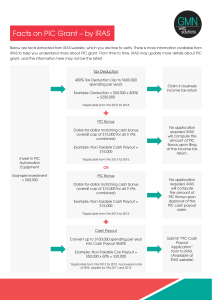

Productivity and Innovation Credit (PIC) Scheme Presentation by Inland Revenue Authority of Singapore 1 April 2014 © 2014 IRAS Singapore Agenda Overview of Corporate Tax Basis of Assessment Filing Obligations Productivity and Innovation Credit (PIC) Scheme Overview Tax Benefits (including PIC+ Scheme) PIC Bonus How to Claim PIC What Qualifies for PIC Case Study Assistance and Service Channels 2 © 2014 IRAS Singapore Basis of Assessment Income is assessable on a preceding accounting year basis Year of Assessment (YA) year in which income tax is charged current YA is YA 2014 Basis Period for a YA the period of income relevant to the YA e.g. 1 Jan 2013 to 31 Dec 2013 (YA 2014) 1 Apr 2012 to 31 Mar 2013 (YA 2014) 1 Jul 2013 to 30 Jun 2014 (YA 2015) 1 Feb 2014 to 31 Jan 2015 (YA 2016) 3 © 2014 IRAS Singapore Filing Obligations Estimated Chargeable Income (ECI) When to file Within 3 months after end of accounting period (e-Filing of ECI via myTax Portal is strongly encouraged) Waiver of ECI filing: You do not need to file ECI for a particular accounting period if: • annual revenue is not more than $1 million • ECI is nil Income Tax Return (Form C/Form C-S) If you are filing Form C Submit a complete tax return comprising of the following by 30 Nov of each year: - Form C and appendix (Form IRIN 301) - audited/unaudited accounts and detailed P/L - tax computation If you are filing Form C-S Submit paper Form C-S by 30 Nov or e-Form C-S# by 15 Dec of each year Notification of filing requirement Company will receive a reminder letter to file the ECI in the last month of the accounting period A tax return filing package will be sent to the company’s registered address in Apr of each year Failure to file Estimated assessment may be raised* Estimated assessment may be raised* Letter of Composition and/or Summons may be issued If you are in a tax loss position A NIL ECI (ECI = 0) is required unless the company has met the qualifying conditions for waiver of ECI filing Submit an Income Tax Return (Form C/Form C-S) # Please authorise yourself/third party as an “Approver” for Corporate Tax Matters via the e-Services Authorisation System (EASY) 4 * If you disagree with the estimated tax assessment, please lodge an objection within two months from the date of the Notice of Assessment with your reasons for not filing on time and grounds of objection © 2014 IRAS Singapore Productivity and Innovation Credit (PIC) Scheme 5 © 2014 IRAS Singapore Overview of PIC Scheme 6 activities covered under scheme: Training of Employees* Purchase/Leasing of PIC IT and Automation Equipment* Acquisition/In-licensing of Intellectual Property Registration of Intellectual Property Research & Development Approved Design Project 6 * Budget 2014 Enhancement © 2014 IRAS Singapore Tax Benefits under PIC 400% tax deductions/allowances on expenditure on each of the 6 activities for accounting years 2010 to 2017 [Years of Assessment (YAs) 2011 to 2018*] Opt for cash payout in place of tax deductions/allowances for accounting years 2010 to 2017 (YAs 2011 to 2018*) PIC Bonus (YAs 2013 to 2015) 7 * Budget 2014 Enhancement © 2014 IRAS Singapore 400% Tax Deductions / Allowances 8 © 2014 IRAS Singapore Tax Deductions / Allowances 400% tax deductions/allowances on up to $400,000 expenditure per year in each of the 6 activities To allow max PIC benefits, the spending cap across YAs for each activity is as shown below: Years of Assessment Expenditure Cap per Activity Tax Deduction per Activity 2011 and 2012 (Combined) $800,000 $3,200,000 (400% x $800,000) 2013 to 2015 (Combined) $1,200,000 $4,800,000 (400% x $1,200,000) 2016 to 2018* (Combined) $1,200,000 $4,800,000 (400% x $1,200,000) 9 * Budget 2014 Enhancement © 2014 IRAS Singapore Tax Deductions / Allowances Expenditure cap per qualifying activity applies only if carrying on a trade or business for the relevant YAs. Otherwise, combined cap is reduced accordingly For newly incorporated/registered