Economic Performance of the Airline Industry

advertisement

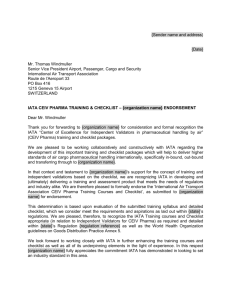

Economic Performance of the Airline Industry Airline Cost Conference 25th August 2015 Brian Pearce, Chief Economist www.iata.org/economics To represent, lead and serve the airline industry ROIC gains driven by a subset of the industry Distribution of 2014 airline ROIC 14 Most frequent ROIC = 0% 12 Median ROIC = 3.2% number of airlines 10 34 airlines ROIC > WACC 8 6 4 2 0 -21 -19 -17 -15 -13 -11 -9 -7 -5 -3 -1 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 % return on invested capital Source: The Airline Analyst, IATA IATA Economics www.iata.org/economics 2 FCF concentrated in the US 2014 Free Cash Flow by region 4 2 FCF US$ billion 0 -2 Network LCC -4 -6 -8 -10 US LA ME EU AP Source: The Airline Analyst, IATA IATA Economics www.iata.org/economics 3 But good ROIC performance in Europe as well 2014 return on capital by region 30% ROIC as as % invested capital 20% Average cost of capital 10% 0% -10% -20% -30% N America Europe Asia Pacific LA ME AF Source: The Airline Analyst, IATA IATA Economics www.iata.org/economics 4 Median airline balance sheet still deteriorating Free cash flow and adjusted net debt 30 Adjusted net debt, US$ billion 25 6 airlines could repay all debt in next 5 years 20 15 10 5 0 -50% Median airline $3 billion net debt -3% FCF/net debt -40% -30% -20% -10% 0% 10% 20% Free cash flow as a % of adjusted net debt 30% 40% 50% Source: The Airline Analyst, IATA IATA Economics www.iata.org/economics 5 2015 should see record profits for the industry Global commercial airline profitability 8.0 6.0 30 EBIT margin 20 10 2.0 0.0 0 Net post-tax profit -2.0 -10 US$ billion % revenues 4.0 -4.0 -20 -6.0 -8.0 -30 2000 2002 2004 2006 2008 2010 2012 2014 Source: ICAO, IATA IATA Economics www.iata.org/economics 6 Though that’s still only $8.27 per passenger Worldwide airline net post-tax profit per departing passenger, 2015 250 $205.37 Ancillaries 200 $197.10 $8.27 Ancillaries 150 Fare 100 50 Cargo 0 Revenue Cost Net profit Source: IATA IATA Economics www.iata.org/economics 7 But paying investors ‘normal’ return for 1st time Return on capital invested in airlines 9.0 8.0 Cost of capital (WACC) % of invested capital 7.0 6.0 5.0 4.0 3.0 Return on capital (ROIC) 2.0 1.0 0.0 2000 2002 2004 2006 2008 2010 2012 2014 Source: IATA, McKinsey IATA Economics www.iata.org/economics 8 Widening gap above breakeven driving returns Breakeven and achieved weight load factors 69 Achieved 67 % ATKs 65 Breakeven 63 61 59 57 2000 2002 2004 2006 2008 2010 2012 2014 Source: IATA IATA Economics www.iata.org/economics 9 Consolidation has played an important role Market share of top-4 airlines/JVs 81% 68% 36% 48% 42% 33% 51% 59% Source: SRS Analyser IATA Economics www.iata.org/economics 10 The product structure is changing too 2013 ancillaries and operating profits, % revenues 35% Allegiant 30% Ryanair Ancillaries as % revenues 25% 20% Flybe United 15% Qantas 10% Korean Easyjet Aer Lingus Spicejet SAA Alaska JetBlue Frontier 5% PIA Air Asia Delta Hawaiian BA JAL 0% -20% -15% -10% -5% 0% 5% Operating profits as % revenues 10% 15% 20% Source: IdeaWorks, Airline Analyst, IATA IATA Economics www.iata.org/economics 11 Low fuel prices important but US$ major offset The Brent crude oil price and the US dollar 160 95 US dollar 90 120 85 100 80 80 75 60 70 US dollar trade weighted index Oil price, US$ per barrel 140 Brent crude oil price 40 65 20 60 2008 2009 2010 2011 2012 2013 2014 2015 Source: Datastream IATA