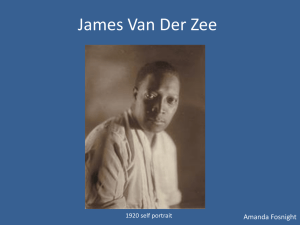

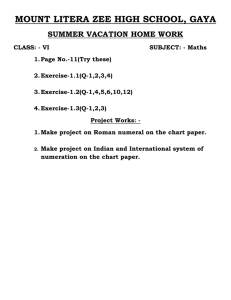

Zee A/r Cover1&4

advertisement