rel2001cap3i - 58 Kb - Banco Central do Brasil

advertisement

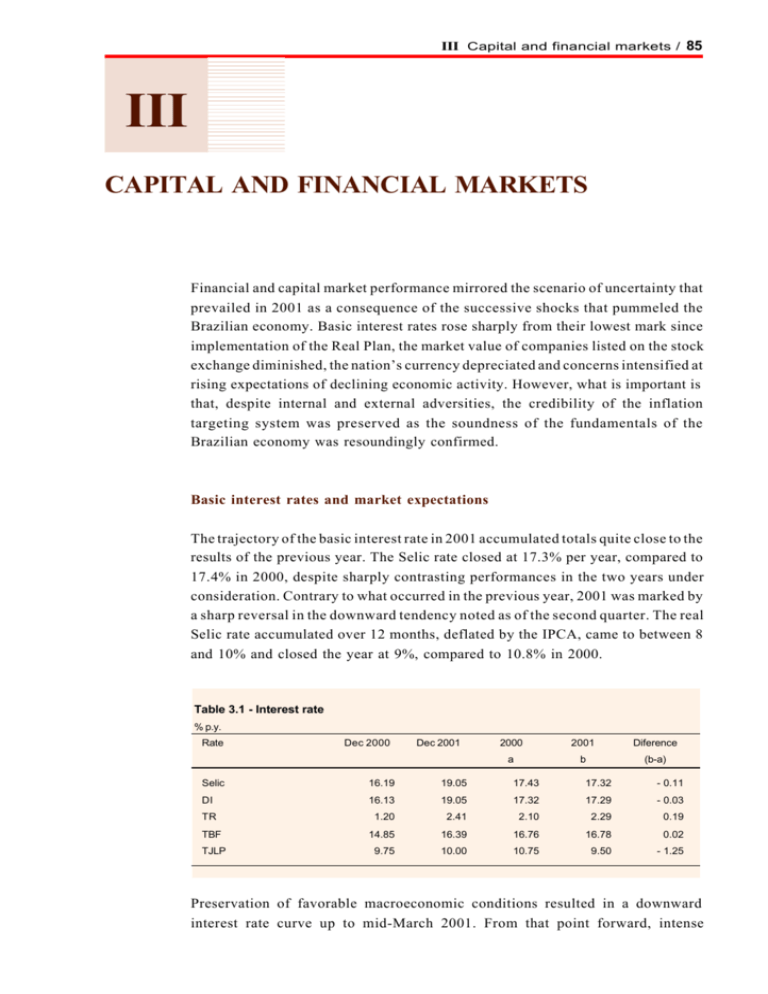

III Capital and financial markets / 85 III CAPITAL AND FINANCIAL MARKETS Financial and capital market performance mirrored the scenario of uncertainty that prevailed in 2001 as a consequence of the successive shocks that pummeled the Brazilian economy. Basic interest rates rose sharply from their lowest mark since implementation of the Real Plan, the market value of companies listed on the stock exchange diminished, the nation’s currency depreciated and concerns intensified at rising expectations of declining economic activity. However, what is important is that, despite internal and external adversities, the credibility of the inflation targeting system was preserved as the soundness of the fundamentals of the Brazilian economy was resoundingly confirmed. Basic interest rates and market expectations The trajectory of the basic interest rate in 2001 accumulated totals quite close to the results of the previous year. The Selic rate closed at 17.3% per year, compared to 17.4% in 2000, despite sharply contrasting performances in the two years under consideration. Contrary to what occurred in the previous year, 2001 was marked by a sharp reversal in the downward tendency noted as of the second quarter. The real Selic rate accumulated over 12 months, deflated by the IPCA, came to between 8 and 10% and closed the year at 9%, compared to 10.8% in 2000. Table 3.1 - Interest rate % p.y. Rate Dec 2000 Dec 2001 2000 2001 Diference a b (b-a) Selic 16.19 19.05 17.43 17.32 - 0.11 DI 16.13 19.05 17.32 17.29 - 0.03 TR 1.20 2.41 2.10 2.29 0.19 TBF 14.85 16.39 16.76 16.78 0.02 TJLP 9.75 10.00 10.75 9.50 - 1.25 Preservation of favorable macroeconomic conditions resulted in a downward interest rate curve up to mid-March 2001. From that point forward, intense 86 / Boletim do Banco Central do Brasil - Annual Report 2001 Graph 3.1 Interest rates 20 % p.y. 15 10 5 0 Over/Selic DI TR 2000 TBF TJLP 2001 Graph 3.2 Over/Selic rate 20 % p.y. 19 18 17 16 15 Jan Feb Mar Apr May Jun Jul Aug 2000 Sep Oct Nov Dec Oct Nov Dec 2001 Graph 3.3 Over/Selic rate accumulated in 12 months 20 18 % p.y. 16 14 12 10 8 6 Jan 2001 Feb Mar Apr Nominal May Jun Jul Aug Sep Real (IPCA) volatility in the interest and exchange futures markets reversed this curve. In the period from March to July 2001, the Selic rate target increased by 3.75 p.p. The average daily volume negotiated in one day DI futures contracts increased to R$22 billion in March, clearly mirroring the intense uncertainty of the period. The rate differential between the one day DI futures market and 360 day DI x pre swap operations came to more than 500 base points. III Capital and financial markets / 87 Graph 3.4 Swap DI x Pre 30 % p.y. 27 24 21 18 15 1.4.2001 3.16.2001 30 days 5.28.2001 8.6.2001 90 days 10.16.2001 180 days 12.28.2001 360 days As of the month of September, the measures taken by Banco Central with the objective of restricting financial system liquidity were viewed as an alternative to a continued upward spiral in basic interest rates and made it possible to hold the Selic rate to 19% per year. Once approved by the CMN, these measures resulted in an increase from 0.33 to 0.50 in the factor used in calculating the PLE of the banks that operate with net exchange exposure above the exemption percentage. Aside from this, the exemption percentage was reduced from 20% to 5%. Banco Central began using the percentage that exceeds the exemption limit as the basis for calculating the required level of capitalization. In other words, if the institution has a net exchange exposure limit of 10% of its PR, the factor of 0.50 will be applied to the 10%. According to the previous rule, the calculation base involved only that part in excess of the exemption limit. The total exchange exposure limit, nevertheless, remained unchanged at 60% of PR. These measures generated their effect in October, reversing the movement leveraged by the September 11 terrorist attacks. Among the factors that contributed to this movement, one should underscore the clear dissociation between the Brazil risk and the Argentine risk, the positive trade balance results and reductions in the nation’s balance of payments