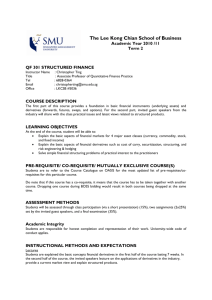

Introduction to Weather Derivatives

Introduction to Weather Derivatives

CASE-Center for Applied Statistics and

Economics

1

1-1

Weather:

Influences our daily lives and choices

Impact on corporate revenues and earnings

According to Metereological institutions: 80% of the business activity in the world is weather dependent

I British Met Office: daily beer consumption increases by 10% if temperature decreases by 3

◦

C

Introduction to Weather Derivatives

1-2

Global climate changes the volatility of weather

The occurrence of extreme weather events increases

Emergence of international weather markets new opportunities arise to handle these risks

I Weather Derivatives (WD)

Introduction to Weather Derivatives

Examples

1-3

Natural gas company suffer negative impact in mild winter

Construction companies can buy WD during rain period

Cloth retailers sell fewer clothes in hot summer

Salmon fishery suffer losses with a single degree of warming in sea temperatures

Introduction to Weather Derivatives

Outline

1.

Motivation X

2.

What are Weather Derivatives?

3.

Weather Indices

4.

Valuation of Weather Derivatives

5.

Application

Introduction to Weather Derivatives

2-1

What are Weather Derivatives (WD)?

What are WD?

3-1

Hedge weather related risk exposures

WD returns uncorrelated with other financial instruments

Formal exchanges: Chicago Mercantile Exchange (CME)

I

I

Monthly and seasonal temperature future contracts

European call and put options on these futures

Common underlying weather variables: temperature, rainfall, wind, snow, frost

I No physical markets in weather: the underlying has no intrinsic financial value

Introduction to Weather Derivatives

What are Weather Derivatives (WD)?

Anatomy of a WD

3-2

A weather derivative is defined by several elements:

Reference Weather Station

Index

Term

Structure: puts, calls, swaps, collars, straddles, and strangles.

Premium

Introduction to Weather Derivatives

What are Weather Derivatives (WD)?

3-3

Example: A beverage company hedge itself against a cold summer with the following option:

Weather Stations: Munich, Berlin and Frankfurt

Risk Period: 01 Jul - 31 August

Weather Index: Average temperature for the 3 Weather Stations

Put Strike: 19

◦

C

Tick: EUR 30,000 per 0.01

◦

C

Maximum Payout: EUR 3,000,000

Payout if: Weather Index < Put Strike:

Min { ( Strike − WeatherIndex ) xTick ; MaximumPayout }

Introduction to Weather Derivatives

What are Weather Derivatives (WD)?

Weather indices: temperature

3-4

Heating degree day (HDD): over a period [ τ

1

, τ

2

]

Z

τ

2 max( T

0

− T u

, 0) du

τ

1

(1)

Cooling degree day (CDD): over a period [ τ

1

, τ

2

]

Z

τ

2 max( T u

− T

0

, 0) du

τ

1

T

0 is some baseline temperature (typically 18

◦

C or 65

◦

F), T u is the average temperature on day u .

(2)

Introduction to Weather Derivatives

What are Weather Derivatives (WD)?

Average of average temperature (PRIM): measure the

” excess ” or deficit of temperature. The average of average temperatures over [ τ

1

, τ

2

] days is:

1

τ

1

− τ

2

Z

τ

2

T u du

τ

1

3-5

(3)

Cumulative averages (CAT): The accumulated average temperature over [ τ

1

, τ

2

] days is:

Z

τ

2

T u du

τ

1

(4)

Event indices: number of times a certain meteorological event occurs in the contract period

Frost days: temperature at 7:00-10.00 local time is less than or equal to − 3 .

5

◦

C

Introduction to Weather Derivatives

What are Weather Derivatives (WD)?

3-6

Weather indices: rain

Cumulative rainfall index I c

: sum of daily rainfall amount in a certain accumulation period

I c

= x

X y t t =1

(5) x : length of the accumulation period

Rainfall deficit index I d

: measures the shortfall accumulated over z periods of the rainfall sum in an s -days period relative to a reference level y min

I d

=

z

X min

0 ,

τ =1

τ · s

X t =( τ − 1) · s +1

y t

− y min

(6)

Introduction to Weather Derivatives

Valuation of WD

4-7

The price of a contingent claim F can be calculated as:

F = e

− rT

E [ ψ ( I )]

I : stochastic variable that expires at time T , weather index

ψ ( I ): payoff of the derivative at expiration r : risk free interest rate

E [ · ]: expectation by means of risk neutral probabilities

(7)

Introduction to Weather Derivatives

4-8 but...

weather cannot be traded → no-arbitrage models to WD are impractical!

