rutgers university school of business – camden campus short

advertisement

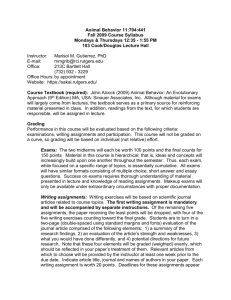

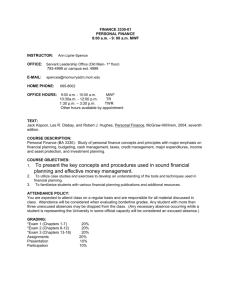

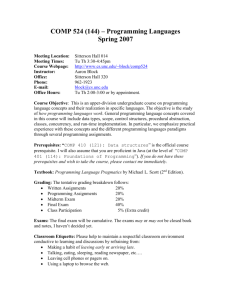

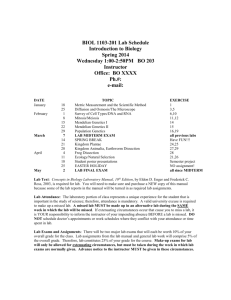

RUTGERS UNIVERSITY SCHOOL OF BUSINESS – CAMDEN CAMPUS SHORT-TERM FINANCIAL MANAGEMENT SUMMER SESSION 2011 SYLLABUS INSTRUCTOR: CHRISTOPHER GLAUM PHONE NO.: (856) 889-0737 (CELL) E-MAIL: cglaum@camden.rutgers.edu LOCATION: BSB 134 OFFICE HOURS: BY APPOINTMENT WEB SITE: http://sakai.rutgers.edu TEXT: THERE IS NO TEXT FOR THE COURSE. STUDENTS NEED TO DOWNLOAD A COURSEPACK (THREE CASES AND AN EXCEL TEMPLATE) FROM THE HARVARD BUSINESS SCHOOL USING THE http://cb.hbsp.harvard.edu/cb/access/9433710 FOLLOWING LINK: COURSE OVERVIEW This goal of this course is to introduce students to the key areas of short-term financial management. Topics include cash management and banking relations, short-term investments, accounts receivable management, accounts payable management, short-term borrowing, and short-term financial planning. Throughout the semester, we will utilize concepts learned from the lecture materials, Harvard Business School cases, and class discussions to understand how to efficiently manage a firm’s working capital and apply those concepts to the current economic/business climate. The grade components and distribution are as follows: Grade Components Two Exams Dell Case Study Cash is King Case Study * Excel Homework Class Participation Grade Distribution 60% 10% 10% 10% 10% 100% A B+ B C+ C D F 90 – 100 85 – 89 80 – 84 75 – 79 70 – 74 65 – 69 < 65 * The Cash is King Case Study is optional. If a student decides not to submit the case, then the two exams will comprise 70% of the final grade. For this course, students need to have a strong knowledge of a spreadsheet software such as Microsoft Excel for certain homework assignments. Students may need to utilize a word processing software such as Microsoft Word for the case studies. TEACHING METHODS All class discussions are based on Microsoft PowerPoint presentations and supporting documents in Microsoft Word, Microsoft Excel, and PDF Format. All of these resources will be posted on SAKAI in advance of the class that the information is being taught. It will be the student’s responsibility to have the documents available when the information is being discussed in class. The course schedule can be found at the end of this syllabus, with any changes announced in class and/or posted on SAKAI. It is expected that students will attend class regularly, be on time, and stay for the entire duration. Students are also expected to come to class being familiar with the material, having at least attempted the homework problems, and willing to participate in class discussions. Students will be asked to volunteer to put their solutions to a homework problem on the board and discuss how they solved the problem, and this is a component of the class participation grade. EXAMS There will be two exams during the semester (tentatively, 6/13 and 6/23), neither of which will be cumulative. The exams will consist of objective questions and problems and students will need a calculator. If you are unable to take an exam for a university approved reason, you must provide notice in writing (or e-mail) so that other arrangements can be made. If an unforeseen emergency arises (hospitalization, death in the family, etc.), you must contact me as soon as possible after the missed exam. The instructor reserves the right to request written documentation to support non-university approved absences and make-up exams are not guaranteed. All exams will take place in our regular classroom (BSB 134). CASE STUDIES There are two case studies during the semester, Cash is King (optional) and Dell’s Working Capital (mandatory). The case studies should be 3-5 pages in length (excluding tables, charts, and graphs). They will be graded on content, communication, and flow, and the relevancy of the answers to the questions. Assignments that contain gross proofreading errors or that do not flow properly will be penalized at the instructor’s discretion. For students who complete the Dell case study at home, the case study must be word-processed and e-mailed to the instructor prior to the beginning of class in order to receive credit. If students elect to submit the Dell case study via e-mail, they are not required to attend class that day (6/21). However, please note that we will have a test review on that day. The Cash is King Case Study is optional and must be submitted by the last class (6/23). The case must be word-processed, with tables prepared in a spreadsheet software package and charts/graphs utilized where pertinent. Late assignments will not be accepted. If a student decides that he/she will not submit the Cash is King Case Study, the two tests will comprise 70% of the final grade. 