Evaluation of the Suitability of International Financial Reporting

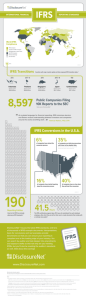

advertisement

Journal of Modern Accounting and Auditing, ISSN 1548-6583 December 2012, Vol. 8, No. 12, 1773-1779 D DAVID PUBLISHING Evaluation of the Suitability of International Financial Reporting Standards (IFRSs) for Application in Emerging North African Countries: A Literature Review and a Research Agenda Morrison Handley-Schachler Teesside University, Middlesbrough, United Kingdom Shala Abulgacem Al-Abiyad, Ali Ahmed Al-Hadad University of Tripoli, Tripoli, Libya Despite the progress of international accounting harmonization, there remain a number of countries which have not adopted International Financial Reporting Standards (IFRSs) but continue to adhere to their own accounting laws or standards, including Libya and some surrounding countries. This paper examines the arguments surrounding the appropriateness of accounting harmonization and the obstacles to achieve it and seeks to apply these arguments in the case of Libya. The conclusion is that although harmonization with IFRSs is not precluded by any cultural considerations, historical factors and accounting education deficiencies may make the adoption of IFRSs more difficult, while the absence of an active stock market may make it less desirable. Keywords: accounting, harmonization, North Africa Introduction In recent time, most countries of the world, especially third-world and middle-income countries which are seeking to develop and advance themselves, have been increasing their engagement in international economic, social, and political affairs, as these countries seeking a positive engagement with their international economic, social, and political environment often adopt ideas and policies from the developed countries. There are, however, occasional oppositions to these developments from academics and professionals in emerging markets, stemming from factors including differences in the availability of technological and financial constraints and education levels. One of the major areas in which emerging countries have adopted ideas from post-industrial countries is in financial accounting, especially with the widespread, but not universal adoption of International Financial Reporting Standards (IFRSs). The present position with respect to the adoption of IFRSs for most countries can be found in Deloitte (2010). The most significant country having not adopted IFRSs is the USA. However, the Securities and Exchange Commission (SEC) has continued to support the goal of eventual convergence of the US accounting Morrison Handley-Schachler, principal lecturer in Fraud and Financial Crime, Teesside M.Handley-Schachler@tees.ac.uk. Shala Abulgacem Al-Abiyad, Ph.D., Faculty of Economics and Political Sciences, University of Tripoli. Ali Ahmed Al-Hadad, Ph.D., Faculty of Economics and Political Sciences, University of Tripoli. University. Email: 1774 THE SUITABILITY OF IFRS FOR APPLICATION IN NORTH AFRICAN COUNTRIES with IFRSs. A comprehensive description of the current differences can be found in PwC1 (2010). While the use of IFRSs is the norm in the European Union (EU), following the enactment of the International Accounting Standards (IAS) regulation2 (European Community, 2002) and in Gulf Cooperation Council (GCC) countries, it can be seen that there is a significant concentration of countries which have not adopted IFRSs in Northwest Africa. These countries include Libya, Tunisia, Algeria, and Mauritania. These countries have a number of common features, including a majority of Islamic population, use of the Arabic language, periods of socialist government, and a partially overlapping imperial history, especially as parts of the Ottoman and French empires (although Mauritania was never under Ottoman rule and Libya was never a French possession). However, none of these factors appear to be sufficient to explain the apparent reluctance to adopt IFRSs, as other countries with none of these features have adopted them. Therefore, the purpose of this study is to evaluate the suitability of IFRSs for adoption in emerging North African countries. This paper presents a review of present literatures relating to issues in the harmonization of accounting standards and adoption of IFRSs and seeks to form conclusions on the advisability of introducing IFRSs in the case of Libya. Literature Review The subject of accounting harmonization has been discussed many times in the accounting literature, with numerous studies being conducted on those developing and emerging countries which have adopted IFRSs, including the studies of Abd-Elsalam and Weetman (2003) in Egypt, Tyrall, Woodward, and Rakhimbekova (2007) in Kazakhstan, and Joshi, Bremser, and Al-Ajmi (2008) in Bahrain. The harmonization process is influenced by several factors, such as culture, politics, economics, and also sociological behaviors. This paper tries to present the evolution of the harmonization process over time and the advantages and weakness generated by its solutions. This paper also tries to present the efforts of the main accounting standard setters, the US Financial Accounting Standards Board (FASB), and the International Accounting Standards Board (IASB) to achieve convergence in the near future, in order to be able to provide the world with a unified accounting model. According to Alsharairi and Al-Abdullah (2009), there is still a debate on the cause