Johor Corporation 2012 Annual Report

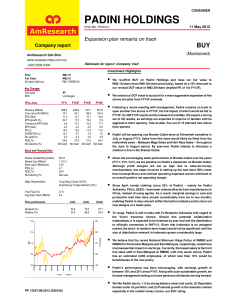

advertisement