businesses whose 1st YA is YA 2014, the combined expenditure cap for YAs 2014 to 2015 per activity is $800,000 Expenditure is net of grant or subsidy by the government or statutory board Expenditure exceeding the cap can still enjoy deduction based on existing rules 10 © 2014 IRAS Singapore New! PIC+ Scheme 11 © 2014 IRAS Singapore PIC+ Scheme From YA 2015, qualifying SMEs that invest in excess of the combined cap of $1.2 million in any of the 6 qualifying activities will enjoy enhanced deductions/allowances on an additional amount of $200,000 for each qualifying activity per YA Qualifying SMEs: Where the business is not part of a group • Annual turnover not more than $100 million; or • Employment size not more than 200 employees Where the business is part of a group • Group annual turnover not more than $100 million; or • Group employment size not more than 200 employees 12 © 2014 IRAS Singapore PIC+ Scheme Expenditure conversion cap under the cash payout option remains unchanged, at $100,000 for all 6 activities per YA IRAS will release further details on the PIC+ scheme by end Mar 2014. 13 © 2014 IRAS Singapore PIC+ Scheme Maximum combined expenditure cap applicable for each 3-year period: YA Max. annual cap Max. combined cap* 2013 2014 2015 2016 2017 2018 400,000 400,000 600,000 600,000 600,000 600,000 $1,400,000# $1,800,000 * Only if you are carrying on a trade or business for the relevant YAs. Otherwise, the combined cap is reduced accordingly. The combined expenditure cap of $1,400,000 is only applicable for YA 2015 as the additional expenditure cap of $200,000 ($600,000 - $400,000) is not available for YA 2013 and YA 2014 # © 2014 IRAS Singapore 14 Cash Payout Option 15 © 2014 IRAS Singapore Cash Payout Option Option to convert expenditure of up to $100,000 in all 6 activities per YA At 30% (YAs 2011 & 2012) / 60% (YAs 2013 to 2018*) cash payout rate $100,000 Expenditure incurred during the basis period for YA 2014 60% $60,000 Cash Payout for YA 2014 Expenditure converted is not tax deductible Cash payout is non-taxable 16 * Budget 2014 Enhancement © 2014 IRAS Singapore Cash Payout Option Years of Assessment Expenditure Cap for All 6 activities Maximum Cash Payout 2011 and 2012 (Combined) $200,000 $60,000 (30% x $200,000) 2013 to 2018 (No pooling of expenditure cap) $100,000 per YA $60,000 per YA (60% x $100,000) 17 © 2014 IRAS Singapore Cash Payout Option Conditions for cash payout option From YAs 2013 to 2015 Employed at least 3 local employees* (Singapore Citizens or PRs with CPF contributions) in the last month of the quarter or combined quarters in the basis period for the relevant YA Carrying on business operations in Singapore * Employees exclude sole-proprietors, partners under contract for service, shareholders who are also directors of companies Note: The 3-local-employee condition does not apply to 400% tax deductions/allowances 18 © 2014 IRAS Singapore Cash Payout Option Conditions for cash payout option New! From YA 2016 to 2018* Employed at least 3 local employees# (Singapore Citizens or PRs with CPF contributions) in the last 3 months of the quarter or combined quarters in the basis period for the relevant YA Carrying on business operations in Singapore # Employees exclude sole-proprietors, partners under contract for service, shareholders who are also directors of companies Note: The 3-local-employee condition does not apply to 400% tax deductions/allowances * Budget 2014 Enhancement 19 © 2014 IRAS Singapore PIC Bonus 20 © 2014 IRAS Singapore PIC Bonus Effective from YAs 2013 to 2015 You will receive an equal amount in PIC bonus for every dollar spent on qualifying activities, subject to the cap of $15,000 over the 3-year period from YAs 2013 to 2015 PIC Bonus is given on top of existing PIC benefits 21 © 2014 IRAS Singapore PIC Bonus Conditions for PIC Bonus Incurs at least $5,000 of PIC-qualifying expenditure^ during the basis period for the YA in which a PIC Bonus is claimed Employed at least 3 local