Review of the Moneylenders (Amendment ) Act 2011 And Its

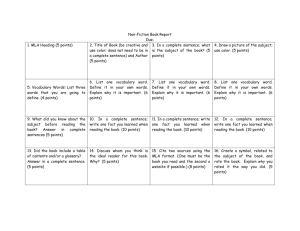

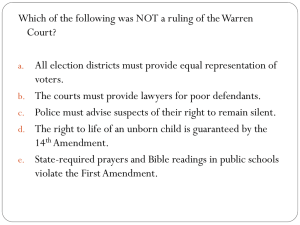

advertisement

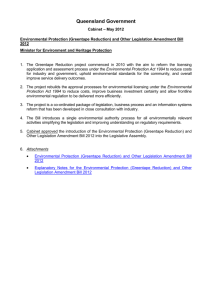

Review of the Moneylenders (Amendment ) Act 2011 And Its Economic Efficiency To The Debt Market RUZIAN MARKOM, ABDUL GHAFAR ISMAIL, SHAHIDA SHAHIMI, AMINURASYED MAHPOP & NURUL ASYKIN MAHMOOD FAKULTI UNDANG-UNDANG, UNIVERSITI KEBANGSAAN MALAYSIA 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 1 Contents 1. Background of Research 2. Statement of Problem 3. Objectives of Research 4. Methodology of Research 5. Significance of Research 6. Research Findings 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 2 Background of Research •Historical Development of Moneylending Industries in Malaysia •The Legal Development of Moneylenders Laws in Malaysia •The Current Moneylending Activities in the Debt Market: Regulated and unregulated 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 3 Historical Development of Moneylending in Malaysia The business of moneylending is the oldest credit institution in Malaysia. It began in the 19th Century where the Malay States as attraction place for living of the immigrants from India and China. (Lal Harcharan Singh, 2003). During the British era, the Indian Community has played important role in economic development of the Malay States in rubber tapping and mining. At the end of the 19th century and early middle of the 20th century, the Chettiar were the sole lender to the Chinese farmer to grow paddy, small rubber tapper, governmet servant and Malays aristocrats. (Kratoska, 2013). 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 4 Historical Development of Moneylenders Law Moneylending issues is a serious phenomenon to the Government f Malaysia. Therefore, rigorous effort was made by the laws to curb the problems in many forms. In the early years, every state has its own laws eg Perlis Enactment No.12 of 133, Straits Settlement Chapter 218. The legacy began in 1919 with the Usurious Loan Enactment with the purpose of curbing high interest rate moneylending. Then, the British enacted Moneylenders Ordinance 1951 to regulate the licensing and to control the interest in moneylending transaction. Since its enactment in 1951, the Act has gone through 15 amendments and the latest was in 2011 which extended the jurisdiction of the MLA to Sabah and Sarawak and the Federal Territory of Labuan and sec 29AA which prohibits assisting of unlicensed moneylenders. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 5 The current moneylending activities in debt market Regulated – financial institutions governed by Bank Negara Malaysia like commercial banks, Islamic banks , SME banks; cooperatives under the KPDNKK; moneylenders and pawnbrokersKPKT Unregulated- unlicensed moneylenders, ar rahnu. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 6 Statement of Problem Moneylenders Act (Amendment) 2011 Regulator- Bahagian Pemberi Pinjam Wang dan pemegang Pajak Gadai, Kementerian Kesejahteraan Bandar,Perumahan dan Kerajaan Tempatan. Debt market Debt market Illegal moneylenders Illegal moneylenders Licensed Moneylender Moneylenders Agreement Collateral & non-collateral Borrowers Efficiency of Debt Market Interest Rate 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN Enforcement 7 Research Objectives 1. To explain the function of the Moneylenders (Amendment ) Act 2011 as a social tool in enhancing the economy of the society; 2. To review the Moneylenders (Amendment ) Act 2011 based on the efficiency of debt market; and 3. To propose amendments to the Moneylenders (Amendment) Act 2011. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 8 Research Methodology This is a qualitative doctrinal research which primarily focuses on the Moneylenders (Amendment) Act 2011 as a social tool in enhancing the economy of the society. This study adopted economic analysis of law approach. The research adopted the Behavioural Claim method which seen “efficient” based on the notion of individuals respond to legal rules economically .(Kornhauser, 1985) In the methodology, the policy and political economy are analysed. The policy analysis focuses on analysis of the effects of legal rules and institutions on outcomes. An outcome usually consists of the objective effects of the rule or institution on the behaviour of private individual. In this research it refers to the effect of the Act and the governing institutions to the borrowers. In contrast, political economy investigates the operation of political institutions such as courts, legislatures, the executive and administrative agencies; it usually focuses on the behaviour of the public officials within the institutions. This involves the interviews and discussions with the public officials from the Ministry of Urban Wellbeing , Housing and Local Government, Commercial Crime Investigation Department, Polis DiRaja Malaysia and Malaysian Institutions of Licensed Moneylenders Association (MiLMA) 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 9 Contd… In analysing the relation between the Moneylenders Act and the efficiency of the debt market, the study has conducted structured interview with officials from Moneylenders and Pawnbrokers Department, Ministry of Urban Wellbeing, Housing and Local Government; Commercial Crime Investigation