Black and Scholes does not work: volatility changes

Price of the derivative must account the market price of weather risk ( λ )

Benth (2004): many arbitrage-free prices exist

Hull (2006): Weather risk is not a systematic risk, λ = 0

Introduction to Weather Derivatives

Pricing Weather Derivatives

Temperature derivatives: Campbell and Diebold (2005),

Jewson and Brix (2005), Benth (2005)

Rainfall: Cao, Li and Wei (2004)

Approaches:

Burn analysis

Index Value Simulation

Daily simulation

Stochastic Pricing Model

Introduction to Weather Derivatives

4-9

Burn analysis

4-10

Evaluates how a contract would have performed in previous years

Uses the empirical distribution of the underlying index

Implementation of the pricing formula

F = e

− rT

"

1 n n

X

ψ ( I t

)

# t =1

Steps:

1.

Historical weather data are cleaned and detrended

2.

Determine Index value - hypothetical payoffs for each year

3.

Calculate payoff average and discounted with r

(8)

Introduction to Weather Derivatives

Call option price:

F = e

− rT

"

1 n n

X

{ I t

− K , 0 }

+

# t =1

Put option price:

F = e

− rT

"

1 n n

X

{ K − I t

, 0 }

+

# t =1 r : risk free interest rate

K : strike

I t

: accumulated weather index for t -th year n : number of years

Introduction to Weather Derivatives

4-11

Index Value simulation

4-12

Utilizes a statistical model for the weather index or the derivative payoff

Supported by goodness of fit tests

Steps:

1.

Given an appropriate distribution, the values of the index are randomly drawn and the payoffs are determined

2.

Calculate payoff average and discounted with r

Introduction to Weather Derivatives

Daily simulation

Describes the dynamics of the weather variable over time

Yield smaller confidence intervals than Burn and index simulation: smaller for rainfall than for temperature

Steps:

1.

Derive the weather index from the simulated sample path

I summing up daily precipitation/daily average temperature

2.

Determined pay offs

3.

Calculate payoff average and discounted with r

Introduction to Weather Derivatives

4-13

Stochastic Model for temperature

Define the Ornstein-Uhlenbleck process X t

∈

R p

: dX t

= A t dt + pt

σ t dB t e kp

: k’th unit vector in

R p

σ t

: temperature volatility

A: p × p -matrix

B t

: Wiener Process

A =

0

− α p

1

...

− α

1

Solution of X t

:

X s

= exp ( A

( s − t )) x +

Z s t exp ( A ( s − u )) e p

σ u dB u

Introduction to Weather Derivatives

4-14

Temperature dynamics:

T t

= Λ t

+ X

1 t

X

1 t

: continuous-time AR(p) (CAR(p)) model

Λ t

: seasonality function

Temperature will be normally distributed each time

Let p = 1, implying X t

= X

1 t

: dX

1 t

= − α

1

X

1 t dt + σ t dB t

4-15

Introduction to Weather Derivatives

Berlin temperature data

Daily average temperatures: 1950/1/1-2006/7/24

Station: BERLIN-TEMP.(FLUGWEWA)

29 February removed

20645 recordings

4-16

Introduction to Weather Derivatives

Seasonal function

4-17

Suppose seasonal function with trend:

Λ t

= a

0

+ a

1 t + a

2 sin

2 π ( t )

365

− a

3

Estimates: a

0

= 86 .

0543 , a

1

= 0 .

0008 , a

2

= 98 .

0582 , a

3

= 174 .

058

Squared 2-norm of the residual at x: min x

{

1

2 k Λ t

− T t k

2

2

} =

1

2 m

X

(Λ t

− T t

)

2

= 3 .

02 + e 07 t =1

Introduction to Weather Derivatives

Fitting an autoregressive model

4-18

Remove effect of Λ t from the data: Y i

= T i

− Λ i

ADF-Test statistic:

(1 − L ) y = c

1

+ c

2 trend + τ Ly + α

1

(1 − L ) Ly + . . . α p

(1 − L ) L p y + u

ADF-Test Result of returns: τ = − 51 .

53, where the 1% critical value is -2.5659 we can reject H

0 that τ = 0 ⇒ Y i is a stationary process I (0) ⇒ no unit roots d = 0

Introduction to Weather Derivatives

Partial autocorrelation function suggest AR(3):

Y i +3

= β i

Estimates:

Y i +2

+ β

2

Y i +1

β

1

= 0 .

91748 , β

2

+ β

3

Y i

= − 0 .

20122 , β

3

+ σ i

ε i

= 0 .

077464 , σ i

2

= 510 .

63

4-19

Introduction to Weather Derivatives

Residuals

Reject H

0 for zero expected innovations: stat= 2.1013.