employees* (Singapore Citizens or PRs with CPF contributions) in the: last month of basis period for the YA – if claiming 400% tax deductions/allowances last month of quarter or combined consecutive quarters – if claiming cash payout Carrying on business operations in Singapore ^ Net of grant or subsidy by the Government or statutory board * Employees exclude sole-proprietors, partners under contract for service, shareholders who are also directors of companies © 2014 IRAS Singapore 22 PIC Bonus Example Company A Description YA 2013 YA 2014 YA 2015 PIC-qualifying expenditure $12k $2k $5k PIC bonus $12k $0^ $3k (capped)# ^ Incurs at least $5,000 of qualifying PIC expenditure during the basis period for the YA in which a PIC Bonus is claimed # Combined cap of $15,000 for the 3 YAs 23 © 2014 IRAS Singapore PIC Bonus PIC bonus is taxable Administrative procedures Businesses will not be required to make separate applications for PIC bonus IRAS will process bonus automatically based on information declared in income tax return or PIC cash payout application Payment of PIC Bonus Within three months from filing income tax return – if claimed 400% tax deductions/allowances Within three weeks after cash payout has been approved – if claimed cash payout 24 © 2014 IRAS Singapore Application of the 3-local-employee condition (From YAs 2013 to 2015) 25 © 2014 IRAS Singapore 3-local-employee condition (Cash Payout & PIC Bonus) YAs 2013 to 2015 Example 2: Business Y has a Dec accounting year-end and it opts for cash payout at the end of 1st, 3rd and 4th quarters. Year of Assessment 2015: Quarters Jan – Mar 2014 Cash payout option exercised Quarter 1 Relevant month for determining 3-local-employee condition Mar 2014 Sep 2014 Dec 2014 When to submit cash payout application From Apr 2014 From Oct 2014 From Jan 2015 Deadline to submit cash payout application Apr – Jun 2014 Jul – Sep 2014 Quarters 2 & 3 combined Oct – Dec 2014 Quarter 4 By income tax return filing due date •15 Apr 2015 for sole-proprietor and partnership • 30 Nov 2015/ 15 Dec 2015 (e-file Form C-S) for company © 2014 IRAS Singapore 26 New! Application of the 3-local-employee condition (From YAs 2016 to 2018) 27 © 2014 IRAS Singapore 3-local-employee condition (Cash Payout) YAs 2016 to 2018 Example 1: Business Y has a Dec accounting year-end and it opts for cash payout at the end of 1st, 3rd and 4th quarters. Year of Assessment 2016: Quarters Jan – Mar 2015 Cash payout option exercised Quarter 1 Relevant months for determining 3-local-employee condition Jan – Mar 2015 Jul – Sep 2015 Oct – Dec 2015 When to submit cash payout application From Apr 2015 From Oct 2015 From Jan 2016 Deadline to submit cash payout application Apr – Jun 2015 Jul – Sep 2015 Quarters 2 & 3 combined Oct – Dec 2015 Quarter 4 By income tax return filing due date •15 Apr 2016 for sole-proprietor and partnership • 30 Nov 2016/ 15 Dec 2016 (e-file Form C-S) for company) © 2014 IRAS Singapore 28 How to Claim PIC (Summary) 400% tax deductions/allowances and PIC Bonus Cash payout and PIC Bonus Cash payout Applicable YA YAs 2011 to 2018* YAs 2011 to 2015* YAs 2016 to 2018 How Claim tax deduction/allowances in income tax return Submit PIC cash payout application form and hire-purchase template (where applicable) When For company, submit income tax return by the filing due date: 30 Nov YAs 2013 to 2018: For sole-proprietor/ partnership, submit income tax return and PIC declaration form by the filing due date: 15 Apr Relevant month/months for determining 3-localemployee condition Last month of the basis period of the relevant YA *PIC Bonus is applicable from YAs 2013 to 2015 After the end of each quarter or combined quarters in the accounting year but not later than the income tax filing due date Last month of the quarter or combined consecutive quarters Last 3 months of the quarter or combined consecutive quarters 29 © 2014 IRAS Singapore Case Study 30 © 2014 IRAS Singapore Case Study 1: 400% Tax Deduction/Allowance + PIC