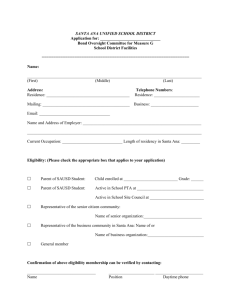

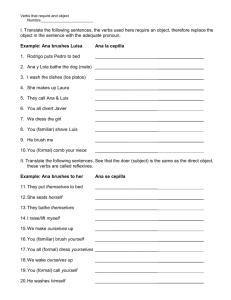

Entire File

advertisement