borrowing requirements. Graph 3.5 Yield curve 27 % p.y. 24 21 18 15 30 60 90 120 150 180 Term in days 1st quarter 2nd quarter 3rd quarter 4th quarter 360 88 / Boletim do Banco Central do Brasil - Annual Report 2001 As a result, the spot interest rate curve shifted downward as the average 360 day rate closed near 23% per year compared to 26% per year in the third quarter. The rate differential between the one day DI futures market and 360 day DI x pre swap operations dropped into the range of 200 base points. Once again, downward movement in interest futures leveraged the average daily volume of one day DI futures contracts to a level equivalent to that of the month of March. Graph 3.6 Swap DI x pre 1 year versus DI future in t interest rates Month average 30 % p.y. 27 24 21 18 15 Jan 2001 Feb Mar Apr May Jun Jul Swap DI x pre Aug Sep Oct Nov Dec DI one day Graph 3.7 Traded volume of futures contracts Daily average 24 21 R$ billion 18 15 12 9 6 3 0 Jan 2001 Feb Mar Apr May Jun DI one day Jul Aug Sep Oct Nov Dec Commercial dollar Graph 3.8 Traded volume of Swap DI x pre and forward DI Daily average 4 R$ billion 3 2 1 0 Jan 2001 Feb Mar Apr May Jun Swap DI x pre Jul Aug Sep Forward DI Oct Nov Dec III Capital and financial markets / 89 Capital market The positive Brazilian stock market scenario between the end of 2000 and early 2001 reflected the highly positive outlook for the Brazilian economy that prevailed at that time. However, expectations were reversed as of February with announcement of strongly negative United States economic indicators. In the first quarter of the year, the Bovespa Index (Ibovespa) accumulated a drop of 5.4%. In the wake of the interest rate hike in Brazil, the Ibovespa fluctuated in the range of 14,500 points without any clearly defined trajectory. The process of electricity rationing that began in June was an additional source of uncertainty, particularly in light of the expected negative impact on business profits. This factor, coupled with the September terrorist attacks in the United States, forced the Ibovespa into a sharp decline to 10,034 points on September 14, the lowest level since August 1999. The market value of the companies listed on the São Paulo Stock Exchange (Bovespa) closed at US$142.8 billion in September, reflecting a drop of 36.7% in the year provoked by a combination of declining stock prices and exchange devaluation. Graph 3.9 20 000 4 000 16 000 3 000 12 000 2 000 8 000 1 000 Jan 2001 Feb Mar Apr May Ibovespa Jun Jul Aug Sep Dow Jones Oct Nov Dec Nasdaq Graph 3.10 Market value open capital companies - Bovespa 250 US$ billion 200 150 100 50 0 Jan 2001 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Nasdaq points Ibovespa/Dow Jones points Ibovespa x Dow Jones x Nasdaq 90 / Boletim do Banco Central do Brasil - Annual Report 2001 The reduced dollar value of companies was seen as an investment opportunity. With this, market expectations began improving and interest in Brazilian papers expanded as demonstrated by growth in the average volume of trading in the final two months of the year – approximately R$700 million. Despite the recovery that marked the end of the year, the Ibovespa closed 2001 with negative growth of 11.5%, at a level of just 13,509 points. Graph 3.11 Traded average volume in Bovespa 800 R$ million 600 400 200 0 Jan 2001 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec The average daily volume of trading at Bovespa came to less than R$500 million in the third quarter of the year. In general, the levying of the CPMF on the volumes traded on the exchange is a factor that should be highlighted, since it demonstrates the need for a review of legislation in such a way as to bring these costs into line with those of other markets, particularly in light of the rising trend toward incorporation and association among international exchanges. Recently, several measures were announced with the objective of stimulating stock market investments. Integration of Brazilian stock exchanges as of May 2000 resulted in optimization of resources through unification of trading systems and clearance, liquidation and custody mechanisms at the national level, making it possible for exchanges to achieve additional scale and, consequently, reduce their operational