NF-e - Esaf

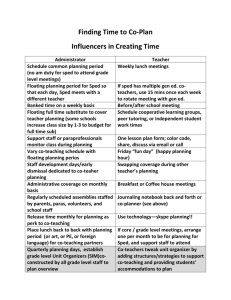

advertisement

Public System of Digital Bookkeeping Cofis Brasília, 18 de abril de 2012 Summary Evolution Premises Collective Construction Coverage Technology Before Sped/After Sped Evolution Constitutional Amendment Nr. 42 – 12/19/03 Art. 37 of the Federal Constitution ... XXII – the tax administrations of the Union, the States, the Federal District and the Municipalities, performed by employees of ... ... and shall act in an integrated form, including with the sharing of tax files and information, as per the law or treaty. Evolution I ENAT – Salvador - 07/17/04 Execution of Protocols in order to search for joint solution in the three areas of the Government that would promote the improvement of Tax Administration Evolution II ENAT – São Paulo - 08/17/05 Execution of the Cooperation Protocol, for the development of the Sped Execution of Cooperation Protocol for the Development of the NF-e, an integral part of the Sped Evolution III ENAT – Fortaleza - 11/10/06 Execution of the Cooperation Protocol for the development of the NFS-e and CT-e Resolution CMN Nr. 3.430 – 12/26/06 Establishes a financing line of BNDES to the States Evolution Decree Nr. 6.022 - 01/22/07 Institutes the Public System of Digital Bookkeeping (Sped) Objective: to promote the integrated performance of the public treasuries by the standardization and rationalization of information and shared access to the digital accounting of the taxpayers Evolution PAC 2007-2010 - 01/22/07 Provides a better business environment for the companies in the Country Eliminate unfair competition and increase the competition among the companies Premises - Basic MP 2.200-2, of August 2001 Institutes the ICP-Brasil in order to create in the country the digital certification chain to assure authenticity, integrity and legal validity of electronic documents ICP Brasil Standard Digital Certification Premises Standardization and Simplification Integration Data Sharing Integration Promote the integrated peformance of the federal, state and municipal public treasuries and the inspection agencies Standardization Eliminate redundancy of information by the standardization of Accessory Obligations Standardize the information submitted by the taxpayers to the different federated units Reduce the costs of the companies with the rationalization and simplification of Accessory Obligations Data Sharing Single and shared database Shared access to the digital accounting of taxpayers, by legally authorized agencies or entities Benefits - Companies A best business environment for the companies in the Country More competition among companies on account of the reduction of unfair competition companies among the Simplification for the compliance of Accessory Obligations by the taxpayers Benefits - Companies Reduce costs with the elimination of issuing and storing paper documents Allow the improvement and betterment of internal invoicing processes and operational logistics Eliminate the possibility of accounting errors in the NF-e and Receiving and Dispatching of Goods registers. Benefits – Public treasury Improvement in the quality of information with consequent improvement of tax control processes Improvement of tax evasion combat Better integration among Public Treasuries and better administrative control Reduction and elimination of frauds Benefits - Society Reduction of “Brazil Cost” Incentive to the use of electronic relationship among Companies (B2B) Use of open standards (Web Services, Internet, XML) Preservation of environment by reducing the consumption of paper Collective Construction Collective Construction – Agencies and Institutions ABRASF BACEN CVM DNRC ENCAT RFB SEFAZ SUFRAMA SUSEP Collective Construction - Companies AMBEV REDECARD BANCO DO BRASIL ROBERT BOSCH BB SEGUROS SADIA CAIXA ECONÔMICA SERPRO CERVEJARIAS KAISER SIEMENS CIA. ULTRAGAZ SOUZA CRUZ DISAL TELEFÔNICA EUROFARMA TOKIO SEGURADORA FIAT TOYOTA FORD USIMINAS GENERAL MOTORS VARIGLOG GERDAU VOLKSWAGEN PETROBRAS WICKBOLD PIRELLI PNEUS Collective Construction - Companies NF-e pilot project CERVEJARIAS KAISER ROBERT BOSCH CIA. ULTRAGAZ SADIA DIMED SIEMENS ELETROPAULO SOUZA CRUZ EUROFARMA TELEFÔNICA FORD TOYOTA GENERAL MOTORS VOLKSWAGEN GERDAU WICKBOLD OFFICE NET PETROBRAS PETROBRAS DISTRIBUIDORA Collective Construction - Companies NF-e 2nd. Phase – Sefaz-SP ACHE LABORATORIOS DEDINI S/A AMBEV DROGASIL APSEN FARMACÊUTICA EUROFARMA AUNDE BRASIL GIVAUDAN CIA. ENERG. STA. ELISA MATTEL CARREFOUR PIRELLI PNEUS CERTISIGN STOCKLER CONSULTEMA CONSULTORIA TIM CELULAR COOP DE CONSUMO and more companies D’AVÓ SUPERMERCADOS 23 other Collective