Department, Polis DiRaja Malaysia and Malaysian Institutions of Licensed Moneylenders Association (MiLMA). Roundtable Discussion on the research was conducted on the 28th of April 2014. The objective of the discussion was to get feedbacks from the stakeholders on the research outcome. It was attended by Inspektor Noor Azizul Rahim Taharim from Moneylenders and Pawnbrokers Department, Ministry of Urban Wellbeing, Housing and Local Government; SAC Wong Wai Loong, Superintenden Lim Chuan Hoo and Inspektor Hafizah Raduan from Commercial Crime Investigation Department, Polis DiRaja Malaysia; Mr Muhammad Kamil Ainul Maslih from Utusan Malaysia and Mr RC Veeraseelan from Malaysian Institutions of Licensed Moneylenders Association (MILMA). Finally, on the 9th of May 2014, Focus Group Meeting was conducted with the members of MiLMA. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 10 SIGNIFICANCE OF RESEARCH i. Individual/Borrower This research will helps individual in understanding the difference between the licensed and unlicensed moneylenders. Individual and the society should be given more information on the benefits of doing transaction with licensed moneylenders as well as the risk and danger dealings with unlicensed moneylenders. Besides, an individual /borrower must be a responsible borrower by being a prudent paymaster to avoid unnecessary action by the moneylenders. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 11 Contd… ii. Industry via the Malaysian Licensed Moneylenders Institutions (MiLMA) This research will hopefully enhance the role of MILMA as representatives of the licensed moneylenders in Malaysia. They should be given status quo in any meetings and discussion of the government in the process of amending new laws and policies relating to moneylending. Their views should be considered and implemented by the Parliament in ensuring efficiency in the debt market. The Government should provide funds for their activities to be recognized in the society at large. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 12 Contd… iii. Government Authorities This research is hopefully will assist the Government Authorities in reviewing the current debt market in Malaysia. In general the regulation of debt market concentrate on the financial institutions including Islamic banks, commercial banks, development banks, takaful and insurance which are governed by the Central Bank of Malaysia. In the alternative, there are another type of debt market which focus on micro lending like the licensed moneylenders, pawnbrokers, cooperatives, unlicensed money lenders, hire purchase, leasing, factoring, microfinance by Amanah Ikhtiar Malaysia, TEKUN. These types of financial services are governed by the Ministry of Urban Wellbeing, Housing and Local Government, Ministry of Cooperatives and Consumerism and other relevant authorities. It is prime time for the government to have alternative legal framework this kind of micro lending under the proper financial services authority. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 13 RESEARCH FINDINGS: A. The Moneylenders (Amendment) Act 2011 as A Social Tool in Enhancing The Economy of The Society. The Different Modus Operandi Between The Licensed and Unlicensed Moneylenders No. Licensed Moneylender Unlicensed Moneylender 1 Business conducted with the license obtained from the Moneylenders and Pawnbrokers Department, Ministry of Urban Wellbeing, Housing and Local Government Business without license 2 Moneylending transaction conducted at the premise stated in the license. Moneylending transaction conducted anywhere 3 Interest rate are controlled and reasonable according to the Act : Collateral loan: 12 % per annum Non Collateral loan: 18 % per annum No controlled rate. The interest rate is oppressive and unreasonable. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 14 4 Standard Form Agreement according to Schedule J for noncollateral loan and Schedule K for collateral loan. The agreement protect both parties in the event of default and court case No standard form contract. Just sign a blank piece of paper. 5 Valid stamped set of agreement given to the borrower No standard from contract 6 The borrower will be informed on the total amount of loan given and the monthly instalment that he needs to pay to the lender. The Borrower will receive lesser amount than the total loan amount. 7 In the event of default, the borrower will be imposed payment In the event of default, the according to the court order. borrower and his family will be harassed and threatened until the payment is made Source : Moneylenders and Pawnbrokers Department, Ministry of Urban Wellbeing, Housing and Local Government (2014) 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 15 Contd.. Cycle Pattern of Efficient Debt Market and Economic Behaviour Financial Loan Surplus Unit FIRM (Moneylender Company) Act Act GOVERNMENT (Ministry) Defisit Unit HOUSEHOLD (Borrower) Loan principle + Interest Source : Modified from Microeconomic (2006) 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 16 Contd… The diagram illustrates that the Government as the regulator and enforcer of the laws for the needs of the firm and household. Firm in this context refers to the moneylender which represent surplus. As a surplus unit, the firm supply loan to the household that is the borrower