Bonus ABC Pte Ltd runs a waste management company Submission Company claims tax deduction/allowance in its Income Tax Return for YA 2014 by 30 Nov 2014 / 15 Dec 2014 (e-file Form C-S) UP TO $8,160 TAX SAVINGS based on corporate tax rate of 17% Investments in accounting year 2013 1) Automated cover systems for open-top containers 2) Sent its staff on waste management courses Tax deduction/allowance $12,000 (Total Expenses) x 400% (YA 2014) $48,000 Investments in PIC Automation equipment: $3,000 Training of Employees: $9,000 Total : $12,000 Choose your Benefits! A) 400% Tax Deduction B) Cash Payout RECEIVE $12,000 PIC BONUS 31 © 2014 IRAS Singapore Case Study 2: CASH PAYOUT + PIC Bonus ABC Pte Ltd runs a waste management company PIC Cash Payout Application Form 1) Apply any time after the end of the financial quarter(s), 2) But not later than 30 Nov 2014 2014 / 15 Dec 2014 (e-file Form C-S) RECEIVE $7,200 CASH PAYOUT Investments in accounting year 2013 1) Automated cover systems for open-top containers 2) Sent its staff on waste management courses Cash Payout Calculation $12,000 (Total Expenses) x 60% (YA 2014) $7,200 Investments in PIC Automation equipment: $3,000 Training of Employees: $9,000 Total : $12,000 Choose your Benefits! A) 400% Tax Deduction B) Cash Payout RECEIVE $12,000 PIC BONUS 32 © 2014 IRAS Singapore Summary of Budget 2014 Changes to PIC Tax Changes Summary Extension of PIC Scheme for three years till YA 2018 For enhanced tax deductions, the expenditure cap of $400,000 per qualifying activity per YA can be combined across YA 2016 to YA 2018 (i.e. $1.2 million per qualifying activity) For PIC cash payout, the expenditure cap of $100,000 per YA for all six qualifying activities cannot be combined across the three YAs, as is the case currently PIC+ Scheme Under the PIC+ scheme, the expenditure cap for qualifying SMEs will be increased from $400,000 to $600,000 per qualifying activity per YA. PIC+ will take effect for expenditure incurred in YA 2015 to YA 2018. The combined expenditure cap will be up to $1.4 million for YA 2013 to YA 2015, and up to $1.8 million for YA 2016 to YA 2018. The expenditure cap for PIC cash payout will remain at $100,000 of qualifying expenditure per YA. 33 © 2014 IRAS Singapore Summary of Budget 2014 Changes to PIC Tax Changes Summary Refining the threelocal-employee condition for PIC cash payout With effect from YA 2016, businesses applying for PIC cash payout will have to meet the three-local-employee condition for a consecutive period of at least three months prior to claiming the cash payout Expansion of “PIC IT and Automation Equipment List” With effect from YA 2014, the List is expanded to include: 1) Website (Item 37) 2) Automated cover system for open-top containers (Item 38) and 3) Landscaping equipment (Item 39) 34 © 2014 IRAS Singapore Summary of Budget 2014 Changes to PIC Tax Changes Summary Individuals under centralised hiring arrangements With effect from YA 2014, the PIC scheme will be enhanced to allow businesses to claim PIC benefits on training expenses incurred in respect of individuals hired under centralised hiring arrangements, subject to qualifying conditions In addition, individuals hired under centralised hiring arrangements can be taken into account for purposes of satisfying the 3-local-employee condition, subject to qualifying conditions 35 © 2014 IRAS Singapore Training of Employees New! Individuals deployed under centralised hiring arrangement* Centralised Hiring Arrangement Individual (Employee C) contracts with the central hirer (Business A) and deployed to another entity (Business B) Employee C is not regarded as Business B’s employee as there is no employment contract, notwithstanding wages and training expenses relating to Employee C is recharged by Business A to Business B Reimbursed Employee C’s wages & training expenses Business A Wages, Training Employment contract Business B Deployed to work Employee C * Budget 2014 Enhancement 36 © 2014 IRAS Singapore