Chapter Outline

Chapter 28

Minimum Wage

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

• TRADITIONAL ECONOMIC

ANALYSIS OF A MINIMUM WAGE

• REBUTTAL TO THE TRADITIONAL

ANALYSIS

• WHERE ARE ECONOMISTS NOW?

McGraw -Hill/Irwin

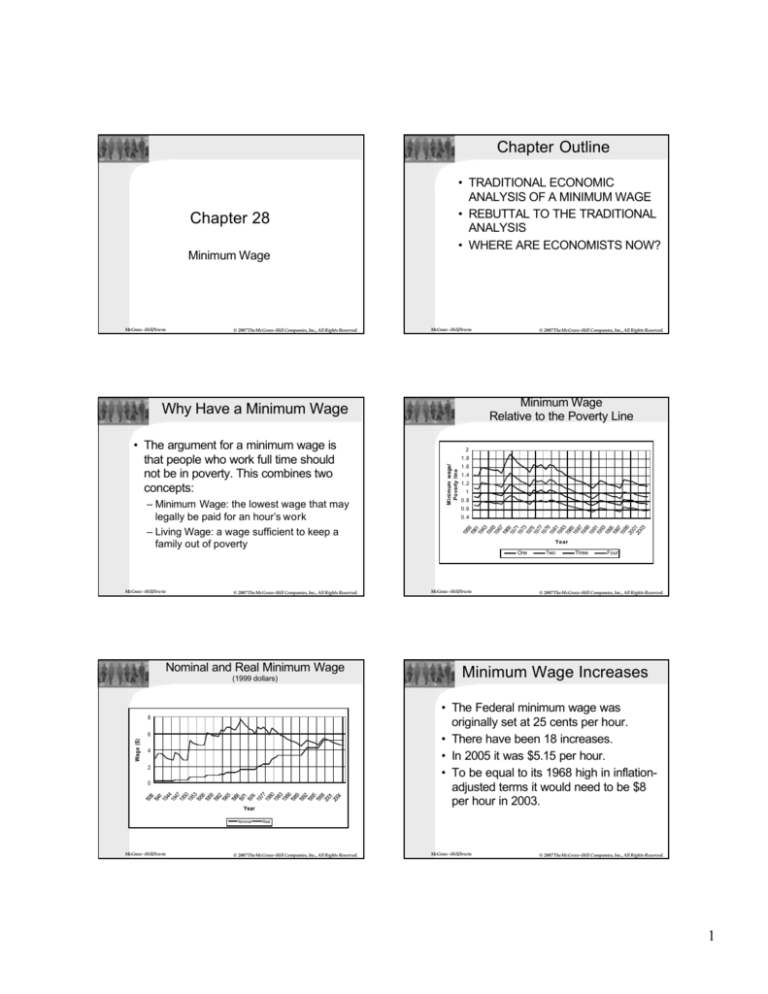

Minimum Wage

Relative to the Poverty Line

Why Have a Minimum Wage

Minimum wage/

Poverty line

– Minimum Wage: the lowest wage that may

legally be paid for an hour’s work

– Living Wage: a wage sufficient to keep a

family out of poverty

2

1.8

1.6

1.4

1.2

1

0.8

0.6

0.4

19

5

19 9

6

19 1

63

19

6

19 5

67

19

69

19

7

19 1

73

19

75

19

7

19 7

79

19

8

19 1

83

19

85

19

8

19 7

89

19

9

19 1

93

19

95

19

9

19 7

99

20

0

20 1

03

• The argument for a minimum wage is

that people who work full time should

not be in poverty. This combines two

concepts:

