Policy on Retention of Financial Records

advertisement

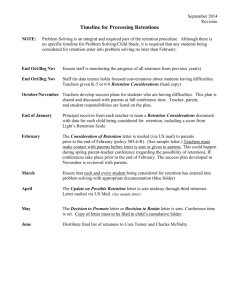

Policy on Retention of Financial Records Status: Approved Custodian: Director: Finance and Administration Date approved: 2014-03-14 Decision No: SAQA 08103/14 Implementation date: 2014-03-17 Due for review: 2016-03-13 File Number: Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 1 Table of Contents 1. PREAMBLE ..........................................................................................................................................3 2. PURPOSE .............................................................................................................................................3 3. OWNERSHIP ........................................................................................................................................3 4. SCOPE OF PRACTICE ......................................................................................................................3 5. PROCEDURE .......................................................................................................................................3 6. TYPE OF POLICY ...............................................................................................................................3 7. DEFINITION ..........................................................................................................................................3 8. MANAGEMENT OF ACCOUNTING RECORDS ............................................................................3 8.1 EFFECTIVENESS OF RECORD MANAGEMENT ....................................................................3 8.2 RESPONSIBILITIES .......................................................................................................................4 9. SUB-PROCESSES ..............................................................................................................................4 9.1 SOURCE DOCUMENTATION ......................................................................................................4 9.2 DISPOSAL OF RECORDS ............................................................................................................5 9.3 RETENTION, FILING AND STORAGE OF DOCUMENTATION ............................................5 Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 2 1. PREAMBLE The policy on Retention of Financial Records is to ensure the proper creation, maintenance, use and disposal of records to achieve efficient, transparent and accountable governance 2. PURPOSE To provide for the effective, efficient, and economical care, custody, and control of SAQA’s accounting records in accordance with SAQA’s Policy on Records Management. 3. OWNERSHIP The custodian of this policy is the Directorate: Finance and Administration. 4. SCOPE OF PRACTICE The policy is applicable to all SAQA staff and stakeholders. 5. PROCEDURE There is no procedure to be read and implemented with this policy. 6. TYPE OF POLICY This policy is of a strategic nature. 7. DEFINITION “Record” - Recorded information regardless of form or medium, evidence of a transaction, preserved for the evidential information it contains. Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 3 8. MANAGEMENT OF ACCOUNTING RECORDS 8.1 EFFECTIVENESS OF RECORD MANAGEMENT 8.1.1 A well-organised filing plan enables SAQA to find information easily. Records that are correctly filed and stored are easily accessible, and this facilitates transparency and accountability. 8.1.2 The orderly and efficient flow of information enables SAQA to perform its functions successfully and efficiently. 8.1.3 Authoritative and reliable records must be created and maintained in an accessible and usable manner to support the business and accountability requirements of the Board. 8.1.4 Efficiency and economy are ensured by eliminating unnecessary duplication of records. 8.1.5 A retention and disposal programme ensures that SAQA maintains only those records it really needs for functional purposes. 8.1.6 Controls must be exercised to ensure that only authorised persons have access to the information, thereby preventing information and/or records themselves from being stolen or damaged. This ensures the protection of privacy and confidentiality, and prevents the inappropriate disclosure of information that could harm SAQA or infringe the privacy rights of individuals. Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 3 8.2 RESPONSIBILITIES 8.2.1 The management of SAQA’s records holdings is a shared responsibility amongst the finance department, the heads of relevant Directorates and the record users. 8.2.2 All record users are obligated to handle SAQA records in accordance with the SAQA’s Policy on Records Management. 9. SUB-PROCESSES 9.1 SOURCE DOCUMENTATION 9.1.1 All entries in the financial records of SAQA must be supported by duly authorised original documentation. 9.1.2 Staff is discouraged from using faxes or photocopies as source documents. 9.1.3 Should the original documentation not be available at the time of data capturing the fax or photocopy may be used but it should be clearly marked as a duplicate awaiting original and should be kept separate until such time as the original has been received. 9.1.4 The original must be compared to the fax/photocopy which must be replaced with the original once the member of staff agreeing the details is satisfied that the original does agree to the document previously used as an input document. The original must be filed. Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 4 9.1.5 This does not apply to the copies of invoices forwarded to the Finance Department. 9.2 DISPOSAL OF RECORDS No changes to the retention periods set out in this document may be made without prior written authorisation from the National Archivist. 9.3 RETENTION, FILING AND STORAGE OF DOCUMENTATION 9.3.1 Retention 9.3.1.1 All financial records and information must be retained in conformity with the local regulations as required by the Auditor-General, taking into account the National Archives and Records Service of South Africa Act No. 43 of 1996 and its regulations. 9.3.1.2 The retention periods commence from the date of the last entry in a particular record. 9.3.1.3 The recommended guidelines for the retention of documentation and records in conformity with local regulation are as follows: Hard Copies of Minutes including resolutions passed Retention Period Indefinite Minute books Annual Financial Statements Books of account Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 5 Hard Copies of Retention Period Supporting schedules to books of account and 15 Years ancilliary books of account Fixed asset registers Internal audit reports System appraisals Staff personnel records (after employment ceased) 7 Years Salary and wage registers Paid cheques and bills of exchange 6 Years Invoices – sales and purchases Bank statements and vouchers Year-end working papers 5 Years Sales tax and VAT records Other vouchers and general correspondence 9.3.1.4 Where financial information is required as evidence in proceedings before a court, Parliament, a provincial legislature, an official inquiry or otherwise, or for purposes of an audit, it must be secured in its then current form until no longer required, even if the National Archivist has authorised its disposal. 9.3.1.5 If no provision is made in local regulation for specific instances, the following guidelines must be adhered to: 9.3.1.5.1 All documents and records must be kept for a minimum period of 5 years. 9.3.1.5.2 Any agreements or contracts exceeding the minimum period should be kept for a period of 5 years after the expiry date stated on the agreement or contract. Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 6 9.3.2 Filing 9.3.2.1 A proper filing system in accordance with SAQA’s Policy on Records Management must be maintained at all times in such manner that a sufficient audit trail is always in existence. 9.3.2.2 Documents must be filed in a logical manner and as prescribed in this manual and should be uniquely referenced to facilitate enquiries from the general ledger to the source documents. 9.3.3 Storage 9.3.3.1 All documents stated above must be stored in a safe place where proper precaution has been taken to prevent loss caused by natural disasters. 9.3.3.2 Documents for the current year as well as the year immediately preceding the current year should always be kept in a secure filing room on the premises of SAQA. 9.3.3.3 Documents for years prior to the previous year should preferably be stored off-site in archives and proper care should be taken in storing the documents in such manner that it remains easily accessible in case information is required. 9.3.3.4 All confidential documents and contracts as well as documents not in use (such as unused cheque books) must be kept separate and must be locked away in a safe Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 7 or secure location. Confidential documents amongst others would include: 9.3.3.4.1 Corporate strategies 9.3.3.4.2 Business development strategies 9.3.3.4.3 New product development strategy 9.3.3.4.4 Contracts 9.3.3.4.5 Bursary status of student or apprentice 9.3.3.4.6 Records of disciplinary action 9.3.3.4.7 Salary, bonus and appraisal records Policy on Retention of Financial Records Status: Approved Date: 2014-03-14 File Reference: 8