reflections, implications, and consequences of accounting harmonization, especially in the emerging economies. In addition, harmonization has its proponents and opponents, because it looks like a form of globalization and a rigid standardization. Therefore, by taking the Jordanian case as an example, they argue that it is questionable whether international standards driven by the advanced countries for a social science like accounting can be installed and are optimal for the emerging economies. With this example, it is apparent that while ambitious steps are being taken in applying the economic reform regime, there is a lack of large Jordanian multinational companies (MNCs), of the kind which, elsewhere, are one of the most vocal parties in demanding a cosmopolitan set of accounting standards. Hazera, Marin Hernandez, and Quirvan (2008) observed that in recent years, banks in the emerging and transition economies throughout the world had been compelled to change lending and financial reporting practices in response to economic transitions of their countries, also reflecting the fact that financial institutions and the major transnational corporations which they finance are among the leading players in accounting harmonization. 1 2 PricewaterhouseCopper (PwC). EU Regulation 1606/2002. THE SUITABILITY OF IFRS FOR APPLICATION IN NORTH AFRICAN COUNTRIES 1775 Gray (1998) and Perera (1989) both suggested that accounting practices were in large part a result of the social environment, although it might be noted that hard evidence tended to be lacking. Doupnik and Salter (1995) found some evidence that uncertainty avoidance (Cyert & March, 1992; Hofstede, 2001) influenced accounting practices, but this might be explained by the capital structures of companies in the countries studied, while other cultural variables appeared to have little if any impact. A cultural dimension to accounting might be thought to present difficulties in the case of Libya, if it could be proved, in view of Libya’s collectivist and socialist society and Islamic heritage, which contrasted with countries such as the UK and France, which were in the forefront of the development of IASs. However, the evidence for such a dimension appears to be weak at best. In the case of Iran, Mashayekhi and Mashayekh (2008) did not find strong evidence for Iranian exceptionalism proving a barrier to convergence with IFRSs, although this convergence did remain incomplete and IFRSs had not been adopted wholesale. It may also be noted that countries with a large number of Islamic financial institutions, including not only the United Arab Emirates (UAE) but also the US and UK, do not appear to have difficulties with the application of IFRSs as a result. More promising (and therefore more troublesome) sources of accounting variation concern cultural heritage and financing, both of which are proposed as key factors in determining accounting methods by Nobes (1998). Notwithstanding early French involvement in the development of IASs, the legacy of French colonial accounting systems with plans and schemes of accounts appears to be an inhibiting factor in the adoption of IFRSs (Boolaky & Jallow, 2008 for the case of Madagascar), even when there is an intention to harmonize with IFRSs. Although, unlike its surrounding countries, Libya was never under the control of France, it was at one time an Italian possession, giving rise to a Roman law influence which might have a similar effect to the influence of French law. In addition and notwithstanding the slowness of the USA to harmonize their standards with IFRSs, IFRSs are very often designed to suit companies whose shares are traded on open and active stock exchanges. This may present issues of suitability in the case of Libya, where funds are, for the most part, either internally generated or derived from the government. Profitability may also not be a key target, with production or sales possibly being of equal or greater importance. This may lead to reluctance to adopt IFRSs in full and a lack of understanding of the purpose of capitalizing items, such as research and development or of disclosing financial assets and liabilities at current value. Using a sample of 102 non-European countries, Ramanna and Sletten (2009) studied variations in decisions on adopting IFRS and found evidence that more powerful countries were less likely to adopt IFRSs, consistent with more powerful countries being less willing to surrender standard-setting authority to an international body. They also found evidence that the likelihood of IFRS adoption at first increased and then decreased with improvements in the quality of countries’ domestic governance institutions, consistent with IFRS being adopted, when governments were capable of timely decision making and when the opportunity and switching costs of domestic standards were relatively low. They did not find evidence that levels of expected changes in foreign trade and investment flows in a country affected its adoption decision. Thus, the authors cannot confirm that IFRS lowers information costs in more globalized economies. Consistent with the presence of network effects in IFRS adoption, they found that a country was more likely to adopt IFRS, if its trade partners or countries within its geographical regions were IFRS adopters. Joshi et al. (2008) found broad but not universal supports for the use of IFRSs amongst accountants in Bahrain, with more experienced