Construction – other entities ABBC ABECS ABRASCA ANDIMA ANFAVEA ANTT CFC FEBRABAN FENACON FENAINFO JUCEMG Range of the Project DW NF-e Integração Trans ReceitanetBX ECD NFS-e e-Lalur EFD EFD Social CT-e FCont EFD Contribuições Technology Investments Made US$ 86 million, including technological development and infrastructure Production of the system at São Paulo and Brasília (new) Data Centers – Bank balancing load and synchronization Use of the same architecture of the National SPED (EFD and ECD) and other RFB systems. Technological infrastructure Range of the Project Electronic Sale Bill (NF-e) Digital Accounting Bookeeping (ECD) Digital Fiscal Bookeeping (EFD) Electronic Transport Bill of Lading (CT-e) Digital Accounting Transition (FCONT) Digital Fiscal Bookeeping (EFD PIS-Cofins) Digital Fiscal Bookeeping (EFD Social) Register to Compute the Real Profit (e-Lalur Int) Electronic Service Sale Bill (NFS-e) Integration of Systems Accounting Sped (ECD) Covered Registers Journal and Ledger Daily Trial Balances and Balances Journal with Resumed Accounting Auxiliary Journal Auxiliary Ledger Accounting Sped (ECD) Legislation Dec. Nr. 6.022/2007 Art. 2 – [2] The terms of the proposition does not exempt the entrepreneur and the company of keeping under their custody and responsibility the records and documents, in the form and terms provided in the applicable Legislation. Art. 4 – The access to the information stored in the Sped shall be shared with the users, within the limit of their respective rights and without prejudice of the Legislation relative to business, tax and banking secrecy. Art. 7 - The Sped shall maintain also functionalities of exclusive use by the registration agencies for the activities of authentication of business registers. Accounting Sped (ECD) Legislation IN RFB Nr. 787, 11/19/2007 Establishes the compulsoriness of maintaining accounting registers and documents of the Digital Accounting (ECD) Approves the technical specifications manual for the layout of ECD files and generation (Sole Annex) Accounting Sped (ECD) Legislation IN RFB Nr. 787, 11/19/2007 Art. 3 The following entities shall adopt the ECD, under the terms of article 2 of the Decree Nr. 6.022, of 2007: I – in respect to accounting facts occurred after January 1st, 2008, the legal entities subject to differentiate economical-tax inspection under terms of the RFB Decision Nr. 11.211, of November 7th., 2007, and subject to income tax based upon the real profit; II – in respect to accounting facts occurred after January 1st, 2009, the other legal entities subject to Income Tax based on the Real Profit; [1] The delivery of the ECD is optional to the other legal entities not compelled under the terms of the proposition, in respect to the accounting facts occurred after January 1st., 2008. Accounting Sped (ECD) Legislation IN RFB Nr. 787, 11/19/2007 Art. 4 The ECD shall be submitted to the Validating and Signing Program (PVA) specially developed for this purpose, to be available in the RFB page in Internet, at the address <www.receita.fazenda.gov.br/sped>, with at least the following functionalities: ............... Art. 5 ECD shall be transmitted annually to Sped up to the last working day of June of the year subsequent to the calendar year related to the accounting. [1] In case of extinction, partial splitting, total splitting, fusion or incorporation, the ECD shall be delivered by the extinguished, split, fused, incorporated and incorporating legal entities up to the last day of the month subsequent to the event. [3] Exceptionally, in respect to accounting facts occurred in 2008, the term mentioned in Paragraph 1st will be the last day of June, 2009. Accounting Sped (ECD) Elimination of OA with ECD Eliminated: IN86 and Manad Tacitly eliminated: Reason (formal elimination proposal) Suggested: transcription of trial balance for suspension and reduction in the Journal (the demonstration of the computation base continues in the Lalur) Diagram Accounting Sped (ECD) Entrepreneur or Company Layout SPED – National Repository . . . . BD Generate File Validate Receive Supply Receipt Supply Situation . Accounting . Data Bank Internet Legal Representative Accountant Java Program . . . . . . . Application Validate Execute Request Visualize Transmit Consult Obtain authentication Download Consult Access . Send Summary (Application, TA, TE) . Receive Authentication/Requirement BD Intranet Internet Extranet Internet Trade Board Entities . Generate GR . Check Payment . Analize Register and Application . Authenticate Register . Supply situation . Updating Data in the SPED BACEN SUSEP SEFAZ RFB OTHERS Updatings Accounting Sped IN