Training of Employees Individuals deployed under centralised hiring arrangement Current treatment Business B not entitled to claim PIC benefits on the training recharged Employee C not taken into account as Business B’s employee for purposes of satisfying 3-local-employee condition 37 © 2014 IRAS Singapore Training of Employees Individuals deployed under centralised hiring arrangement With effect from YA 2014, such individuals are regarded as employees of the entities where they are deployed, subject to qualifying conditions Entity (Business B) will be able to claim PIC benefits on training recharged Individual taken into account for purposes of satisfying the 3local-employee condition under PIC cash payout & PIC bonus for Business B 38 © 2014 IRAS Singapore Training of Employees Individuals deployed under centralised hiring arrangement Qualifying conditions 1) Claimant (Business B) able to produce supporting documents on the recharging of employment costs by a related party (Business A) in respect of employees working solely for the claimant; 2) The corporate structure and centralised hiring practises are adopted for bona fide commercial reasons; and 39 © 2014 IRAS Singapore Training of Employees Individuals deployed under centralised hiring arrangement Qualifying conditions 3) (a) For purpose of claiming PIC on training expenses - The related party (Business A) does not claim deductions on the training expenses recharged to the claimant (Business B) (b) For purpose of fulfilling the 3-local-employee condition - The employee whose cost has been recharged will not contribute to the requisite headcount of the related party (Business A) which bore the upfront manpower costs 40 © 2014 IRAS Singapore PIC IT and Automation Equipment 41 © 2014 IRAS Singapore PIC IT and Automation Equipment Automation equipment that qualify for PIC from YA 2011 are prescribed in the “PIC IT and Automation Equipment List” The “PIC IT and Automation Equipment List” has been expanded in Budget 2014 Both purchase and lease (only for own use) of PIC IT and automation equipment qualify for PIC One expenditure cap applies for both purchase cost and lease payments: $800,000 for YAs 2011 and 2012 combined; $1,200,000* for YAs 2013 to 2015 combined; and $1,200,000* for YAs 2016 to 2018 combined *For qualifying SMEs under PIC+ scheme, a higher expenditure cap applies © 2014 IRAS Singapore 42 PIC IT and Automation Equipment Current Automation Equipment in “PIC IT and Automation Equipment List" includes: Facsimile Optical character reader Laser printer Mainframe/Computers Milling machines Office system software Automatic storage and retrieval system of warehouses Injection mould machines Automotive navigation systems Automated kitchen equipment for the purpose of food processing (for F&B industry only) Interactive shopping carts Automated housekeeping equipment Automated seating systems for convention or exhibition centre Self-climbing scaffold system Concrete pumps More examples are available at the IRAS website. 43 © 2014 IRAS Singapore PIC IT and Automation Equipment With effect from YAs 2014 to 2018, “PIC IT and Automation Equipment List" has been expanded: Description Item 37 – Website Budget 2014 Enhancement Website development costs 100% write-off will apply under S19A(10) instead of S19A(2) Item 38 - Automated cover system for Only the automated covering system open-top containers and not the vehicle or container Item 39 – Landscaping equipment Examples: Ride-on mower, Wood chipper, Trencher and Potting machine 44 © 2014 IRAS Singapore Flowchart on PIC IT and Automation Equipment IT and Automation Equipment Yes Capital Allowance Write-down over 1 year, 3 years or tax working life of asset In PIC IT and Automation Equipment List* (Refer to the PIC IT and Automation Equipment List*) Approved cases Capital Allowance Write-down over 3 years or tax working life of asset * Refer to IRAS’ website at www.iras.gov.sg <For Companies><Productivity and Innovation