accountants viewing IFRSs more favorably. A positive picture of the prospects 1776 THE SUITABILITY OF IFRS FOR APPLICATION IN NORTH AFRICAN COUNTRIES for countries adopting IFRSs was also given by Ballas, Skoutela, and Tzovas (2010), who examined the case of Greece and found that accountants favored the adoption of IFRSs and that they provided greater transparency, despite counter-indications in the form of a weaker stock market- and credit-based financing system and despite linguistic barriers to understand the standards. Alali and Cao (2010) extensively reviewed the literature on the adoption of IFRSs and noted that the IASB was subjected to political pressures and that the resulting standards might not be interpreted and applied in the same way in different countries, which was confirmed by the research of Kvaal and Nobes (2010) on the differences among countries in the incidence of adoption of different treatments permitted in IFRSs, while Chua and Taylor (2008) noted that the use of particular IFRSs remained subjected to endorsement by national governments or supranational organizations, such as the EU, even where IFRSs were adopted. This may result in less complete harmonization. Tyrall et al. (2007) identified Kazakhstan, a former Soviet Republic, as a country where a gradualist approach to the adoption of IFRSs has been taken with the increasing foreign direct investment as the key attraction. Boolaky and Jallow (2008) had also examined the case of Madagascar, where they found that the attempted adoption of an accounting plan in harmonization with IFRSs left a number of gaps, where subjects dealing with IFRSs were not covered by the accounting plan or where the plan did not keep pace with the subsequent development of IFRSs. Compliance may also be incomplete, even after a complete adoption and even allowing for differences in interpretation. Al-Shammari, Brown, and Tarca (2008) found incomplete compliance in those Gulf States, which had adopted IFRSs with compliance being better, for example, in Bahrain than in Oman or Kuwait. Al-Akra, Ali, and Marashdeh (2009) found that in the case of Jordan, compliance with IFRSs could have been enhanced by improved accounting education quality and better auditing regulation. However, it may be noted that both Al-Shammari et al. (2008) and Peng, Tondkar, van der Laan Smith, and Harless (2008) found that compliance increased over time in the Gulf States and China respectively. Ahmad and Gao (2004) identified several difficulties in accounting education in Libya, including a lack of qualified accounting academics and a failure to match academic accounting education with the needs of accountants in industry. Problems with the managerial education and the understanding of management accounting issues were also found by Al-Abiyad (2008), and these problems appeared to extend to both tax accounting and financial accounting issues. A further issue may be the approach to valuation in IFRSs. The IASB has opted for accounting principles which take a neutral approach to reflect the present reality of the assets and liabilities of an enterprise. This is intended to serve the needs of capital markets, in which investors form judgments on the value of companies based on a true and fair view of earnings and of the assets which are employed in generating these earnings, allowing a view to be formed on companies’ returns on equity and capital employed and to estimate future free cash flows. This leads to a strong encouragement to the use of current estimated values for non-current assets and to put intangible assets, such as knowledge accessible as a result of past researches and developments, onto the balance sheet. This contrasts rather surprisingly with the US Generally Accepted Accounting Principles (GAAP) approach. Although the USA is home to the world’s leading capital markets and federal laws on presentation of accounts applied only to companies with securities registered with the SEC, US GAAP continues to favor historic cost and allows a far narrower range of intangible assets to be recognized. This approach may appear to be surprising, as it appears to provide less relevant information to capital markets. Indeed, it can partly be seen THE SUITABILITY OF IFRS FOR APPLICATION IN NORTH AFRICAN COUNTRIES 1777 as a preference for reliability over relevance. However, it also appears to go back to a common law system, in which accounting is seen as a private matter between the owners and managers of a company and in which the owners are concerned with the honesty, not the effectiveness of their managers and merely want to know what their money has been spent on, not how well the company is doing. This by and large remains the case in English and Scottish law, which appears essentially unchanged from the position of Candler v Crane, Christmas and Co. (1951) and Caparo Industries plc v Dickman (1990), notwithstanding the modifications of cases such as ADT Ltd. v BDO Binder Hamlyn (1995) (in which the auditors BDO Binder Hamlyn, formerly Binder Dijker Otte, were sued by ADT Ltd., formerly American District Telegraph), in which special circumstances have led to the auditors being deemed to have declared the financial statements to be useful for investment purpose, and Royal Bank of Scotland plc v Bannerman Johnstone Maclay (2005), in which it was held that lenders might be able to sue negligent auditors. However, in addition to being objective and useful for