2 EXCEL HOMEWORK PROBLEMS The course schedule includes three homework assignments must be submitted in Microsoft Excel, which are worth 10% of your final grade. The homework assignments will be graded on effort and result. If you know you are going to miss a class when homework is due, the assignment must be e-mailed to the instructor prior to the beginning of class in order to receive credit. Assignments not in Excel and/or submitted late will not be accepted. CLASS PARTICIPATION The class participation grade comprises 10% of your final grade and will be based on attendance (50%) and participation in class discussions (50%). Since this class only meets 11 times during the semester, your participation grade will be impacted if you miss more than one class. Students are expected to participate in class discussions, volunteer to put their solutions to a homework problem on the board, and discuss how they solved the problem. If students elect to submit the two case studies via e-mail, they will get credit for attending class those days (6/7 and 6/21). ACADEMIC INTEGRITY “Academic Integrity requires that all academic work be wholly the product of an identified individual or individuals. Joint efforts are only legitimate when the assistance of others is explicitly acknowledged … The principles of academic integrity entail simple standards of honesty and truth. Each member of the university has a responsibility to uphold the standards of the community and to take action when others violate them … Students are responsible for knowing what the standards are and for adhering to them. Students should also bring any violations of which they are aware to the attention of their instructors.” This class will ask you to work independently. In all cases, you are responsible for preparing your own work and documenting the work of others. Cheating, plagiarism, and other types of misconduct are not acceptable. Penalties can include expulsion from the University. Students are expected to know, understand and adhere to the policies on academic integrity outlined above. Procedures for violation of these policies outlined in the University Code of Academic Conduct will be followed. The academic policy can be found at: http://academicintegrity.rutgers.edu/integrity.shtml#1. ADMINISTRATIVE Dropping the Course: June 17, 2011 is the last day to drop the course without a failing grade. Students with Disabilities: Any students in need of accommodations due to disabilities should contact Associate Dean Tom DiValerio at tdivaler@camden.rutgers.edu. His phone number is 856-225-6161. 3 Classroom Behavior: As future business professionals, you are expected to conduct yourselves with professional courtesy to your classmates and to your instructor. Rutgers classroom behavior policies can be found at: http://www.rci.rutgers.edu/~polcomp/judaff/docs/UCSC.pdf . Student Responsibilities: It is your responsibility in this learning environment to check SAKAI on a regular basis for updates and announcements. Cell Phones: Students are required to have their cell phones in silent mode on lecture days and turned off during exams. If you need to take a phone call for an emergency, please be respectful of other students and leave the classroom before answering the phone. 4 Short-Term Financial Management Summer Session 2011 Term I Course Schedule Assignment Due: Reviewed in Class Submitted in Excel Date Class Discussion 5/31 Review of Financial Statements 6/2 Review of Financial Statements Peet’s Working Capital 6/6 Working Capital Management Peet’s Ratios 6/7 Working Capital Management Peet’s Cash Flow 6/9 Working Capital Management Working Capital HW 6/13 Exam 1 6/14 Short-Term Financial Planning 6/16 Cash Budgeting % of Sales Problem 6/20 Short-Term Financing Base Case Cash Budget 6/21 Dell Case Study 6/23 Exam 2 Short-Term Financing HW 5 Downside Cash Budget