4-20

Introduction to Weather Derivatives

Seasonal volatility

4-21

Close to zero ACF for residuals of AR(3) and highly seasonal ACF for squared residuals of AR(3)

ACF

Introduction to Weather Derivatives

Figure 2: PACF

Introduction to Weather Derivatives

4-22

4-23

Calculate the daily variances of residuals for 56 years and calibrate it to the next truncated Fourier series:

σ

2 t

= c +

4

X c i sin i =1

2 i π

365 t

+

4

X d j cos j =1

2 j π

365 t

4-24

Dividing out the seasonal volatility from the regression residuals:

ACF for residuals unchanged, residuals become normally distributed

ACF for squared residuals non-seasonal

Figure 4: Residual/seasonal variance

Introduction to Weather Derivatives

Temperature futures

HDD-futures price F

HDD ( t ,τ

1

,τ

2

) at time t ≤ τ

1

:

F

HDD ( t ,τ

1

,τ

2

)

= E

Q

Z

τ

2 max (18

◦

C − T u

, 0) du |F t

τ

1

No trade in settlement period

Constant interest rate r

Q is a risk neutral probability

Not unique since market is incomplete

Temperature is not tradable

Analogously: CDD and CAT future prices

Introduction to Weather Derivatives

4-25

Risk neutral probabilities

4-26

Defined by the Girsanov transformation of B t

: dB t

θ

θ t

: time-dependent market price of risk.

= dB t

− θ t dt

Density of Q

θ

:

Z t

θ

= exp

Z t

0

θ s dB s

−

1

2

Z t

θ

2 s ds

0

Dynamics X t under Q

θ

: dX t

= ( AX t

+ e p

σ t

θ t

) dt + e p

σ t dB

θ t with solution:

X s

Z s

= exp ( A

( s − t )

) x +

exp ( A

( s − u )

) e p

σ u

θ u du t

Z s

− u )

) e p

σ u dB

θ u

(9)

CDD futures

4-27

F

CDD ( t ,τ

1

,τ

2

)

=

Z

τ

2

τ

1 v

( t , s )

ψ m ( t , s , e

1

0 exp( A

( s − t )

) X t

))

!

ds (10) v

( t , s ) where m ( t , s , x ) = Λ v

ψ

2

( t , s ) x

=

= x φ

R s t x

σ

2 u

+ φ

0 x e

1

0 s exp(

−

A c +

( s − t )

R

τ

2

) e

τ

1 p

σ u

θ u e

1

0

2 du exp( A

( s − t )

) e

φ is the cumulative standard normal distribution fct.

p du + x

The future price is a function of the lagged temperatures

T t

, T t − 1

, ..., T t − p

Introduction to Weather Derivatives

4-28

From the martingale property and It ˆ

0 s formula, the time dynamics of the CDD-futures prices: dF

CDD ( t ,τ

1

,τ

2

)

Z

τ

2

= σ t e

1

0 exp( A

( s − t )

) e p

τ

1

× φ m ( t , s , e

1

0 exp( A

( s − t )

) X t

))

!

v

( t , s ) dsdB t

θ

Benth (2005): No analytical solution, do Monte Carlo simulation

Introduction to Weather Derivatives

CAT futures price

F

CAT ( t ,τ

1

,τ

2

)

=

Z

τ

2

+

Λ u du + a

( t ,τ

1

τ

1

Z

τ

2

,τ

2

)

X t

θ u

σ u a

( t ,τ

1

,τ

2

) e p du

τ

1

Z

τ

2

+ θ u

σ u e

0

1

A

− 1

(exp( A

( τ

2

− u )

) − I p

) e p du

τ

1 where I p a

( t ,τ

1

,τ

2

)

: p × p identity matrix and

= e

1

0

A

− 1

(exp( A

( τ

2

− u )

) − exp( A

( τ

1

− t )

)

Time dynamics of F

CAT

: dF

CAT ( t ,τ

1

,τ

2

)

= σ t a

( t ,τ

1

,τ

2

) e p dB

θ t

Introduction to Weather Derivatives

4-29

Data adjustments

Station changes

Instrumentation

Location

Trends: to capture weather surprise

Global Climate Cycles

Urban heat

Forecasting

Introduction to Weather Derivatives

4-30

Questions for Research

Memory in AR(3): volatility with monthly/weekly measurement period

Role of the strike value

Longterm (interannual) variability of parameters - capture volatility due to climate changes

Relationship between weather variables and production

Formula for options on CAT/CDD/HDD futures

WD related to catastrophes

Introduction to Weather Derivatives

5-31

Conclusion

6-1

CAR(p) model for the temperature dynamics

I Autoregressive process with seasonal mean and seasonal volatility

Analytical future prices for the traded contract on CME

I HDD/CDD/CAT/ futures with delivery over months or seasons

Introduction to Weather Derivatives

Reference

F.E. Benth

Option Theory with Stochastic Analysis: An Introduction to

Mathematical Finance

(Berlin: Springer), 2004.

Benth and S. Benth

Stochastic Modelling of temperature variations with a view towards weather derivatives

(Appl.Math. Finance), 2005.

K. Burnecki

Weather derivatives

(Warsaw), 2004.

Introduction to Weather Derivatives

6-2

S. Cambell, F. Diebold

Weather Forecasting for weather derivatives

J.American Stat. Assoc. , 2006.

J.C. Hull

Option, Futures and other Derivatives

(6th ed. New Jersey: Prentice Hall International), 2006.

M. Odening

Analysis of Rainfall Derivatives using Daily precipitation models: opportunities and pitfalls

6-3