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

Year

One

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

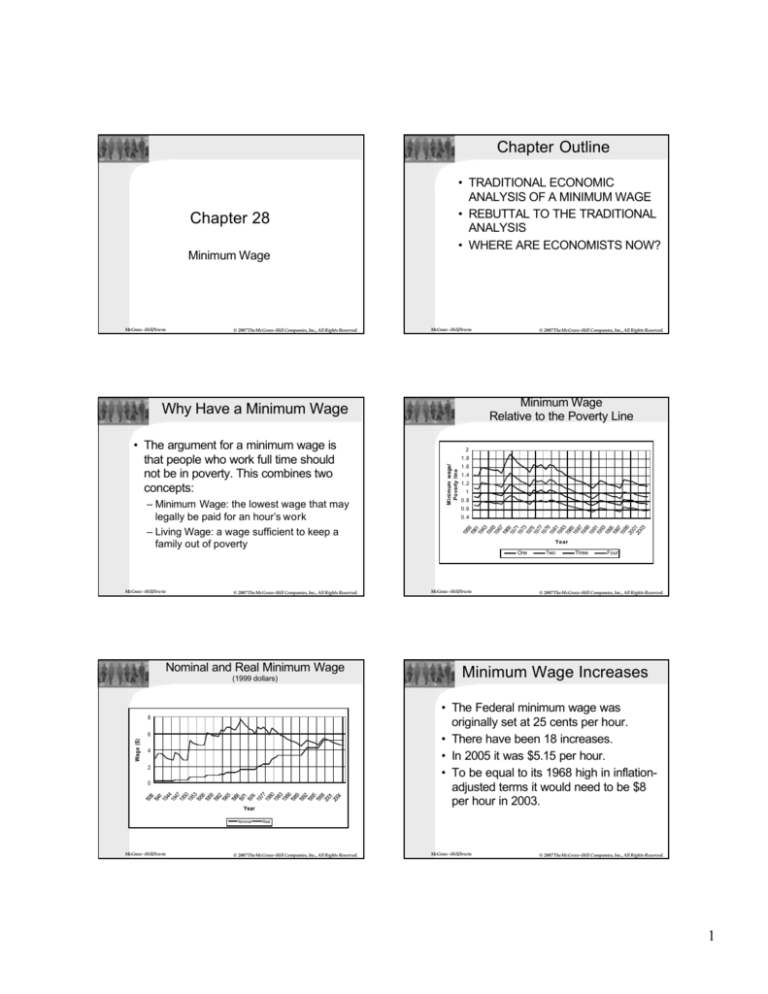

Nominal and Real Minimum Wage

(1999 dollars)

8

Wage ($)

6

4

2

19

38

19

41

19

44

19

47

19

50

19

53

19

56

19

59

19

62

19

65

19

68

19

71

19

74

19

77

19

80

19

83

19

86

19

89

19

92

19

95

19

98

20

01

20

04

0

Year

Nominal

McGraw -Hill/Irwin

McGraw -Hill/Irwin

Two

Three

Four

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

Minimum Wage Increases

• The Federal minimum wage was

originally set at 25 cents per hour.

• There have been 18 increases.

• In 2005 it was $5.15 per hour.

• To be equal to its 1968 high in inflationadjusted terms it would need to be $8

per hour in 2003.

Real

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

1

Minimum Wages

in States and Cities

States

Cities

New York

Delaware

Florida

Hawaii

Maine

Illinois

District of Columbia

Rhode Island

Massachusetts

California

Vermont

Connecticut

Oregon

Washington

Baltimore, MD

Boston, MA

Chicago, IL

Cleveland, OH

Denver, CO

Detroit, MI

Los Angeles, CA

Minneapolis, MN

San Antonio, TX

San Francisco, CA

McGraw -Hill/Irwin

The Labor Market without a Minimum

Wage

•

W

A

W*

C

B

0

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

L*

McGraw -Hill/Irwin

– The company must pay the market wage to

attract workers.

– Paying below the market wage is not in its

interests because such a wage would not

attract sufficient workers to the company.

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

• The gain to the workers who keep their

jobs is less than the loss to the losers

who

– lose their jobs and

– are firms who have to pay higher wages.

McGraw -Hill/Irwin

(continued)

– small businesses more than larger firms.

– minorities more than whites.

• A majority of minimum wage workers are

young adults who are not supporting families.

An increase in the minimum wage is an

inefficient mechanism for helping poor

working families.

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

The EITC Alternative

to the Minimum Wage

The Case Against

• An increase in the minimum wage by 10%

decreases the number of jobs held by teens

by 1% to 3%.

• A minimum wage increase negatively affects

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

What’s Wrong with the

Minimum Wage

Minimum Wage Relevance

• A minimum wage is only relevant if it is

above the market wage.

• A minimum wage below the market

wage is irrelevant.

Value to the firms:

• 0ACL*

Supply

• Firms pay workers:

• OW*CL*

• The opportunity cost to workers:

• OBCL*

• Surplus to firms:

• W*AC

Demand • Surplus to workers:

Labor • BW*C

• The earned income tax credit (EITC)

– is a targeted tax credit to the working poor.

– was, in 2004, as much as $4,140 for a

working poor family with two children.

– 70% of benefits go to households in

poverty

– 70% of minimum wage benefits go to

households not in poverty

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

2

The Rebuttals to the Traditional

Analysis

• The Macroeconomic Argument

– The money that is transferred from employers to

employees in more likely to be spent than saved

thereby increasing GDP.

• The Work Effort Argument

– People who are paid more may work harder than

people who are paid less. This may return some of

the increased wage paid by employers back to

them in terms of increased productivity.

• The Inelasticity of Labor Demand Argument

Where are Economists Now

• Economists have long been against the

minimum wage and for the EITC.

• Card and Kruger challenged many of the

long-held conclusions in the 1990s with

research verifying the Inelasticity Argument.

• For most labor economists, subsequent

research has re-verified the original pro- EITC,

anti-minimum wage argument.

– If the demand for labor is inelastic then there is

less of a loss in employment and a smaller

deadweight loss.

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

Kicking it Up a Notch: Demonstrating the

Case Against the Minimum Wage

•

W

•

Supply

A

E

W min

W*

•

C

•

F

B

•

Demand

0 Lmin L* LS

McGraw -Hill/Irwin

Labor

•

Value to the firms:

• 0AEL min

Firms pay workers:

• 0W minELmin

The opportunity cost to workers:

• 0BFLmin

Surplus to firms:

• W minAE

Surplus to workers:

• BW minEF

Unemployed workers

McGraw -Hill/Irwin

Demonstrating the Inelasticity Argument

W

Supply

E

W min

W*

F

C

B

Low level of DWL

Demand

0

• Who had jobs

• L*-Lmin

• Who are now looking

• LS-L*

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

LminL*

Labor

Small number of displaced workers

McGraw -Hill/Irwin

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

3