RFB Nr. 787, of November 19th., 2007, determines the compulsoriness of maintaining accounting records and documents of the Digital Accounting (ECD) and approves the technical specification manual of layout for the generation and files of ECD (Sole Annex) IN DNRC Nr. 107, of May 30th., 2008, determines the procedures to the validation and efficiency of the accounting instruments of the entrepreneurs and business companies (review of IN DNRC Nr. 102/2006) Agreement between RFB and DNRC with approval by the Trade Boards for the use Tax Sped e-Lalur: The purpose is to cover the computation of the tax up to the value transferred to the DCTF Contribuinte RFB Lay out Data bank SPED Reception Validation Electronic Power-of-attorney Text File Accountant Administrator . Original File . Data bank . Download Java Program Internet • • • • • • • Import Recover Type Validate Exscute Visualize Transmit Periodicity: ANNUAL WebService PORTAL www.receita.fazenda.gov.br/sped Tax Sped Covered Registers Entry Register Outlet Register ICMS Computation Register IPI Computation Register Inventory Register Tax Sped Compulsoriness A common list will be prepared between RFB and Treasury Department Other Companies will be exempt Requirement After January 2009. (ICMS Agreement 143/06, amended by the ICMS Agreement 13, of April 4th., 2008) Layout Cotepe Act Nr. 09, of April 18th., 2008 (amends the Cotepe Act Nr. 11, of June 28th., 2007) Tax Sped Legislation: ICMS Agreement Nr. 143, of 12/15/2006 Institutes the EFD: set of tax accounting documents and other information of interest of the State Public Treasuries and of the RFB, as well as, in the computation of taxes relative to the operations and payments made by the taxpayers (First clause) Tax Sped Legislation: ICMS Agreement Nr. 143 of 12/15/2006 The use of EFD is compulsory for the ICMS or IPI taxpayers. The Public treasuries may exempt some taxpayers from EFD. Tax Sped Legislation: ICMS Agreement Nr. 143 of 12/15/2006 The taxpayer shall maintain different EFD for each facility (Fifth clause). The digital file shall contain the information of the tax computing period and will be generated and maintained within the term established by the Legislation of each State and RFB (Sixth clause). Diagram Tax Sped Taxpayer Layout SEFAZ RFB Databank Santa Catarina Electronic Power-ofAttorney Text File RIS SPED Legal Represaentative Java Program Minas Gerais Validation Reception Rio de Janeiro . . . . . . Import Type Validaate Execute Visualize Transmit Periodicity: MONTHLY . Original File . Databank . Download São Paulo Internet Updatings Tax Sped Compulsoriness of the EFD after January 1st, 2009: sole base of compelled within the federal and state sectors PVA homologation with the functionality of typing with of basic Help Users guidance, separate manual, to explain how to fill out the EFD sectors Attached manual is part of the layout published in Cotepe Act NF-e Concept It is a document issued and stored electronically, of digital existence only, for the purpose of documenting a merchandise circulation or service rendering operation performed between the parties, the legal validity of which is assured by the digital signature of the issuing party and reception by the Public treasury, before the occurrence of the Generating Fact. NF-e Diagram Seller For each operation the seller shall request Sefaz an authorization to use the NF-e Purchaser Sends NF-e The reception is made before the Generating Fact Treasury Department NF-e Diagram Seller Sefaz will validate the Purchaser received NF-e Sends NF-e Validation Reception: Digital Signature Validation Treasury Department XML Diagram Numbering Issuing Party Authorized NF-e Diagram Seller Purchaser If the analysis is positive, will authorize the use of NF-e Sends NFE Returns the NF-e Use Authorization Validation Reception: Digital Signature Validation Treasury Department SML Diagram Numbering Issuing Party Authorized NF-e Diagram Seller Purchaser Will retransmit NF-e to Destination Sefaz and to Federal Revenue Dept. Sends NFE Returns Authorization to use NF-e Retransmits NF-e Treasury Department Destination Sefaz and Federal Revenue Dept. NF-e Diagram Seller Authorized Transit - DANFE Sends NFE Returns Authorization to use NF-e Treasury Department Purchaser The use of the NF-e in the operation is authorized, DANFE will monitore the transit of the goods Destination Sefaz and Federal Revenue Dept. NF-e Auxiliary Document NF-e Diagram Seller Purchaser The addressee shall check the existence and validity of the NF-e by consulting the Internet, using the access key Treasury Department NF-e web site NF-e Diagram Seller With the