which represent deficit. In return of the loan, the household need to pay back the loan together with the stipulated interest. Efficiency will be achieved when there is a balance between need and supply. Efficiency is one of the normative criteria in economic law analysis. Nevertheless, there is no uniform decision on what construed as efficient law in economics. In relation to the research, the Act is comprehensive law that plays the role of social tool in encouraging efficient economy. The Act serves the function of law to rectify the market situation. Thus, the concept of efficiency relates to the ability of the amended Act in regulating the debt market need and supply in fair and balance environment. Finally, the Act increase the social benefit and conform to the concept of utilitarianism which emphasize on morally right laws brings peace and harmony in the society. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 17 Findings of Research : B. Review of the Moneylenders (Amendment ) Act 2011 A. Interest rate not economical The findings of the discussion with the moneylenders revealed that lending rates are fixed at 12 per cent for secured loans and 18 percent for unsecured loans is not economical. To achieve economic efficiency in the market the optimal interest rate should be determined by demand and supply in the market. This can be referred to on lending practices in Singapore, Thailand and Hong Kong. The direct impact is the request for loan from unlicensed moneylenders will be reduced. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 18 Contd… B. The Application Process In addition, the application process should be simplified and approvals for loans of RM3 , 000 and below. Deregulation of the loan application process by simply signing a deal without having to turn off defaulting other processes such as stamping and so on . This flexibility saves cost and ease of doing them. Section 16 of the Act should be reviewed. In practical, it is difficult for the moneylenders to duly stamped the document and hand in to the borrowers before releasing the loan. For instance, a moneylender stays in Bagan Serai , he needs to go to Permatang Pauh to sign the document and they also depends on the runner who came once a week. By that time, the borrower will opt for unlicensed moneylender because they urgently need the cash. It is suggested that the legal provision should revert back to the old practice of promissory note be given to the borrower in the alternative of the agreement. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 19 Contd… C. Licensing Requirement It is suggested that the licensing requirement should include attendance of Moneylenders Course. The Moneylenders Course will equipped the moneylender with legal, basic account and ethics on business of moneylending. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 20 Contd… Statistics of Cases Relating to Unlicensed Moneylenders Source: Commercial Crime Investigation Department, Polis DiRaja Malaysia (2014) 3/4/2015 Year Total Open Cases Case of Inquiry Arrest Case 2005 50 7 10 2006 62 11 5 2007 162 23 12 2008 270 66 15 2009 483 276 35 2010 279 217 23 2011 261 179 51 2012 445 271 206 2013 442 378 199 2014 147 49 98 JUMLAH 2601 1477 654 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 21 Contd.. The cases of unlicensed moneylending were entrusted to the Commercial Crime Investigation Department in 2005. The department is only involved with unlicensed moneylenders. The results have been an increase in unlicensed moneylenders in 2005 until 2009. The numbers was highly increased in 2009 due to the massive campaign and Ops Jerung. This awareness encourages the public to make reports. Previously they did not dare to come to make a complaint for fear of interference from an unlicensed moneylender. The campaign resulted in an unlicensed moneylender, reduced their activities. Then, the cases decline until 2011. Investigation Reports showed that the unlicensed moneylenders activate again in 2012 even though the amendment was enacted in 2011. This is due to current economic factors such as rising oil prices and reduced price subsidies which affected the income of households. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 22 Conclusions and Recommendations: a. Relocating the jurisdiction of Ministry responsible for dealing with moneylending – Ministry of Urban Wellbeing , Housing and Local Government or new Director General for Consumer Credit under the Ministry of Finance b. Include the provision for unlicensed moneylenders in the Act c. Review the Interest rate imposed to the borrowers d. The Application Process must easy, fast and efficient e. Imposed Prudent and Responsible lending – moneylenders be given accessed to CCRISC in cooperation with the bank f. Increase the number of enforcement staffs concerned g. Aspects of the borrower : practical place for repayment h. Enhancement of the Moneylending Industry by recognizing the Moneylenders Institutions Associations in any decision and policy making relating to moneylending activities i. Establishment of Credit Advisor Bureau to assist the vulnerable borrower. j. Positive Perception of the Moneylenders to the Public by rename as consumer credit. 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 23 Thank you WASSALAM 3/4/2015 REVIEW OF MLA (AMENDMENT)2011 RUZIAN 24