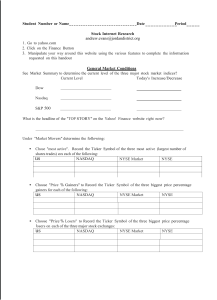

Grading a stock using the NASDAQ doze

advertisement

Grading a Stock Using the NASDAQ dozen Stock:_____________________________ Ticker:_____ Pass Fail http://www.nasdaq.com/investing/dozen/ Metric Revenue Revenue will give you an idea of how much money the company is making. If revenue is consistently increasing, this means the company is growing. Increasing Decreasing Increasing Decreasing Increasing Decreasing Buy or Strong buy Less than a buy Positive last 4 quarters Negative any last 4 quarters EPS increases EPS decreases 5 yr greater than 8% 5 yr less than 8% Less than 1.0 Greater than 1.0 Higher than industry Lower than industry Less than 2 More than 2 Positive net activity for last 3 months Negative net activity for last 3 months Positive Negative Earnings per share (EPS) EPS tells you how much money the company is making in profits per every outstanding share of stock. The higher the EPS is, the more money your shares of stock will be worth because investors are willing to pay more for higher profits. Return on Equity (ROE) ROE gives us a glimpse into how efficiently company management is producing a return for the owners of the company---based on the amount of equity in the company. Recommendations If the company's future outlook is positive, the analysts recommend a "buy." If the company's future outlook is poor, then the analysts recommend a "sell." Earnings Surprises When analyzing a company's earnings surprise track record, you want to see that the company is consistently meeting or beating its expectations. Forecast Look at the future earnings forecasts to insure that the future profitability of the stock in question is strong. Earning growth The earnings growth number gives you an idea of how much analysts believe earnings are going to grow per year for the next five years. PEG Ratio One of the more popular ratios stock analysts look at is the P/E, or price to earnings, ratio. The drawback to a P/E ratio is that it does not account for growth. The PEG ratio solves this problem by including a growth factor into its calculation. Industry Earnings Most investors are interested not only in how much the company is earning but also how the company's earnings compare to the average earnings of companies in the industry. Days to cover Short interest is the number of shares that investors are currently short on a particular stock. Days to cover is the number of days---based on the average trading volume of the stock---that it would take all short sellers to cover their short positions. Insider trading If managers are confident in the company, chances are good that they will be buying stock in the company. Weighted Alpha Weighted Alpha is a measure of one year growth with an emphasis on the most recent price activity. A positive Weighted Alpha indicates the stock price is moving higher and a negative Weighted Alpha indicates the stock price is moving lower. Candidate for growth Strong Moderate Poor 9-12 Pass 6-8 Pass 0-5 Pass