information, the Inspection may perform postvalidation of the data and proceed with the necessary procedures Purchaser Inspection Post-validation: Public treasury • Coherence of information • Crossing of data NF-e Diagram Taxpayer Original SEFAZ SPED Validation Autorization TED Dist TED Dist Generates XML Bill Reception Validation Validation of Signature Internet RIS Client WebService TED Dist Consultation Periodicity: Randomly SUFRAMA Detran Visualizer WebService Destination SEFAZ Internet NF-e Situation PORTAL www.nfe.fazenda.gov.br Virtual Sefaz of the NF-e Central technological frame to Receive, Treat and Send the NF-e to the Original or Destination Sefaz Offer the technological infrastructure to Sefaz to authorize the issue of the NF-e Contribute to the mass use of NF-e Simplification of efforts, economy and standardization Virtual RFB Sefaz Serve the 27 State Treasury Departments Production, since January 2nd., 2008 Capacity to receive 300 NF-e per second High capacity of growth and availability higher than 99.99% Receiving and treating more than 180 million NF-e/AN per month. Virtual Sefaz of the NF-e Fast service for the demand in the case of compulsoriness of NF-e of April and December 2008; Implantation of physical flow control of interstate operations, in order to assure the effective entering of the goods in the State of destination; Under liberation for the production of the SCAN contingency of SEFAZ-UF through the National Environment – under production in September 2008. Multiregional Distribution of NF-e Taxpayers Taxpayers Taxpayers Taxpayers NFe NFe NFe SEFAZ NFe ... NFe SEFAZ State SEFAZ National SPED Virtual SEFAZ Federal Massification of Use of NF-e 9 out of the 27 States authorize with their own systems: SP, RS, BA, GO, MG, MT, PE, DF and RO 7 states in the Virtual RFB SEFAZ: CE, ES, MA, PA, PI, PR and RN 12 states in the Virtual RS SEFAZ: AC, AL, AM, AP, MS, PB, RJ, RR, SC, SE,TO and RO Present situation of the NF-e Adhesion of 19 Companies in the pilot phase Adhesion of 45 other Companies in the 2nd. phase in SP More than 700.000 Companies issuing already the NF-e in operations with all States Acttually : more than 4 billion NF-e issued Present situation of the NF-e MF/SE agreement under commodatum regimen (US$ 28 million), to improve the technological infrastructure of SEFAZ and of State border Inspection Stations Activation of the NF-e Service Station by phone 08009782338 Improvement of the contingency electronic solution (production in September 2008) Free of charge provision by SEFAZ/SP of a NF-e issuing system for companies with small issuing volume. Portal of Sped Portal of NF-e NF-e Updating On April 1st, 2008, the issuing of NF-e became compulsory for the taxpayers (more than 6,000 facilities) : Manufacturers and distributors of cigarettes Producers, formulators and importers of liquid fuels Distributors of liquid fuels Transporters and retail distributors of fuels The compulsoriness is applied to all operations of those contributors, being prohibited the issue of models 1 and 1A bills of sale NF-e Updating Starting on December 1st, 2008, there will be compulsory issue of NG-e by the following taxpayers (approximately 45,000 facilities): Manufacturers of alcoholic beverages (RB > R$ 360.000) Manufacturers of beer, draft beer and soft drinks Manufacturers and importers of wines Steel mills ironworks Merchants of electrical energy Manufacturers of automotive vehicles Manufacturers and distribution of medicines Cold-storage plants Manufacturers of cement NF-e Updating Protocol for the extension of compulsoriness, from September 1st to December 1st., 2008: Problems of curtailment Security Form – 7 suppliers Increased from R$0,10 to R$0,85 per sheet Adjustment of the standard for replacing the security form by DANFE with previously authorized access key Creation of exception rules for certain segments that are not prepared for the issue (fuels, vehicles) NF-e Updating In 2009, the following sectors will become obligatory: Wholesale merchants of food, beverages and cleaning material Fuels: solvents, alcohol for other purposes (closing the chain) Automotive Batteries Auto parts industry Manufacturers of beverage containers Importers of vehicles Importers of alcoholic beverage CT-e Updating Electronic Transport Bill of lading (CT-e): States: SP, RS, GO and RO RFB: Construction of the National Portal and Environment Pilot project: 9 Companies to the present 36 Companies CT-e of Virtual Sefaz : RS (Aug/08) and SP (Jan/09) Pilot in June 2008 Voluntary adhesion in September 2008 Compulsoriness for January 2009 (Invoicing) Carlos Sussumu Oda sped@receita.fazenda.gov.br