Credit> No Case–by-case approval, subject to meeting criteria Rejected cases • Does not qualify for PIC • Continue with current Capital Allowance treatment © 2014 IRAS Singapore 45 PIC IT and Automation Equipment Case-by-case approval Businesses that invest in equipment not in the PIC IT and Automation Equipment List may apply to IRAS to have the equipment approved on a case-by-case basis Businesses can: submit the Application for Approval of Equipment for PIC Form to IRAS (available on IRAS website) two months before the return filing due date or earlier Application will be processed within 3 weeks of receipt of form 46 © 2014 IRAS Singapore PIC IT and Automation Equipment Case-by-case approval Revised Criteria (from YA 2013): a) Equipment automates or mechanises the work processes of the business; b) Equipment enhances productivity of the business (for example, in terms of reduced man-hours, more output or improved work processes); and c) If the equipment is a basic tool, it must increase productivity compared to existing equipment used in the business; or it has not been used in the business before 47 © 2014 IRAS Singapore PIC IT and Automation Equipment Cash payout option Election is on “per equipment” basis (cannot claim tax deduction and cash payout on the same equipment) Expenditure in excess of expenditure conversion cap forfeited With effect from YA 2012, HP equipment with repayment covering 2 or more basis periods are eligible for cash payout i.e. for equipment acquired under HP agreement signed during the basis periods relating to YAs 2012 to 2018 Hire purchase (HP) equipment acquired under HP agreement signed during the basis period relating to YA2011, and with repayment covering 2 or more basis periods, are not eligible for cash payout 48 © 2014 IRAS Singapore PIC IT and Automation Equipment Minimum ownership period Minimum 1-year holding for purchased equipment Claw-back may apply if equipment disposed of or leased out within 1 year from date of purchase Waiver of claw-back provisions Automatic waiver: If in the basis period when the equipment was acquired, the cost of qualifying equipment acquired (excluding the cost of equipment disposed of) is more than or equal to the expenditure cap applicable to that basis period Case-by-case basis: If IRAS is satisfied with the commercial reason(s) that led to the disposal 49 © 2014 IRAS Singapore PIC IT and Automation Equipment (Summary) Without PIC With PIC (YAs 2011 to 2018) Qualifying Expenditure Purchase Lease 100% accelerated CA 100% revenue deduction 400% allowances/deductions subject to expenditure cap1, 100% allowances/deductions on balance exceeding the cap Cost of equipment Lease payments Minimum Ownership Period 1 year from the date of purchase N.A.2 Cash Payout Option (YAs 2013 to 2018) Per equipment basis Convert expenditure at 60% subject to cap3 Convert expenditure at 60% subject to cap3 PIC Bonus 1Total PIC Bonus of up to $15,000 over 3-year period from YAs 2013 to 2015 expenditure cap for YAs 2011 and 2012 - $800,000 for each of the six activities Total expenditure cap for YAs 2013 to 2018 - $1,200,000 for each of the six activities for each 3-year period (YAs 2013 to 2015 and YAs 2016 to 2018). For qualifying SMEs under PIC+ scheme, a higher expenditure cap applies 50 2Equipment cannot be sub-leased within the same basis period of the YA 3 Maximum expenditure for YAs 2013 to 2018 - $100,000 per annum for all six activities taken together © 2014 IRAS Singapore Assistance and Service Channels Website www.iras.gov.sg ‒ <Businesses><For Companies ><Productivity and Innovation Credit> ‒ <News & Events><Singapore Budget 2014- Tax Changes> Email ‒ ctmail@iras.gov.sg for general tax matters ‒ ctpayment@iras.gov.sg for payment matters ‒ picredit@iras.gov.sg for Productivity and Innovation Credit Helpline ‒ For companies: 1800-356-8622 ‒ For self-employed/partnership: (+65) 6351 3534 ‒ 8.00am to 5.00pm from Mondays to Fridays © 2014 IRAS Singapore © 2014 IRAS Singapore