Economics www.iata.org/economics 12 Driving further divergence in performance this year Airline net post-tax profit margins Net post-tax profit as % revenue 8% N America 6% 4% Europe Asia-Pacific 2% 0% -2% -4% -6% 2007 2008 2009 2010 2011 2012 2013 2014 2015 Source: ICAO, IATA IATA Economics www.iata.org/economics 13 Longer-term impact of lower fuel prices not clear Return on invested capital and unit costs 9.0 70 8.0 Unit costs 65 ROIC, % invested capital 7.0 6.0 60 5.0 55 4.0 3.0 50 2.0 Operating costs/ATK, US cents/ATK Return on invested capital 45 1.0 0.0 40 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Source: IATA, McKinsey IATA Economics www.iata.org/economics 14 Costs typically passed through to prices Unit cost and the price of air transport 4.0 7.0 3.5 6.0 3.0 5.0 1973 oil crisis 2.5 4.0 US deregulation 2.0 3.0 1.5 EU deregulation Unit cost (US$/ATK) 1.0 2.0 1.0 0.5 US$ in 2013 prices per tonne kilometer US$ in 2013 prices to fly a tonne kilometer Boeing 707 Price (US$/RTK) 0.0 1950 1960 1970 1980 1990 2000 2010 Source: ICAO, IATA IATA Economics www.iata.org/economics 15 A strong economy is unambiguously positive Airline industry ROIC and world GDP growth 6.0 8.0 Airlines ROIC 5.0 4.0 World GDP growth, % 4.0 3.0 2.0 2.0 World GDP growth 1.0 0.0 0.0 -2.0 -1.0 Airlines ROIC, % invested capital 6.0 -4.0 -2.0 -3.0 -6.0 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Source: IATA, McKinsey, IHS Global Insight IATA Economics www.iata.org/economics 16 Economic cycle positive but not very strong Indicators of the global economic cycle 70 20% 15% year-on-year % growth 65 World trade growth 60 Industrial production growth 10% Business confidence 55 5% 0% 50 -5% 45 -10% 40 -15% 35 -20% -25% Net balance of respondents, 50 = no change 25% 30 2008 2009 2010 2011 2012 2013 2014 2015 Source: Datastream IATA Economics www.iata.org/economics 17 Chinese equity market bubble has burst IATA Economics www.iata.org/economics 18 But growth in demand for travel and cargo looks OK Growth of air travel and air freight 25% 20% Freight (FTK) growth year-on-year % growth 15% 10% Travel (RPK) growth 20-year average growth rate 5% 0% -5% -10% -15% -20% 2008 2009 2010 2011 2012 2013 2014 2015 Source: IATA IATA Economics www.iata.org/economics 19 Though cargo growth should be much stronger International trade compared to global industrial production 1.2 1.1 Index, 2005=100 1.0 0.9 0.8 0.7 0.6 1992 AFTER: FTKs growth 3.2% p.a. BEFORE: FTKs growth 6.4% p.a 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Source: Netherlands CPB, IATA IATA Economics www.iata.org/economics 20 Trade and cargo markets appear to have peaked 7. World trade in goods and air FTKs Billion FTKs (seasonally adjusted) Index of world trade, 2005=100 (seasonally adjusted) 140 15 14 130 13 120 12 110 11 100 10 9 International FTKs Apr-15 Dec-14 Aug-14 Apr-14 Dec-13 Aug-13 Apr-13 Dec-12 Aug-12 Apr-12 Dec-11 Aug-11 Apr-11 Dec-10 Aug-10 Apr-10 Dec-09 Aug-09 Apr-09 Dec-08 Aug-08 Apr-08 Dec-07 Aug-07 90 World Trade Index Source: Netherlands CPB, IATA IATA Economics www.iata.org/economics 21 Business confidence has been diminishing IATA Economics www.iata.org/economics 22 Risk that growth expectations now too high IATA survey of airline CFOs and heads of cargo Net balance responses. 50=no change 120 Passenger services growth expected in the next 12 months 100 80 Cargo services growth expected in the next 12 months 60 40 20 0 2006 2008 2010 2012 2014 Source: IATA Business Confidence survey IATA Economics www.iata.org/economics 23