1 Chapter 5 Uncertainty Two measures of risk: (1) expected value (2

advertisement

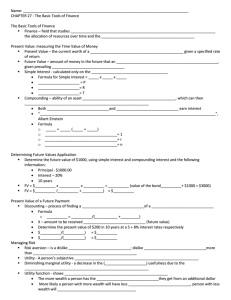

ECON191 (Spring 2011) 2 & 4.3.2010 (Tutorial 3) Chapter 5 Uncertainty Two measures of risk: (1) expected value (2) variance Expected value: Probability weighted average of the payoffs associated with all possible outcomes E(X) = Pr1X1 + Pr2X2 + … + PrnXn Preference toward risk To evaluate an individual’s attitude toward risky situations, we calculate the expected utility An individual gets utility from income, and payoff measured in terms of utility Expected utility: sum of the utilities associated with all possible outcomes, weighted by the probability that each outcome will occur E(U) = Pr1U(W1) + Pr2U(W2) + … + PrnU(Wn) Example: No Gamble: sure income of 50 which yields U(50) Gamble: win 100 with probability 0.5 and win nothing with probability 0.5 Expected Value = 0.5 (0) + 0.5(100) = 50 (This is a Fair Gamble, Why?) Expected Utility = EU = 0.5 U(0) + 0.5 U(100) Utility U(100) U(Wealth) U(50) EU U(0) Wealth 0 U(100) 50 Utilit y Risk Averse Diminishing marginal utility of wealth EU of the gamble < utility of a certain wealth EU < U(50) Prefer certain income than uncertain (risky) income with the same expected value 100 U(Wealth) Risk Loving Increasing marginal utility of wealth EU of the gamble > utility of a certain wealth EU > U(50) Prefer uncertain income than certain income with the same expected value EU U(50) U(0) Wealth 0 50 100 Utility U(Wealth) U(100) EU = U(50) U(0) Wealth 0 50 100 Risk Neutral Constant marginal utility of wealth. EU of the gamble = utility of a certain wealth EU = U(50) Indifference between certain income than uncertain income with the same expected value 1 Risk Premium the maximum amount of money that a risk-adverse person is willing to pay to avoid taking risk Risk Premium = (Initial Wealth) – (the certain income that yields the same expected utility as the expected income) The greater the variability of income, the higher the risk premium Example: Buying an insurance Owing a house: land = 20 and house = 80, total wealth = 100 Probability of fire = 0.2, if fire occurs, wealth = 20 Expected wealth = 0.2 (20) + 0.8(100) = 84 No Insurance Expected Utiltiy = EU = 0.2 U(20) + 0.8U(100) Insurance Risk premium = 20 and compensation = 80 No Fire: Wealth = 100 – premium = 80 Fire: Wealth = 100 – premium – loss + compensation = 80 Utility U(85) U(Wealth) EU = U(80) U(20) Insurance premium < 20, for example, 15 The agent is better off with insurance U(85) > EU RP Wealth 0 20 80 84 85 100 Max insurance premium = 20 Utility U(Wealth) EU = U(90) Expected Loss = 0.2 (80) = 16 A risk averse agent is willing to pay for more the fair premium 16 to insure the house as he dislikes uncertainty. Risk Loving Insurance premium = 10, (Max premium = 10) The agent is indifference between owing a house with no insurance and a house with full insurance. EU = U (90) Insurance premium > 10, for example, 15 The agent is worse off with insurance U(85) < EU U(85) U(20) 0 Risk Averse Insurance premium = 20 (Max premium = 20) The agent is indifference between owing a house with no insurance and a house with full insurance. EU = U (80) Wealth 20 84 85 90 100 Max premium = 10 Expected Loss = 0.2 (80) = 16 A risk loving agent is not willing to pay for the fair premium 16 to insure the house as he likes uncertainty. 2 Review Questions Question 1 Suppose that Jeff’s utility function is given by U(W) = W0.5, where W represents total wealth. Is Jeff risk-averse, risk-loving, or risk-neutral? Risk Averse It could be shown that here expected utility is smaller than his utility for a given level of income. (Can be shown by diagram or by calculus) Question 2 A consumer has an income for the next year of $14400, but faces a 0.5 probability of a monetary loss of $ 4400 due to illness. There are no other losses in utility cause by the illness. Her utility function is U(W) = W0.5 where W is the amount of income, net of any loss she suffers. (a) What is the expected dollar loss? Expected loss = 0.5(4400) = 2200 (b) What is her expected income? Expected income = 0.5(14400) + 0.5(10000) = 12200 (c) What is this consumer’s expected utility? EU = 0.5U(14400) + 0.5U(10000) = 0.5(144000.5) + 0.5(100000.5) = 110 (d) What is the minimum certain income she would accept to avoid risk to by completely insured. What is the risk premium? Graph your answers. The minimum certain income she would accept to avoid the risk is given by the solution to U(W*) = W*0.5 = 110 or W* = 12100 The risk premium is 14400 – 12100 = 2300 U(W) U(W) EU =100 = U(12100) RP X 10000 12100 12200 14400 3 Question 3 Person A owns a house worth $2000. She cares only about her wealth, which consists entirely of the house. In any given year, there is 30% chance that the house will burn down. If it does, its scrap value will be $600. Jane’s utility function is U wealth . a) Draw Person A’s utility function. U U wealth . U (2000) U(X) = EU 0.3 U (600) 0.7 Max. Insurance/ Risk Premium W 600 X 1580 2000 b) Is Person A risk-averse or risk preferring? Person A is risk averse. c) What is the expected monetary value of Person A’s gamble The expected monetary value of Person A’s gamble 0.7(2000) 0.3(600) 1580 d) How much would Person A be willing to pay to insure her house against being destroyed by fire? If Person A has a monetary value at X with certainty, her utility will be equal to EU, we know that, U ( X ) X EU 0.7U (2000) 0.3U (600) 0.7 2000 0.3 600 38.65 X 1494.09 Therefore, Person A will be willing to pay a maximum insurance fee of 2000 1494.07 505.91 e) Say that Person B is the president of an insurance company. He is risk neutral and has a utility function of the following type: U = $. Between what two prices could a beneficial insurance contract be made by Person A and Person B? The insurance company has a 30% chance to pay 1400 and a 70% chance to pay nothing. If it is neutral, it would be willing to charge a premium of 0.3(1400) 420 for the fire insurance. Person A is willing to pay a maximum of 505.91, Therefore, if the price is between 420 and 505.91, then both will benefit. 4