costs. Improvement in protection mechanisms for minority stockholders was included in the new corporate legislation in order to create additional incentives for small scale investors to join the market. Thus, the new Corporate Law determines that the maximum quantity of preferred shares issued will be 50% of capital. Law 6,404 permitted issue of up to 2/3 of capital in the form of preferred shares, thus making it possible to obtain stock control of companies through ownership of just 16.67% of capital. However, this new ratio will only be obligatory for new companies that open their capital as of the entry into force of the new Corporate Law. III Capital and financial markets / 91 Aside from this, the controlling stockholder must make a public offer of acquisition of the totality of outstanding shares at a minimum price equivalent to the value of net worth stated on the most recently approved balance sheet in order to cancel the registration of an open stock corporation that possesses securities on the market or that are traded through exchanges or over-the-counter, as well as to take measures with the purposes of increasing the controlling stockholder’s share by an effective or potential margin of 10% or to the point that such participation comes to an overall level of 80% of the capital stock. It also ensures those holding preferred shares representing at least 10% of the capital stock of the right to elect one member of the Council of Administration, and the right to reimbursement of the value of the shares when a decision is taken to create or increase the number of preferred shares, alter preferences or advantages and reduce the obligatory dividend, when such measures are approved in the framework of decisions involving mergers, split-ups or acquisitions. In the case of preferred shares, it sets a priority dividend of at least 3% of the equity value of the share or a priority in capital reimbursement, with or without a premium. In the latter case, it guaranties a minimum dividend 10% greater than that of common shares, while ensuring that those holding the preferred shares in question will be entitled to sell their stock participation under the same conditions defined for voting shares when stock control of a company is transferred. Bovespa acted swiftly to anticipate and broaden these legal changes and inaugurated what it termed the New Market, which is a separate listing involving the trading of shares issued by companies that voluntarily commit themselves to adopting practices of corporate governance and transparency that go beyond the demands of legislation. These rules expand the rights of stockholders, improve the quality of the information normally provided by companies and, by demanding that conflicts be resolved through the offices of an Arbitration Chamber, have given investors the security of a more flexible and specialized alternative that what is now available through the courts. Viewed in global terms, the New Market is divided into three stages. In the first – known as Level 1 – companies are required to commit themselves to rigid rules on transparency. In the second stage, Level 2, adherence to policies of corporate governance, as well as transparency, is required. In the final stage, which corresponds to the New Market in its fullest sense, companies are obligated to comply with the requirements of Level 2, at the same time in which those companies that desire to participate at this level are required to issue only common shares with voting rights. It is precisely for this reason that this is the segment considered most propitious for negotiating the shares of new companies or of those that resolve to open their capital. 