A325 Exam 1 review Fall, 2010

advertisement

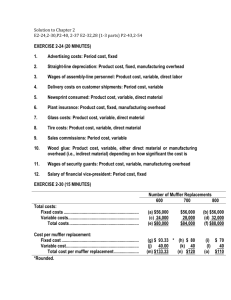

A325 Exam 1 review Fall, 2010 The exam is EIGHT problems (each with subsidiary questions) and you have ONE HOUR AND THIRTY minutes (1:30) to complete it. You are permitted to bring one page of notes with whatever you wish on them – but you must be able to read them without any special mechanism. The exam has no multiple-choice questions. You MUST show your work to receive credit. Here is a summary of the questions and a reference to similar material when such exists. 1. A chapter 3 problem with “fill in the unknowns”. Most like 3-56 (solution attached to this document) (3-53 in 4th edition – solution also attached). 2. Overhead application and proration of over- or under-applied overhead. This problem is most similar to Zaf radiator and to the problem attached to this review sheet but there is a slight twist that refers to job costing (see next problem). 3. Job-Order costing. This problem is most like problem 4-41 in the book (solution attached to this document) (same problem for 4th edition). 4. Activity-based costing. This problem is most like questions 10 and 16 off of quiz 3. 5. Cost estimation using regression and activity analysis (ABC). This question is almost EXACTLY like Peterson’s catering. 6. Cost-Volume-Profit. This is much like CVP problems covered in class (ECAT examples). 7. Cost-Volume-Profit with margin of safety discussed in class. 8. Variable costing problem with inventory changes (like in class). 3-56 (5th edition) Case A 1. Direct materials used + Direct labor + Manufacturing overhead Total manufacturing costs $18,000 35,000 50,000 $103,000 2. Sales - Cost of goods sold Gross margin $150,000 - ? = $125,000 $25,000 3. Beginning finished goods + Cost of goods manufactured - Ending finished goods Cost of goods sold $ 35,000 + ? = $130,000 -40,000 125,000 4. Beginning work in process + Total manufacturing costs - Ending work in process Cost of goods manufactured ? +103,000 -22,000 $130,000 = $49,000 5. Gross margin - Selling and administrative expenses Operating income $25,000 -? $10,000 Case B 1. Sales - Cost of Goods sold Gross margin ? = $84,000 - 61,000 $23,000 = $15,000 2. Beg. Finished goods inventory + Cost of goods manufactured - End. Finished goods inventory Cost of goods sold $ 28,000 +45,000 - ? = $12,000 $61,000 3. Direct materials used + Direct labor + Manufacturing overhead $ 8,000 + 9,000 + ? = $ 18,000 Total manufacturing costs 4. Total manufacturing costs + Work in process inv., Jan. - Work in process inv., Dec. Cost of goods manufactured $35,000 $35,000 14,000 - ? = $4,000 $45,000 3-53 (4th edition) Case A 1. Direct materials used + Direct labor + Manufacturing overhead Total manufacturing costs $18,000 15,000 20,000 $53,000 2. Sales - Cost of goods sold Gross margin $100,000 - ? = $75,000 $25,000 3. Beginning finished goods + Cost of goods manufactured - Ending finished goods Cost of goods sold $ 15,000 + ? = $76,000 -16,000 75,000 4. Beginning work in process + Total manufacturing costs - Ending work in process Cost of goods manufactured ? +53,000 - 7,000 $76,000 5. Gross margin - Selling and administrative expenses Operating income $25,000 -? $10,000 Case B 1. Sales - Cost of Goods sold Gross margin ? = $46,000 - 43,000 $ 3,000 2. Finished goods inventory + Cost of goods manufactured - Finished goods inventory Cost of goods sold $ 8,000 +45,000 - ? = $10,000 $43,000 3. + Direct labor + 9,000 = $30,000 = $15,000 + Manufacturing overhead Total manufacturing costs 4. Total manufacturing costs + Work in process inv., Jan. - Work in process inv., Dec. Cost of goods manufactured + ? = $ 18,000 $35,000 $35,000 14,000 - ? = $4,000 $45,000 Background Tomek Company uses a job costing system that applies factory overhead on the basis of direct labor-hours. The company's factory overhead budget for 2007 included the following estimates: Problem Information Budgeted total factory overhead Budgeted total direct labor-hours Company's Ledger Actual factory overhead Actual direct labor-hours $568,000 71,000 Work-in-process inventory Finished goods inventory $582,250 71,500 Applied Factory Overhead $139,000 $216,840 Cost of goods sold $200,160 Requirements Compute the firm's predetermined factory overhead rate for 2007. Predetermined Factory Overhead Rate $8.00 Calculate the amount of overapplied or underapplied overhead. Applied Overhead Actual Overhead Underapplied Overhead $572,000 $582,250 $10,250 Applied Overhead Remaining in: WIP Inventory Finished Goods Inventory Cost of Goods Sold (CGS) Total Dollar $139,000 $216,840 $200,160 $556,000 Proration (allocation) of Underapplied Overhead: To WIP Inventory $2,562.50 To Finished Goods Inventory $3,997.50 To CGS $3,690.00 $10,250.00 % 25.00 39.00 36.00 100.00 4-41 YOU DO NOT NEED TO PREPARE JOURNAL ENTRIES (SAME PROBLEM 4TH EDITION) 1. Predetermined Overhead Rate = $ 120,000 / 8,000 = $15 per DL hour 1. Journal Entries a. Materials Inventory Accounts Payable 90,000 90,000 b. Work-in-Process Inventory- Job S10 Work-in-process Inventory - Job C20 Work-in-Process Inventory - Job M54 Factory Overhead Materials Inventory 23,000 42,000 22,000 4,000 c. Work-in-Process Inventory- Job S10 Work-in-Process Inventory- Job C20 Work-in-Process Inventory- Job M54 Factory Overhead Salary Expense (S & A) Accrued Payroll 6,110 4,030 1,820 2,500 6,000 d. Factory Overhead Depreciation Expense (S & A) Accumulated Depreciation 91,000 20,460 2,200 1,700 3,900 e. Advertising Expense (S & A) Cash 6,000 f. Factory Overhead Accounts Payable (or Cash) 1,300 g. Factory Overhead Accounts Payable (or Cash) 1,600 6,000 1,300 1,600 h. Work-in-Process Inventory 13,800 Factory overhead 13,800 Applied Overhead = $15 x 920 hours = $13,800 i. Finished Goods Inventory-Job S10 46,660 Work-in-Process Inventory- Job S10 46,660 $6,110 / $13 = 470 direct labor-hours $10,500 + $23,000 + $6,110 + ($15 x 470) = $46,660 j. Accounts Receivable 59,000 Sales Cost of Goods Sold 54,000 Finished Goods Inventory - Job J21 k. Cash Accounts Receivable 59,000 54,000 25,000 25,000 3. Ending balance of the Materials Inventory = Beginning balance + Purchases - Uses = $27,000 + $90,000 - $91,000 = $26,000 4. Ending balance of the Work-in-Process Inventory = Job C20 Cost + Job M54 Cost = (Direct Materials + Direct Labor + Applied Overhead) of 2 jobs = ($42,000 + $22,000) + ($4,030 + $1,820) + [$15 x (310 + 140)] = $64,000 + $5,850 + $6,750 = $76,600 where direct labor-hours for Job C20 = $4,030 / $13 = 310 hours for Job M54 = $1,820 / $13 = 140 hours Alternative approach: Ending WIP = Beginning WIP + DM + DL + Applied OH - FG = $10,500 + ($23,000 + $42,000 + $22,000) + ($6,110 + $4,030 + $1,820) + $13,800 - $46,660 = $76,600 5. Actual Overhead = $4,000 + $2,500 + $2,200 + $1,300 + $1,600 = $11,600 $11,600 (Actual) - $13,800 (Applied) = $2,200 Overapplied Overhead