the purposes of owners under the agency theory, historic cost and the expensing of research and development activities also lead to a more conservative balance sheet. The effect on the income statement is ambivalent, as historic cost leads to lower depreciation with the expensing of research and development accelerating the recognition of expenditure. This results in differences between US GAAP and IFRSs, which are of significance for companies seeking to raise funds on a US stock exchange. Gray, Linthicum, and Street (2009) found that there was a strong tendency for new adopters of IFRSs to publish financial statements, which showed significantly higher earnings than US GAAP users. However, more seasoned users of IFRSs provided income statements showing earnings which were more in line with US GAAP. This preference of IFRSs for fair values and the resulting tendency to sacrifice reliability for relevance to capital markets was identified by Chand and White (2007) as a weakness in the case of Fiji, while IFRSs were found to provide excessive flexibility, resulting in an ability to adapt earnings to meet target earnings. This may be exacerbated by the existence in IFRSs of the “Presents Fairly” override, which is open to abuse or may simply lead to a neglect of accounting standards (Nobes, 2009). In addition, Chand and White (2007) found that related party disclosures under IFRSs were insufficient for local needs. Both of these factors could present problems in Libya, especially in the context of enterprises run by managers chosen through a political process rather than being appointed as specialists. The manipulation of earnings to meet targets and the concealment of transactions with businesses, with which managers have personal connections, can both be temptations in some circumstances. In addition, where product prices are fixed through a political process, flexibility in accounting standards can be used to conceal higher levels of profitability in some parts of the supply chain at the expense of others. Overall, the authors have examined a number of factors which can result in problems when a middle-income country seeks to adopt IFRSs, including culture, education, the extent of international trade, and sources of financing. All of these issues have been raised extensively in literatures. However, not all of them appear to be of equal importance. Conclusions As a middle-income country, Libya still has some ways to bridge the gap with post-industrial countries in terms of technology and economics, in addition to the higher education system and the professional education of managers and other workers. This leads to inevitable concerns about the country’s preparedness for the 1778 THE SUITABILITY OF IFRS FOR APPLICATION IN NORTH AFRICAN COUNTRIES adoption of a largely alien and sometimes abstruse set of accounting principles, which managers may not understand or may not consider it necessary, even if they understand them. However, it may also be remarked that Libya may have other reasons for not moving swiftly to adopt IFRSs. Libya’s financial and political system has differed radically from those of countries which are prominent in the development of IFRSs, notably the UK, which has an active stock market and many multinational companies which rely on the issue of shares for funding. Libya does not have the same financing system, and this makes the use of financial statements for the purpose of decision making by potential shareholders less vital, while there may be more emphases on assessing whether companies have met governmental or socially determined targets, as well as on the use of accounts to determine taxes. In addition, accounting information may be needed for the negotiation of prices between suppliers and customers along the supply chain, which may perhaps require different information from that required by outside investors. In order to assess the suitability of IFRSs for Libyan purposes, further researches are required to establish a number of significant points in relation to the accounting situation in Libya and the applicability of IFRSs. The following research topics will be particularly useful: (1) What are the real sources of GAAP in Libya and what is the current state of Libyan accounting law and accounting standards? (2) What are the present differences between GAAP in Libya and IFRSs? (3) Where differences exist, is Libyan accounting practice similar to other countries’ practices, especially to accounting practices in the USA, whose standards have historically been the greatest rivals to IFRSs? (4) How do Libyan accounting practices compare with those of other Northwest African countries, especially Tunisia, Algeria, and Mauritania, which have also been slow to adopt IFRSs? Do these countries form a coherent accounting block? References Abd-Elsalam, O. H., & Weetman, P. (2003). Introducing international accounting standards to an emerging capital market: Relative familiarity and language effect in Egypt. Journal of International Accounting, Auditing, and Taxation, 12(1), 63-84. ADT Ltd. v BDO Binder Hamlyn (1995). 