92 / Boletim do Banco Central do Brasil - Annual Report 2001 The major securities negotiated on the capital market can be divided into two groups: those originating in third party loans, represented here by debentures and promissory notes, and those originating in the sale of part of a company’s capital or, in other words, stocks. Contrary to what occurs in the second group, debentures and promissory notes are callable securities and, for this reason, are issued in limited numbers. Business financing through issues of stocks, debentures and promissory notes on the capital market in 2001 increased by 22.7% over the previous year’s results and totaled R$21.8 billion. This was due exclusively to debenture issues since use of the other types of securities declined in the period. For the most part, these operations were a result of long-term borrowing needs on the internal market generated by increased costs and higher external financing risks. Debenture issues at the CVM totaled R$15.2 billion, of which 61.8% were referenced in DI, 28% to the IGP-M, 8.6% to the TJLP and 1.6% to others. Table 3.2 - Primary issues of companies Issues - CVM (R$ million) Period Stocks Debentures 2000 2001 Commercial papers 2000 2001 2000 2001 Total 2000 2001 Jan 0 0 35 254 529 633 564 887 Feb 468 500 1 007 450 165 267 1 640 1 217 Mar 0 401 200 3 736 586 475 786 4 611 Apr 0 0 280 320 100 742 380 1 062 May 0 0 1 525 69 1 393 1 365 2 918 1 434 Jun 33 9 10 941 599 97 642 1 047 440 0 2 465 2 800 1 921 552 4 825 3 352 Aug 0 315 162 0 590 44 752 359 Sep 0 0 202 324 60 260 262 584 Oct 191 0 1 033 370 5 295 1 228 665 Nov 0 0 100 642 560 460 660 1 102 278 129 1 729 5 256 1 083 77 3 091 5 462 1 410 1 354 8 748 15 162 7 591 5 267 17 749 21 782 Jul Dec Total Graph 3.12 Primary issues 16 R$ billion 12 8 4 0 Stock Source: CVM Debenture 2000 Commercial paper 2001 III Capital and financial markets / 93 Financial investments The overall balance of financial investments, which encompass financial investment funds (FIF), savings accounts, CDB (excluding those in the FIF portfolios), stock funds and extramarket funds came to R$557.5 billion at the end of 2001, for growth of 13.1% in the year. FIF registered net worth of R$320.6 billion, for growth of 18.1% in relation to 2000. This performance was below the level of previous years due to the migration of resources into CDB and to direct investments in federal public securities with exchange indexing clauses. FIF accumulated nominal profitability of 17.1% in 2001, registering the second best performance among financial investments. The final balance of financial investments in 2001 was R$556.1 billion, for growth of 13.1% in the year. The overall balance of the financial investments, encompassing FIF, savings accounts, bank deposit certificates (excluding the CDB in the FIF portfolios), stock funds and extramarket funds, totaled R$557.5 billion, with growth of 13.4% in the year. Graph 3.13 Investment funds - Net worth Stock funds 320 28 R$ billion 30 300 280 260 26 24 22 240 20 Jan 2001 Mar May Jul Sep Nov Jan 2001 Mar Extramarket 20 16 R$ billion R$ billion FIF 340 12 8 4 0 Jan 2001 Mar May Jul Sep Nov May Jul Sep Nov 94 / Boletim do Banco Central do Brasil - Annual Report 2001 Stock funds managed to maintain a relatively stable volume of resources, as net worth increased by 2.2% to R$24.9 billion at the end of December. Profitability in the year came to 4.3% and was influenced by negative performances in the months of March and September (-5.9% and -7%, respectively) as a result of the strong volatility prevalent on the stock market at the time. Among the different types of stock funds, Mutual Privatization Funds, which are based on Employment Compensation Fund (FMP-FGTS) resources, closed the year with assets of R$2.4 billion for growth of 0.5%. As of August 2001, investors in these funds were able to opt to invest in Free Portfolio Mutual Privatization Funds (FMP-FGTS-CL) or return to the FGTS, without losing the discount of 20% obtained in relation to the price of the overall stock issue. The FMP-FGTS-CL registered total net worth of R$8.3 million in December 2001. The extramarket funds, which invest the available resources of entities belonging to the indirect administration and foundations subject to federal government supervision, came to a net worth level of R$12.3 billion in 2001, with growth of 18.6% in the year. It should be noted that, as of the month of August, the CMN released the BNDES from the obligation of investing available cash resources in this fund. With this decision, the month closed with a net negative inflow of R$3.5 billion, as part of these resources migrated into FIF. As of the month of April, Foreign Capital Fixed Income Funds were abolished according to the terms of Resolution 2,689, dated 1.26.2000. This instrument had the objective of making it