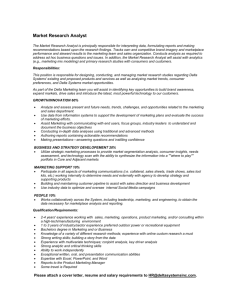

Delta Air Lines, Inc.

advertisement