1996 British company cases 808-887 (High Court Queen’s Bench Division 1995). Ahmad, N., & Gao, S. (2004). Changes, problems, and challenges of accounting education in Libya. Accounting Education, 13(3), 365-390. Al-Abiyad, S. A. (2008). Managing property, plant, and equipment: Factors affecting decisions about their replacement in Libyan manufacturing companies. Edinburgh Napier University, Diss. Al-Akra, M., Ali, M. J., & Marashdeh, O. (2009). Development of accounting regulation in Jordan. International Journal of Accounting, 44(2), 163-186. Alali, F., & Cao, L. (2010). International financial reporting standards⎯Credible and reliable? An overview. Advances in Accounting, Incorporating Advances in International Accounting, 26(1), 79-86. Al-Shammari, B., Brown, P., & Tarca, A. (2008). An investigation of compliance with international accounting standards by listed companies in the gulf co-operation council member states. International Journal of Accounting, 43(4), 425-447. Alsharairi, M. A., & Al-Abdullah, R. J. (2009). The reflections of the international accounting harmonization on emerging economies: Jordan as an example. The Second Conference of the Faculty of Business at the University of Jordan on Critical Issues for Emerging Economies in Today’s Business Environment, April 2009, Amman, Jordan. Retrieved from http://www.ssrn.com/abstract=1410084 Ballas, A. A., Skoutela, D., & Tzovas, C. A. (2010). The relevance of IFRS to an emerging market: Evidence from Greece. Managerial Finance, 36(11), 931-948. Boolaky, P., & Jallow, K. (2008). A historical analysis of the accounting development in Madagascar between 1900 to 2005: The journey from accounting plan to IFRS. Journal of Applied Accounting Research, 9(2), 126-144. THE SUITABILITY OF IFRS FOR APPLICATION IN NORTH AFRICAN COUNTRIES 1779 Candler v Crane, Christmas and Co. (1951). 2 king’s bench 164-207 (Court of Appeal 1950). Caparo Industries plc v Dickman (1990). 2 appeal cases 605-663 (House of Lords 1990). Chand, P., & White, M. (2007). A critique of the influence of globalization and convergence of accounting standards in Fiji. Critical Perspectives on Accounting, 18(5), 605-622. Chua, W. F., & Taylor, S. L. (2008). The rise and rise of IFRS: An examination of IFRS diffusion. Journal of Accounting and Public Policy, 27(6), 462-473. Cyert, R. M., & March, J. G. (1992). A behavioral theory of the firm (2nd ed.). Malden, MA: Blackwell. Deloitte. (2010). Use of IFRSs by jurisdiction. Retrieved from http://www.iasplus.com/country/useias.htm Doupnik, T. S., & Salter, S. B. (1995). External environment, culture, and accounting practices: A preliminary test of a general model of international accounting development. International Journal of Accounting, 30(2), 189-207. European Community. (2002). Regulation (EC) No.1606/2002 of the European parliament and of the council of July 19th., 2002 on the application of international accounting standards. Retrieved from http://www.eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2002:243:0001:0004:en:PDF Gray, S. J. (1988). Towards a theory of cultural influence on the development of accounting systems internationally. Abacus, 24(1), 1-15. Gray, S. J., Linthicum, C. L., & Street, D. L. (2009). Have “European” and US GAAP measure of income and equity converged under IFRS? Evidence from European companies listed in the US. Accounting and Business Research, 39(5), 431-447. Hazera, A., Marin Hernandez, S., & Quirvan, C. (2008). Toward a framework of the harmonization of bank financial reporting standards in transition economies: The case of Mexico. AAA 2009 Mid-Year International Accounting Section (IAS) Mid-Year Meeting. Retrieved from http://www.ssrn.com/abstract=1276505 Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions, and organizations across nations (2nd ed.). Thousand Oaks, CA: Sage Publications. Joshi, P. L., Bremser, W. G., & Al-Ajmi, J. (2008). Perceptions of accounting professionals in the adoption and implementation of a single set of global accounting standards: Evidence from Bahrain. Advances in Accounting, incorporating Advances in International Accounting, 24(1), 41-48. Kvaal, E., & Nobes, C. (2010). International differences in IFRS policy choice: A research note. Accounting and Business Research, 40(2), 173-187. Mashayekhi, B., & Mashayekh, S. (2008). Development of accounting in Iran. International Journal of Accounting, 43(1), 66-86. Nobes, C. (1998). Towards a general model of the reasons for international differences in financial reporting. Abacus, 34(2), 162-187. Nobes, C. (2009). The importance of being fair: An analysis of IFRS regulation and practice⎯A comment. Accounting and Business Research, 39(4), 415-427. Peng, S., Tondkar, R., van der Laan Smith, J., & Harless, D. W. (2008). Does convergence of accounting standards lead to the convergence of accounting practices? A study from China. International Journal of Accounting, 43(4), 448-468. Perera, M. H. B. (1989). Towards a framework to analyze the impact of culture on accounting. International Journal of Accounting, 4(1), 42-56. PwC. (2010). IFRS and US GAAP similarities and differences. Retrieved from http://www.pwc.com/us/en/issues/ifrs-reporting/assets/ifrs-simdif_book-final-2010.pdf Ramanna, K., & Sletten, E. (2009). Why do countries adopt international financial reporting standards. Harvard Business School Working Paper 09-102. Retrieved from http://www.hbs.edu/research/pdf/09-102.pdf Royal Bank of Scotland plc v Bannerman Johnstone Maclay (2005). 1 session cases (Scotland) 437-452 (Court of Session Inner House Second Division 2005). Tyrall, D., Woodward, D., & Rakhimbekova, A. (2007). The relevance of international financial reporting standards to a developing country: Evidence from Kazakhstan. International Journal of Accounting, 42(1), 82-110.