possible for nonresidents of the country to gain direct and simplified access to Brazilian financial and capital markets. In the month of March, a new CPMF rate was introduced. This contribution is levied on the initial investments of all of these operational modalities, with the sole exception of savings accounts provided that the funds be maintained in such accounts for periods of more than three months. The new rate also impacted investments in CDB due to the specified term of this type of operation and, indirectly, stock funds, since it corresponds to a tax on stock acquisitions and, consequently, produced a dampening effect on stock market trading. The balance of savings accounts reached a level of R$118.7 billion in December 2001, with growth of 6.2% in the year. The less attractive profitability of this type of operation (8.6% in the year) explains the very limited inflow. The loss of resources was somewhat attenuated in the month of December, which registered a net inflow of R$1.6 billion, a phenomenon that is characteristic of the month as workers across the country receive their Christmas bonuses. In January 2001, Resolution 2,809, which had been issued on 12.22.2000, introduced the mechanism of automatic alteration of the “b” factor, the component used in III Capital and financial markets / 95 Graph 3.14 Time and savings deposits Time deposits Savings deposits 110 120 105 118 116 R$ billion R$ billion 100 95 114 90 112 85 110 80 108 Jan 2001 Mar May Jul Sep Nov Jan 2001 Mar May Jul Sep Nov calculating the Reference Rate (TR) reduction factor. This mechanism has the objective of achieving gradual convergence of the profitability levels of financial investments to the extent that the Selic target is lowered, thus minimizing transfers of resources among the various modalities of financial investments exclusively as a result of arbitrage. Furthermore, the fixed 6% rate of interest per year for savings accounts which is specified in legislation acts, in practical terms, as a profitability floor for the other financial investments. As shown in Table 3.3, Selic rate bands were utilized, with their respective parameters. The gradual convergence can be noted throughout the first quarter of the year when the Selic target moved below the 16% per year mark, with the “b” parameter being altered automatically to 0.44. Table 3.3 - Factor "b" of the reduction factor of the Reference Rate (TR) Target for the Selic rate Factor "b" Formula for the reduction factor of the TR Higher than 16 0.48 1.005 + 0.48TBF Equal or less than 16 0.44 1.005 + 0.44TBF Equal or less than 15 0.40 1.005 + 0.4TBF Equal or less than 14 0.36 1.005 + 0.36TBF Equal or less than 13 0.32 1.005 + 0.32TBF Equal or less than 12 0.28 1.005 + 0.28TBF Equal or less than 11 0.24 1.005 + 0.24TBF Equal or less than 10 0.20 1.005 + 0.2TBF The balance of time deposits expanded by 19.7% in the year and totaled R$107.6 billion in December 2001. Accumulated earnings reached 17.7% in the year. The attractiveness of this type of investment in 2001 was due mostly to the flexibility permitted for adjusting to the new interest rate levels coupled with the release of 96 / Boletim do Banco Central do Brasil - Annual Report 2001 CDB referenced to floating rates from the demand of minimum terms, as of August 1999. With these factors, the modalities of CDB referenced to DI and postset CDB became the most attractive investment modalities, in detriment to preset CDB and, taken together, came to represent a full 70% of the total balance of these assets. Table 3.4 - Nominal income of financial investment - 2001 % p.m. % p.y. Itemization Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2000 2001 FIF 1.43 1.04 1.20 1.27 1.69 1.01 1.82 1.85 1.63 1.35 0.84 0.74 17.26 17.07 Extramarket 1.40 1.39 1.39 1.24 1.43 1.34 1.26 1.35 1.17 1.24 1.17 1.15 16.69 16.51 Stock funds 10.62 - 3.46 - 5.86 5.39 0.85 - 1.67 - 2.14 - 2.12 - 6.99 2.59 4.88 3.56 Savings 0.72 0.73 0.73 0.63 0.75 0.72 0.66 0.70 0.60 0.63 0.62 0.60 CDB 1.22 0.99 1.28 1.28 1.38 1.30 1.67 1.65 1.34 1.57 1.37 1.38 Graph 3.15 Nominal income of major financial investments - 2001 20 16 % 12 8 4 0 -4 -8 -12 FIF Stock Funds Savings Interbank Certificate of Deposit Gold US Dolar Commercial Ibovespa 3.36 4.31 8.39 8.59 17.05 17.72